You May Be Eligible For More Credits This Year

In addition, Americans may be eligible for different credits this year due to the coronavirus pandemic.

Most important, low- to medium-income Americans are generally able to take advantage of the earned income tax credit, a tax break which can be used to lower the amount families owe and potentially lead to a bigger refund. In 2020, the maximum credit for someone with no qualifying children is $538, and the most a family with three or more children could receive is $6,660, according to the IRS.

Some Americans who didn’t previously claim the earned income tax credit may be able to this year, depending on how much money they made. And, non-filers who submit a return for the first time for 2020 can look back over the last three years to see if they were eligible and retroactively file to claim the credit, said Maag.

Other changes will also ensure that families get the maximum credit they need, even if they lost income because of Covid. If you claimed the earned income credit in 2019 but had lower income in 2020, you can use your 2019 income again to claim the credit.

There are other credits that families may be eligible for or can use their 2019 income to claim in 2020, such as the child tax credit.

How Can I Reduce My Taxable Income

One way to reduce taxable income is by topping up your retirement savings with traditional IRAs and 401s, up to the maximum allowable contribution.;

Contributions to Health Savings Accounts and Flexible Spending Accounts are another way to shrink your taxable income.

You could potentially earn thousands of dollars before paying taxes. However, even when your income falls below the cut-off level and you do not have to pay taxes, you need to file to taxes to get a refund check.

RELATED ARTICLES

Can You Get The Child Tax Credit If You Have No Income

Category: Child Tax Credit, Tax CreditsTags: 2019, 2020, child, , income, no, tax

Millions of Americans dont care when the tax season begins or ends because they dont have to file taxes. If you are someone who has little to no income, youre under no obligation to file a Federal tax return.

On the other hand, you can still file your taxes if you want to. Theres nothing illegal about filing a Federal tax return displaying zero income. In some cases, this is a smart idea.

So, if you are an American who isnt legally obligated to file a Federal tax return this year, you may want to see if filing can get you the child tax credit even with no income.

Don’t Miss: What Can I Write Off On My Taxes For Instacart

Filing As Early As Possible Should Help Refunds Come Faster

To be sure, Americans could also experience surprise tax bills this year, especially if they received unemployment insurance or started a side-hustle amid the pandemic.

Still, experts encourage all Americans to file a tax return for 2020 and to do so as soon as they’re able to receive any refund as quickly as possible.

“Tax returns are a crucial lifeline for a lot of lower-income people,” said Brown.

Should I File With No Income

Filing taxes with no income may actually come with a few perks. If you have no income, can you get a tax refund? The answer is, in some limited cases, yes!

Some tax credits, such as the additional child tax credit, can be taken directly off the amount of tax you owe, rather than from your income. Even better, you can receive these credits as a refund even if you are not required to pay taxes. Of course, to claim any type of IRS tax credit, you must file your tax return.

If you’re in a position to claim deductions or credits, it’s a wise move to file tax returns during no-income years. Even if you’re not entitled to a refund, deductions or credits for a particular tax year, filing your tax return anyway allows you to carry over deductions and credits into future tax years when you do make income. Likewise, filing helps protect you from audits, as the IRS typically only audits tax returns within three years of their date of filing; if you don’t file, that time limit doesn’t apply.

Don’t Miss: How To Appeal Property Taxes Cook County

Minimum Income Requirements Based On Age And Status

There is no set minimum income for filing a return. The amount varies according to both filing status andage. The minimum taxable income level for each group is listed in the following chart. If your income fallsbelow what is listed for your age group and marital status, you are not required to file a return.

| Filing Status | |

|---|---|

| 65 or older 65 or older | $24,800 |

| Qualifying Widow with Dependent Children | Under 65 |

| $400 |

How Do I Submit Form 8843

Form 8843 is typically attached to an income tax return.

If, however, you have NO income and are ONLY filing Form 8843, you can use Glacier Tax Prep to generate the 8843 form:

Department of the TreasuryUSA

Each individual who has NO income and files ONLY a Form 8843 MUST send the form in a separate envelope. Do not include more than one Form 8843 per envelope.

For example, Juanita Garcia is present in the U.S. under F-1 immigration status with her husband and 3 year old daughter . Juanita is the only person in the family who received U.S. source income during the tax year. Therefore, Juanita will file an income tax return with Form 8843 attached. Juanitas husband will file Form 8843 and mail in a separate envelope. Juanita must complete a Form 8843 for her daughter and must submit her daughters Form 8843 in a separate envelope.;

Don’t Miss: How To Track Your Taxes

Nonresidents Military Partial Residents Residents With Out

I am a resident of Missouri. Are the wages I earn in Missouri for “remote work” subject to Missouri withholding?

Yes. Any time an employee is performing services in exchange for wages in Missouri, those wages are subject to Missouri withholding. This applies in the case of “remote work” where an employee is located in Missouri, and performs services for the employer on a remote basis. This rule also applies if the service for which the employee is receiving wages is “standing down” .

I am a resident of Kansas. I am performing “remote work” at my residence in Kansas for a Missouri-based employer. Am I obligated to withhold Missouri tax from my wages?

No. If a nonresident employee performs all of his or her services outside of Missouri, the wages paid to that employee are not subject to Missouri withholding.

I am a nonresident with Missouri source income. Why am I required to include my non-Missouri source income on my return?

If you begin with only Missouri source income, your deductions will be too high. You must begin your Missouri return with your total federal adjusted gross income, even if you have income from a state other than Missouri. Your deductions and exemptions apply to your total income, not just your Missouri source income.

For more information, refer to the Resident/Nonresident and Military Status pages.

If I serve in the United States military, what income is taxable to Missouri?

If I am unable to file my return by the due date, can I get an extension?

Can You File Taxes With No Income

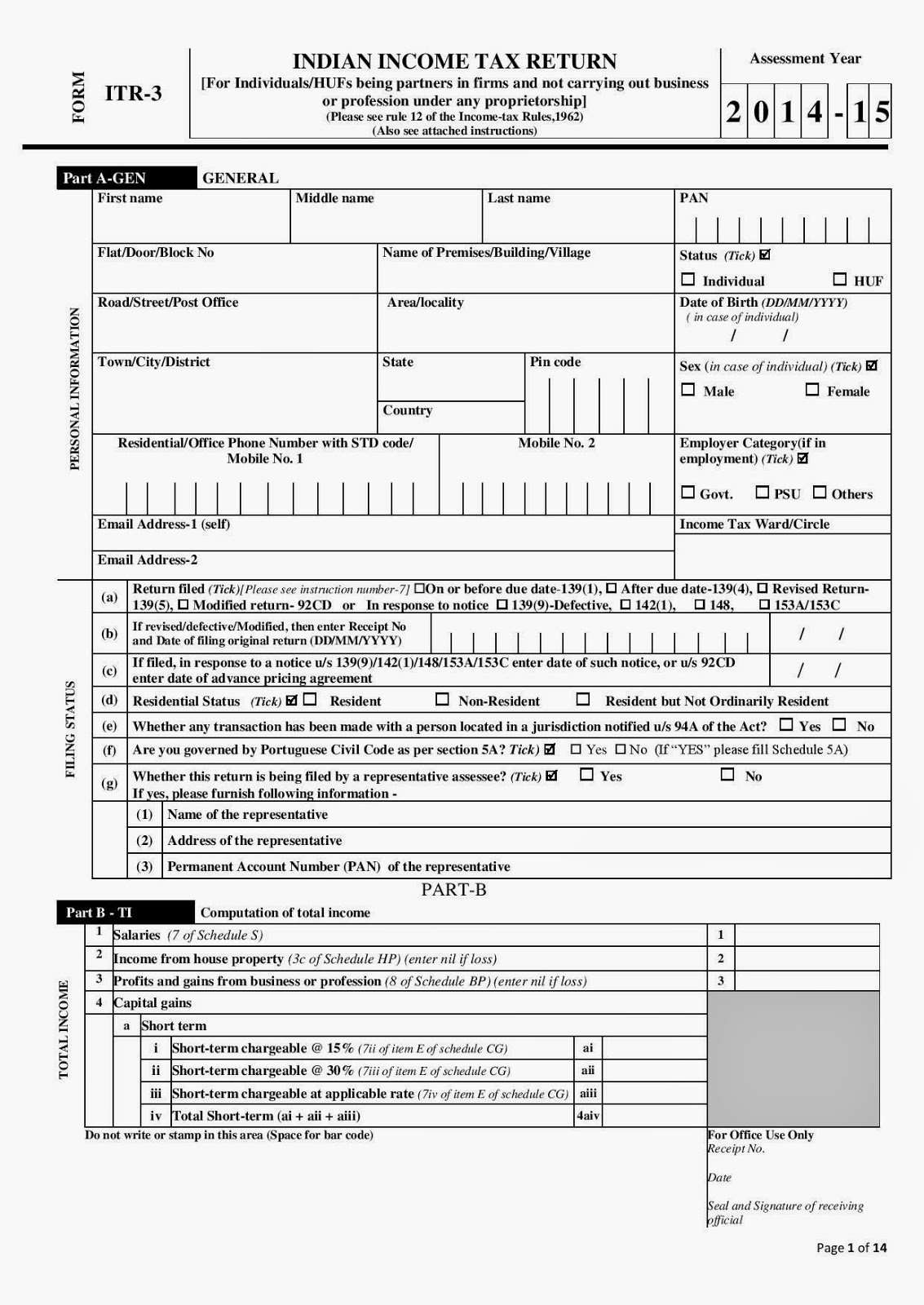

It is possible to file a tax return if you made zero income during the tax year. The nuts and bolts of filing for those who made no income work just as they do for people who earned money you can complete and file a common tax form such as Form 1040EZ, Form 1040A or Form 1040 by paper mail, with a tax preparer or through online submission, or via any number of different tax-filing apps. As a general guide, here are the tax forms available to use:

- Use a 1040EZ if you’re single or married filing jointly, not claiming any dependents and have interest income of less than $1,500.

- Use a 1040A if you have capital gains distributions, are claiming tax credits, or adjustments to income from IRA contributions and student loan interest.

- Use a 1040 if you claim itemized deductions, are reporting self-employment income or reporting income from sale of property. Read More:Tax Deductions: A List of Items That Can Be Claimed on Income Taxes

Also Check: How To Pay My Federal Taxes Online

Watch For Your Income Documents To Arrive

You should receive forms about how much income youve earned from your employers and other income sources in January or February. If you are a full-time employee, you will receive a Form W-2 detailing your earnings, as well as which taxes were withheld. If you work freelance or on a contract, you may receive a Form 1099-NEC;detailing what you earned. You may also receive documents showing dividends or interest earned on investments , or student loan interest youve paid . If youre a college student , youll receive a Form 1098-T that shows how much you paid in tuition, as well as any amounts you received from grants or fellowships, to help you figure out deductions and credits related to education expenses.

While People With Income Under A Certain Amount Aren’t Required To File A Tax Return Because They Won’t Owe Any Tax If You Qualify For Certain Tax Credits Or Already Paid Some Federal Income Tax The Irs Might Owe You A Refund That You Can Only Get By Filing A Return

Get to know the IRS, its people and the issues that affect taxpayers

As the Deputy Commissioner of Wage & Investment, its important to me that my organization ensures that everyone can claim the tax credits theyre eligible for, whether its a tax refund, a stimulus payment or federal withholding credits.

Before I talk about 2020 tax returns, I do want to mention that IRS employees are hard at work to process some of last years returns that we werent able to get to because of the many office closures during the pandemic. Its important that you file your 2020 tax return even if your 2019 tax return hasnt been processed yet. We will still process your 2019 return even if youve already gotten your 2020 tax refund.

You May Like: Where Do I Get Federal Tax Forms

Age And Status Requirements For Dependents

Being claimed as a dependent on someone elses taxes changes the rules a bit, and it does not rule out the possibility that you will still be required to file. If you are an adult, working dependent, you will likely be required to file your own return.

| Under 65 | $12,400 earned | |

| Single Dependents | 65 or older OR blind | $14,050 earned |

| Single Dependents | 65 or older AND blind | $15,700 earned |

| Under 65 | $12,400earned OR Your gross income was at least $5 and yourspouse files a separate return and itemizes deductions. | |

| 65 or older OR blind | $13,700earned income OR Your gross income was at least $5 and yourspouse files a separate return and itemizes deductions | |

| 65 or older AND blind | $15,000earned OR Your gross income was at least $5 andyour spouse files a separate return and itemizes deductions |

How To File A Zero Income Tax Return

This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.There are 10 references cited in this article, which can be found at the bottom of the page. This article has been viewed 56,348 times.

Generally, you are not required to file a tax return with the IRS if your income is below the taxable threshold. However, even if you had no income for the year, you may want to file a return if you are eligible for refundable tax credits. If you’re filing a tax return with zero income, you can use the IRS’s Free File system to avoid preparation fees.XTrustworthy SourceInternal Revenue ServiceU.S. government agency in charge of managing the Federal Tax CodeGo to source

Recommended Reading: Do You Have To Claim Social Security On Taxes

Who Is Required To File An Income Tax Return

If you are new to Canada or if you are just entering the workforce, you may be wondering if filing a Canadian tax return is a necessity, and if so, when do you have to file your first tax return?The Canada Revenue Agency does require annual filing for most citizens but there are exceptions, so lets have a look at who is required to file a Canadian T1 General tax return and when;

Do I Need To File A Tax Return

Factors such as age, disability, filing status, and income will determine whether or not the U.S. federal government requires you to file a tax return. The charts below will assist you in determining this.

However, just because you are not required to file a tax return does not necessarily mean you shouldn’t. Later in this article, we will discuss the reasons to file a tax return even when it is not required.

Read Also: How To Get Tax Exempt Status

Learn Which Credits And Deductions You Can Take

Getting a sense of which;;can help you pull together the proper documentation. Here are a few to consider:

- Savers credit.;If you are not a full-time student and are not being claimed as a dependent, you may be eligible for a tax credit if you contribute to a retirement plan. The amount of the credit depends on your filing status and adjusted gross income. For the 2021 tax year, if your filing status is single, you may be eligible if your adjusted gross income is $33,000 or less. If you are married and are filing jointly, you may be eligible if your adjusted gross income is $66,000 or less. However, these numbers are subject to change in future tax years.

- Student loan interest.;You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

- Charitable deductions.;Donating to your alma mater or a favorite charity? Generally, you can deduct those donations if you itemize your taxes.

- Freelance expenses.;If you are self-employed, you may be able to claim deductions for work-related expenses such as industry subscriptions and office supplies.

If you think you may qualify for additional credits or deductions, check the;IRS website.

How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRAs website for filing deadlines.

Recommended Reading: Who Can I Call About My Tax Refund

Having Your Return Filed By An Accredited Person

You can have a person accredited by Revenu Québec file your return. Note that accredited persons who file more than 10;income tax returns are required to file them online.

Before having an accredited person file your return online, you must complete and sign two copies of the authorization form .You and the accredited;person must each keep a copy of the form for a period of six years from the date on which the tax return was filed. Do not send us a copy unless we ask for it.

Filing Requirements For Dependents

Taxpayers who are claimed as dependents are subject to different rules for filing taxes.

Dependents include children under the age of 19 , or who are permanently disabled along with qualifying relatives .; When their earned income is more than their standard deduction, taxes have to be filed. A dependent’s income is unearned when it comes from sources such as dividends and interest.

Single, under the age of 65 and not older or blind, you must file your taxes if:

- Unearned income was more than $1,050

- Earned income was more than $12,000

- Gross income was more than the larger of $1,050 or on earned income up to $11,650 plus $350

If Single, aged 65 or older or blind, you must file a return if:

- Unearned income was more than $2,650 or $4,250 if youre both 65 or older and blind

- Earned income was more than $13,600 or $15,200 if youre both 65 or older and blind

If youre married, under the age of 65 and not older or blind, you must file a return if:

- Unearned income was more than $1,050

- Earned income was more than $12,000

- Your gross income was at least $5 and your spouse itemizes deductions

- Your gross income was more than the larger of $1,050 or your earned income was $11,650 plus $350;

Read Also: When Is Sales Tax Due

Coronavirus Unemployment Benefits And Economic Impact Payments

You may have received unemployment benefits or an EIP in 2020 due to the COVID-19 pandemic.

Unemployment compensation is considered taxable income. You must report unemployment benefits on your tax return if you are required to file.;

If you received the EIP, you do not need to report it as income whether youre required to file a tax return or not. If you did not receive some or all of your stimulus payments, you may claim missing stimulus money that you are owed by filing for a Recovery Rebate Credit on your 2020 return.