Is Florida Property Tax High

If youre looking to invest in property in Florida, its good to know how it compares, whether to your home state or other investment options. Below is a short run-down of how Florida compares to other states, and the most important facts all about its placement in the national average. For a comparison on all US states, make sure to check our property tax guide.

Sales And Gas Taxes In Boynton Beach

Sales and gasoline taxes are mixed in Boynton Beach when compared with the other 50 largest Florida cities and towns. The combined state and local sales tax rate in the city is 7%. That’s the second-lowest sales tax rate on our list. One the other hand, the city’s combined state and local gas tax is 38.025 cents per gallon, which is the highest gas tax rate in our rankings.

Property Taxes In Largo

Largo generally has below-average local tax rates, except when it comes to taxes on utilities. For 2017, the average property tax rate in Largo was $845 per $100,000 in home value. That’s below average for our list. This means the owner of a $250,000 home in Largo would pay about $2,112 in real property taxes each year.

Recommended Reading: What Age Can You File Taxes

How Do They Work

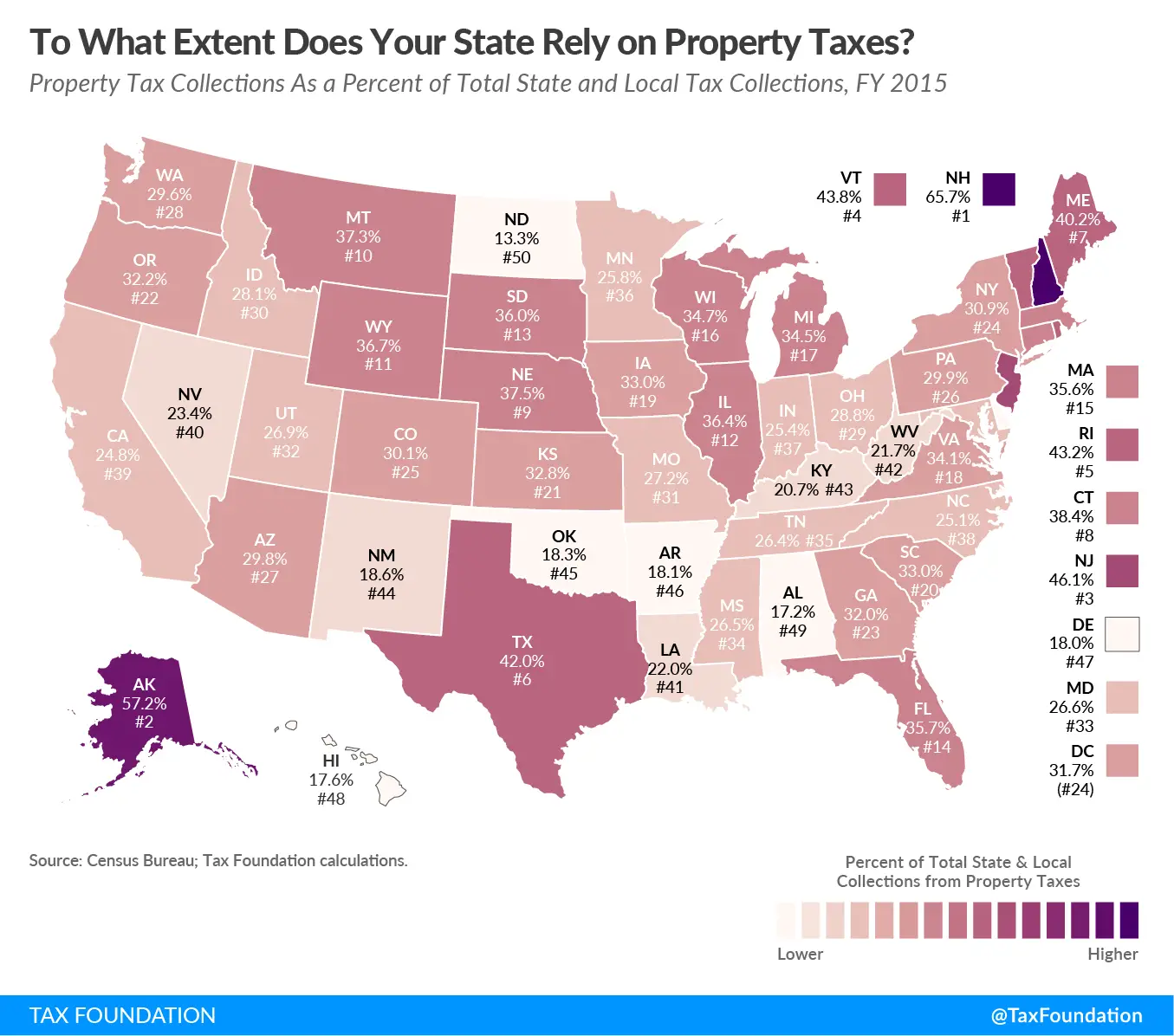

In the U.S., because there are state as well as county and city property taxes, it is a complicated system. If you live in New York, you may even have to account for additional taxes such as a mansion tax. In general, for any given piece of land you have state property taxes as well as county property taxes. In addition to this, some cities levy additional taxes for property. Therefore, when owning property, it is important to be informed about property taxes at all government levels. In Florida, of all the money the state receives from taxes, 36.4% originate from property taxes. This is much more than Californias property tax proportion of 26.0%, and similar to New York States property tax proportion of 32,0%

Sales And Gas Taxes In West Palm Beach

The sales tax rate in West Palm Beach is 7%. That includes the statewide 6% sales tax and an additional 1% local tax. At 7%, the city’s combined rate is average for the cities and towns our list. The total state and local tax on gasoline in the city is 38.025 cents per gallon. That’s the highest rate you’ll see in our survey.

Don’t Miss: How To Look Up Employer Tax Id Number

Sales And Gas Taxes In Tallahassee

Although Tallahassee’s property tax rates are not among the 10 highest, all the city’s other local tax rates are at or near the top. The combined state and local sales tax, for example, is 7.5%. That’s the second-highest sales tax rate we’re seeing on our list. The city’s state and local gasoline tax is 38.025 cents per gallon, which is the highest gas tax rate in our rankings.

Property Taxes In Riverview

There’s both good tax news and bad tax news for Riverview residents. Property tax rates are high$1,126 in 2017 for every $100,000 in home value, on average. For a $250,000 home, that means about $2,816 in property taxes each year, which is high when compared with amounts for the other Florida cities and towns we’re reviewing.

Recommended Reading: Is Property Tax Included In Mortgage

Utility Taxes In Gainesville

City residents get hit hard with local utility taxes. The local public service tax on electricity is 10% . The city’s public service tax on water is also 10% . Gainesville’s communications services tax is also pretty high. At 6.17%, it’s one of the 10 highest rates for the 50 largest Florida locales.

How Tax Dollars Are Spent

There are several factors that determine where tax dollars are spent, such as constitutional and state mandates, programs essential to reducing future costs, the rising cost of insurance, the Countys Strategic Plan and strategic focus areas, input from citizens during the budget process and other necessities at the time of budget formulation.

Also Check: Is Political Contribution Tax Deductible

The Florida Homestead Exemption Explained

Mon Jul 25 2022

If youâve ever bought or considered buying residential property in Florida, youâve probably heard of the stateâs homestead exemption, and with good reason. The Florida homestead exemption is a powerful tool that reduces the tax burden on the stateâs homeowners. But what is the homestead exemption in Florida and how does it work?

Hereâs your guide to using this exemption to maximize the value of Florida homeownership and minimize your tax burden.

How Much Taxes Do You Pay In Florida

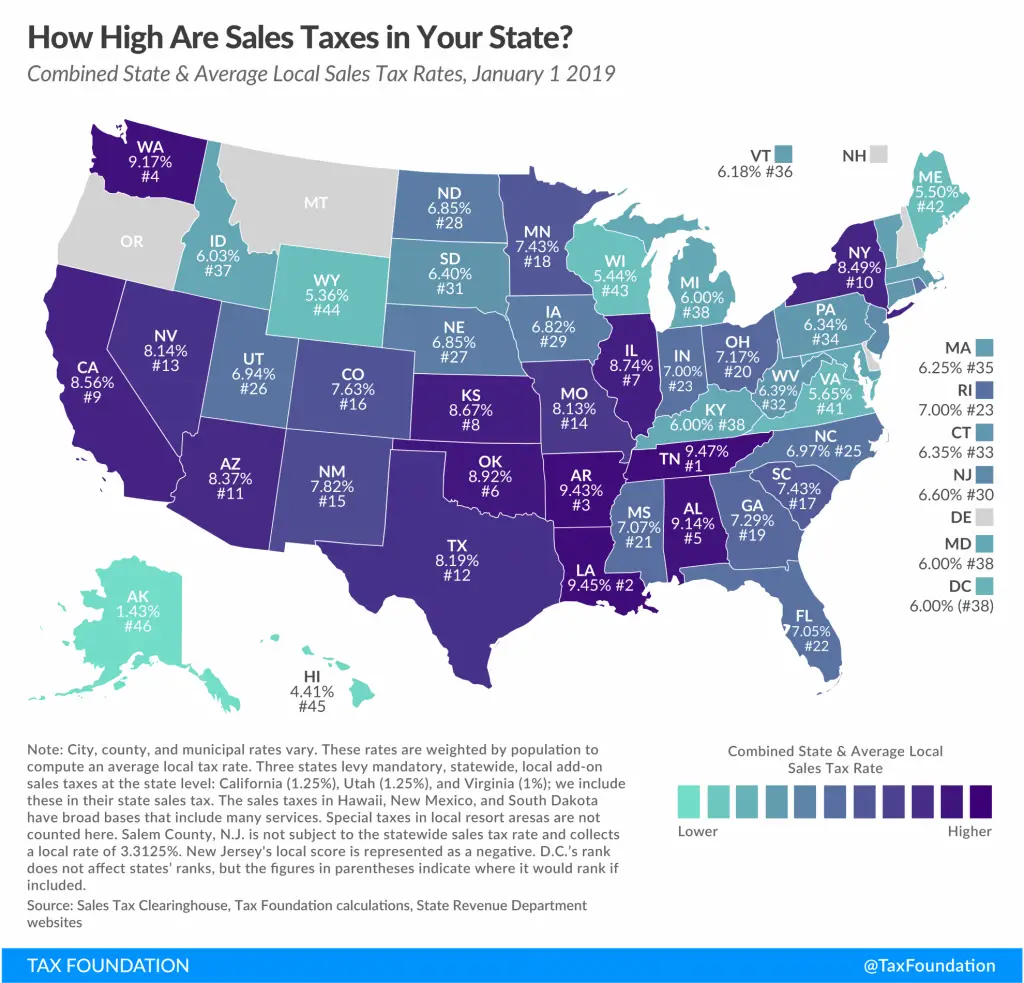

The statewide sales tax rate in Florida is 6%. Additionally, some counties also collect their own sales taxes, ranging from 0.5% to 2.5%, which means that actual rates paid in Florida may be as high as 8.5%. According to the Tax Foundation, the average sales tax rate in Florida is 7.05%, 23rd-highest in the country.

Don’t Miss: How Much Is Tax In Ny

How Florida Property Taxes Compare

Florida’s property tax rates are relatively low when compared to other states. WalletHub ranked Florida no. 24 in the nation for effective property tax rates in 2021, with the average homeowner paying 0.89% of their home’s value in taxes each year.

For a Florida median home value of $215,300, that translated to paying $1,914 in property taxes. In contrast, the national median tax bill was $2,197.

Of course, what you’ll truly pay for property tax will vary widely across the state and your location. Looking at the average total property tax millage rates in 2021 published by Florida Tax Watch, the highest rates were paid in St. Lucie, Alachua, Broward, and Duval counties. The highest per capita total property tax levies were Monroe , Walton , and Collier counties.

The lowest per capita total property taxes were in Union , Holmes , and Jackson .

The resource also shows the highest per capita school district property tax levies, and independent special district levies were paid in Walton, Collier, and Monroe counties. The highest municipal taxes were paid in Broward , Palm Beach , and Monroe counties.

Didnt Receive Your Bill

You can view, print or pay your 2022 property tax bill online. This gives you peace of mind that you are paying the correct amount due and confirms we received your payment.

Also, make sure your address is up to date with the Palm Beach County Property Appraisers Office. We mail over 600,000 property tax bills to the owner and address of the record on file with the Property Appraisers Office.

Just a reminder If you do not receive your property tax bill, you are still responsible for paying the total amount due before April 1.

Florida Statutes, Chapter 197, Section 122 states:All owners of property are held to know that taxes are due and payable annually and are responsible for ascertaining the amount of the current and delinquent taxes and paying them before April 1 of the following year in which taxes are assessed.

You May Like: Where Do You Mail Federal Tax Returns

Sales And Gas Taxes In Brandon

The sales tax in Brandon is high, but the gasoline tax is below average. The combined state and local sales tax in Brandon is a whopping 8.5%, which is the highest sales tax rate in our rankings. However, combined state and local gas taxes in Brandon are only 33.025 cents per gallon, which is the second-lowest gas tax rate on our list.

The Florida Property Tax

The Florida constitution reserves all revenue from property taxes for local governmentsthe state itself doesn’t use any of this money. Property taxes are based on the “just value” or market value of properties as they’re assessed by a local appraiser as of Jan. 1 of each year.

Increases in value are limited to 3% of the previous year’s assessment or the Consumer Price Index , whichever is less. This limitation is known as the “Save Our Homes” cap.

Taxes are based on millage rates set by local governments, with 10 mills being equal to 1%. The millage rate is multiplied by the value of the property to determine the dollar amount of the tax. County, city, and school districts are permitted to levy taxes at up to 10 mills each.

Also Check: Do You Have Until Midnight To File My Taxes

What Are Property Taxes

Property Taxes are ad-valorem taxes which you pay for owning property, meaning that it is based on the monetary value which is estimated to be attached to an item, piece of land, property, etc. A property appraiser provides the basis for calculation.

Property tax is often confused as being a tax on real estate property. Yet this is a misconception. The largest proportion of property taxes come from real estate, because this is the most expensive property most people own. Yet property taxes can also be levied on airplanes, computers, furniture, etc. When buying a house, these must be paid in advance, and then received back from the seller. Property taxes are typically a rate which is multiplied by the estimated value of the property. This value is estimated by an appraiser, and takes into account location, age, etc.

How Property Tax Is Calculated

Your property tax is calculated by first determining the taxable value. The taxable value is your assessed value less any exemptions. The taxable value is then multiplied by your local millage rate to determine your ad valorem taxes. Ad valorem taxes are added to the non-ad valorem assessments. The total of these two taxes equals your annual property tax amount.

Your propertys assessed value is determined by the Palm Beach County Property Appraiser. The millage rate is set by each ad valorem taxing authority for properties within their boundaries.

Non-ad valorem assessments are determined by the levying authority using a unit measure to calculate the cost of services. For example, Solid Waste Authority fees are based on the type of property producing the waste.

Read Also: How To File Federal Taxes Electronically

Utility Taxes In Miami Beach

Local electricity and water taxes in Miami Beach are the highest you’ll see in our list. There’s a 10% public service tax on electricity, which is the highest rate in our rankings. The city’s public service tax on water is $1.80 for every 1,000 gallons of water used. That’s the highest water tax rate you’ll see on our list by a fairly wide margin. Fortunately, the local communications services tax isn’t too high. It stands at 5.72%, which is more-or-less average for the cities and towns being ranked.

Average Property Tax In Florida Per County

Because local governments collect property taxes in Florida, the tax rate can differ from one place to another. On average, the Florida property tax rate sits at 0.83%, with homeowners paying an average of $2,035 in property taxes every year. This is comparatively lower than the national average of 1.07%.

Below is a list of Florida counties and their corresponding average effective property tax rates as of writing:

- Alachua County 1.18%

Also Check: How Much Does H& r Block Charge To Do Taxes

A Big Investment Requires Professional Help

Florida remains a popular destination for vacationers from all over the world. As such, it makes sense to buy homes in the Sunshine State, whether for personal use or to use as a rental property. Buying a home is one of the largest investments you will ever make. Thus, you should understand what obligations come with it.

If you are concerned about tax liability, it pays to know a lot about the area you plan to buy property in. Florida property tax can be difficult to grasp since rates change from county to county.

Additionally, there are so many exemptions and assessment limits to take into account. A rental management company can help you calculate property taxes. Use our online directory today to help you find the best one in your area.

Appealing Your Home Value

You can’t change the millage rate, but you can appeal the appraised property value. You can discuss this directly with the property appraiser’s office or file a petition with the county value adjustment board .

Each county has a five-member VAB, which reviews and decides on assessment, classification, or exemption challenges. The value adjustment board is not affiliated with the property appraiser or tax collector. Value adjustment boards are unable to modify local governments’ millage rates.

Read Also: Can I File Taxes If My Parents Claim Me

How Florida Property Taxes Work

In Florida, each county sets its own millage rate, which is used to calculate property taxes. One mil equals $1,000 of value expressed another way, one mil equals $1. The millage rates are the same across property categories, so a residential property has the same millage as an industrial property. Florida has 640 local governments that assess a property tax.

The property appraisers in each county set the property’s value based on its anticipated January 1 value. Each property owner is notified in August of the impending tax bill via a yearly Notice of Proposed Property Taxes from the county property appraiser. It has the home’s value and proposed local millage rates. After the local governments have finalized their budget estimates in late October or November, the county tax collector sends a tax bill to each residence.

Property taxes are due the following March 31. Florida homeowners can receive up to 4% off their tax bill by paying early. If the tax payment is late, the local collector sets a Tax Certificate on that property that is sold to investors or debt collectors.

Florida’s Department of Revenue verifies that the information from each local government is accurate, approves its budget, and ensures the taxing rates comply with Florida Truth-in-Millage requirements. One TRIM benefit is it limits the maximum millage rate based on the per capita Florida personal income. In 2019, the maximum millage rate was 1.0339.

How Can I Minimize My Property Taxes In Florida

In Florida if you own a home you will become aware very quickly that one of the joys of homeownership is paying property taxes! We dont have a state income tax in Florida so they do try to make up a bit of the revenue with…

In Florida if you own a home you will become aware very quickly that one of the joys of homeownership is paying property taxes! We dont have a state income tax in Florida so they do try to make up a bit of the revenue with property taxes which average around 2% of your homes value statewide. Thats a significant amount of money, so you want to do whatever you can to keep your property taxes low! There are several things that you can do to keep your tax bill as low as possible.

Recommended Reading: What Is The Sales Tax In Washington

Our Guide To Florida Property Taxes

When buying a home, property taxes are just one of the many things you have to factor in. As these increase over time, you need to know how they’ll impact your budget and enjoyment of your home. In Florida, property taxes vary widely from county to county and even within counties. So how do you know how much you’ll pay in property taxes?

Our guide breaks down everything you need to know to understand Florida’s property taxes and gives advice for calculating your tax burden.

How Is Florida Property Tax Calculated

Real property tax rates vary from state to state. In fact, state and local governments use various methods to calculate your real property tax base.

Property value is determined by a local tax assessor. County appraisers establish the value of your property each year as of January 1. They review and apply exemptions, assessment limitations, and classifications that may reduce your propertys taxable value.

Use the drop-down menu found on the Florida Department of Revenue website to find your county property appraisers website.

You May Like: What Is The Age Limit For Child Tax Credit

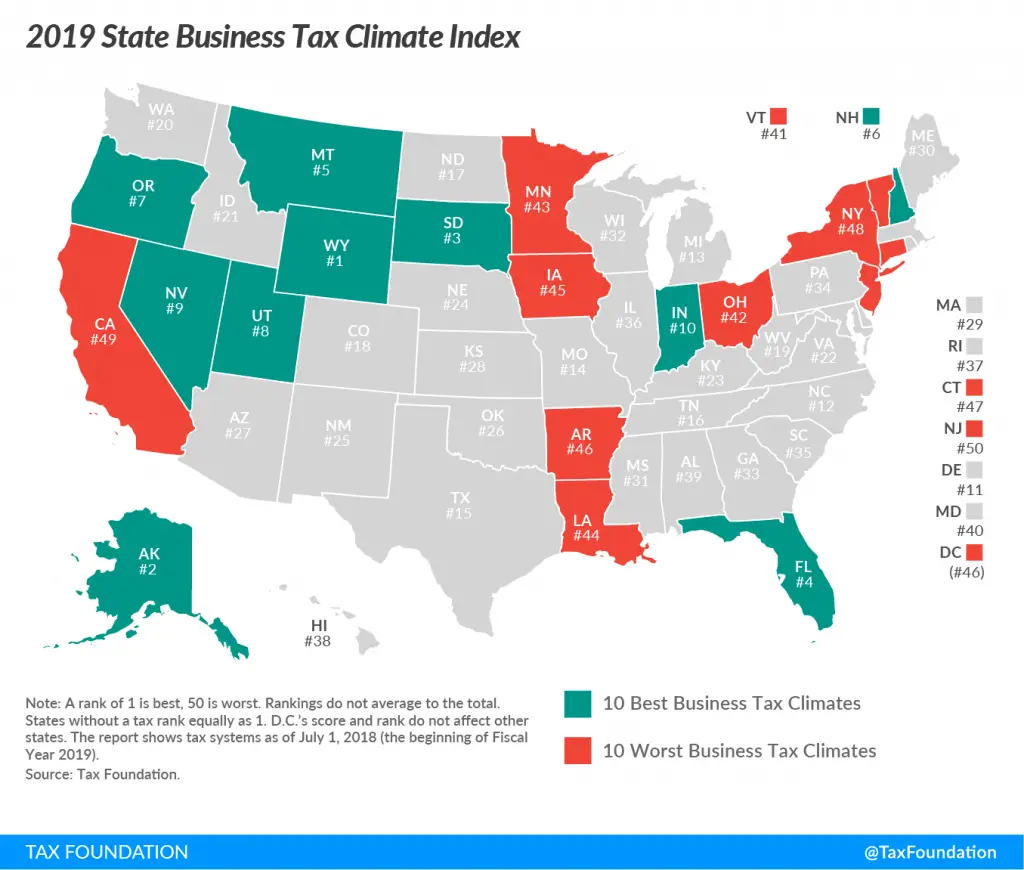

Taxes In Florida Explained

For decades, Florida has had one of the lowest tax burdens in the country, according to the independent research organization Tax Foundation. For 2013, Florida will place the fifth-lowest tax burden on its residents and businesses. But not all taxes are created equal, and the state collects in a variety of ways that residents need to be aware of.

Mill Rates Are Tax Rates

What is millage or what is a mill rate? Florida, like New York State, uses millage rates to calculate the tax you need to pay. They serve the same purpose and work quite similarly to conventional property tax rates. A millage rate, is first and foremost a number. This number indicates the amount of property tax a property owner is required to pay for their property. A mill rate of 1 indicates 1$ of tax for $1.000 worth of property, a mill rate of 24 indicates $24 of tax per $1.000 worth of property.

- Mill Rate of 1 indicates 1$ of tax for $1.000 worth of property

Important, as cited on the State of Floridas official website:

Florida Property Tax is based on market value as of January 1st that year.

Recommended Reading: Do You Need To Report Unemployment On Your Taxes

Tax Saving Tip #: Make Sure That Your Homes Initial Valuation Is As Low As Possible

You cannot assume AT ALL that the tax bill paid on your new home by the prior owner is at all reflective of what your taxes will be in the future! The January 1 that follows your home purchase is a magic day. On that day the County Property Appraiser will push a button on a computer and ZING out will come your propertys FIRST valuation. You get officially notified of that value by a letter that comes about the second week of August called a TRIM notice. However, you can look on your county property appraisers website starting usually in February and see working values for your property. This gives you some indication of what theyre going to come up with. Your initial valuation SHOULD be about 85% of what you paid for your property. If your Assessed Value shows more than that to a significant degree, then you should say something! You cant really say anything until you receive your TRIM notice in August because if you do, theyll just say that everything is preliminary and to wait until its official when you get your TRIM notice. Once you do, be sure and note that on the TRIM notice it shows a date by which you lose your rights to say anything! See below on Make any Necessary Adjustments to see how to officially say something and get an erroneous value fixed.