California Payroll Tax Rate Example

New employers pay 3.4% in SUTA for employees making more than $7,000 per year. Theyve renamed SUTA as State Unemployment Insurance . Existing employers pay between 1.5% and 6.2% depending on their unemployment experience. Those who lay off or terminate fewer employees will typically have a lower rate. These taxes are calculated on top of the FICA and FUTA taxes that employers in California and all states must pay.

Louisiana Tax Tables And Personal Income Tax Rates And Thresholds In Louisiana

Each year, the state of Louisiana publishes new Tax Tables for the new tax year, the Louisiana Tax Tables are published by the Louisiana State Government. Each of these tax tables contains rates and thresholds for business tax in Louisiana, corporation tax in Louisiana, employer tax in Louisiana, employee tax in Louisiana, property tax in Louisiana, sales tax in Louisiana and other tax rates and thresholds in Louisiana as well as providing instruction and guidance for changes to specific Louisiana state tax law and/or tax legislation.

These tax tables are then, amongst other things, used to calculate Louisiana state tax and associated payroll deductions. The changes to the Louisiana tax tables can be long and often contain information that , whilst important for the correct calculation of tax in Louisiana, is not relevent to the majority of Louisiana taxpayers who pay most of their direct tax via their salary income. The Louisiana state tax tables listed below contain relevent tax rates and thresholds that apply to Louisiana salary calculations and are used in the Louisiana salary calculators published on iCalculator. The Louisiana state tax tables are provided here for your reference.

Louisiana State Rate For 2021

4% is the smallest possible tax rate 4.45%, 7.45%, 7.7%, 7.8%, 7.95%, 8%, 8.075%, 8.2%, 8.45%, 8.6%, 8.7%, 8.75%, 8.8%, 8.95%, 9%, 9.05%, 9.075%, 9.15%, 9.2%, 9.28%, 9.4%, 9.45%, 9.575%, 9.6%, 9.7%, 9.8%, 9.85%, 9.943%, 9.95%, 10%, 10.116%, 10.2%, 10.44%, 10.45%, 10.95%, 11.2% are all the other possible sales tax rates of Louisiana cities.11.45% is the highest possible tax rate

The average combined rate of every zip code in Louisiana is 8.936%

Read Also: What Does Agi Mean In Taxes

Quarterly Tax Payment Due Dates

Quarterly FUTA taxes are due if you owe more than $500 in taxes each quarter. The due dates are:

- Quarter one: April 30

- Quarter three: Oct. 31

- Quarter four: Jan. 31

However, SUTA tax due dates varies by state. For example, in Michigan, the taxes are due on the 25th of the month instead of the end of the month: April 25, July 25, Oct. 25, and Jan. 25. Failing to meet the deadline may result in a penalty or late tax payment interest assessment. Therefore, you not only have to know what taxes to withhold and pay but also when and how to pay itby state.

Consequences Of Not Making Or Being Late On Employment Tax Payments

If employers fail to remit payroll tax payments or send them in late, it could have the following impact:

- Employers may face criminal and civil sanctions

- Employees may lose access to future Social Security or Medicare benefits

- Employees may lose access to future unemployment benefits

If youre late making deposits for FICA or federal income taxes, youll be charged penalties.

Read Also: Www.1040paytax.com Official Site

Louisiana Just Got $56m Back In Uncashed Tax Refunds See How Much Of It Might Be Yours

The Louisiana Department of the Treasury announced Friday that $5.63 million in uncashed state income tax refunds is owed to 22,000 people and businesses and some of it may be your money.

The good news is there’s a fairly easy way for you to both find out if you’re owed it and to claim it.

Basically, the state collects money that they call unclaimed property. This can include leftover dollars from payroll checks, old savings accounts if you transferred banks, stocks, dividends, insurance proceeds, utility deposits on behalf of residents, and more.

You can search Louisiana unclaimed property on this website by searching your name. You may need to provide:

- State issued ID such as a driver’s license or passport

- Proof of Social Security number such as a W-2 or SS card

- Proof of current or previous address, such as a pay stub or utility bill

How Your Louisiana Paycheck Works

No matter which state you call home, your employer withholds money for FICA taxes, which include Social Security and Medicare taxes. Every pay period, your employer withholds 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. Your employer then matches that contribution. If you make $200,000 or more, your earnings in excess of $200,000 are subject to a 0.9% Medicare surtax, not matched by your employer.

Next up is federal income tax withholding. The only way you can get around this is if your income is very low. Exactly how much your employer withholds to cover your federal income tax liability depends on several factors, including marital status, number of dependents and taxable income.When you start a new job or need to change your withholding, you have to provide your employer a new W-4 form.

In recent years, the Form W-4 has seen an overhaul. More specifically, the new withholding form doesnt ask you to list total allowances. Instead, it features a five-step process that allows filers to enter personal information, claim dependents and indicate any additional income or jobs. It also requires filers to specify annual dollar amounts for income tax credits, non-wage income, itemized and other deductions and total annual taxable wages.

Read Also: How To Correct State Tax Return

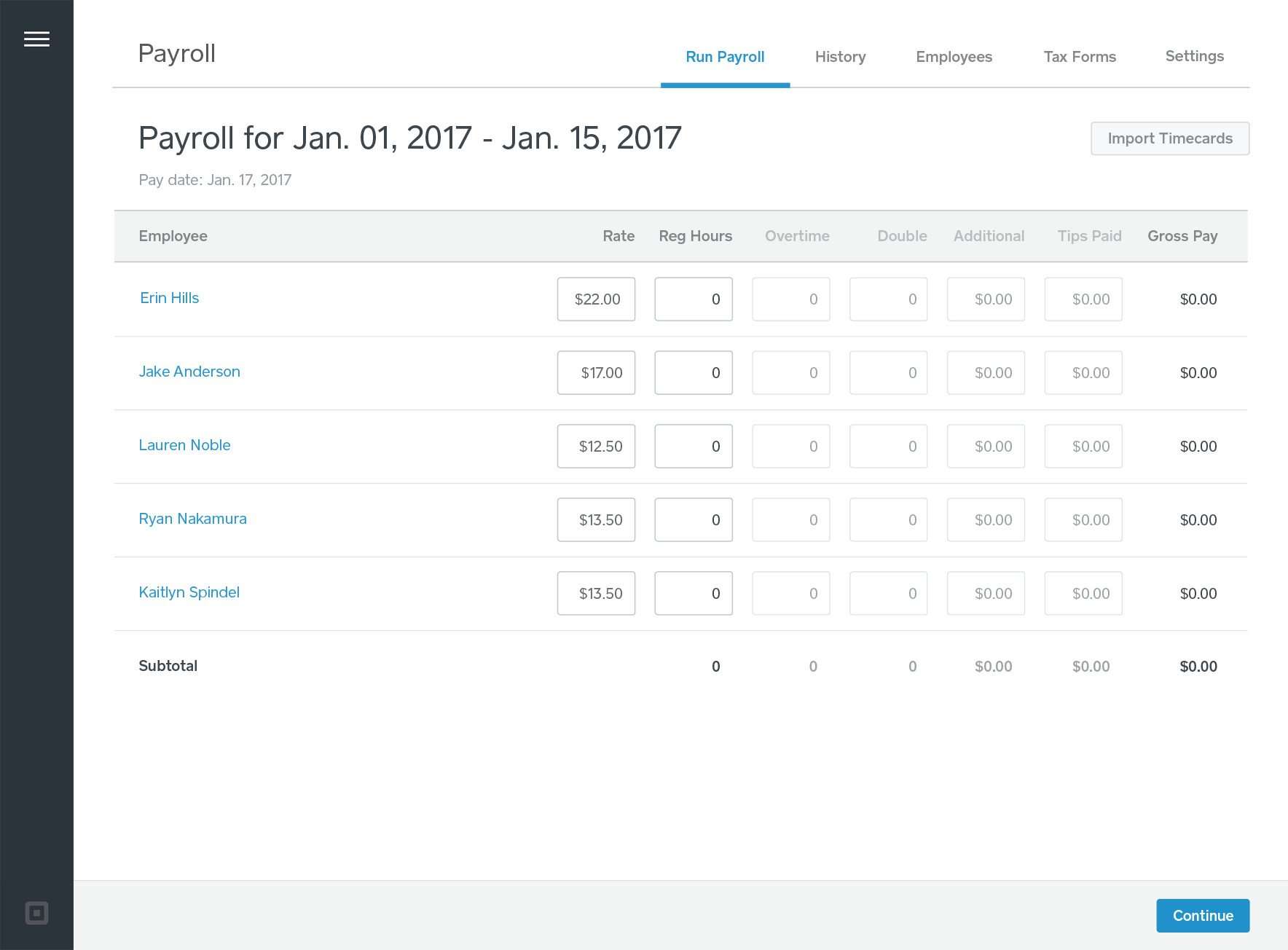

Find Your Louisiana Tax Id Numbers And Rate

Louisiana Revenue Account Number

You can find your Revenue Account Number on any previous mailings from or quarterly filings submitted to the Department of Revenue.

Louisiana Unemployment Tax Employer Account Number

You can find your Unemployment Tax Employer Account Number on any previous mailings from or quarterly filings submitted to the Workforce Commission.

Unemployment Insurance Contribution Tax Rate

Look up your Unemployment Insurance Contribution Tax Rate online by logging into your Louisiana Wage and Tax System account set up through the Workforce Commission.

Your Insurance Contribution Rate can be found on the letter mailed to you by the Experience Rating Unit of the Workforce Commission each December.

You are responsible for ensuring Square Payroll has the correct tax ID numbers and tax rates for your business. Please contact us if you need to update your rate.

Louisiana State Payroll Taxes

Now that were done with federal taxes, lets look at Louisiana income taxes. The state charges a progressive income tax, meaning the more money your employees make, the higher the income tax. The tax rate ranges from 2% on the low end to 6% on the high end.

Louisiana does not have any local city taxes, so all of your employees will pay only the state income tax.

Don’t Miss: Where Is My State Refund Ga

Louisiana Payroll Laws Taxes And Regulations

To ensure accuracy every time you run payroll, it is vital that you understand how to calculate Louisiana payroll taxes and the applicable laws and regulations. With few exceptions, most employers in the US must pay Federal Insurance Contributions Act taxes. The current FICA tax rate for Social Security is 6.2% of each employees paycheck and 1.45% for Medicare youll deduct the amounts from everyones gross pay and pay a matching amount out of your business bank account.

To ensure you maintain compliance with payroll regulations, review the specific steps of doing payroll in Louisiana below.

How 2021 Sales Taxes Are Calculated In Louisiana

The state general sales tax rate of Louisiana is 4.45%. Cities and/or municipalities of Louisiana are allowed to collect their own rate that can get up to 7% in city sales tax.Every 2021 combined rates mentioned above are the results of Louisiana state rate , the county rate , the Louisiana cities rate , and in some case, special rate . The Louisiana’s tax rate may change depending of the type of purchase. Some of the Louisiana tax type are: Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.Please refer to the Louisiana website for more sales taxes information.

You May Like: What Does H& r Block Charge

Does Everyone Pay Payroll Tax

In general, most employers and employees pay Social Security and Medicare taxes. Exemptions apply, however, for certain classes of nonimmigrant and nonresident aliens. Examples include nonimmigrant students, scholars, teachers, researchers and trainees , physicians, au pairs, summer camp workers, and other nonimmigrants temporarily present in the United States in F-1, J-1, M-1, Q-1 or Q-2 status.1

Louisiana Tax Brackets 2020

Looking at the tax rate and tax brackets shown in the tables above for Louisiana, we can see that Louisiana collects individual income taxes differently for Single versus filing statuses, for example. We can also see the progressive nature of Louisiana state income tax rates from the lowest LA tax rate bracket of 2% to the highest LA tax rate bracket of 6%.

For single taxpayers living and working in the state of Louisiana:

- Tax rate of 2% on the first $12,500 of taxable income.

- Tax rate of 4% on taxable income between $12,501 and $50,000.

- Tax rate of 6% on taxable income over $50,000.

For married taxpayers living and working in the state of Louisiana:

- Tax rate of 2% on the first $25,000 of taxable income.

- Tax rate of 4% on taxable income between $25,001 and $100,000.

- Tax rate of 6% on taxable income over $100,000.

For the Single, Married Filing Jointly, Married Filing Separately, and Head of Household filing statuses, the LA tax rates and the number of tax brackets remain the same. Notice, however, the Louisiana income tax brackets for Married Filing Jointly increase from $12,500 to $25,000 at 4%, and increase from $50,000 to $100,000 at 6% the highest tax bracket. Married Filing Separately income tax brackets are one half that of the Married Filing Jointly income tax brackets in the state of Louisiana.

Recommended Reading: How Much Does H And R Block Charge To Do Your Taxes

How To Calculate Salary After Tax In Louisiana In 2022

The following steps allow you to calculate your salary after tax in Louisiana after deducting Medicare, Social Security Federal Income Tax and Louisiana State Income tax.

What Are The Basic Types Of Payroll Tax

Several types of payroll taxes exist at the national and state levels. They are as follows:

- Federal payroll tax Better known as Federal Insurance Contribution Act , the federal payroll tax has two parts one for Medicare and the other for Social Security.

- Social Security payroll tax Employers and employees share in the Social Security tax, with each paying half of the total liability until the employee reaches the wage base limit of $142,800 .

- Medicare payroll taxMedicare tax is also split evenly between employers and employees, but unlike Social Security, it doesnt have an earnings limit. However, certain employees making more than $200,000 per year may have to pay an additional Medicare tax, which employers arent required to match.

- Unemployment taxes Employers alone pay federal unemployment tax on the first $7,000 that every employee earns. The same is true for state unemployment programs, except the wage base limits vary, and in a few states, employees also contribute to the tax. Employers who pay their state unemployment on time and arent in a credit reduction state may be eligible for a lower federal unemployment tax rate.

- State and local payroll tax Some states and municipalities may have additional payroll taxes for short term disability, paid family medical leave or other programs. Employers should check with their local authorities for specific requirements.

Also Check: Do You Have To Pay Taxes On Plasma Donations

States That Have A State Income Tax

Not all states have a state income tax. However, in states that do, the employee must be asked what amount to withhold from the paycheck. That amount is to be withheld by the employer and paid to the state. The income tax rate varies by state and also varies by person based on factors such as their marital status and the number of exemptions they claim.

Employees provide this information on the equivalent of a federal W-4 form, which may be called by a different name in each state. For example, South Dakota has no state income taxes, while North Dakota does and uses the Federal W-4 to track withholdings. New Jersey also has state tax withholdings and tracks them on a Form NJ-W4.

Louisiana Child Labor Laws

In Louisiana, children under the age of 14 are prohibited from working. Children aged 14 and 15 may work a job not in manufacturing, mining, or other hazardous industries, provided that:

- The child does not miss school

- The child only works three hours on a school day or 18 hours in a school week

- The child only works eight hours on a non-school day or 40 hours in a non-school week

There are no restrictions placed on children aged 16 or 17 who wish to work, other than the break requirement listed above.

For more information on federal child labor laws, check out our guide to hiring minors.

You May Like: Where’s My Tax Refund Ga

Other Taxes And Duties For Your Llc

Depending on your industry, you may be liable for certain other taxes and duties. For example, if you sell gasoline, you may need to pay a tax on any fuel you sell. Likewise, if you import or export goods, you may need to pay certain duties. Speak to your accountant about any other taxes or duties you may need to pay.

What Is The Percentage Of Federal Income Tax Withheld

As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax authorities.

To calculate how much of your employeeâs federal income tax to withhold, youâll need a copy of their Form W-4, as well as your employeeâs gross pay.

Your next step is to determine the method you want to use to calculate withholding. Most employers have two options, the wage bracket method and the percentage method. While not exactly simple, the wage bracket method is the more straightforward way to calculate payroll tax.

Read Also: How To Correct State Tax Return

How You Can Affect Your Louisiana Paycheck

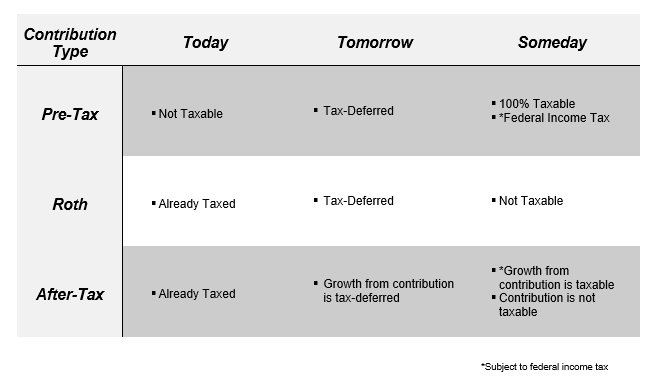

If you want to shelter more of your earnings from taxes, you can always contribute to tax-advantaged accounts. You can put pre-tax dollars in a 401 and let that money grow tax-free until you start taking distributions in retirement. You can also put pre-tax dollars in a flexible spending account or health savings account account to use for medical expenses. Some workplaces offer other benefits you can pay for with pre-tax dollars, such as commuter cards that let you pay for parking or public transit.

If, on the other hand, your focus is on having more take-home pay in your paycheck, you can ask for a raise or seek supplemental wages. This includes overtime, but also bonus pay, award money and commissions. These supplemental wages are subject to Louisiana income taxes at the regular rate.

With average income tax rates and low property taxes, Louisiana may be on your list of potential places to call home. If youre looking to become a resident, take a glance at our Louisiana mortgage guide to understanding mortgages in the Pelican State.

Payroll Tax Administrator Salary In Louisiana

How much does a Payroll Tax Administrator make in Louisiana? The average Payroll Tax Administrator salary in Louisiana is $52,163 as of October 29, 2021, but the range typically falls between $46,691 and $58,329. Salary ranges can vary widely depending on the city and many other important factors, including education, certifications, additional skills, the number of years you have spent in your profession.

- Adjust Payroll Tax Administrator Salary:

- Select State

Also Check: Where’s My Tax Refund Ga

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

New York Payroll Tax Rate Example

New employers pay 3.13% in SUTA for employees making more than $11,100 per year. They refer to it as the Unemployment Insurance Contribution Rate . Existing employers pay between 0.06% and 7.9%. Employers with few unemployment claims may pay nearly 10 times less than those with high unemployment claims. In New York, as in most states, it pays to reduce your turnover.

Read Also: Can Home Improvement Be Tax Deductible