Tips For Paper Filing

You can do a few things to streamline your return submission when you file by paper:

- Make sure your name and Social Security number are on every page, both front and back.

- Double-check your address. This is where the IRS will send any notices, so it’s important that you don’t make a mistake.

- Mail your return to the right IRS service center. The address can change, depending on which state youre in and whether youre including payment with your return. The IRS provides a state-by-state list online so you can find the correct address.

- Get an automatic extension if you’re mailing your return close to the official filing deadline. Keep in mind that you should make a payment with your extension if you think you’ll owe anything. Otherwise, you could be subject to penalties and interest.

The IRS will generally accept paper filings postmarked by the filing deadlineit doesn’t have to receive it by this date.

Where Do I Mail California Tax Return

mailformsTaxrefundfilingmail

Where do i send my california tax return?

Without payment: When sending in a California tax return without a payment, use the following address: Franchise Tax Board, PO Box 942840, Sacramento, CA 94240-0001.

where do you mail federal tax returns?

Contents

If You Owe More Than You Can Pay

If you cannot pay what you owe, you can request an additional 60-120 days to pay your account in full through the Online Payment Agreement application or by calling 800-829-1040 no user fee will be charged. If you need more time to pay, you can request an installment agreement or you may qualify for an offer in compromise.

You May Like: Can Home Improvement Be Tax Deductible

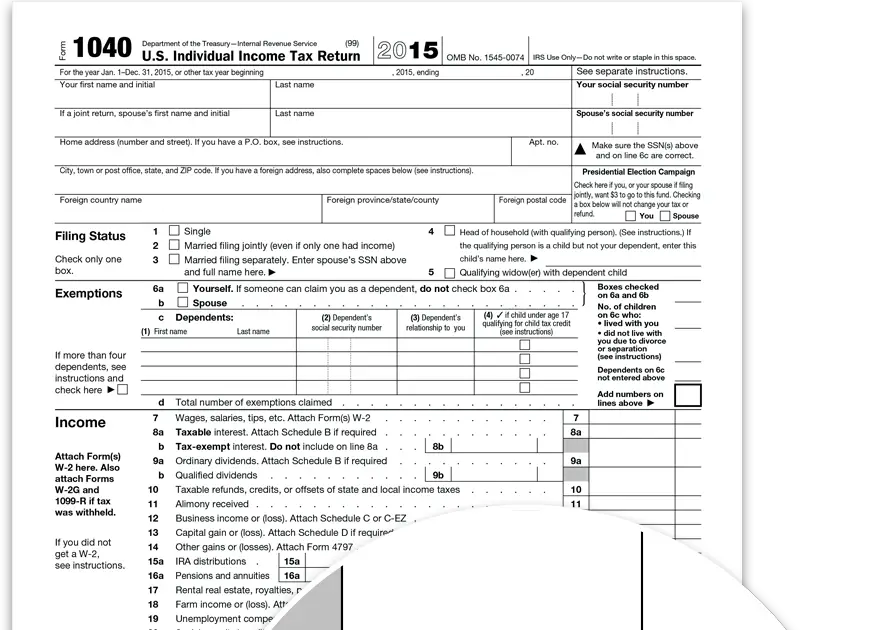

Gather Tax Filing Information

Youll need to do this whether youre hiring a tax preparer or doing the tax filing yourself. The goal is to gather proof of income, expenses that might be tax-deductible or win you a tax credit, and evidence of taxes you already paid throughout the year. Our tax prep checklist has more guidance, but heres a short version of what to round up:

-

Social Security numbers for yourself, as well as for your spouse and dependents, if any.

-

W-2 form, which tells how much you earned in the past year and how much you already paid in taxes.

-

1099 forms, which are a record that some entity or person not your employer gave or paid you money.

-

Retirement account contributions.

-

State and local taxes you paid.

-

Educational expenses.

I Made A Payment In Mto But It Was Never Withdrawn From My Account What Happened

If you accessed our payment service, Pay Connexion, and have a payment confirmation number but your payment did not process

- Check with your financial institution or credit card company to see if there is a reason that the payment was rejected.

- Some corporate bank accounts require a Debit Block Identification Number in order to release payments. Check with your financial institution to verify if you have the correct Company ID Number.

- Sales, Use, Use Purchases, and Withholding Taxes

2014 tax year and prior 9000000103

2015 tax year and beyond 9037133001

- Michigan Business Tax, Flow-Through Withholding, Corporate Income Tax

All years 9000000103

2014 tax year and prior 9659083002

2015 tax year and beyond 9244842701

- Bulk Sales Tax

2015 tax year and beyond 9244842702

Recommended Reading: Is Freetaxusa A Legitimate Company

B Hire And Work With A Tax Preparer

While it’s never been easier to do your own taxes using software, as your financial life gets more complex you might wonder if you’re missing something and should get someone to prepare and help file your taxes. If you have a business or a healthy side gig, or you just want help understanding all of the forms, you might seek out a professional’s guidance.

» Find a local tax preparer for free:See who’s available to help with your taxes in your area

If you don’t want to meet in person with a tax preparer, theres a way to file taxes without leaving the house. A secure portal lets you share documents electronically with a tax preparer. Typically, the preparer will email you a link to the portal, youll set up a password and then you can upload pictures or PDFs of your tax documents.

Receiving A Paper Income Tax Return

We will send to you the relevant paper Income Tax Return between Feb to Mar each year if you are required to file an Income Tax Return.

If you are certain that you have to file, but did not receive a notification from us by 15 Mar, please contact us.

Please submit your paper tax return by 15 Apr.

do not need

Tax resident individuals should receive:

Also Check: Www Aztaxes Net

How Do I File And Pay My Taxes For 2015 And Beyond

The preferred method of filing and paying is through the e-service: Michigan Treasury Online . View the step-by-step guides including filing and paying taxes through MTO.

Alternatively, you may print paper versions of the forms from our website to mail.

Exceptions apply. Some forms for 2015 and beyond are only available for electronic filing via MTO and/or bulk e-file. For more information, see Table 2: Tax Return Form Number by Tax Year. If you are a 4%/6% filer , you are required to file via MTO. If you are an accelerated filer or you remit credit schedules with your SUW return , you are required to file via MTO or bulk e-file.

For 2014 and prior tax years, filing must be submitted in paper format and mailed. All forms for 2014 and prior remain available for printing.

Paying Other Business Taxes

Making your tax payments online is the best and easiest way to pay. LLC owners, sole proprietors, or partners in partnerships can use one of several IRS e-pay options, including direct debit from a bank account, credit card, or debit card.

Corporation and partnership returns should use the IRS Electronic Federal Tax Payment System .

You May Like: Doordash Mileage Calculator

Please Note The Following When Sending Mail To The Colorado Department Of Revenue:

Certified Mail, Express Mail & Courier Services

Although these mailing methods give the option to receive proof of delivery, sending forms or payments by certified mail, express mail or a courier service may delay processing. Sending forms and payments by first class standard mail via the U.S. Postal Service ensures the fastest processing time.

Proper Postage on the Envelope

Addressing the Envelope

Zip Code

Double Check the Mailing Address

Factors That Can Affect Timing

Your tax refund may be delayed for several reasons, including if your return is incomplete, includes errors, was affected by fraud or identity theft, or requires further review.

There are also specific items that can hold up your refund. For example, tax returns that include Form 8379: Injured Spouse Allocation may take up to 14 weeks to process.

If you claim certain tax credits, the earliest you will receive your tax refund is the first week of March. Under the Protecting Americans from Tax Hikes Act, the IRS is prohibited from issuing refunds before mid-February for taxpayers who claim the EITC or the Additional Child Tax Credit .

Read Also: How To Get Tax Preparer License

Online Filing Sales Tax Returns

Like income returns, there are various options for individuals and businesses to file their sale tax returns online. GST/HST NETFILE and GST/HST TELEFILE allow individuals to file their sales tax returns directly online, and are the quickest and easiest options to use. As previously stated above, the My Business Account is also available for filing sales taxes, alongside other business-related taxes.

Individuals can also pay their net tax owed electronically through their Canadian financial institution using the Electronic Data Interchange option . However, those in Quebec will be unable to use this electronic service. Other internet-based filing services include the GST/HST Internet File Transfer, offering business owners the ability to pay their sales taxes to the CRA directly through their third-party accounting software.

Know The Pros And Cons Of Digital And Paper Tax Returns

When you file your taxes, you have two options for submitting your return with the Internal Revenue Service : electronically or by mail.

Both methods of filing have their pros and cons. E-filing is safe, faster, and generally more convenient than paper filing. Filing by mail can be cheaper, though it takes the IRS longer to process refunds.

Learn more about choosing how to file your tax return.

Recommended Reading: Doordash How Much Should I Set Aside For Taxes

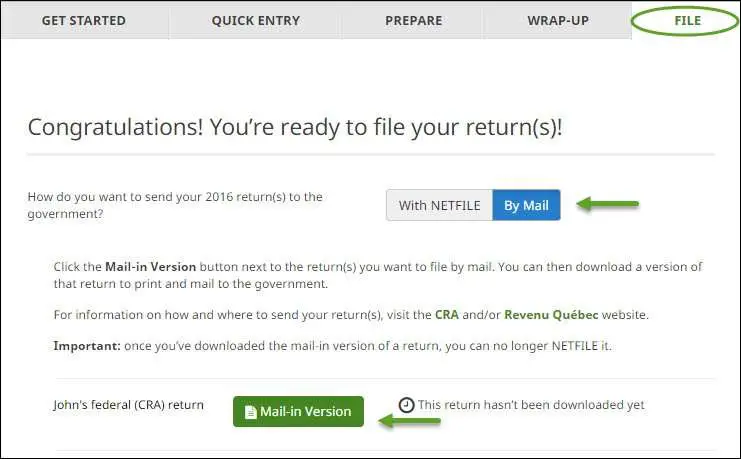

How Do I File My Taxes Online

Filing your taxes with TurboTax Free is quick and easy. First youll be asked to set up a profile and follow a simple process to find all the credits and deductions youre entitled to. With the CRAs Auto-fill my return, you can also import your tax info directly from the CRA. This service pulls info from your income slips , government benefit slips, RRSP receipts, and unused tuition credits. All the relevant info will be populated from these forms into your tax return saving you time and effort.

If you decide not to use CRAs Auto-fill my return service, or if you have additional info to enter that isnt captured through the import, you can find all the forms you need quickly and easily through TurboTaxs search feature.

You can also easily look for all the credits and deductions that apply to you using the search bar in TurboTax Free. If youre not sure where to start, heres a list of common credits, deductions, and expenses you may be eligible for:

Once youve entered all your info for the year and youre ready to file, our software will guide you through the steps to NETFILE your return online or print and mail your return. Well also give you step-by-step instructions on how to pay the CRA if you owe taxes.

We Provide Qualified Tax Support

E-file’s online tax preparation tools are designed to take the guesswork out of e-filing your taxes. Our program works to guide you through the complicated filing process with ease, helping to prepare your return correctly and if a refund is due, put you on your way to receiving it. Should a tax question arise, we are always here help and are proud to offer qualified online tax support to all users.

If you’ve ever tried calling the IRS during the tax season, you probably know that telephone hold times at peak periods can be hours long. Our dedicated support team enables customers to get their questions answered just minutes after a question is sent, even during peak times. Simply send us a “help” request from within your account and our experts will begin working on your problem and get you an answer as quickly as possible. Prefer to call us? We also provide full telephone support to all taxpayers filing with our Deluxe or Premium software.

Recommended Reading: Doordash Tax Deduction

I Filed My Tax Return On Mto But I Want To Mail My Payment How Does This Work

You may utilize MTO to file a return and/or make a payment. Mailed payments must be submitted with Form 5094 Sales, Use and Withholding Payment Voucher in order to route and post your payment properly. DO NOT SEND A COPY OF YOUR E-FILED RETURN WITH YOUR PAYMENT.

After filing a tax return showing a payment is owed, MTO will prompt you to make an electronic payment. If you wish to mail a payment, you will click Cancel on the Would you like to make a payment pop-up modal.

You will be returned to the File and Pay a Tax Return page. On the right hand navigation pane, select SUW Actions and then Make a Payment. Under the Payment Voucher section of the page, a list of prepopulated printable payment vouchers are displayed. If the return period you are looking for is not listed, click the Sales, Use and Withholding Payment Voucher link to print a blank payment voucher that you may complete prior to mailing with your payment.

Can I Print An E

Your e-filed return will be immediately available for reviewing and printing under the View and Print Filed Returns tab on MTO. The only time you will not be able to immediately view your filed return is if you have more than one return pending processing for a tax period. Once returns are processed, you can view them under the Amend and Pay Processed Returns tab on MTO.

Read Also: How Much Should I Set Aside For Taxes Doordash

Tips From The Us Postal Service

The U.S. Postal Service warns taxpayers to be sure they use correct postage.Weigh your return, or take it to the post office to have it weighed.

Tax returns sent without enough postage will be returned, and that’s just wasted time.

You can purchase a certificate of mailingat the post office to prove that you mailed your return on a specific date. Keep the certificate the post office doesn’t keep copies.

The postmark is what counts when mailing your business return. Some post office locations offer extended hours and late postmarking before Tax Day.

How To Mail A Paper Return

You may need to mail a paper return to the IRS or state agency if:

- You prefer mail over e-file

- Your e-file was rejected and must be paper filed to correct the problem*

- You’re filing your return after the October deadline

Before mailing the return, be sure to read the filing instructions. They will include important information such as where to file, what to attach to the return , refund or balance due, information about estimated tax payments, etc.

Note. File your return, schedules, and other attachments on standard size paper. Cutting the paper may cause problems in processing your return.

*Note. If you are paper filing your return because you were rejected on the filing due date, you should also include an explanation and a copy of the IRS rejection with your paper return. This return would need to be mailed within 10 days of your rejection and no later than April 25th.

Was this helpful to you?

You May Like: Louisiana Payroll Calculator

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

I Filed And Paid My Taxes On Mto But The Return And Payment Do Not Appear On My Account Whats Wrong

Verify that the return has been filed.

- After successfully e-filing a return in MTO, a unique 12 digit confirmation number is provided. For example: 301234567890. If you have a confirmation number in this format for the tax period in question, you have submitted a return.

- Your return will be available for viewing, printing, or amending in MTO once it has been processed by Treasury.

- Helpful Hint: If all registered tax obligations have been reported for a tax period, the return obligation will no longer appear under the Required Returns list under the File & Pay section of MTO. Use this as a double check.

Verify that a payment has been scheduled.

- Payment information is gathered by our separate payment processing system, Pay Connexion, which automatically queues after clicking Pay from the Would You Like to make a Payment screen.

- After successfully scheduling an EFT payment, a unique confirmation number is provided. The format for payment confirmation numbers is always a series of letters and numbers.

- Your payment will be visible in MTO 72 hours after the payments processing date.

- Your pending payment will be visible on Pay Connexion immediately.

Read Also: Is Plasma Money Taxable

Using A Private Delivery Service

You can use a private delivery service, but only certain IRS-approved services are acceptable.

The IRS listsDHL, Federal Express, and UPSas designated private delivery services, but only some of the services from these companies are acceptable, including:

- DHL Express : DHL Express 9:00, DHL Express 10:30, DHL Express 12:00, DHL Express Worldwide, DHL Express Envelope, DHL Import Express 10:30, DHL Import Express 12:00, DHL Import Express Worldwide

- Federal Express : FedEx First Overnight, FedEx Priority Overnight, FedEx Standard Overnight, FedEx 2 Day, FedEx International Next Flight Out, FedEx International Priority, FedEx International First, FedEx International Economy

- United Parcel Service : UPS Next Day Air Early A.M., UPS Next Day Air, UPS Next Day Air Saver, UPS 2nd Day Air, UPS 2nd Day Air A.M., UPS Worldwide Express Plus, UPS Worldwide Express

When To File Your Return

If you file your return on a calendar year basis, the 2020 return is due on or before . A fiscal year return is due on the 15th day of the 4th month following the end of the taxable year. When the due date falls on a Saturday, Sunday, or holiday, the return is due on or before the next business day. A fiscal year return should be filed on a tax form for the year in which the fiscal year begins. For example, a 2020 tax form should be used for a fiscal year beginning in 2020. See Directive TA-16-1, When a North Carolina Tax Return or Other Document is Considered Timely Filed or a Tax is Considered Timely Paid if the Due Date Falls on a Saturday, Sunday, or Legal Holiday.

Out of the Country: If you are out of the country on the original due date of the return, you are granted an automatic four month extension to file your North Carolina individual income tax return if you fill in the “Out of Country” circle on Page 1 of Form D-400. “Out of the Country” means you live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or you are in military service outside the United States and Puerto Rico. The time for payment of the tax is also extended however, interest is due on any unpaid tax from the original due date of the return until the tax is paid.

Nonresident Aliens: Nonresident aliens are required to file returns at the same time they are required to file their federal returns.

You May Like: Do You Get Taxed On Plasma Donations