Create Item Sales Tax From The App

With the Square app, you can create multiple tax rates and customize how tax is applied to your items.;

Tap the three horizontal lines in the upper right corner to navigate to the menu.

Tap Settings>Checkout>Tax.;

On an iPhone, tap the + icon in the top-right corner. On an iPad, tap Add a New Tax, and on an Android device, tap Create Tax.;

Enter the tax information and toggle on;Enabled;to automatically apply this tax at checkout.;

Tap Applicable Items to choose which items;this tax will automatically apply to.;Toggle on Custom Amounts to apply this tax to amounts entered at the time of a sale.

Tap the back arrow >Item Pricing. Select if this tax will be included in item prices or added to a price at the time of sale.

Make sure to save your updates.

What Is Us Sales Tax

In the United States, sales tax is a consumption tax that is theoretically only charged once, at the final purchase of the final product by the end consumer. US sales tax is not a nationwide policy, such as VAT throughout the European Union or GST in Australia. Rather than administered on a federal level, it exists at the state and local levels. States and local jurisdictions have the power to set their own tax laws and rates.

- 45 states and the District of Columbia collect statewide taxes.

- 38 states have some form of local tax, collected in part or all of the state.

The result is that there are thousands of taxing jurisdictions in the United States! Within those states and local jurisdictions, there are several other factors that determine whether your business is liable or not â which is to say, whether your business has nexus.

Note: There’s also a use tax in the United States, used whenever sales tax isn’t applicable. Though this mostly affects your customers, it’s something you should be aware of, especially as a remote seller.

Calculating Sales Tax During A Tax Holiday

This example shows how to calculate the sales tax amount and the total amount a customer owes for purchases made during a sales tax holiday. Some of the customer’s items are taxable because they do not qualify for the sales tax exception, while other items are non-taxable because of the exception. The customer is purchasing new clothes, shoes, a backpack and school supplies, tissues and cleaning wipes, a laptop and makeup. The following list shows the store’s total sales amount for each of these categories:

- Clothes: $155.95

Read Also: How To Pay Llc Taxes

How To Deduct Sales Tax In The Us

When filing federal income tax, taxpayers need to choose to either take the standard deduction or itemize deductions. This decision will be different for everyone, but most Americans choose the standard deduction. Sales tax can be deducted from federal income tax only if deductions are itemized. In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time. Itemizing deductions also involves meticulous record-keeping and can be tedious work because the IRS requires the submission of sales tax records, such as a year’s worth of purchase receipts. Anyone who plans to itemize should be keeping detailed records, as it will be very helpful in determining the amount of sales tax paid.

For more information about or to do calculations involving income tax, please visit the Income Tax Calculator.

Should I Charge Sales Tax On Everything

It may be tempting to look at the complicated tangle of sales tax rules and just decide to charge sales tax on everything. Thats not a good idea either for your customers, who may not appreciate being charged tax for something they shouldnt be, or for your business, which could be fined for charging unnecessary taxes or even be charged with tax fraud.

While it may take some work to figure out what sales tax rates to charge for the different services and goods your business offers, it pays off in the long run.

Start with your states revenue department to determine what should be taxed. There are important distinctions to sort out.

For instance, say you have a small shop that sells homemade jams, jellies, maple syrup, nuts, candy, home-brewed wine and baked goods, as well as hand-made toys and crafts. You have a bricks-and-mortar store, but also sell online.

While food is considered a necessity and generally is not taxed, 15 states do charge taxes in a variety of ways. Some charge taxes on all groceries, though most at a lower rate than other retail items.

For the sake of argument, well say your store is in Maine. While Maine doesnt tax groceries, there are many exceptions.

So, the food and drink items you sell from your brick-and-mortar store in Maine are subject to a 5.5% tax. The non-food items are subject to an 8% sales tax.

Thats just one small example of how a small business owner may have to understand a wide variety of sales tax differences.

15 Minute Read

Don’t Miss: Can You File Missouri State Taxes Online

Goods And Services Tax/harmonized Sales Tax

The goods and services tax is a;5% federal tax you pay on most goods and services you purchase in Canada. In some provinces, the GST has been combined with provincial sales tax to create the harmonized sales tax . HST rates vary by province.

Some common examples of goods and services that we do not pay GST/HST on, are:

- basic groceries such as milk, bread and vegetables

- prescription drugs and drug-dispensing fees

- medical devices such as hearing aids and artificial teeth

- most healthcare, medical and dental services

- residential rents, including university residences and boarding houses

- used residential housing

- local or municipal bus services and passenger ferry services

- legal aid services

- most child care and educational services including tuition fees

How To Handle Sales Taxes When You Sell Across State Lines

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance.;He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer.;His background in tax accounting has served as a solid base supporting his current book of business.

E-commerce provides businesses with access to much larger markets, but it also complicates even the simplest of retail transactions. One of the most challenging aspects can be figuring out which sales taxes apply to individual sales, especially when you’re selling to out-of-state customers. Here’s an overview of when you should collect sales taxes for out-of-state sales and how to keep track of everything.

Don’t Miss: How Much Is New York State Sales Tax

How To Add Sales Tax

wikiHow is a wiki, similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 14 people, some anonymous, worked to edit and improve it over time. This article has been viewed 82,133 times.Learn more…

When browsing in your favorite department store, the prices listed aren’t actually telling you the total cost. Most cities and states charge a sales tax, driving the price of a cool new jacket or a fabulous piece of jewelry past what is listed on the tag. Depending on where you are sales tax may differ, so it’s important to be able to quickly and easily figure out how much you’ll be charged at checkout. Follow one of these easy methods to figure out your final tab.

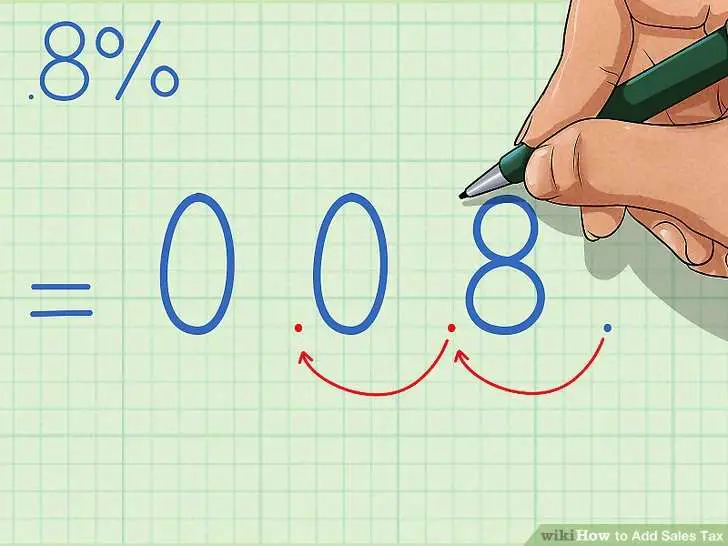

Multiply Retail Price By Tax Rate

Nailing down the rates is much more complicated than the actual math used to determine how much sales tax you’ll be paying that’s just a simple percentage.

Let’s say you’re buying a $100 item with a sales tax of 5%.

Your math would be simply: x = .

That’s $100 x .05 =$5.

Since you’ve figured out the sales tax is $5, that means the total you’ll pay is $105.

Don’t Miss: What Tax Bracket Are You In

Sales Tax Generally Depends On The Ship

When selling online, you first need to determine if you are required to collect sales tax from buyers in your buyerâs state. Next, you need to determine the sales tax rate at the buyerâs location.

There are over 10,000 sales tax jurisdictions in the United States. And the sales tax rate you charge depends on your buyerâs shipping address. For example, the sales tax rate in Atlanta, GA is 8.9%, but the sales tax rate just outside the city limit is 7%. To collect sales tax when selling online, you must determine if your customer lives within the Atlanta city limits or outside them.

If your customer lives in Atlanta proper, youâd charge them 8.9% sales tax. But if they live outside the city limits, youâd only charge 7%.

What Businesses Need To Know

Small business owners have to be prepared and knowledgeable about their sales tax obligation. Mistakes in reporting or remitting sales taxes or even missing a scheduled payment can result in penalties or criminal charges. The pitfalls are many, and it is easy to overlook or forget something.

Common stumbling blocks are confusion over what constitutes a resale and what to do about them; understanding terminology; and even what, specifically, to tax.

Recommended Reading: Can I File Old Taxes Online

Exemption Based On The Type Of Buyer

If youâre selling to certain organizations, your products might be tax-exempt. Anything sold to the US federal government cannot be taxed. Similar exemptions often exist for state and local governments and agencies, non-profit organizations, or other licensed charitable, religious, or educational groups.

How Do I Manage Sales Tax Questions Successfully

Most sales tax questions and issues arent one-time problems. The most common pain points for small business owners are concerns that come up again and again. While you cant avoid paying sales tax, you can find a comprehensive solution that makes how you deal with taxes smarter and more efficient.

- Save time. When all your information is in one place, it saves you valuable time. A comprehensive sales tax solution allows you to look up sales tax rates, identify appropriate product taxability statuses, get due dates, and search sourcing rules easily, putting all your sales tax answers in one place.

- Stay organized. Gone are the days of managing multiple stacks of paper, hoping you remembered to file the one you need in the exact moment you need it. A comprehensive tax solution helps you stay organized, save time, free up capital, and keep ahead of upcoming legislative changes without risk to your business.

- Lower risk. You want to see a problem before it becomes a problem. Having industry leading, up-to-date information at your fingertips is critical to success. The ability to access step-by-step tax guidance, automated compliance, and exemption forms in a single space allows you to work confidently while minimizing risk.;

Read Also: Do You Have To Pay Taxes On Plasma Donations

Determining Factors For Sales Tax Nexus

Although thereâs no standard policy, and no standard definition of ânexus,â the policies usually differ in the same ways. Certain characteristics come into play across the board. Understand these factors, and youâll have an easier time understanding the nuances of any singular stateâs law.

Where youâre located

Classic physical presence factor. If you have a retail space, a storage space/warehouse, an office, an employee, or any other tangible representation of your business in a state, then youâre probably required to register there.

What you sell

Sales tax policies can differ depending on what type of product you sell. Is it a physical good? Is it a physical service, or a digital service? Is it a digital item, or a digital subscription? Read more for specific guidance on SaaS, online courses, and digital products.

How you sell it

Certain marketing and selling practices constitute a nexus in some states. Do you sell from a brick-and-mortar, your website, or an online marketplace? Do you use telemarketers that call customers in a state, or do you have any affiliate businesses marketing your product in that state? These types of nexus often affect e-commerce businesses in the US.

How much you sell of it

Best Alternatives To Quickbooks: Freshbooks

The account software market has been flooded with variety making it challenging to find the best alternative to the QuickBooks services at an affordable price. FreshBooks created 2004 specially targeted at small business and freelancer offers the best services at an affordable price. It is equipped with features that are sure to make your task simple and fast.

Also Check: Are Taxes Due By Midnight May 17

What Are Sales Tax Holidays

Sales tax holidays are short-term periods in which consumers are exempt from paying sales taxes. These holidays usually exist to provide additional savings that encourage consumers to make purchases for back-to-school shopping or hurricane preparedness during a specific time. The length of a sales tax holiday also varies, but it is often a day, weekend or one week.

Not every state has a sales tax holiday. States that have a sales tax holiday usually identify specific items and a maximum sales price for each item that qualifies for the sales tax exemption.

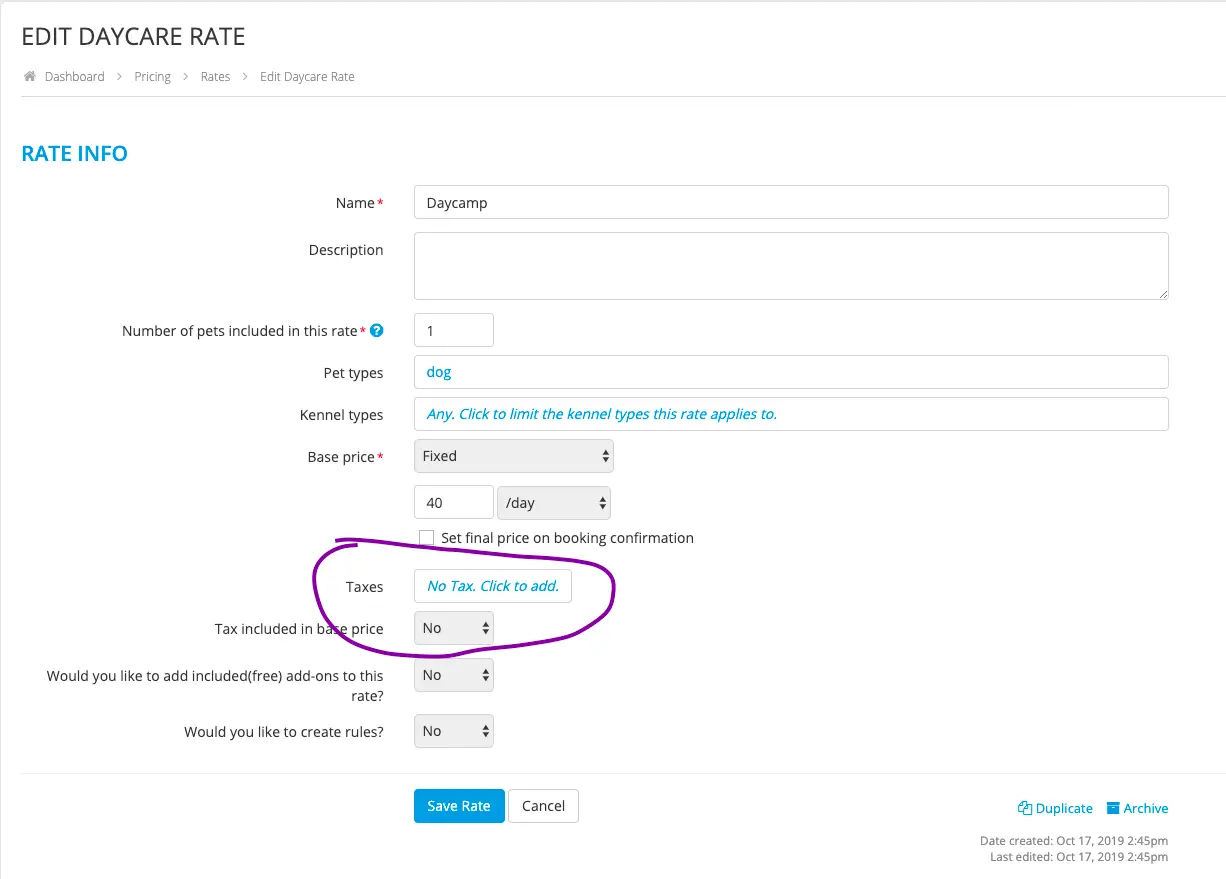

When To Add Tax

There is no federal sales tax, and while 45 states do implement sales tax, it’s important to recognize that each state has its own unique tax rate, and they each have different rules regarding what is taxable. Generally, only retail items sold to consumers are taxable and not services or items that are sold wholesale to other retailers, but each state has more specific rules. For example, some states require beverages to be taxed, while others don’t, and some tax clothing, while others don’t.

When trying to determine how much sales tax to add to a transaction and whether or not a certain item should be taxed, it is important to review your local tax rate and laws regarding what is taxable. Since local governments may add their own additional taxes, always look up the tax rate for the specific city where the purchase will take place. For example, try searching “Fort Worth sales tax” rather than just “Texas sales tax”. This is true even in Alaska, Delaware, Montana, New Hampshire and Oregon since local governments in those areas might charge sales tax even if the states themselves don’t charge it.

If you’re trying to estimate the total price of something before buying it to budget for the purchase and you don’t want to get too bogged down in the state tax code, just add sales tax to the entire purchase even if specific items you intend to buy may or may not be taxed. This way, you can be sure you won’t go over budget, even if your items are a little less.

You May Like: How To Calculate Net Income After Taxes

Sales Taxes On Internet Products And Services

The landscape of;internet sales tax is continually changing, and a recent Supreme Court decision opened the way for more states to charge sales taxes on sales over the internet. As of December 2019, 43 states collect sales tax on internet transactions. Most only collect the tax on sellers who have more than 200 internet transactions or $100,000 in sales each year.

Each state has complicated regulations for internet sales tax and these regulations may change. Check with your state sales taxing agency to be sure you are following the law.

Calculate The Combined Sales Tax Rate

The combined sales tax rate is a single figure that represents an area’s total sales taxes, which includes city, county and state sales taxes. Businesses calculate the combined sales tax rate by adding these individual sales tax rates together. Businesses with two or more locations need to calculate the combined sales tax rate for each area they do business in to ensure they collect the correct amount of sales tax from consumers at each location.

For example:The city of Tampa is in Hillsborough County in the state of Florida. Florida’s base sales tax rate is 6%, and Hillsborough County has a sales tax rate of 2.5%. When you add these sales tax rates together, the combined sales tax rate in Tampa, Florida is 8.5%. But counties surrounding HillsboroughâPinellas County, Pasco County and Polk Countyâeach have a sales tax rate of 1%, making the combined sales tax rate in these areas 7%.

Read Also: How Much Tax Do You Have To Pay On Stocks

The Complexity Of Sales Tax

Sales taxes are, frankly, a mess. There are;many taxing localities involved, each with its own tax rate and list of taxable products and services. If you have a tax presence in different states, you may have to collect different taxes on different items. And if you sell online, trying to figure out if you have to collect sales tax from customers in many states becomes almost impossible to manage.;

To help you sort this out, this article contains the steps and decisions you will need to go through in order to collect, report, and pay sales taxes on the products or services you sell. Here are the main steps in the process of preparing to collect, report, and pay sales taxes.