How To Check On Your State Tax Refund

Each state uses a slightly different system to let taxpayers check their tax refund status. In general though, there are two pieces of information that you will need in order to check on your refund.

The first important information is your Social Security number . If you do not have a SSN, most states allow you to use a few different types of ID. One common type is an Individual Taxpayer Identification Number . If you file a joint return, use whichever ID number appears first on the return.

Almost all states will also require you to provide the amount of your refund. Most states ask you to round your return to the nearest whole number but some states, like Vermont, will ask for the exact amount of your refund.

These two things will be enough for you to check in some states. Other states may also require your date of birth, the year of the return, your filing status or your zip code. Below is a run down of how you can check your refund status in each state that collects an income tax.

Note that Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming have no state income tax. New Hampshire and Tennessee do not tax regular wages and income. Tennessee has phased out tax on income from dividends and investments and New Hampshire has proposed legislation to do the same.

How Long Will It Take To Get Your Refund

General refund processing times during filing season:

- Electronically filed returns: Up to 4 weeks

- Paper filed returns: Up to 8 weeks

- Returns sent by certified mail: Allow an additional 3 weeks

The Wheres my Refund application shows where in the process your refund is. When we’ve finished processing your return, the application will show you the date your refund was sent. All returns are different, and processing times will vary.

See how our return process works:

My Address Has Changed I Want To Change The Address/ E

Login in the Income Tax e-Filing website and go to My Profile Settings Update Contact details. Provide the new Address/ e-mail ID/ Mobile Number and submit. Once submitted, your Address / e-mail ID / Mobile number is updated in your profile and also sent to the CPC to update on the Income Tax Return.

Not Determined

What does this mean?

This means that the Income Tax Department has still not processed your Income Tax Return or determined the refund yet.

Please check your refund status after a month to see if it has been updated.

Refund Paid

Step 1. What does this mean?

This means:

-

The Income Tax Department has sent the refund to you .

Step 2. What do I do now?

-

If you received your refund, congrats! See you again next year

-

If your refund status is Refund Paid, and you havent received it yet, heres what you need to do:

If you had opted for direct debit to your bank account while filing and you havent received your refund, you need to immediately contact your own bank or the State Bank of India to check for any errors.

You can contact SBI

b. On phone at 1800 425 9760

c. By post at Cash Management Product, State Bank of India, SBIFAST, 31 Mahal Industrial Estate, Off: Mahakali Caves Road, Andheri , Mumbai 400093

If you opted for refund via cheque while filing, but havent received the cheque check out the Speed Post tracking reference number for your cheque on the Refund Bankers website.

No demand no refund

Step 1. What does this mean?

This could mean either:

You May Like: Tax Write Offs For Doordash

Wheres My State Tax Refund West Virginia

Check on your state tax return by visiting the West Virginia State Tax Departments website. On the right side of the page, you will see a link called Wheres My Refund? This link will take you to the refund status page. Enter your SSN, the tax year and the amount of your refund in order to check your status.

How To Check Your 2019 Tax Refund Status

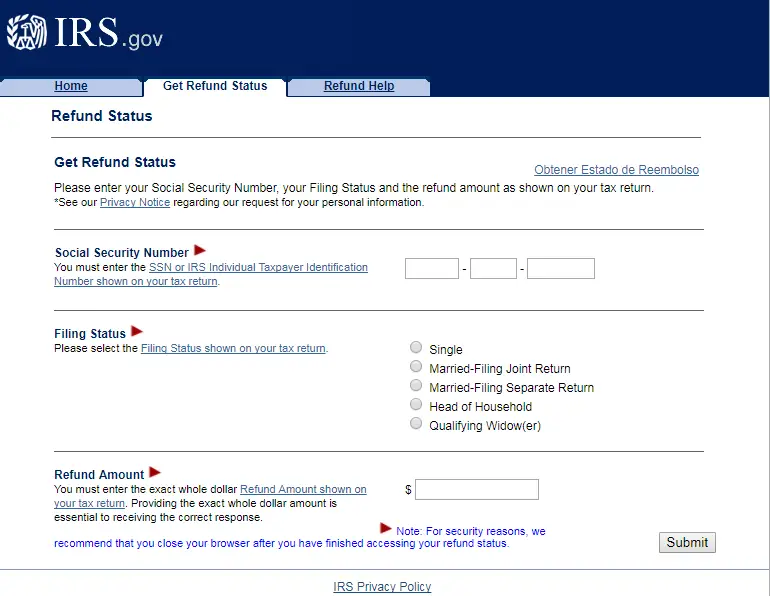

There are two different types of tax refunds that you may need to check the status of Federal tax returns and State tax returns. The method for checking each tax return is similar. Youll need to know the https://www.budget101.com/money-matters/5845-frequently-asked-questions-about-tax-filing-status/ that you used when you filed, as well as the expected amount of the tax refund.

Recommended Reading: Form Acd-31015

How Do I Confirm That The Irs Received My Paper Mailed Tax Return

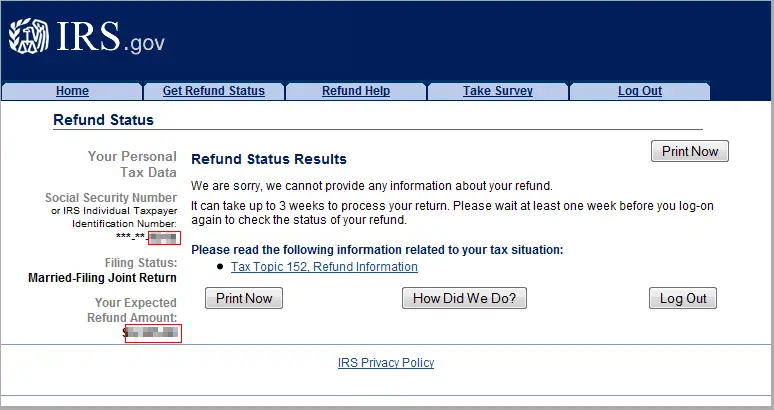

The IRS asks you to wait 4 weeks after you mail your return before looking up your refund at Where’s My Refund?

The “Where’s My Refund” tool,located at , follows your tax return fromreceipt to completion. It will tell you when your return is in received statusand if your refund is in approved or sent status.

The IRS releases most refunds within 21calendar days after the e-filed return has been accepted. For mailed returns, allow56 weeks from the postmark date.

For more information please click the link below.

My Bank Account Number Has Changed I Want To Change The Bank Account Number Which I Mentioned In My Income Tax Return

You can only change your Bank Account Number if you had a refund failure i.e your IT Return is processed and a refund was generated for you but you did not receive it. If you wish to change the Bank Account Number for Refund failure case, then login in the Income Tax e-Filing website and go to My Account Refund re-issue request. Select the mode through which you wish to receive the refund- ECS or Cheque. Enter the new Bank Account Number and provide address details. Submit the request.

Once the request is submitted, your new Address is updated with the Income Tax Department.

Recommended Reading: Federal Tax Return Irs

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

We may take longer to process your return if we select it for a more detailed review. See Review of your tax return by CRA for more information.

If you use direct deposit, you could get your refund faster.

Wheres My State Tax Refund Hawaii

Hawaii taxpayers can visit the Check Your Individual Tax Refund Status page to see the status of their return. You will need to provide your SSN and the exact amount of your refund.

Refunds can take nine to 10 weeks to process from the date that your tax return is received. If you elect to receive your refund as a paper check, you can expect it to take an additional two weeks. If you e-filed and have not heard anything about your refund within 10 weeks, call the states Department of Taxation.

Don’t Miss: Property Tax Protest Harris County

Wheres My State Tax Refund Minnesota

Through the Wheres My Refund? System, you can check the status of your Minnesota tax refund. You will need to enter your SSN, your date of birth, your return type , the tax year and the refund amount shown on your return. Its important to be aware that if your tax return does not have your date of birth on it, you cannot check its status.

The refund system is updated overnight, Monday through Friday. If you call, the representatives will have the same information that is available to you in this system.

How Long Will It Take To Get My Tax Refund

The IRS usually issues tax refunds within three weeks, but some taxpayers could have to wait a while longer to receive their payments. If there are any errors, or if you filed a claim for an earned income tax credit or the child tax credit, the wait could be lengthy.

When an issue delays your return, its resolution “depends on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,” according to the IRS website.

The date you receive your tax refund also depends on the method you used to file your return. If you submitted a tax return by mail, the IRS says it could take six to eight weeks for your tax refund to arrive once it’s been processed.

If your tax refund goes into your bank account via direct deposit, it could take an additional five days for your bank to post the money to your account. This means if it takes the IRS the full 21 days to issue your check and your bank five days to post it, you could be waiting a total of 26 days to get your tax refund.

Don’t Miss: Appeal Cook County Property Taxes

Tracking Refunds From Amended Tax Returns

Refund information for an amended federal income tax return on Form 1040X isn’t available on “Where’s My Refund” portal. But there is a resource you can use to track the status of an amended return for the current tax year and up to three prior tax years. Not surprisingly, it’s called the “Where’s My Amended Return” portal.

To access the tool, you’ll need to provide your Social Security number, date of birth, and zip code. It can take up to 3 weeks after you mailed it for an amended return to show up in the portal. Processing an amended return can take up to 16 weeks. The “Where’s My Amended Return” tool will let you know if your amended return is received, adjusted, or completed.

How Long Will My Refund Information Be Available

- For U.S. Individual Income Tax Returns filed before July 1: Around the second or third week in December.

- For U.S. Individual Income Tax Returns filed on or after July 1: Throughout the following year until you file a tax return for a more current tax year.

If your refund check was returned to us as undeliverable by the U.S. Post Office, your refund information will remain available throughout the following year until you file a tax return for a more current tax year.

Recommended Reading: How To Get A License To Do Taxes

How To Check The Status Of Your Refund

You can choose one of the following methods to check the status of your CRA tax refund:

- Use the instructions provided in My Account

- Use the CRA mobile app MyCRA

If you pay your income tax in instalments, you can arrange for any refund amount to be transferred to your instalment account. You are offered the option to do so when filing electronically, or you can attach a request to your paper return.

How To Get A Fast Refund

The sooner you file your tax return, the sooner you’ll get any tax refund due. Plus, this year, filing your tax return early could boost your third stimulus check .

If you have a federal tax refund coming, you could get your money back in as little as three weeks. In the past, the IRS has issued over 90% of refunds in less than 21 days. If you want to speed up the refund process, e-file your 2020 tax return and select the direct deposit payment method. That’s the fastest way. Paper returns and checks slow things down considerable.

Even if you e-file and request direct deposit, it still takes more time for the IRS to process some tax returns. If that happens, your refund could be delayed. Process delays should be expected if your return:

- Includes errors

- Is incomplete

- Is affected by identity theft or fraud

- Includes Form 8379, Injured Spouse Allocation or

- Needs further review in general.

The IRS will contact you by mail if they need more information to process your return.

Also, don’t expect your refund before the first week of March if you claim the earned income tax credit or the additional child tax credit. By law, refunds for returns claiming these credits must be delayed. This applies to the entire refund, not just the portion associated with the credits.

You May Like: How Much Tax For Doordash

How To Check The Status Of A Mailed Paper Return You Already Sent

Hello,

If you are expecting a refund you can check the IRS website Where’s My Refund 4 weeks after mailing your return.

If you are not expecting a refund tracking your return can be a little more complicated. You can use the IRS’s new online transcript request option to tell when your return has been processed. Once the return shows up in the transcript request the IRS has received and processed your return. Before that time it will show that you have not filed for the year. You can also judge by when the IRS processes your payment

Wheres My State Tax Refund Michigan

Checking your refund status is possible through the Michigan Department of Treasury. Just visit the Wheres My Refund? page. Michigan requires you to enter slightly different information than most other states. You will need to enter your SSN, the tax year, your filing status and your adjusted gross income.

Michigan says to allow four weeks after your return is accepted to check for information. This assumes you filed electronically. If you filed a paper return, allow six to eight weeks before checking.

Don’t Miss: Tax Deductible Home Improvements

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

If You’re Waiting For Your Tax Refund The Irs Has An Online Tool That Lets You Track The Status Of Your Payment

Good for you if you already filed your 2020 tax return. It must feel nice to have that out of the way. But if you’re getting a refund, now you have to wait around for your payment to arrive. If you really need the money, the delay can really be frustrating. Fortunately, the IRS has a tool that can help reduce the anxiety that comes with waiting it’s called the “Where’s My Refund” portal.

The online tool will show the status of your tax refund within 24 hours after the IRS receives your e-filed return or four weeks after a paper return is mailed. In most case, it will tell you that your tax refund has either been:

- Received

- Approved or

- Sent .

In some cases, if the IRS is still reviewing your return, the tool may display instructions or an explanation of what the IRS is doing. Once your refund is processed and approved, the tool will give you an estimated date when you’ll get your payment.

If your refund is being deposited into your bank account, wait at least five days after the IRS sends the payment before contacting your bank to check on it. Some banks will credit funds more quickly than others. If you’re getting a paper check, it could take a few weeks before you receive it in the mail.

- Head of Household and

- Qualifying Widow.

Read Also: Does Door Dash Tax

Tax Deductions And Tax Credits Explained

Remember that a tax deduction reduces your taxable income, cutting your tax bill indirectly by reducing the income that’s subject to a marginal tax rate. A tax credit is a dollar-for-dollar discount on your tax bill. So, if you owe $1,000 but qualify for a $500 tax credit, your tax bill goes down to $500.

What if youre eligible for tax credits that are greater than what you owe say, $1,000 in tax credits with a $500 liability? Whether you get that $500 difference refunded to you will depend on whether the tax credits you qualify are refundable or not. Refundable tax credits go into your tax refund if they exceed what you owe. By contrast, some tax credits are nonrefundable, which means they have the power to reduce your tax liability down to zero but cant be refunded to you if they exceed your liability. Our tax return calculator will take all of this into account when figuring out what you can expect at tax time.

How To Verify With The Irs That A Tax Return Was Received

Once youve put in the time and effort required to file your tax return, you want to make sure your work isnt lost in cyberspace or in the mail. If youre due a refund, you want your forms to arrive safely and be processed as quickly as possible. The Internal Revenue Service offers several ways for you to verify that your return has been received and that your IRS refund status is being processed.

Recommended Reading: Protesting Harris County Property Tax