How Many Dependents Can I Claim On W4

As a single parent, you can get two allowances for only one job. If you have more than two children, you will need to work out how to claim different allowances for each one. This is, in fact, true and if someone declares you as their dependent in their tax return, they can only claim one personal allowance. This means that a lot of taxes will be withheld from your income and might result in a refund

Do I Claim 0 Or 1 On My W4 2021

This is a question about the 0 or 1 on your W4 for 2021. You can claim either one. If you are not expecting income from this job then you should claim the 0 on the w4, but if you are expecting income from this job then you should claim the 1 on the w4.

In order to know whether you should claim 0 or 1, there are a few things that need to be evaluated:If you expect more than $2,400 in taxable wages for 2020If your employer is withholding Social Security and Medicare taxesIf your employer will withhold federal income tax from your wagesThe IRS calculates your withholding based on the number of allowances you claim on your W-4. For example, if you are single and have one job, you would claim one allowance.

If the 0 and 1 seem too confusing for you, we recommend using a withholding calculator to see what is best for your situation.

Status Of Personal Exemptions

The Internal Revenue Code used to allow taxpayers to deduct personal exemptions for themselves, as well as for each of their dependents. These deductions reduced gross income to arrive at taxable income through tax year 2017. The provision was eliminated by the Tax Cuts and Jobs Act beginning in 2018.

The TCJA is set to expire at the end of 2025, however. One of three things could happen at that time: Congress might let the law die a natural death, and personal exemptions would return, or it might renew the TCJA in its present form, so we’d be without personal exemptions for another stretch of years. Finally, Congress could resurrect the TCJA, but with changes that might or might not affect the status of these exemptions.

Recommended Reading: Doordash 1099-nec Schedule C

What Does Claiming 0 On Your Taxes Means

Claiming 0 will have the largest amount withheld from your paycheck for federal taxes. This is because you want to avoid owing more come tax season. If you are looking to increase your refund, then claiming 0 is your only option. However, it will be important to remember that this means there wont be any wages available during the year should you need them

You might also need to claim 0 in a few different situations:

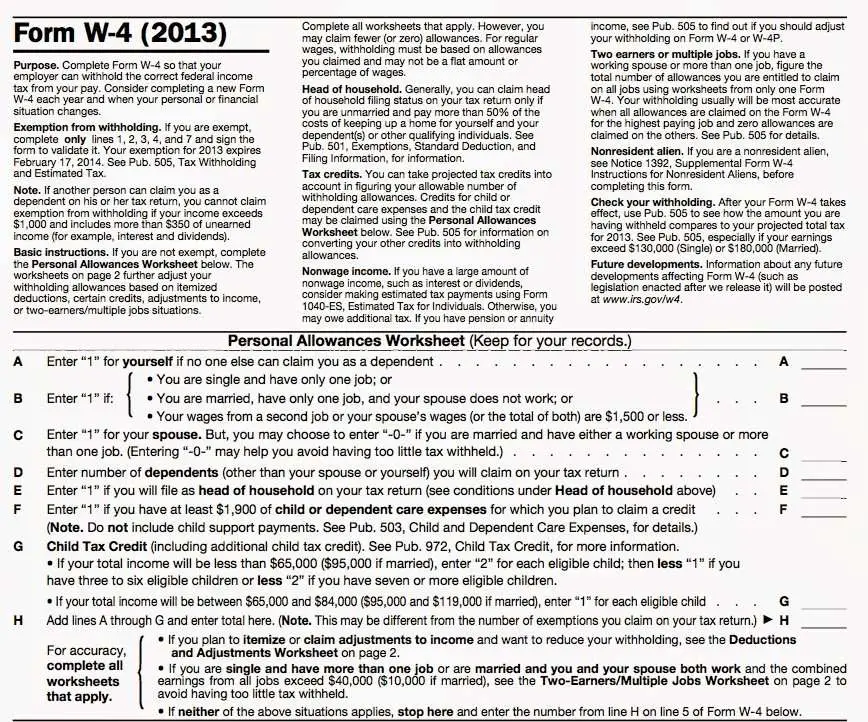

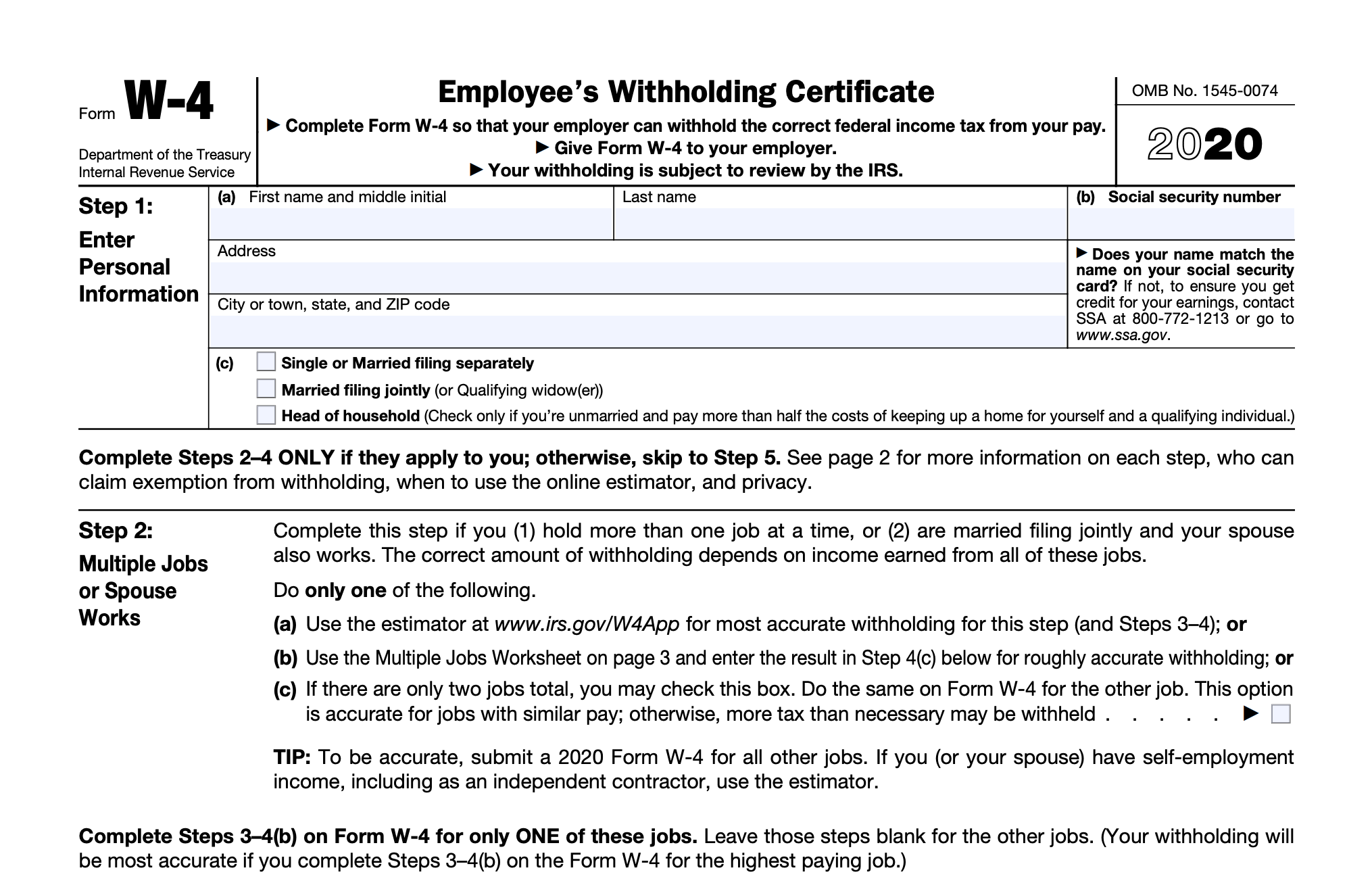

What Is A W

Most people cross paths with a W-4 form, but not everybody realizes how much power Form W-4 has over their tax bill. Here’s what the form is used for, how to fill it out and how it can make your tax life better.

A W-4 form, formally titled “Employee’s Withholding Certificate,” is an IRS form employees use to tell employers how much tax to withhold from each paycheck. Employers use the W-4 to calculate certain payroll taxes and remit the taxes to the IRS and the state on behalf of employees.

You do not have to fill out the new W-4 form if you already have one on file with your employer. You also don’t have to fill out a new W-4 every year. If you start a new job or want to adjust your withholdings at your existing job, though, you’ll likely need to fill out the new W-4. Either way, it’s a great excuse to review your withholdings.

Also Check: Irs Employee Lookup

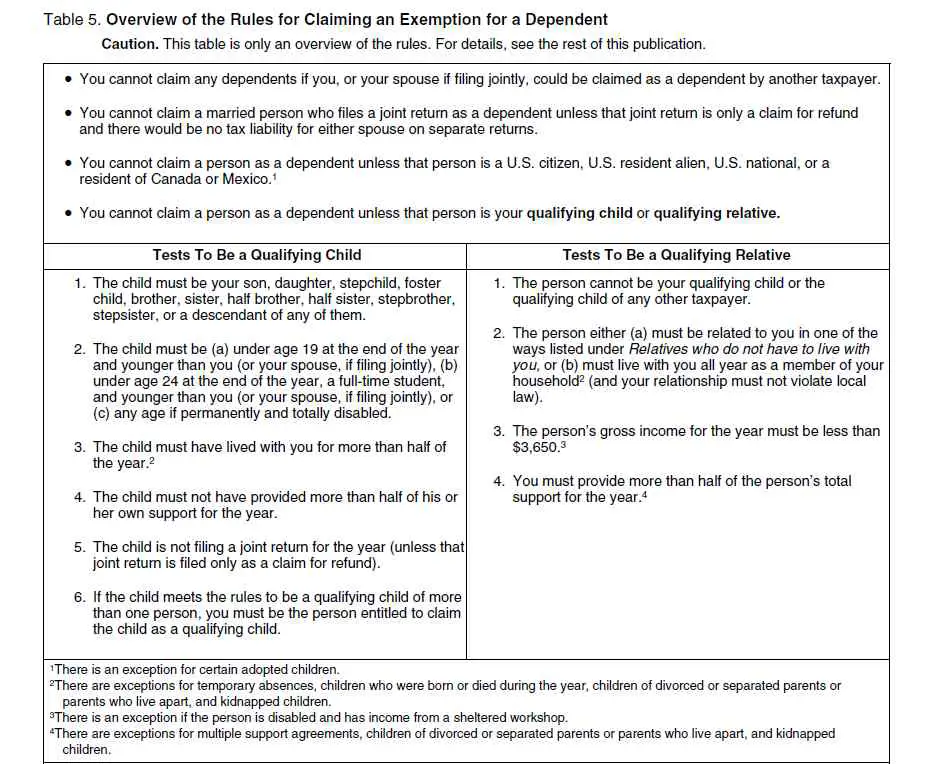

Who Is Not A Tax Dependent

These people generally wont count as your tax dependents:

-

Anyone at all, if someone else can claim you as a dependent .

-

Generally, a married person who files a joint tax return .

-

Anybody who is not a U.S. citizen, U.S. resident alien, U.S. national or a resident of Canada or Mexico .

-

People who work for you.

-

Foreign exchange students.

Childrens Fitness Tax Credit And Art Amount

Only Quebec, Manitoba, and Yukon still have the fitness tax credits and the childrens art amount. All other provinces have eliminated these credits.

- Yukon childrens fitness tax credit which allows you to claim $1000 fees paid for children under 16 offers also a supplement of an additional $500 for children with disabilities. Yukon offers a claim of $500 fees paid for the childrens art amount for children under 16 who are enrolled in an art program and a supplement for an additional $500 for children with disabilities.

- Manitoba offers the same childrens art amount as Yukon but a different Manitoba fitness amount that covers $500 in fees paid for any family member.

- Quebec residents can apply for a similar credit called Tax Credit for Childrens Activity. The credit allows you to apply for $500 in fees paid per child and another $500 per child who is suffering from infirmity or disability.

Don’t Miss: Plasma Donation Taxable

Which Parent Should Receive The Dependency Exemption

Child support is based in part on each parents net disposable income. The more net income a child support payor has, the greater the child support obligation. The more net income a child support payee has, the less the child support obligation. Dependency exemptions typically increase net income, thereby either increasing or decreasing child support, depending on who claims the child. Claiming a child does not create a dollar for dollar increase or decrease in child support, so it is important to specifically determine the benefit or loss.

As a general rule, the parent who earns more taxable income receives a greater value for the dependency exemption. For a parent with little to no taxable income, there is a very limited benefit to this exemption. For example, a stay at home parent has no income except for possibly spousal support . Deducting $4,000 from no earned income will result in no benefit to that parent. Conversely, assume the other parent earns $100,000 a year. That parent would benefit from deducting $4,000 from earned income because that parent would pay less in taxes.

Conversely, when a parent earns too much income, the dependency exemption begins to lose value, up to the entire amount. A parent earning in excess of $400,000 annually will likely receive no benefit to claiming a child on taxes. Therefore, assuming the other parent earns less, the high earning parent should make sure the other parent claims the children as dependents.

What Should I Put On My W

If you got a huge tax bill when you filed your tax return last year and dont want another, you can use Form W-4 to increase your withholding. Thatll help you owe less next time you file. If you got a huge refund last year, youre giving the government a free loan and could be needlessly living on less of your paycheck all year. Consider using Form W-4 to reduce your withholding.

Here are some steps you might take toward a specific outcome:

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

Rules For Claiming A Dependent On Your Tax Return

OVERVIEW

Claiming dependents can help you save thousands of dollars on your taxes. Yet many of us are not aware of who in our family may qualify as our dependent. Review the rules for claiming dependents here for a qualifying child or relative.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Having trouble deciding if your Uncle Jack, Grandma Betty or daughter Joan qualifies as a dependent? Here’s a cheat sheet to quickly assess which of your family members you can claim on your tax return.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: Are Home Improvements Tax Deductible

Filing To Recover Taxes Withheld

Some employers automatically withhold part of pay for income taxes. By filing Form W-4 in advance, children who do not expect to owe any income tax can request an exemption. If the employer already has withheld taxes, your child should file a return to receive a refund of all taxes withheld from the IRS.

To receive a refund, your child must file IRS Form 1040.

Do I Need To File Form 2120

Taxpayers use Form 2120 when they want to claim a relative as a dependent on their tax return, but they dont pay enough of the cost of supporting that relative to do so under normal tax rules. If other people who contribute to the cost of caring for that relative agree, the taxpayer may be able to claim the dependent.

Also Check: Www.1040paytax.com.

Could My Adult Dependent Still Be Required To File A Tax Return

Yesyour adult dependent may still need to file a tax return in certain situations.

If your single dependent was under age 65 and not blind in 2020, they must file a tax return if they had:

- Unearned income more than $1,100

- Earned income more than $12,400

- Gross income more than the larger of:

- $1,100

- Earned income up to $12,050 plus $350

If your single dependent was age 65 or older, they must file a tax return if they had:

- Unearned income more than $2,750

- Earned income more than $14,050

- Gross income more than the larger of:

- $2,750

- Earned income up to $12,050 plus $2,000

If your single dependent was under age 65 and blind, they must file a tax return if they had:

- Unearned income more than $2,750

- Earned income more than $14,050

- Gross income more than the larger of:

- $2,750

- Earned income up to $12,050 plus $2,000

If your single dependent was age 65 or older and blind, they must file a tax return if they had:

- Unearned income more than $4,400.

- Earned income more than $15,700.

- Gross income more than the larger of:

- $4,400

- Earned income up to $12,050 plus $3,650

Filing For Educational Purposes

Filing income taxes can teach children how the U.S. tax system works while helping them create sound filing habits for later in life. In some cases, it also can help children start saving money or earning benefits for the future as noted above.

Even if your child doesn’t qualify for a refund, wants to earn Social Security credits, or opens a retirement account, learning how the tax system works is important enough to justify the effort.

Also Check: Is Plasma Donation Income Taxable

Child Tax Credit: What Will You Receive

If you have children or other dependents under the age of 17, you likely qualify for the Child Tax Credit. Its been increased as part of the American Rescue Plan, which was signed by President Biden in March 2021 as part of a U.S. government effort to help families deal with the financial hardships stemming from the COVID-19 pandemic. Direct cash payments will begin on July 15. There are also a number of income limits you should know about when planning how much youll receive. Since planning your familys finances goes beyond just taxes, consider working with a local financial advisor to optimize your plans.

Which Dependents Are Eligible For The Child Tax Credit

Eligibility for the CTC hinges on a few factors. The child you claim as your dependent has to meet seven pieces of criteria from the IRS:

Don’t Miss: Appeal Cook County Taxes

What Dependent Tax Credits Are Available

If you do claim a qualifying child as a dependent , you may be able to claim a Child Tax Credit.2 The maximum amount of credit that you’d be eligible for is $2,000 per qualifying child . The income threshold where the child tax credit begins to phase out has also increased from $110,000 to $400,000 for married couples filing jointly. What this means is that even more families with children under the age of 17 qualify for the larger credit. Heck yeah!Now, if you claim a qualifying relativesomeone who is not your childyou would qualify for a non-refundable tax credit of up to $500 per qualifying person. You may also be able to claim this credit if you have children over the age of 17 or another qualifying dependent.3

Claiming Dependent And Property Tax Credits

As with federal income tax returns, the state of Arizona offers various credits to taxpayers. One credit taxpayers inquire frequently on is the dependent tax credit. Prior to the 2019 return, Arizona allowed taxpayer’s to claim an exemption for each dependent. Beginning with the 2019 tax return, the dependent deduction was replaced with a dependent credit. The credit is $100 for each dependent under 17 years of age and $25 each for all other dependents. The credit is subject to a phase out for higher income taxpayers.

To get the dependent credit , individuals must enter all information requested under the dependent section on front of Forms 140, 140A, 140PY, or under the dependent section on page two of Forms 140PTC and 140X. If there are more dependents to enter, taxpayers can use the continuation sheet provided with each of these forms. Individuals want to include names, social security numbers, relationships and months the dependents lived in the home. Individuals who do not furnish this information may lose the dependent credit .

As for the property tax credit, individuals may qualify for a credit if they were residents of Arizona the entire year and meet all of the following criteria:

Taxpayers should note that property tax claims must be filed on or before the due date, including any extensions, for the year in which the credit is being claimed. They can request an extension of up to six months when filing Form 140PTC. Please read the instructions on the form.

You May Like: Do You Have To Pay Taxes On Plasma Donations

Member Of Household Or Relationship Test

First of all, the person must either be related to you or live with you as a member of your household. “Related” means the person is either:

- your child, stepchild, eligible foster child, or a descendant of any of them

- your brother, sister, half brother, half-sister, stepbrother, or stepsister

- your father, mother, grandparent, or other direct ancestor, but not a foster parent

- your stepfather or stepmother

- a son or daughter of your brother or sister

- a brother or sister of your father or mother, or

- your son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law.

If any of these relationships were established by marriage, they don’t count if the marriage was later ended by death or divorce.

How To Claim Dependents On Taxes

When it comes to filing taxes, knowing how to file is an important part of completing taxes properly. This is because filing correctly could help you get the most from your tax return, and it could help prevent receiving any penalties from the IRS.

Claiming dependents could reduce the amount of your taxable income. A large part of filing taxes is figuring out how to claim dependents and who qualifies as a dependent. Figuring out the process of claiming a relative as a dependent on a tax return is fairly simple and only takes a few stepsâfrom identification to filling out paperwork.

You May Like: Payable Doordash 1099