Manage & Efile Form 1099

Tax1099 is an IRS-authorized digital tax compliance enabler. Taxpaying business entities can easily report and eFile their 1099-NEC forms and submit the forms to the IRS within minutes. With bulk eFiling solutions, data import, sleek integrations, and smooth features, businesses can scale their tax information reporting as they grow and adapt.

With in-built dynamic tax calculations, the total tax you owe is calculated as you enter the information in the electronic returns.

Bulk tax solutions include real-time IRS TIN matching, USPS address validation, W-9 solicitation, which allows businesses to do more in less time.

API solutions enable businesses to eliminate workload and leverage automated tax reporting solutions.

Collectively, Tax1099 offers everything a business needs in order to stay compliant and helps maintain regulatory tax filing practices in check.

Whats more?

With our 3-step e-filing process, secure e-transmission, and free re-files for rejected returns, businesses find value in our digital tax experiences.

Our penalty prevention programs are one of the many reasons why businesses choose our tax compliance solutions. With Tax1099, you can schedule your eFiles so you never miss a deadline and prevent being penalized by the IRS for missed due dates.

You too can join the compliance journey loved and recommended by 100,000+ businesses like you.

eFile Form 1099-NEC online with Tax1099 now.

Why Do I Have To File 1099 Forms

The IRS uses 1099 forms to ensure recipients are properly reporting their payments on their tax returns. Its important that you complete the forms accurately and report each payment in the proper box.

Make sure youre paying attention to what type of payments you made, how much you paid to each payee, and report the payments on the appropriate form. Reach out to your tax professional if you have any questions.

Originally published 11/11/2020. Updated 11/22/2021.

Incorrectly Reporting This Income

If you were to just report the income as “Other Income“, these additional taxes would not calculate correctly. When the IRS reviews your return later in the year, they would find that you did not report this correctly and you would have to not only pay the self-employment taxes, but you would end up owing penalties and interest.

If you believe you are an employee of the person or company that issued you the Form 1099-NEC, you will need to contact them directly to get this corrected.

Also Check: License To Do Taxes

How To Report 1099

Incentive payments and other types of income that appear in Box 3 are reported on Line 8 of Schedule 1 thats submitted with the 2021 Form 1040. You would then enter the total amount of other income as calculated on Schedule 1 on Line 8 of Form 1040.

Entering the total on Line 8 separates it from any wages or salary you earned, which are entered on Line 1 of the 2021 Form 1040. This also separates it from self-employment earnings that are calculated on Schedule C, then also reported on Schedule 1. This tells the IRS that this money isn’t subject to Social Security or Medicare tax because it wasn’t salary, wages, or self-employment income.

There was no Schedule 1 for tax years 2017 and earlier, and the Form 1040 and Schedule 1 have changed in other ways since the 2018 tax year.

Unfortunately, you cant deduct work-related expenses from your other income, even if its an automotive manufacturers incentive payment. Through 2017, you could claim work-related expenses if you itemized your deductions, but these expenses were eliminated effective from 2018 through 2025.

Other Types Of Box 3 Income

Box 3 isnt limited to auto salespersons, although they often reap the benefit of having some of their income reported here. “Other Income” thats reported in Box 3 also includes any sources that don’t neatly fit anywhere else on the form, including:

- Prizes and awards

- Payment you received for serving jury duty

- Taxable damages received in a lawsuit

This list is not exhaustive. Basically, Box 3 reports any income you receive from an endeavor that you didnt engage in for profit, and thats admittedly a gray area. Automotive salespersons certainly work to earn a living, but they work for and are under the control of the dealership, not the manufacturer directly, and therein lies the loophole.

Prizes and awards only fall into this category if you did not place a wager to reap the winnings. For example, the car’s fair market value would be reported as Other Income in Box 3 if you won a brand-new BMW by participating on a game show, but not if you won it in a raffle for which you bought a ticket. In that case, it’s gambling winnings, which are reported on Schedule 1.

Also Check: Is Freetaxusa Legitimate

Why Would I Receive A 1099 Nec

If you work as an independent contractor, freelancer, or self-employed individual, you should receive a 1099-NEC from any business that paid you at least $600 during the tax year. However, if you were paid by credit or debit card or through a third-party payment processor like PayPal, you shouldnât receive a 1099-NEC for those payments.

The business is required to send you a copy of your 1099-NEC form by January 31 of the following tax year. They will also send a copy to the Internal Revenue Service . As a result, the IRS expects to see that compensation reported on your tax return â whether you report your business income and expenses on Schedule C attached to your Form 1040 or file a separate business tax return.

What Is Efw2 And How Does It Apply To Filing Income Statements With Michigan

EFW2 is a type of electronic data file format used by employers and service providers to send W-2 forms to the federal Social Security Administration . Every year, the SSA publishes a document called Specifications for Filing Forms W-2 Electronically , which provides filing instructions and specifications on preparing data files in the EFW2 format. MTOs EFW2 portal provides a way send Treasury a copy of the federal file and satisfy Michigan W-2 reporting requirements. Taxpayers and service providers wishing to take advantage of this program must apply with the SSA.

You May Like: Irs Forgot Ein

Who Needs To File 1099 Nec

Your business needs to file a 1099 NEC for each independent contractor if you meet all of the following conditions:

- The payment was made to someone who is not your employee

- The payment was made for services in the course of your trade or business

- You paid an individual, single-member LLC, partnership, or LLC taxed as a partnership

- The payments totaled $600 or more during the tax year

Additionally, you will need to send Form 1099-NEC if you withheld any federal income tax from nonemployee compensation payments under the backup withholding rules, regardless of the amount.

You donât have to file a 1099 NEC for payments to corporations or LLCs taxed as corporations, although there are a few exceptions. Those exceptions are outlined in the IRS Instructions for Form 1099-MISC and 1099-NEC.

You also donât need to complete a 1099-NEC for payments made by credit card or debit card or via a third-party payment processor, like PayPal or Stripe. Payments made via these methods are included on a 1099-K issued by the financial institution or payment processor.

Why Did The Irs Reintroduce 1099

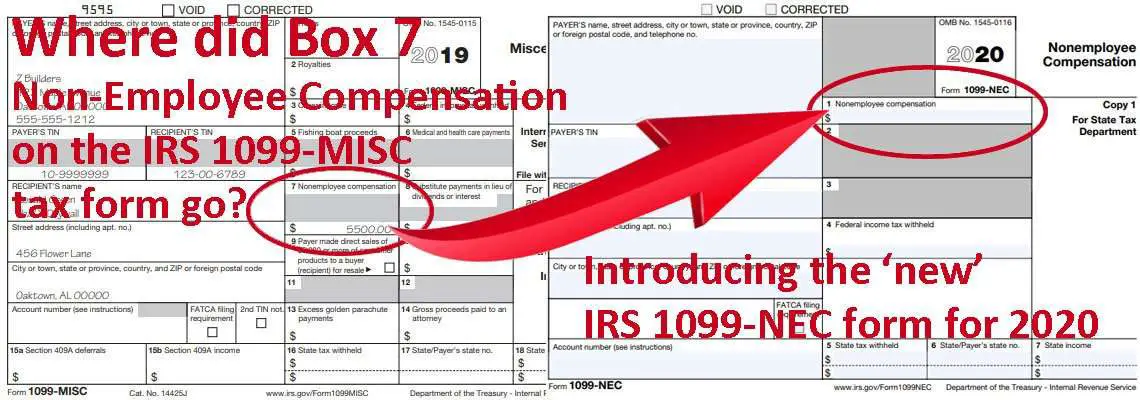

Before its reintroduction, the last time form 1099-NEC was used was back in 1982. Since then, prior to tax year 2020, businesses typically filed Form 1099-MISC to report payments totaling $600 or more to a nonemployee for certain payments from the trade or business. These payments generally represent nonemployee compensation and, up until now, would typically appear in box 7 of 1099-MISC.

In order to help clarify the separate filing deadlines when reporting different types of payments on Form 1099-MISC, the IRS decided to reintroduce Form 1099-NEC which has a single filing deadline for all payments that use the form.

Read Also: How To Find Employer Ein Without W2

Nonemployee Compensation Vs Employee Status

For tax purposes, one of the main differences between an employee versus a non-employee is whether payroll taxes are being withheld every pay period. Independent contractors have no automatic withholdings deducted from any monies paid to them by a company. An employee, however, will have an employer automatically withhold these payroll taxes from each paycheck, unless the employee opts to have none withheld.

In addition, independent contractors complete a Form W-9 to provide to the payer, while employees fill out a W-4 to list their withholdings and allowances. If you are an independent contractor, no allowances for yourself, dependents and spouse, or withholdings such as social security and Medicare, will be deducted from your paycheck. Come tax time, you are solely responsible for making sure you take care of your tax obligations to the IRS.

How Do I Report The Self

Of course, a new tax means new paperwork too. When you start a small business and you do not incorporate or form a partnership, you report the results of your operations on Schedule C and file it with your Form 1040.

You calculate your self-employment tax on Schedule SE and report that amount in the “Other Taxes” section of Form 1040. In this way, the IRS differentiates the SE tax from the income tax.

Also Check: What Home Improvement Expenses Are Tax Deductible

Who Needs To File Form 1099

Any business that makes nonemployee compensation payments totaling $600 or more to at least one payee or withholds federal income tax from a nonemployees payment, will now use this revamped form to report those payments and withholding.

Generally, payers need to file these forms by January 31 and have no automatic 30-day extensions to file unless the business meets certain hardship conditions.

How Do You File Form 1099

IRS filing requirements specify that payers should use a separate IRS transmittal Form 1096 for sending each type of 1099 form when filing Forms 1099-NEC and Forms 1099-MISC with the IRS.

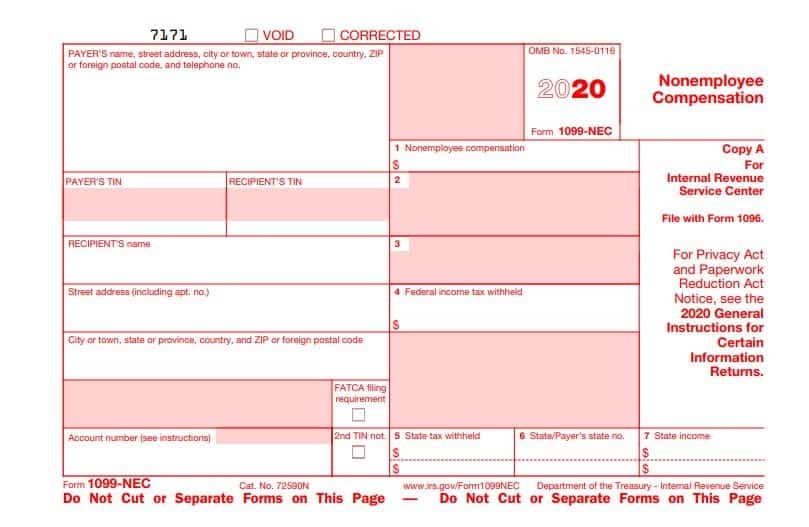

When the payer efiles or sends on paper the Forms 1099-NEC and 1099-MISC, Copy A goes to the Internal Revenue Service Center, Copy 1 to the state tax department , and Copy B to the recipient.

You May Like: Do I Have To Claim Plasma Donations On My Taxes

Where Do You Mail Irs Form 1099

You don’t need to mail IRS Form 1099-MISC anywhere, but if you receive Form 1099-MISC, then you must put that information on your Form 1040. If you want to mail your Form 1040 into the IRS, then check the IRS list of addresses to see where taxpayers in your state must send mail. Note how the address changes depending on whether you are including a payment with your Form 1040 or not.

How Does Form 1099

Form 1099-MISC differs from Form 1099-NEC in one distinct way. A business will only use a Form 1099-NEC if it is reporting nonemployee compensation.

If a business needs to report other income, such as rents, royalties, prizes, or awards paid to third parties, it will use Form 1099-MISC. Generally, a person will now receive 1099-MISC to report payments that are not subject to self-employment taxes.

People who earn income from one-off activities such as an honorarium for speaking at an event or from ownership of rights to income-producing property may receive Form 1099-MISC to report this income, Stern says.

You May Like: Efstatus Taxact Online

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

When Do You Need To File 1099 Nec

Youâre required to send Copy B of Form 1099-NEC to payees by January 31 and file Copy A with the IRS by March 1 . If you need it, Copy 1 is for filing a copy with a state tax department.

If any of those dates fall on a weekend or holiday, the filing deadline shifts to the next business day.

Be sure to mark those dates on your calendar because the penalty for filing Form 1099-NEC can be stiff. For small businesses that miss the due date, the penalty varies from $50 to $270 per form, depending on how long past the due date you issue them. The IRS caps those penalties at $1,113,000 for seriously delinquent forms.

And intentionally disregarding your filing obligations can cost you dearly. That penalty is $550 per form, with no cap.

Don’t Miss: Is Plasma Money Taxable

How Do I Send Magnetic Media To The State Of Michigan

If you have 250 or more income statements, you must use MTO to electronically send a magnetic media formatted file. Taxpayers with fewer than 250 income statements, may send physical magnetic media, but business taxpayers and their service providers are encouraged to send income statements electronically using MTO, regardless of the number of income statements to report.

View TreasurysIncome Statement Remittance Guidefor W-2 and 1099 filing options.

What Is Form 1099

Beginning in the 2020 tax year, Form 1099-NEC is the Internal Revenue Service form used by businesses to report payments made to independent contractors, freelancers, sole proprietors, and self-employed individuals. The 2020 form is a redesign of a 1982 form of the same name. In more recent years, prior to 2020, nonemployee compensation was reported in box 7 on Form 1099-MISC.

Form 1099-NEC was resurrected to address confusion related to dual-filing deadlines on Form 1099-MISC. In past years, the IRS detected significant fraud relating to individuals falsifying 1099-MISC forms by reporting small employee compensation and large withholdings. These individuals filed their tax returns, requesting sizable refunds, prior to the March 31 IRS filing deadline for the Form 1099-MISC.

The IRS was unable to match recipient information with the corresponding 1099-MISC. In order to remedy the issue, the IRS delayed issuing refunds based on the Earned Income Tax Credit until after Feb. 15 and simultaneously pushed back the filing deadline for the nonemployee compensation portion of the 1099-MISC to Jan. 31. All other payment types on the 1099-MISC still had a March 31 due date. This dual-filing deadline caused confusion for many payers.

Form 1099-NEC is one of many 1099 tax forms, which include 1099-MISC for miscellaneous income, 1099-INT for interest income, and 1099-DIV for dividend and distribution income.

You May Like: 1040paytax.com Safe

What Do I Do With My 1099

You use your IRS Form 1099-MISC to help figure out how much income you received during the year and what kind of income it was. Youll report that income in different places on your tax return, depending on the type of income.

If you need help estimating how interest income on a Form 1099-MISC could affect your tax bill, check out our free tax calculator.

» MORE:See if you can take the Qualified Business Income deduction this year

What Are The Instructions For Completing 1099

File your Form 1099-NEC electronically with the IRS, and the required stateusing TaxBandits, an IRS authorized e-file provider supporting e-filing for allthe 1099, W2, 94x, and ACA Forms.

Simply follow the steps below to file your Form 1099-NEC:

- Step 1: Create a free TaxBandits account or Login If you have one already

- Step 2: Enter Form Information

- Step 3: Review Form Information

- Step 4:E-file it with the IRS and State

If you have opted for postal mailing or online access, TaxBandits willdeliver copies to your recipients on your behalf

Ready to file Form 1099-NEC?

You May Like: Is Plasma Donation Income Taxable

I Am Required To File All Income Statements Via Magnetic Media Or Can I Choose Different Filing Methods For Different Income Statements

It depends. If you have 250 or more income statements, you must use MTO to electronically send a magnetic media formatted file. Taxpayers with fewer than 250 income statements, may send physical magnetic media or utilize any other filing option listed in Treasurys Income Statement Remittance Guide. Business taxpayers and their service providers who need to send state copies of income statements directly to Treasury are encouraged to do so electronically using MTO, regardless of the number of income statements to report.

Do Non Profits Get A 1099 Nec

Beginning with the 2020 tax year, the IRS now requires business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC. Similar required filing thresholds apply to the forms: if annual payments exceed $600, one or the other form must be filed for each payee.

Read Also: Buying Tax Liens In California

Case : Payment Of $1200 To A Copywriter As Independent Contractor

Imagine that you hired a copywriter for a period of 2 months. Your company just expanded its digital operations and is looking at putting in quality copywriting on your digital experiences, such as websites, social media, business brochures, and more.

Youre paying the independent contractor a monthly fee of $1200 for the period of three months.

After the end of each month, your accounting team is processing a payment of $1200 to this copywriter. At the end of the mutually-agreed period of 3 months, the work was completed as planned.

This can also be defined as a simple, non-employee business arrangement.