State Sales Tax Loss In 2020 Compared To 2019

Graphic by Jesse Howe | Sun-Times

Overall in Illinois during the worst of the pandemic, the states share of sales tax revenue dropped by at least $675 million, according to the state Department of Revenue. That includes the 5% sales tax the state keeps of the 6.25% collected on most purchases.

Of the rest, 1% goes to the city and 0.25% to the county in which the tax is collected. In Chicago, the 0.25% goes to the Regional Transportation Authority instead of to Cook County. Additional local taxes also might be added, though none of those figures were available from state revenue officials.

In an email, Alexis Sturm, director of the Governors Office of Management and Budget, points to similar shortfalls in other states.

Every state in the nation saw tremendous drops in revenue when the pandemic hit, placing enormous stress on our social safety net programs just when they were needed most, Sturm wrote.

Sturm also points out that, to make up for some of the losses and to keep state-funded programs going for such essentials as housing, health care and food, the state borrowed from the federal government.

In Schaumburg, the cut of the 10% sales tax rate that consumers pay there typically tops $52 million a year that goes to the village government, which also takes in another $13 million in taxes on hotels and restaurants.

Aurora Illinois Sales Tax Rate

aurora Tax jurisdiction breakdown for 2021

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

Aurora, Illinois sales tax rate details

The minimum combined 2021 sales tax rate for Aurora, Illinois is . This is the total of state, county and city sales tax rates. The Illinois sales tax rate is currently %. The County sales tax rate is %. The Aurora sales tax rate is %.

South Dakota v. Wayfair, Inc.

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Illinois, visit our state-by-state guide.

COVID-19

The outbreak of COVID-19 may have impacted sales tax filing due dates in Aurora. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Illinois and beyond.;AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

Cook County Illinois Sales Tax Rate

Cook County Tax jurisdiction breakdown for 2021

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

Cook County, Illinois;sales tax rate details

The minimum combined 2021 sales tax rate for Cook County, Illinois is . This is the total of state and county sales tax rates. The Illinois state sales tax rate is currently %. The Cook County sales tax rate is %.

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Illinois, visit our state-by-state guide.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

NOTE: The outbreak of COVID-19 may have impacted sales tax filing due dates in Cook County. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

You May Like: Where To File Taxes For Free

Illinois Liquor Wine And Beer Taxes

In addition to traditional sales taxes, alcoholic beverages like wine, beer, and liquor are subject to excise taxes on both the Illinois and Federal levels. Excise taxes on alcohol are implemented by every state, as are excises on cigarettes and motor fuels like gasoline.

Excise taxes are applied on a per-unit basis, generally per gallon for liquids, and unlike sales taxes are collected from the merchant who sells the alcohol rather than the end consumer. However, in almost all cases, excise taxes are passed on directly to the consumer in the form of raised alcohol prices.

- Other Illinois Excise Taxes:

Illinois Liquor Tax -$8.55 / gallon

;Illinois’ general sales tax of 6.25% also applies to the purchase of liquor.

In Illinois, liquor vendors are responsible for paying a state excise tax of $8.55 per gallon, plus Federal excise taxes, for all liquor sold.

Additional Taxes: Under 20% $1.39/gallon$2.68/gallon in Chicago and $2.50/gallon in Cook County

Illinois Sales Tax Registration

To collect sales tax in the State of Illinois, a business must first register for a sales tax permit, required before you make any purchases or sales and before you hire your first employee. To do so, you can use the MyTaxIllinois website or you can complete the paper form, REG-1 to obtain your sales tax permit.

To complete your sales tax permit application, you will need all of your businesss identifying information, a detailed breakdown of your business structure, owners, and officers, and a list of what you will be collecting sales tax on. The process is free and takes about 2 days online, or 6-8 weeks if you mail the paper form to process, so its recommended you file this as early as possible so you have a permit in hand before you start operating in Illinois.

Once you receive your permit, you are not required to renew it regularly, but it is recommended to keep it up to date with relevant information as your business grows.

Don’t Miss: What Age Do You Have To File Taxes

Consumer Taxes In Chicago: Increases And Updates For 2021

Annually the Civic Federation releases a report on consumer taxes in the City of Chicago. Consumer taxes are tied to the use or consumption of certain goods and services that can be charged directly to consumers through retail transactions or passed onto consumers by businesses or governments. Consumer taxes in Chicago are imposed at various levels of government including by the City of Chicago, Cook County, the State of Illinois and federal government. This blog highlights the changes that several consumer taxes have undergone since the Civic Federations 2020 consumer taxes report was released in February 2020.

For a summary of tax changes that went into effect last year, see the Civic Federations 2020 blog post on consumer taxes.

Tax Changes:

The following taxes have undergone changes effective January 1, 2021.

Personal Property Lease Transaction Tax With the passage of the City of Chicagos FY2021 budget, the City increased the personal property lease transaction tax rate for nonpossessory computer leases of software and infrastructurereferred to as cloud software or infrastructurefrom 5.25% to 7.25%. The rate for all other lease transactions remains the same at 9.0% of the lease or rental price.

Other Updates:

Additionally, the following updates have taken place during 2020 since the release of the Civic Federations previous annual consumer taxes report.

Related Links:

Fast Free Auto Insurance Quotes

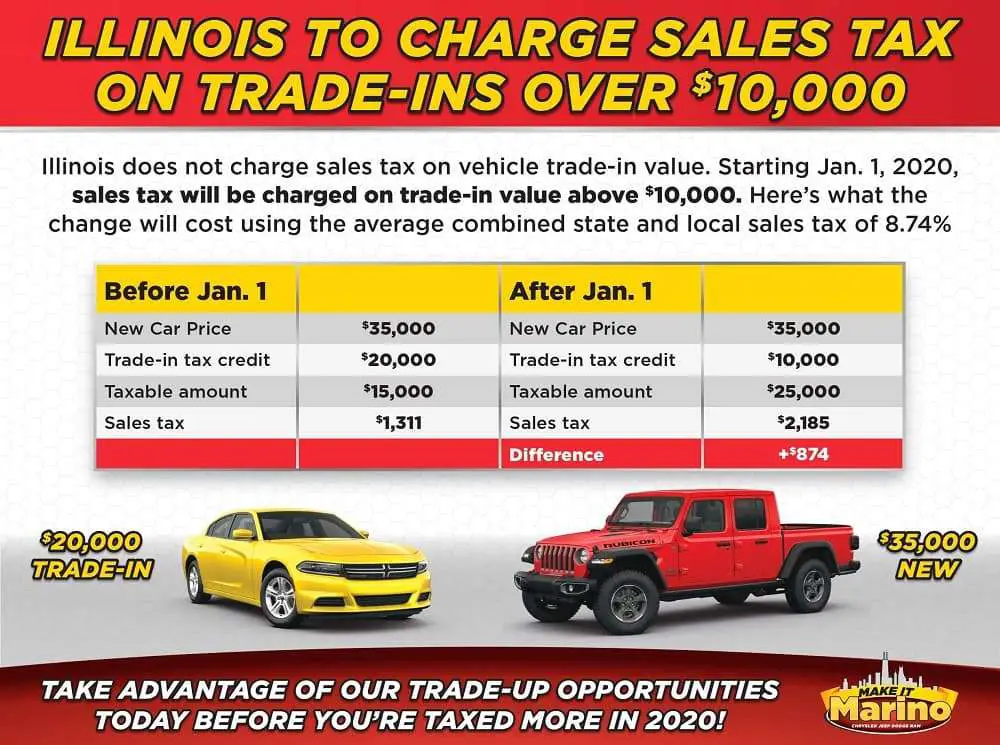

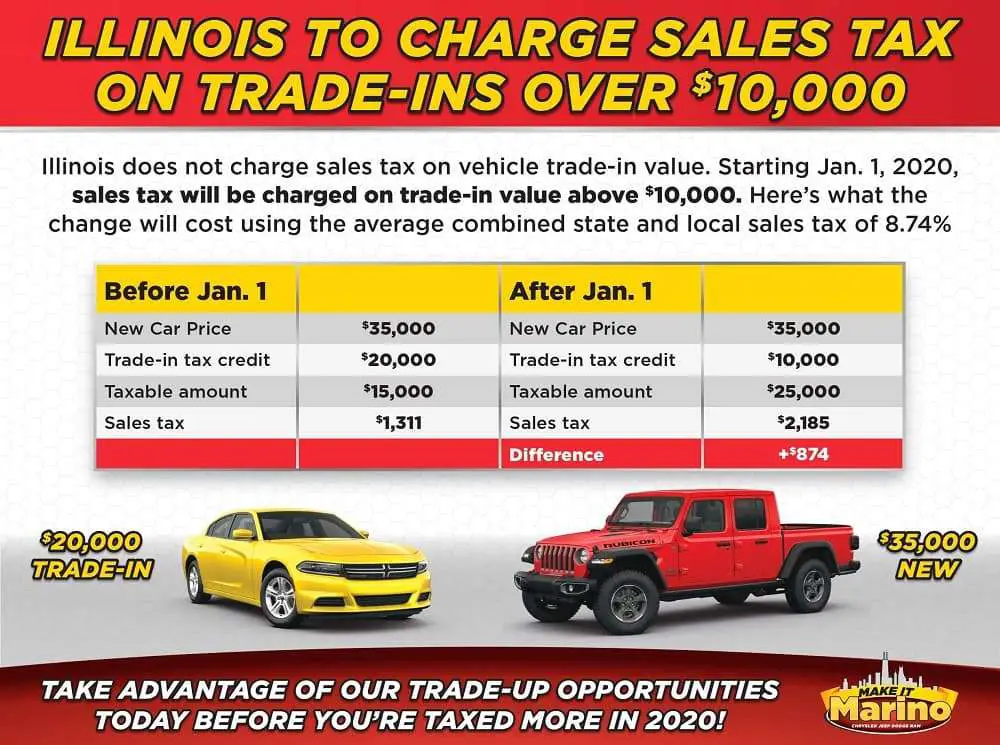

If youre buying a new or used car, its important to know the taxes and fees you may have to pay. Illinois tax on new and used vehicles is generally 6.25% but can vary by location. See the chart below for more.

Did you know comparing insurance quotes can save you hundreds on your auto insurance? Receive personalized rates and policy options in minutes by calling EverQuote at 833-494-0309.

Here are typical fees in Illinois:

Read Also: Is Doordash Worth It After Taxes

How Are Rebates And Dealer Incentives Taxed

Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. For example, a $1,000 cash rebate may be offered on a $10,000 car, meaning that the out of pocket cost to the buyer is $9,000.

Illinois taxes vehicle purchases before rebates or incentives are applied to the price, which means that the buyer in this scenario will pay taxes on the vehicle as if it cost the full $10,000.

Are Services Subject To Sales Tax In Illinois

Generally speaking, services in Illinois are not taxable. Note: if the service provided results in a product, the product is subject to sales tax. The labor is not taxable, but the product itself is a taxable good. The Service Occupation Tax, otherwise known as SOT, is applied in a situation where any tangible personal property is being transported, and concurs with a service transaction.

You can find a table describing the taxability of common types of services later on this page.

Recommended Reading: How To Appeal Property Taxes Cook County

Illinois Sales Tax Tates

Illinois has a base state sales tax rate of 5%. In addition to this rate, there are also several location specific sales taxes. These are administered by both home rule units and non-home rule units. A home rule unit in Illinois is defined as a county with a chief executive officer or a municipality with a population of at least 25,000. It is possible for smaller municipalities to vote to become home rule units as well. These home rule sales tax rates are defined on The State of Illinoiss Department of Revenue website, and are between 0.25% and 2.50% depending on location.

Additional local sales taxes at the county level include County Public Safety, Public Facilities, and Transportation Sales Taxes. These are charged at the county level and range between 0.25% and 1.25%. An additional 1.00% sales tax is also charged in certain counties with the County School Facility Tax Rate. All of these taxes are rolled together into either State, Local, or County level taxes and all are collected by the State of Illinois, though some local governments may impose taxes beyond these.

The above rates apply to general merchandise, which includes most tangible property, with the exception of qualifying food, drugs, and medical appliances, and any items that require a title or registration.

When To File Taxes In Illinois

When you register for sales tax, Illinois will assign you a certain filing frequency. Youâll be asked to file and pay sales tax either monthly, quarterly, or annually.

Usually the frequency they choose is based on the amount of sales tax you collect from buyers in Illinois. High-revenue businesses file more frequently than lower volume businesses, for example.

Illinois sales tax returns are due on the 20th day of the month following the reporting period. If the due date falls on a weekend or holiday, then your sales tax filing is generally due the next business day.

Don’t Miss: How Much Income To File Taxes

Illinois Sales Tax Software

Illinoiss variable sales tax rates can be frustrating for out of state sellers who dont have a means of tracking the different rates based on location. It is important that you record and pay the sales tax due on time for the states in which you have sales tax nexus. This is where a tool like TaxTools can be of use. With detailed data review tools, sorting tools to ensure you are paying the right sales tax rates based on buyer destination, and integration with existing eCommerce platforms in a single interface, its much easier to manage than doing it manually. To learn more, contact us today or and get started.

AccurateTax believes that sales tax automation should be affordable for all businesses. The laws don’t make compliance easy, but our software helps. See how much time you can save by using AccurateTax.

Solutions

Illinois Sales Tax Rates By City

The state sales tax rate in Illinois is 6.250%. With local taxes, the total sales tax rate is between 6.250% and 11.000%.

Illinois has recent rate changes .

Select the Illinois city from the list of popular cities below to see its current sales tax rate.

Sales tax data for Illinois was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Also Check: How Can I Make Payments For My Taxes

Penalties For Late Filing

Illinois charges a;late filing penalty;of 2% of the original tax if the filing date is within 30 days of the filing deadline. If you do not file a return within 30 days after receiving a notice of non-filing, an additional penalty will be imposed equal to the greater of $250 or 2% of the tax shown due on the return without regard to timely payments. The penalty cannot exceed $5000.

Illinois also charges a;late payment penalty;that is equal to 2% if the time of payment falls between 1-30 days after the deadline. After 30 days, the rate increases to 10% of the unpaid tax shown on the original tax return. If your company is audited for unpaid sales tax, the interest penalty increases to 15%, and if your company continues to delay the rate can rise to 20% of the total unpaid sales tax.

When You Need To Collect Illinois Sales Tax

In Illinois, sales tax is levied on the sale of tangible goods and some services. The tax is collected by the seller and remitted to state tax authorities. The seller acts as a de facto tax collector.

To help you determine whether you need to collect sales tax in Illinois, start by answering these three questions:

If the answer to all three questions is yes, then youre required to register with the state tax authority, collect the correct amount of sales tax per sale, file returns, and remit to the state.

Don’t Miss: Are Debt Settlement Fees Tax Deductible

How Does Leasing Affect Car Sales Tax In Illinois

When you choose to lease a car in Illinois, youll pay sales tax on the cost of your new or used car the key factor is that youll only owe tax on the part of the car you lease your monthly payment rather than on the total value of the vehicle. If you choose to purchase your vehicle at the end of your lease term, youll pay a sales tax on the depreciated price.

How To Register For An Illinois Seller’s Permit

You can register for an Illinois sellers permit online through the DOR. To apply, youll need to provide the DOR with certain information about your business, including but not limited to:

- Business name, address, and contact information

- Federal EIN number

- Date business activities began or will begin

- Projected monthly sales

You May Like: How Much Is Sales Tax In New Mexico

Filing When There Are No Sales

Once you have an Illinois seller’s permit, youre required to file returns at the completion of each assigned collection period regardless of whether any sales tax was collected. When no sales tax was collected, you must file a “zero return.

Failure to submit a zero return can result in penalties and interest charges.

Filing Illinois Sales Tax Returns

You will pay Illinois sales and use tax by:

- For Those in State Illinois is an origin-based state so you will collect sales tax based on where you are located in the state. Because of the varied nature of county, municipality, and state rates, this makes the process much easier.

- For Those Out of State For those outside of Illinois who have nexus in the state, you must charge sales tax based on the destination of the purchase. This requires careful tracking of locations and the ability to quickly calculate the final sales tax rate for any given location in the state.

- Shipping and Handling Shipping is not taxable if it is itemized from the item being purchased. If the two are not separated, however, it is subject to tax and you will need to collect it based on destination of the buyer.

- Filing Your Return To file your sales tax return with the State of Illinois, you can use the My Tax Illinois website or you can file the form ST-1 via mail.

How frequently you need to file your sales taxes will be determined by the amount of sales tax you collect on a regular basis. Your frequency will be determined at the time you obtain your permit, and may change at any time. If the Illinois Department of Revenue decides to change your frequency, they will notify you before the next payment is due. The following frequencies apply depending on your liability:

- Annual Less than $50 due per year

- Quarterly Between $50 and 200 per year

- Monthly More than $200 per year

Also Check: What Is The Date To Pay Taxes

Chicago Illinois Sales Tax Rate

chicago Tax jurisdiction breakdown for 2021

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

Chicago, Illinois sales tax rate details

The minimum combined 2021 sales tax rate for Chicago, Illinois is . This is the total of state, county and city sales tax rates. The Illinois sales tax rate is currently %. The County sales tax rate is %. The Chicago sales tax rate is %.

South Dakota v. Wayfair, Inc.

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Illinois, visit our state-by-state guide.

COVID-19

The outbreak of COVID-19 may have impacted sales tax filing due dates in Chicago. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Illinois and beyond.;AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.