Gain A Trusted Partner

Bench also provides tax advisory sessions that help business owners better understand their tax situation. This is particularly relevant for S corporations, which tend to receive more scrutiny from the IRS because of the lack of rules around âreasonable salaries.â

With our Premium plan, business owners get access to on-demand and unlimited tax consultations so they can ensure theyâre remaining compliant with the IRS while also receiving consultation on tax savings, deduction limits, entity reclassification, and more.

How Much Does An S Corp Pay In Taxes

All California LLCs or corporations that choose S Corp taxation must pay a 1.5% state franchise tax on their net income. This is paid by the business itself, not the LLC members or corporate shareholders. Also, all LLCs and S Corps must pay a minimum $800 franchise tax annually, except for the first year.

What To Do If You Have A Qsss

In most instances, New York will follow the federal QSSS treatment in the Article 9-A and Article 32 franchise taxes, but different situations may apply when the parent is not a New York S corporation. See New York QSSS treatment – tax years beginning before January 1, 2015 for additional information.

Recommended Reading: Does Doordash Send You A 1099

Which High Income Taxpayers Pay Tax

A single taxpayer treats her or his S corporation or active real estate investment income as net investment income and so potentially subject to net investment income tax if her or his modified adjusted gross income exceeds $400,000.

A married taxpayer filing a separate return treats her or his S corporation or active real estate investment income as net investment income and so potentially subject to net investment income tax if her or his modified gross income exceeds $250,000.

Let me give an example so you see how this works.

Say a single person earns $410,000 in S corporation income and $90,000 in W-2 wages and therefore enjoys $500,000 of modified adjusted gross income. Build Back Better treats the $410,000 of S corporation income as net investment income. And therefore this taxpayer will pay the 3.8% tax on $300,000 of that $410,000 of S corporation income. Note that the taxpayer pays the 3.8% on the lesser of the $410,000 of net investment income or the amount by which the taxpayers $500,000 of modified adjusted gross income exceeds $200,000which equals $300,000.

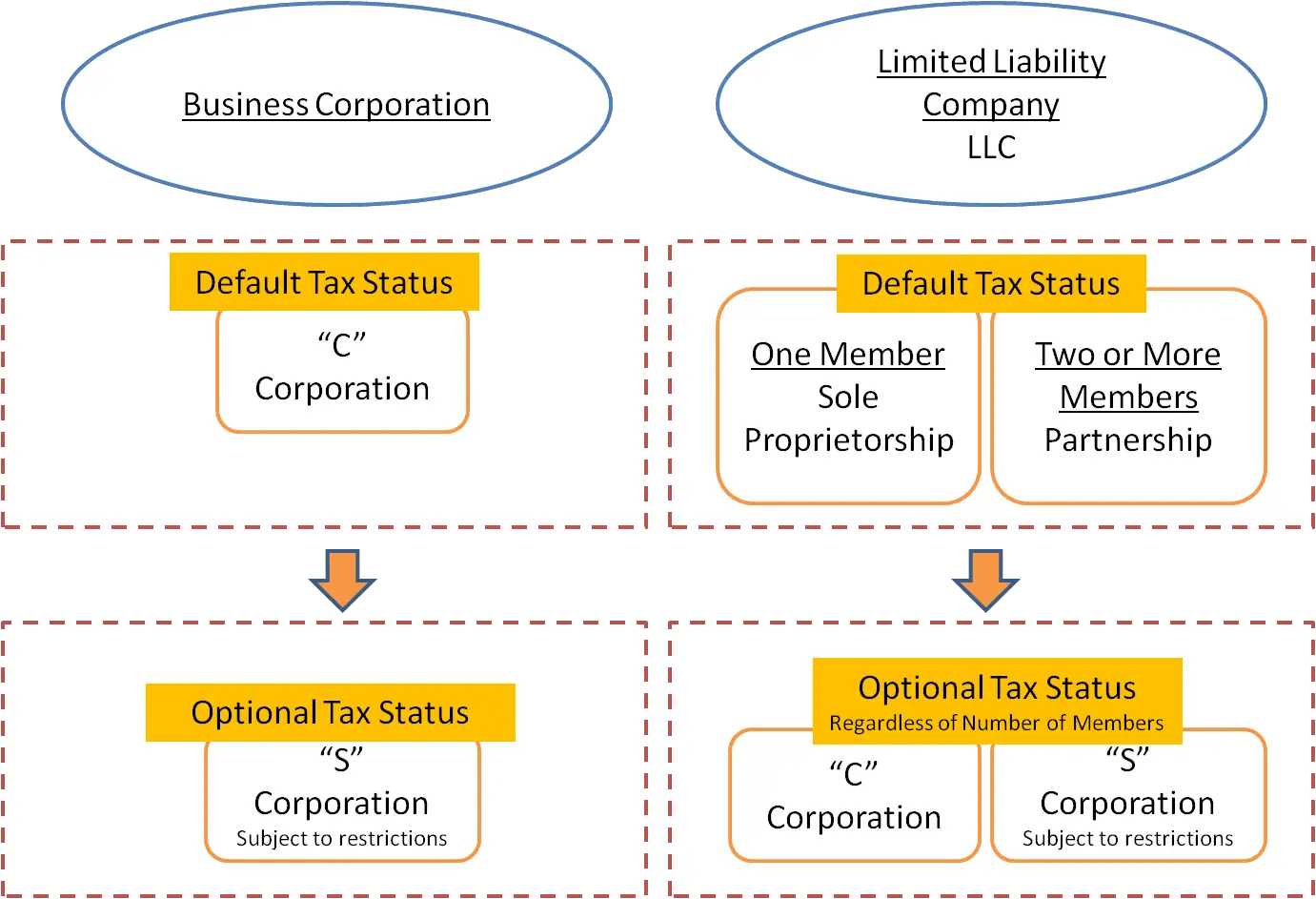

An Overview Of How Businesses Are Taxed

Starting a business is a big decision. But its just one of many to follow. Most importantly, youll decide which type of entity your business should be. Among several choices including sole proprietorship, partnership and limited liability company , a corporation is one of the most popular choices.

Corporations offer some key advantages over other business entities. For starters, unlike partnerships and sole proprietorships, the owners arent personally liable for the businesss debts. A corporation is also usually the best choice if you plan to grow a company to considerable size.

However, choosing to incorporate isnt the end of it. Entrepreneurs also need to choose what kind of corporation to become. The choices C Corp and S Corp get their names form the relevant section of the Internal Revenue Code that governs how they are taxed. But there is more than a single letters difference between them.

Read Also: Doordash Accounting Method

How S Corporations Are Taxed

In an S Corporation, the taxes flow through it to the individuals who own it and the income or losses are reported on their tax forms. The taxes are reported in the same way that a partnership does. On the tax Form 1120S, the details of the businesss finances are reported, including:

- Income

- Losses

- Tax credits

A Schedule K-1 must also be submitted to all shareholders, which shows the portion of money received that were reported on the 1120S. Each shareholder reports their share on a Schedule E when they file their 1040 taxes. Owners of an S Corporation can benefit from this format, more than would be possible by using the C organization format for their LLC. In a regular LLC, owners who are partners are not considered employees.

When an owner who actively participates in the business performs services for an LLC that is taxed as an S Corporation, it is necessary to be treated as an employee for tax purposes and as an owner. Average pay or salary must be given for those tasks performed, and the same benefits need to be given that other employees receive. The dual status of an owner is how greater tax benefits are given. The salary given for services performed is taxable, and must be reported on 1040 taxes. Social Security and Medicare Taxes will also have to be taken out of this income, as well as any Federal and state taxes that apply.

The Advantages And Benefits Of An S Corporations

S Corporations offer several advantages if your company qualifies:

Tax advantages

S Corporations are exempt from federal income tax except for certain capital gains and passive income. Similar to the LLC, the S Corporation allows profit to pass through to its shareholders, and the income is then taxed on the shareholders personal tax returns at each shareholders individual tax rates. Because the S Corporation is a pass-through entity, this ensures that the corporations profits are only taxed once at the shareholder level. This means that S Corporations avoid having to pay what is often referred to as double taxation of dividends. See how much you can save with our S Corporation Tax Calculator.

Asset protection

If your business is an S Corporation, you have certain legal protections for your personal assets which are separate from the assets of the business. For example, shareholders are not personally liable for the companys debts or liabilities, and for the most part, creditors are not able to go after the shareholders personal assets in order to recover business debts.

Flexible characterization of income

Easy transfer of ownership

S Corporation ownership interests are easy to transfer to other owners without causing significant tax consequences or terminating the corporate entity. An ownership transfer of an S Corporation does not require adjustments to property basis or compliance with complicated accounting rules.

Also Check: Appeal Cook County Property Taxes

Other Taxes Paid By S Corporations

The S corporation pays the same taxes as other businesses, including:

An S corporation must pay employment taxes on employee pay, including withholding and reporting federal and state income taxes, paying and reporting FICA taxes, worker’s compensation taxes, and unemployment taxes. Also, if the S corporation owns a building or other real property, property taxes are required to be paid on this property.

S corporations are required to pay state sales taxes and excise taxes in the same manner as other business types. Check with your state department of revenue for more information on sales and excise taxes.

Some states levy franchise taxes, state income taxes, or gross receipts taxes on S corporations each year. Check with your state department of revenue to see if your state requires these taxes.

Positive Return On Investment

Although the IRS charges minimal filing fees to elect S corp status, there are additional bookkeeping and payroll costs that can be expensive. Some LLCs already have employees and payroll costs, in which case this isnt really a factor in deciding whether to elect S corp.Because of the added administrative costs, the tax advantages of electing the S corp classification must be substantial enough to more than cover them for the election to make sense. Generally speaking, a reasonable salary plus $10,000 in annual distributions is often enough to save money on your tax return.

For help choosing payroll and accounting services, see our review of the Best Payroll Software for Small Business.

Are you looking for the right business structure for your small business? Visit our How to Choose a Business Structure guide.

Read Also: When Does Doordash Send 1099

General Relief Rules For S Corporation Elections

The following requirements must be met to qualify for late S corporation election relief by a corporation or entity classified as a corporation:

- The entity intended to be classified as an S corporation, is an eligible entity, and failed to qualify as an S corporation solely because the election was not timely

- The entity has reasonable cause for its failure to make the election timely

- The entity and all shareholders reported their income consistent with an S corporation election in effect for the year the election should have been made and all subsequent years and

- Less than 3 years and 75 days have passed since the effective date of the election .

In addition, if the electing entity is requesting a late corporate classification election to be effective on the same date that the S corporation election was intended to be effective, the requesting entity must also meet the following additional requirements:

- The entity is an eligible entity as defined in Treas. Reg. § 301.7701-3

- The entity failed to qualify as a corporation solely because Form 8832 was not timely filed and

- The entity timely filed all required federal tax returns consistent with its requested classification as an S corporation.

If the entity qualifies and files timely in accordance with Rev. Proc. 2013-30, the Campus can grant late election relief. If the entity does not qualify under the provisions of the Revenue Procedure, its only recourse is to request a private letter ruling.

Consult With An Experienced Business Attorney

Always consult with an experienced business formation before deciding to proceed with forming an entity.

Make sure doing so is the best course of action and weigh the pros of cons of forming a C corporation, S corporation, LLC taxed as a sole proprietorship , LLC taxed as a partnership , LLC taxed as a C corporation or LLC taxed as an S corporation.

Take liability protection and tax savings into consideration and make sure you make the right decision from day one.

If you would like to have your entity formed by a licensed attorney, simply call us at 989-5294 or simply get the process started online.

Also Check: Will A Roth Ira Reduce My Taxes

Electing To Be Taxed As An S Corporation Can Have Tax Advantages Especially With The New Pass

Create your LLC with Nolo

Need time on your business name?

A limited liability company is a legal entity formed under state law to run a business. It provides many of the advantages of a corporation , but is easier to form and operate. For details, see LLC Basics. Whenever a business entity is created it automatically receives a form of tax treatment by default.

A multi-owner LLC is automatically taxed as a partnership by default, while LLCs with one owner are taxed like sole proprietorships . However, LLCs may choose to be taxed as a C corporation or S corporation. This is easily accomplished by filing a document called an election with the IRS. Once this is done, as far as the IRS is concerned, the LLC is the same as a corporation and it files the tax forms for that type of entity.

Most LLCs stick with their default form of taxation. But electing to be taxed as an S corporation can have tax advantages. This can be especially true as a result of the new pass-through tax deduction created by Tax Cuts and Jobs Act.

What If I Elected S Corp Status This Year

Becoming an S corp involves incorporating as a regular corporation first, then submitting Form 2553 to the IRS .

In order to file your taxes as an S corporation in the same year that you applied for S corp status, you must file 2553 âno more than 2 months and 15 days after the beginning of the tax year the election is to take effect,â according to the IRS.

So, for example, if your businessâ tax year began on January 1st, 2021, and you wanted to be taxed as an S corporation when you file your return for that year in 2022, you must have submitted your 2553 no later than March 15, 2021.

For a more detailed guide to filling out 2553, read our detailed breakdown of how to elect for S corp status with the IRS.

Read Also: Doordash Dasher Taxes

Section 179 And Bonus Depreciation For Vehicles

Expanding on the vehicle deductions, a qualifying heavy vehicle used for at least 50% business purposes can produce a Section 179 first-year depreciation deduction. With Section 179, you can expense up to $510,000 of qualifying new or used equipment placed in service. Heavy SUVs with GVWRs between 6,001 and 14,000 pounds are subject to a $25,000 limit on Section 179 expensing. If you are subject to the $25,000 limitation, any heavy new vehicles can also qualify for a 50% first-year bonus depreciation for the remaining depreciation base.

For example, if you buy a $45,000 heavy SUV, you can expense $25,000 under Section 179 and take $10,000 of 50% bonus depreciation on the remaining $20,000 of cost, and $2,000 of normal annual depreciation on the remaining $10,000 in the same year. Total depreciation is $37,000 in the first year! A non-heavy vehicle used for at least 50% business use and classified as a passenger auto is subject to luxury auto depreciation limits. In contrast, using the example above, your depreciation write off in year one is only about $11,000.

If you use your vehicle for personal and business mileage, you need to keep track of both by keeping a mileage log using a notebook or popular mileage apps such as MileIQ. In order to claim these deductions, you must keep all receipts and include these reimbursements in your W2 unless you have an Accountable plan set up.

How To Take A Distribution From An S Corp

S Corporations can be a great way to reduce the amount of tax that you pay as a business owner. You can be treated as an S Corporation by the Internal Revenue Service in a couple of different ways. You can choose to originally file as an S Corporation, or you can start a limited liability company and file a Form 2553 to be treated as an S Corporation for tax purposes.

Also Check: Do You Have To Claim Plasma Donation On Taxes

Us Income Tax Return For An S Corporation

Although they are largely exempt from corporate taxes, S corporations must still report their earnings to the federal government and file tax returns.

Form 1120-S is essentially an S corp’s tax return. Often accompanied by a Schedule K-1, which delineates the percentage of company shares owned by each individual shareholder, Form 1120-S reports the income, losses, dividends, and other distributions the corporation has passed onto its shareholders.

Unlike C corps, which must file quarterly, S corps only file once a year, like individual taxpayers. Form 1120-S is simpler than tax forms for C corporations, too. The version for 2020 ran five pages.

As long as a company elects S corporation status , it must file Form 1120-S. The form is due by the 15th day of the third month after the end of its fiscal yeargenerally, March 15 for companies that follow a calendar year.

Like individuals, S corporations can request a six-month extension to file their tax returns. To do so, they must file Form 7004: Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns by their return’s regular due date.

Rigid Profit And Loss Allocation

Because it is a corporation, an S corporation is required to allocate profits and losses among the owners based strictly on the percentage of ownership or number of shares held. In contrast, an LLC is able to allocate its profits and losses in whatever proportions the owners desire.

Thus, the founding owner who transfers 50 percent of the ownership to a new member could receive a disproportionate share of the income from the LLC. In an S corporation, the founders’ allocation is reduced from 100 percent to 50 percent.

Read Also: Pastyeartax Com Reviews

How Do I Elect S Corp Tax Status

To file for S corp status, your business must first be incorporated as a regular C corporation or have filed for LLC status.

If youâre electing S corp status as a C corporation, you must submit Form 2553, Election by a Small Business Corporation to the IRS, signed by all of your companyâs shareholders.

Get a detailed breakdown of how to elect for S corp status with the IRS.

How S Corporation Owners Aretaxed

The owners of the S corp pay income taxes based on their distributive share of ownership, and these taxes are reported on their individual Form 1040. For example, if the profits of the S corp are $100,000 and there are four shareholders, each with a 1/4 share, each shareholder would pay taxes on $25,000 in profits.

Read Also: How To Protest Property Taxes In Harris County

Mandatory New York S Election

Shareholders of eligible federal S corporations that haven’t made the election to be treated as a New York S corporation for the current tax year will be deemed to have made that election under Tax Law section 660 if the corporation’s investment income is more than 50% of its federal gross income for that year. This provision only applies to S corporations taxable under Article 9-A. See TSB-M-07I or TSB-M-08C for more information on the mandatory New York S corporation election.

Should I File My Llc As An S Corp

Before filing for an S corp status, you should carefully consider if that is the best course of action for your business. You should only file for this type of status if:

- Your business is well-established and produces stable profits

- You are familiar with bookkeeping and payroll taxes

- You can afford to pay the reasonable salary

- You need to have at least $10.000 in annual distributions

Before reaching a final decision regarding the status of your company, you should also be aware of LLC taxed as S corp disadvantages. The rules for filing company taxes are stricter if the company is taxed as an S corp LLC owners need to adopt a calendar year as the companys tax year, unless they can list a reason for having a fiscal year. There is less flexibility in allocating income and losses, and the IRS pays more attention to these entities, meaning the chances of an audit are significantly higher. Another disadvantage is that 1099 forms arent available for an LLC taxed as S Corp LLCs taxed as S corps arent entitled to non-employment compensation.

If youre still uncertain as to whether you should file for an S corp status, you can always consult a financial advisor that can help you reach the right decision.

| DID YOU KNOW? A multi-member LLC is, by default, treated as a general partnership the amount of taxable income they have to pay depends on their share in the company. Even if they dont have any profits, they still have to report taxes. |

Read Also: How Much Tax For Doordash