How To Plan Ahead To Pay Back Taxes

The best way to avoid paying back taxes is filing your annual tax return during tax season. Take time to review your overall tax situation to come up with strategies for reducing your tax bill and achieving your financial goals.

If you think you owe back taxes, consider working with a tax professional who can help you gather past tax returns and file any that you may have missed.

If you think you might owe the IRS when you file your tax return this year or next, consider making estimated tax payments in advance. These payments are generally required for sole proprietors who arent subject to withholding from their paychecks by an employer. Making quarterly estimated tax payments can help you to avoid penalties on your upcoming tax return.

Due Date For Filing Wht Return

Companies other than Petroleum Companies withholding tax returns should be filed within twenty-one days from the date the amount was deducted or the time the duty to deduct arose.

Other companies including Petroleum Companies, withholding tax returns should be filed within thirty days from the date the amount was deducted or the time the duty to deduct arose.

Filing Tax Returns – 7-10 working days

How And When To Pay Your Bill

You dont need to pay your Self Assessment tax bill immediately.

The deadline for paying any tax you owe in addition to tax you may have paid through your 2021 to 2022 Payments on Account and your first 2022 to 2023 Payment on Account is 31 January 2023.

If you file your tax return early, you will know how much you owe and can then choose a payment option that works for you.

You can now make Self Assessment payments quickly and securely through the HMRC app. You can also check if a repayment is due by checking your personal tax account.

Recommended Reading: When Can I File My Income Tax

Employees Personal Income Tax Returns

Personal Income Tax is paid by individuals in employment through the Pay-As-You-Earn system, the income is taxed on actual basis.

The taxpayer is required to declare income other than employment income earned from all sources in the preceding year and income earned from employment in the current year.

Requirements For Filing Company Income Tax

- Company Tax Identification Number – must be registered as tax payer in Nigeria. For TIN application

- Duly completed Self-Assessment form.

- Schedule of Fixed Assets

- Evidence of Payment of the taxes due.

The Audited Financial Statement to be sign by two Directors. The accounts should be audited and signed by External Auditors who must be members of recognized professional bodies.

Also Check: How To Qualify For First Time Home Buyer Tax Credit

Give Yourself Time And Make Sure Youre Registered

Remember to give yourself enough time to do this ahead of the deadline, to allow for your UTR to be posted to you.

If this is your first time completing a tax return, you will need to register for Self Assessment and then HMRC will send you your UTR.

If you are completing a Self Assessment return because you are self-employed, then you will also need to register your self-employment with HMRC.

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Also Check: Can You Go To Jail For Not Paying Taxes

Budgeting To Pay Your Tax Bill

You can use our Budget payment plan service to make regular weekly or monthly payments towards your next tax bill. You must be up to date with your previous Self Assessment payments and you can decide how much to pay each week or month.

Set up your plan using your HMRC online account. Go to the Direct Debit section and choose the set up a budget payment plan option when filling in the Direct Debit form. If the amount in your budget payment plan does not cover your next bill in full, you will need to pay the difference by the payment deadline. Find out more about paying weekly or monthly.

A budget payment plan is different from payments on account, which you normally make in January and July.

Find out more about paying in instalments.

How Can I File And Pay My Back Taxes

Its best to use reliable and easy-to-use software if you’re going to prepare your tax returns yourself. Plan on spending a few hours on each tax return you have to file. There are tax software programs that can help you for free.

Again, make sure youre using software and forms for the appropriate tax year. Regulations vary from year to year, and the software settings can be critical for compliance as well as your liabilities or refund.

You might get a better result by hiring an experienced tax professional because they can help you with more complicated tax compliance and know how to deal with the IRS, if necessary.

Look for someone with significant experience in preparing back taxes if you decide to use the services of a professional. This would be the way to go if you need advice on handling incomplete tax documentation, or an advocate who will negotiate with the IRS on your behalf.

Youll need to print out the back tax returns and mail them in to the IRS to officially file them. You cant do it online.

Read Also: How To Report Bitcoin On Tax Return

How Do I Apply For An Itin

If you want to file a tax return but cannot obtain a valid SSN, you must complete IRS Form W-7, Application for IRS Individual Taxpayer Identification Number. Form W-7 must be submitted to the IRS with a completed tax return and documents verifying identity and foreign status. You will need original documents or certified copies from the issuing agencies. The instructions for Form W-7 describe which documents are acceptable.

Parents or guardians may complete and sign a Form W-7 for a dependent under age 18 if the dependent is unable to do so, and must check the parent or guardians box in the signature area of the application. Dependents age 18 and older and spouses must complete and sign their own Forms W-7.

You can use this checklist to help prepare your application.

There are three ways you can complete the ITIN application:

Individuals Living Abroad Or Traveling Outside The United States

If youre living or traveling outside the U.S. or Puerto Rico on May 1, you have until to file your return. You must still pay any tax you expect to owe by the May 1 due date.

Enclose a statement explaining that you were out of the country, and write Overseas Rule on the top of your return and on the envelope.

Don’t Miss: How To Get Stimulus Check On Tax Return

Income Tax Return Filing Dates

- 1 July 2022 to 24 October 2022

- Taxpayers who file online

- Taxpayers who cannot file online can do so at a SARS branch

If you are being auto-assessed, see all the info you need to know on our How does the Auto-Assessment work webpage. If you are not in the auto-assessment group and need to submit a return, see our info for provisional and non-provisional taxpayers on the 2022 Tax Filing Season media release.

Do You Need To File A Tax Return

Here’s how to figure out if you should file a tax return this year:

- Look at your income to see if you made the minimum required to file a tax return

- Decide which filing status is best for you

- If you’re retired, find out if your retirement income is taxable

- Find out if you qualify to claim certain to lower the amount of tax you owe

- Use the Interactive Tax Assistant to see if you need to file

You May Like: How Do I Change My Tax Withholding On Unemployment

When Can I File My Taxes

Each year, the IRS issues a statement in early January with the first day to file taxes.

Typically, the official date when you can file taxes falls in mid to late January.

The IRS announced it will start processing tax returns Feb. 12. Worried about waiting weeks for your refund? We can do your taxes now and when you file at Block, you could get a Refund Advance up to $3,500 today. No waiting on the IRS. No loan fees and 0% interest.

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Don’t Miss: How To Get Tax Return From Turbotax

What If Someone Else Can Claim You As A Dependent

Different income thresholds apply if someone else can claim you as a dependent, as well as the type of incomeearned or unearned. Your total income might be less than the standard deduction for your filing status. However, you will still need to file a tax return if one of the below situations applies for tax year 2021:

| Unearned Income |

|---|

| 65+ | Yes |

For example, let’s say you’re single, 16 years old, not blind, and your parents claim you as a dependent. You had $13,000 in earned income last year. You would have to file a tax return because that’s more than the threshold of $12,550 for tax year 2021. If all else was the same, but you were blind, you would not have to file because that’s less than the threshold/standard deduction of $14,250 for 2021.

You must also file a tax return if either your unearned or your earned income exceeds the applicable amount for your circumstances. For example, you would have to file a return if you had $1,101 in unearned income, even though you only had $10,000 in earned income, were single and under 65 last year, and someone claimed you as a dependent. You may also have to file if your gross income is greater than the threshold computed for your circumstances. The $5 rule for married taxpayers filing separate returns still applies, as well.

Tax Return Filing Status

Youll also have to determine your filing status. This is important because it helps determine how much in income tax you’ll pay. You can file as:

- Single: You’ll file as a single taxpayer if you are not married and aren’t being claimed as a dependent on someone else’s tax returns. Single taxpayers are eligible for a standard deduction of $12,550 for the 2021 tax year.

- Most people who are married file in this category. This allows them to file one joint tax return. If you file under this category, your standard deduction for the 2021 tax year is $25,100.

- Married couples can also each file their own tax returns, reporting only their personal income, deductions and credits. The standard deduction for taxpayers who file this way is $12,550 for the 2021 tax year.

Recommended Reading: Are Charitable Contributions Still Tax Deductible

Resident Individual Income Tax

Resident taxpayers who are required to file a federal individual income tax return are required to file a Louisiana income tax return,IT-540, reporting all of their income. If a Louisiana resident earns income in another state, that income is also taxable by Louisiana. A temporary absence from Louisiana does not automatically change your domicile for individual income tax purposes. As a resident taxpayer, you are allowed a credit on Schedule G for the net tax liability paid to another state if that income is included on the Louisiana return.

Residents may be allowed a deduction from taxable income of certain income items considered exempt by Louisiana law. For example, Louisiana residents who are members of the armed services and who were stationed outside the state on active duty for 120 or more consecutive days are entitled to a deduction of up to $30,000. In each case, the amount of income subject to a deduction must be included on the Louisiana resident return before the deduction can be allowed.

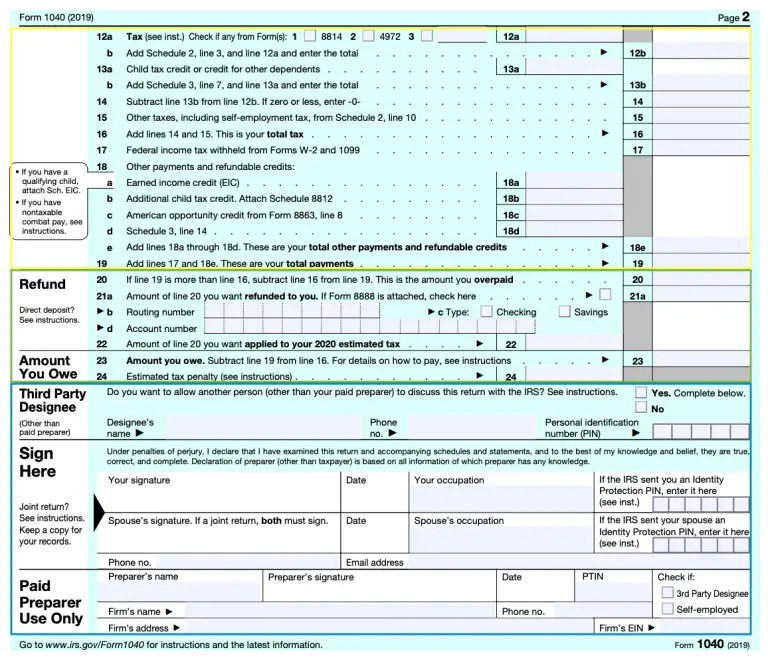

What Could Cause A Refund Delay

There are countless reasons your tax refund could be delayed. Weve outlined some common instances where a delay could occur:

- If you file a paper return, the IRS says you should allow about six weeks to receive your refund.

- If the IRS mails you a physical check, you will receive a check through the mail.

- If you file Form 8379, Injured Spouse Allocation, it could take up to 14 weeks to process your tax return.

- If your identity has been stolen and another return was filed with your social security number, it could take longer for the IRS to sort out the situation.

- If you owe a debt, like unpaid child support, your refund could be offset to pay part or all of it.

Each of the possibilities above could cause a delay or prevent receiving the refund altogether. Its important to note that each individuals tax scenario is unique and no two filings are handled exactly the same.

Recommended Reading: How To Evade Taxes Legally

When Is The Earliest You Can File Your Tax Return

You can prepare your return as soon as you get all relevant and required tax information including W-2s and 1099s. Employers must send W-2s and 1099s by January 31st of the following tax year.

On the IRS side, the government agency often distributes communication in January regarding the official start to the tax season. This notice designates the first official day the IRS will begin accepting returns.

What Is The Last Day To File Taxes

The last day to file taxes for individual federal income tax returns is April 15, or as late as April 18 in the event Tax Day falls on a Saturday, Sunday or official holiday. Some state-level holidays can extend the tax deadline by one day further. You can request a six-month filing extension through filing Form 4868, making your last day to file individual income taxes October 17, 2022.

If you also file taxes for your small business as a partnership, LLC or S Corp, the last day to file taxes is March 15 unless it falls on a weekend or official holiday. If your business runs on a non-calendar tax year, your federal tax return is generally due by the 15th day of the third month following the end of the tax year.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Also Check: Do Retired People File Taxes

Who Must Send A Tax Return

You must send a tax return if, in the last tax year , you were:

- self-employed as a sole trader and earned more than £1,000

- a partner in a business partnership

You will not usually need to send a return if your only income is from your wages or pension. But you may need to send one if you have any other untaxed income, such as:

- money from renting out a property

- tips and commission

- income from savings, investments and dividends

You Can Claim Refundable Tax Credits

Refundable tax credits are particularly valuable for low-income taxpayers because they can provide a refund beyond what you paid for the year via withholding or estimated tax payments.

In other words, if its worth more than the tax you owe, the IRS will issue you a refund for the difference. Refundable credits include:

Don’t Miss: How Does Payroll Tax Work