Self Assessment: What Is It

Self Assessment is the tax return process for self-employed people.

Whereas HMRC collects Income Tax from employees directly through the PAYE system, the self-employed need to work out their income and expenses and then pay their bill each January.

You might even need to complete a Self Assessment return if youre not self-employed. For example, if you earn money from renting out a property, read our guide to Self Assessment for landlords.

Youll also need to complete a tax return if you have significant income from savings, investments and dividends read more about paying tax on dividends.

What If I Haven’t Filed A Tax Return

TAXPAYERS had until May 17 to file an extension if they needed more time to submit their returns.

If you didnt file a tax return or an extension, but should have, you need to take action – or the penalties you face may increase.

If you file your return over 60 days late, youll have to pay a $435 fine or 100% of the tax you owe – whichever is less.

However, there is no penalty for filing a late return after the tax deadline if a refund is due, said the;IRS.

If you didn’t file and owe tax, file a return as soon as you can and pay as much as possible to reduce penalties and interest.

You won’t have to pay the penalties if you can show “reasonable cause” for the failure to do so on time – we explain how in our guide.

Box A: Employee’s Social Security Number

This is your taxpayer identification.

The IRS uses your social security number to verify the data it receives from the City against the amounts shown on;your tax returns.

The Social Security Administration uses your SSN to record;your earnings for future social security and Medicare benefits.

If your SSN is incorrect, present your social security card to your Personnel Office immediately. The Personnel Office will forward a copy of your social security card to OPA along with a W-2 Duplicate Request Form or a W-2 Correction Request Form. OPA will verify your information with the Social Security Administration and then issue a corrected W-2.

Read Also: Can I Check My Property Taxes Online

Contact John F Dennehy Cpa Today

When it comes to filing your taxes, even the slightest error could have serious financial consequences. In certain instances, preparation mistakes could precipitate the IRS to perform an individual audit, which may lead to serious legal ramifications.

Fortunately, you do not need to go through this process alone. At John F. Dennehy CPA, we are a team of accountants and tax preparation experts who offer years of experience completing and filing even the most complex returns.;

We regularly work with individuals, small business owners, real estate investors, and virtually everyone else to simplify tax season, minimize liability, and maximize return. We will guide you through the process from start to finish. You can leave the tax filing heavy lifting to us, so you can focus on more pressing matters.;

Contact John F. Dennehy CPA today.;

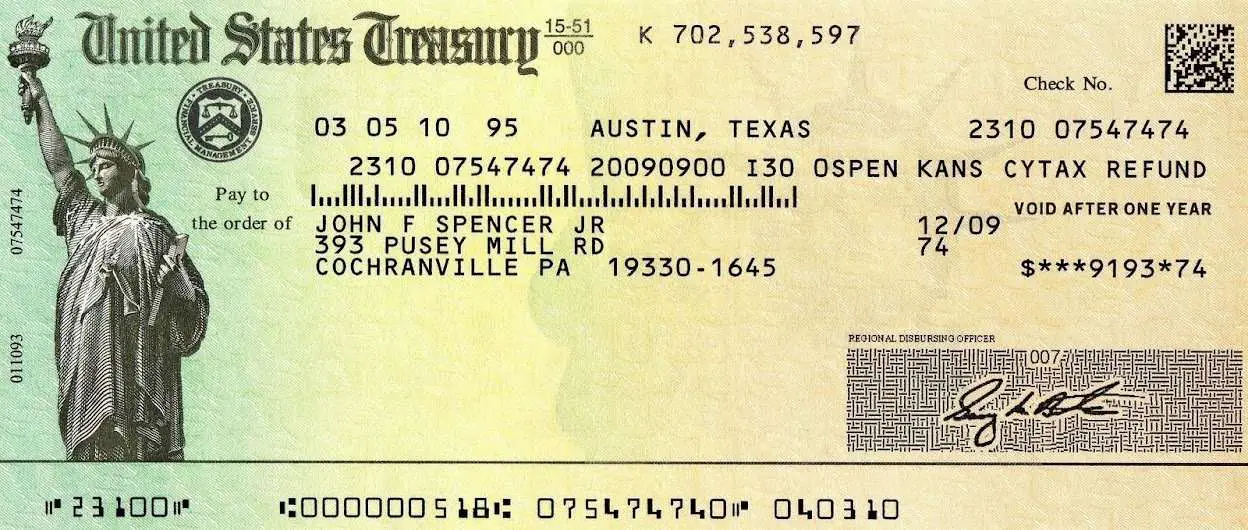

Tax Refund Update: The Latest On Irs Delays And How To Track Your Check

Still waiting on your federal tax refund? Here’s the reason for the holdup.

If you see “IRS TREAS 310” on your bank statement, it could be your income tax refund.;

At the start of September, the IRS announced it had 8.5 million unprocessed individual returns, including 2020 returns with errors and amended returns that require corrections or special handling. Refunds normally take around 21 days to process, but the IRS says delays right now could be 120 days. But it’s nearly fall and the IRS is still facing a massive backlog that’s causing stress for taxpayers that need financial relief amid the pandemic.;

To add to that, the IRS has also been busy with stimulus checks, child tax credit payments and;refunds for tax overpayment;on unemployment benefits. The “plus-up” stimulus adjustments and the third advance monthly check of the child tax credit — which goes out tomorrow, Sept. 15 — could give families some financial relief, but an overdue tax refund would be an even bigger help.;

In most cases, taxpayers can only continue to practice patience — the tax agency isn’t easy to reach. The best solution is to track your refund online using the Where’s My Refund tool or check your IRS account. We’ll show you how. We can also tell you what to do if you received a “math-error notice” from the IRS. This story is updated frequently.;

Also Check: How To Reduce Income Tax

How Long Will It Take For The Changes To Be Made

- If you submitted your request online, your change request will take about two weeks to be processed.

- If you submitted your request by mail, your change request will take longer. Due to COVID-19, the CRA may take 10 to 12 weeks to process paper adjustments.

Keep in mind that some adjustment requests are considered complex and may take longer to process. Complex requests include situations where additional information or review is required.;

For more information on processing times, go to Service Standards in the CRA.

Online or by mail, you can request an adjustment for any of the 10 previous calendar years. For example, a request made in 2021 must relate to 2011 or a later tax year. Adjustment requests for different years should be on different forms but they can be mailed in together or submitted to the CRA at the same time.

Form 8917 Tuition And Fees Deduction

After viewing, if Form 8917 Line-by-Line instructions do not answer your question, you may contact us, only if you are using the Free File Fillable Forms program.

- Line 1 is a manual entry for all rows and columns.

- Line 2 sums entries from line 1c.

- Line 3 receives the figure from your Form 1040, line 9.

- Line 4 is a manual entry.

- Line 5 is a manual entry.

- Line 6 calculates as $2,000 or $4,000, depending on your selection of the Yes or No radio button, and transfers the amount to Schedule 1, line 21.

Also Check: How Much Do I Get Back In Taxes

Form 4868 Application For Automatic Extension Of Time To File Us Individual Income Tax Return

After viewing, if Form 4868 Line-by-Line instructions do not answer your question, you may contact us, only if you are using the Free File Fillable Forms program.

- Select the “File an extension” icon from the top.

- Part I – Complete the entity portion of the form. There are separate areas for the taxpayer and spouse FIRST, MIDDLE INITIAL and LAST NAME.

- Part II

- Manually enter lines 4 and 5

- Line 6 subtracts line 5 from line 4

- Line 7 – Manually enter the amount you are paying with the extension

- Lines 8 and 9 are checkboxes

Taxpayers Should Be Aware Of How Incomes From Other Sources Have To Be Reported In The Tax Return And Know About The Various Deductions Available To Them This Weeks Cover Story Looks At Some Of The Incomes That Might Get Missed By Diy Taxpayers When They Sit Down To File Their Returns

tax liabilitytax returninterest incomedividendsOther incomes to be reported in tax returnincome tax returnCalculating capital gainsHow capital gains are taxedReporting the capital gains and calculating the tax can be challenging because each transaction has to be entered in the tax return. Cleartax.com lists some common investments and the tax rates that apply to gains arising from them.Also Read:How to adjust capital gains against capital losses in ITRDont miss unlisted shares, foreign assetsAlso Read:ITR filing: How inflation can help reduce your income tax liabilityDividends are now taxableInterest is also fully taxableReconciling income and expenses

Read More News on

You May Like: Where Can I Find My Property Tax Bill

Boxes E F: Employee’s First Name And Initials Last Name Suff Employees Address And Zip Code

This box;shows your name and address which is currently in;the City’s Payroll Management System.

If your name changes, your earnings cannot be posted by SSA until your social security records are updated. You can report a name change to SSA by calling 1-800-772-1213.

If your name is incorrect, you should notify your agency. A corrected W-2 will be issued.

If your address is incorrect, you can still use the W-2. You should change your home address in NYCAPS Employee Self-Service or report address changes to your agency.

What To Do If You Need Help With The 1040 Tax Tables

The IRS provides multiple free resources on its website if you need help preparing your tax return or have questions about a tax issue. These resources include publications, forms, instructions, non-English language assistance, and even live help, in some cases. Tax preparation options include Free File, the VITA program, and the TCE program.;

Also Check: Do You Have To Claim Social Security On Taxes

Sections Of Your Notice Of Assessment

Your notice contains your:

This section shows you the result of your assessed or reassessed tax return. This may be a refund, a zero balance, or a balance owing. The amount we show includes any outstanding balances you may owe from previous returns.

The account summary may also show the result from concurrent assessments or reassessments.

How Can You Use The Where’s My Refund Tool

To check the status of your 2020 income tax refund using the;IRS tracker tools, you’ll need to give some information: your Social Security number or Individual Taxpayer Identification Number, filing status — single, married or head of household — and your refund amount in whole dollars . Also, make sure it’s been at least 24 hours before you start tracking your refund.;

Using the IRS tool Where’s My Refund, go to the;Get Refund Status;page, enter your SSN or ITIN, filing status and exact refund amount, then press;Submit. If you entered your information correctly, you’ll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

The IRS also has a mobile app called;IRS2Go;that checks your tax refund status — it’s available in English and Spanish. You’ll be able to see if your return has been received, approved and sent. In order to log in, you’ll need some information — your Social Security number, filing status and expected refund amount. The IRS updates the data in this tool overnight, so if you don’t see a status change after 24 hours or more, check back the following day. Once your return and refund are approved, you’ll receive a personalized date by which to expect your money.;

You May Like: How To File 2 Different State Taxes

Form 2210 Underpayment Of Estimated Tax By Individuals Estates And Trusts

After viewing, if Form 2210 Line-by-Line instructions do not answer your question, you may contact us, only if you are using the Free File Fillable Forms program.

Notes

A.;; ;If the form instructions indicate you are not required to complete Form 2210, you will not be able to e-file with Form 2210 attach and have your return accepted. Therefore, you can e-file this form only when you select Box C and/or D from Part II. If you select Box A and/or Box B, you must mail in your return.B.;; ;Selecting Box A or Box B, from Part II, requires you to attach a statement with justification for a waiver of penalty. However, Free File Fillable Forms does not support attaching such statements to your return; therefore, you cannot select Box A or Box B and have your transmitted tax return accepted.C.;; ;Part III, , line 11 will not calculate unless you select Box B in Part II. If you enter an amount on line 17, that figure will transfer to Form 1040, line 38. ;However, as explained earlier, Box B requires you to attach a statement to the return, explaining the waiver request and Free File Fillable Forms does not support attaching such documents.

Here’s How To File Itr Using The New Tax Filing Portal

To make the process of filing an income tax return easier, it’s important to register to the new Income Tax website. Also, taxpayers need to follow few simple steps to file ITR online.

Right now, income tax returns 1, and 4 are available for filing for individuals.

How you can file your ITR using the new portal.

Step 1: First you need to register yourself on the portal if you are a first-time user with your permanent account number as your user id and create a password. After that, you need to log in to the portal.

Step 2: Now click on the tab e-file”. Then click on File Income Tax Return”

Step 3: You will need to select the assessment year for which you are filing the ITR and then click on continue. It will ask whether you want to file ITR online or offline. You can choose online which is also the recommended mode of tax filing.

Step 4: Then you will have to choose if you want to file ITR as an Individual, HUF or others. Choose an individual.

Step 6: Next you will be asked the reason for filing ITR- income above the basic exempted limit or because of the seventh provision under Section 139. Under this Section, if a person has deposited an aggregate amount of more than Rs 1 crore in one or more current accounts during the year, incurred more than Rs 2 lakh on a foreign trip or paid more than Rs 1 lakh electricity bill, he or she is liable to file ITR. You are required to select the right option.

Don’t Miss: How To Calculate Payroll Tax Expense

Do I Need To Fill In A Self Assessment Tax Return

HMRC says that you need to send a tax return and pay your bill through Self Assessment if in the last tax year you were:

- a self-employed sole trader earning more than £1,000

- a partner in a business partnership

Youre classed as self-employed if you run your business yourself and are responsible for its success or failure.

HMRC also says you might need to send a return if you have untaxed income from:

HMRC has a tool you can use to check whether you need to file a Self Assessment tax return.

How To Change Your Income Tax Return After You File It

May 20, 2021

Ottawa, Ontario

Canada Revenue Agency

If you think that the income tax and benefit return you filed for the 2020 tax year is missing important details such as the Home office expenses for employees or you made a mistake, you dont need to file a new return. Heres what you can do if you need to change your return.

Also Check: Do I Pay Taxes On Stimulus Check

What Does A ‘math Error’ Notice From The Irs Mean

Millions of Americans have received confusing “math-error notices” from the IRS this year — letters saying they owe more taxes. Once they get the notice, they have a 60-day window to respond before it goes to the agency’s collection unit.;

From the start of the year to August, the IRS sent more than 11 million of these notices. According to the Taxpayer Advocate Service, “Many math error notices are vague and do not adequately explain the urgency the situation demands.” Additionally, sometimes the notices “don’t even specify the exact error that was corrected, but rather provide a series of possible errors that may have been addressed by the IRS.”;

The majority of the errors this year are related to stimulus payments, according to the Wall Street Journal. They could also be related to a tax adjustment for a variety of issues detected by the IRS during processing. They can result in tax due, or a change in the amount of the refund — either more or less. If you disagree with the amount, you can try contacting the IRS to review your account with a representative.

Obtaining Reading Income Tax Returns

Postcards are mailed by mid January of each year to all residents on file as of mid-December. Postcards are mailed to businesses in lieu of forms and as a reminder of the filing requirement. You may download the appropriate tax form above. You may also contact the Reading Tax Office by e-mail or call 733-0300.During the tax season , returns are also available upon request in the Tax Office at the Reading municipal building at 1000 Market Street.ITEMS TO BE INCLUDED WITH THE RETURN W-2 form.

Read Also: How To Do Taxes Freelance

How To Read And Understand Your Form W

KPE

With tax season in full swing, you probably have a number of tax forms either in hand on on the way. If you’re an employee, one of those forms is the form W-2, Wage and Tax Statement. No matter whether you’re self-preparing your tax return or having your return prepared professionally, you should have a basic understanding of what the form says and how it affects your bottom line. Here’s what you;need to know:

A form W-2 is issued by an employer to an employee. An employer has certain reporting, withholding and insurance requirements for employees that are a bit different from those owed to an independent contractor.

The threshold for issuing a form W-2 is based on dollars. Not time worked. Not position held. Just dollars earned. The magic number is $600. Every employer who pays at least $600 in cash or cash equivalent, including taxable benefits to an employee must issue a form W-2. If any taxes are withheld, including those for Social Security or Medicare, a form W-2 must be issued regardless of how much was paid out to an employee. If you were paid less than $600 and still received a form W-2, don’t panic: Sometimes, an employer will issue a form W-2 to all employees because it’s easier for them.

As an employee, you get three copies:

The left side of the form is for reporting taxpayer information:

Box b. Your employer’s EIN is reported in box . An EIN is the employer’s equivalent of your SSN.

The right side of the form is used to report dollars and codes: