Imposed Sales Tax On Vapor Products

Effective December 1, 2019, a new 20% supplemental sales tax will apply to retail sales of vapor products in New York, which should be collected by a vapor products dealer. Any business that intends to sell vapor products must be registered as a vapor products dealer before making sales of vapor products. The Tax Department is developing an online registration process. In addition, if a taxpayer has debit blocks on their bank account, even if the taxpayer has already authorized sales tax payments to the Tax Department, the taxpayer must communicate with their bank to authorize their vapor products registration payment.

Sales And Other Taxes

The states sales tax has been set at 4% since June 1, 2005, but local municipalities can add up to 8.88%. Food, prescription drugs, and non-prescription drugs are exempt, as are clothing and footwear costing less than $110 per item.

The state imposes a motor fuel tax that includes a:

- Motor fuel excise tax

- Petroleum business tax

- Petroleum testing fee

The state gasoline tax was 32.98 cents a gallon as of February 2021 state and federal taxes together are 51.38 cents per gallon. The cigarette tax is $4.35 per pack of 20.

There are several exemptions available that will allow you to avoid paying state sales tax:

- If the vehicle is a gift from a family member

- If you paid out-of-state sales tax

- If you were not a resident of New York when the vehicle was purchased

- If you are a member of the U.S. Armed Forces and you are not a resident of the state of New York

- If you leased the vehicle

Have You Decided Selling Is Your Best Option

Now that you know about the taxes involved when trying to sell your house in New York, its a lot of information and a lot to take in. But if you have decided to sell, you can sell your house as-is directly to a cash buyer like Leave the Key Homebuyers.

Theyll buy your house in any condition or situation. Theyll review the details of your house and find time to meet you at the property quickly. Theyll handle all the repairs so you dont even need to worry about it. Then, theyll make you a fair cash offer based on the value of the house. If you accept, you set the closing date. Then, all you need to do is sign the contract and get your cash.

Just fill in this simple form and we will be in touch.Or give us a call at

Also Check: Does Doordash Pay Taxes

New York Provides Updates For Housing Development Fund Projects Covid

Effective April 16, 2021, New York exempts certain housing development fund projects from sales and use tax, and provides for a COVID-19 debt relief credit against corporate income tax. For specific details, please see L. 2021, A3006 . Further, New York has extended certain Brownfield credit periods for two years for specified taxpayers that failed to meet credit requirements due to COVID-19 pandemic restrictions. For information pertaining to the Brownfield credit extension, please see L. 2021, S2508 .

What Is Property Tax In New York

Property tax is a levy on real property imposed by state and local governments. Its typically calculated as a percentage of the assessed value of the property. Property taxes are used to provide services such as road maintenance, schools, and libraries. In New York, all municipalities except for New York City charge this type of tax on residential and commercial properties.

Property tax is one of the three major taxes in New York State, and its collected by local governments to help fund schools, libraries, police departments, fire protection, and other municipal services. Property tax rates vary from place to place and depend on many factors such as the assessed value of your property , exemptions you may be eligible for, and how much money your municipality needs.

Don’t Miss: Doordash Mileage Calculator

New York City Property Tax

The New York City Department of Finance values residential and commercial properties. A tentative value value assessment is sent out to property owners on May 1 each year for most communities. A final assessment is then sent out if there aren’t any changes.

New York City assessments are based on percentages of market value, and those percentages can vary based on the type of property. You have a right to appeal if you don’t agree with your assessment.

Property tax rates are set each year by the mayor and by city council, and they can vary depending on the type of property. They’re applied to property values to help determine each homeowner’s annual tax liability. Property taxes are due either in two semi-annual payments for homes with assessed values of more than $250,000, or four quarterly payments for homes with assessed values of $250,000 or less.

New York City offers several exemptions and property tax reductions, including exemptions for senior citizens, veterans, and the disabled. The New York State STAR exemption for owner-occupied housing is also available, as well as property tax abatements or reductions for certain individuals.

The 2021-2022 New York State budget also gives homeowners a break in the form of a tax credit for any portion of real property taxes that exceeds 6% of their qualified adjusted gross incomes if their QAGI is less than $250,000.

What Is The Property Tax Rate In New York State

The property tax rate in New York State is the highest in the country. Its important to know, as a homeowner, what you are paying for and how it impacts your yearly budget.

The average property tax rate in New York State is 1.07% of the assessed value of $1 Million dollars or less. The average home assessment value in New York State is about $200,000 which equals an annual property tax of around 2,500$. The assessed value of a home is determined by the city and town that it sits in. This amount can vary from county to county and municipality to municipality based on how valuable they believe your property is. Every three years, your local government completes an assessment of all properties in its area. The goal of the assessment is to determine what would be required to bring any given property up to code and market value if it were sold as new construction.

Read Also: 1099 For Doordash

What Are New York County Real Estate Taxes Used For

Property taxes have always been local governments near-exclusive area as a funding source. Together with the county, they depend on real estate tax receipts to carry out their public services.

The number and significance of these public services relying upon real estate taxes cant be overestimated. New York relies on real estate tax revenues a lot. Not only for the county and cities, but down to special-purpose districts as well, such as sewage treatment stations and athletic parks, with all reliant on the real property tax.

Typically, local school districts are an important draw on property tax funds. Another big chunk is reserved for city and other governmental employees salaries and benefits. Financing police and fire protection is another material cost driver. Then theres highway construction and many other transportation needs. Another requisite is water and sanitation works, as well as garbage removal. Also there are leisure amenities, like picnic areas, and swimming pools. To sum up, It all adds up!

The Senior Citizen Property Tax Exemption In Ny Explained

The NY senior citizen property tax exemption is essentially a tax reduction. Your homes taxable assessment will get a 50% reduction if your income isnt higher than the set maximum income limit. Certain local governments allow homeowners whose income exceeds the limit to receive the reduction but a much lower percentage.

Also Check: Ein Free Lookup

Property Tax Reductions And Exemptions

Property tax exemptions reduce the assessment of your property’s value, which is what your property tax bill is based on when your local rate is applied to it. New York law permits local governments to allow different exemptions. New York has exemptions for older adults, veterans, and the disabled.

There’s also the STAR exemption for residential property that’s used as the owners primary residence.

Taxes On Selling A House In New York: What Are The Taxes To Sell My Home

When selling a house in New York, a lot of people focus on the sale price and real estate agent commissions. But what they might not be thinking about are the taxes involved in a real estate transaction in New York State. There are a lot of tax implications that you need to be aware of when selling your home and depending on the situation they can have a real impact on your bottom line. Lets take a closer look at the taxes to sell your home and dig deeper into how taxes are involved in selling a house in New York.

You May Like: Reverse Tax Id Lookup

Reality Check: Few Will Really Pay More Than 50%

New Yorks income tax rate for annual earnings above $1 millionwill rise to 9.65%, from its current 8.82%, under the latest deal. It will also create new tax brackets for income above $5 million and $25 million a year, with even higher rates of 10.3% and 10.9%, respectively.

The increases combined with New York Citys own 3.9% tax on personal income, as well as federal income tax rates that range from 10% to 37%, will raise the top marginal personal tax rate for city residents to nearly 52%. That would push New York past California, which currently has the highest marginal personal tax rate of just over 50% on income over $1 million.

Few of Gothams wealthiest, however, will end up paying rates that high. Nearly 3 million New York City residents file taxes, according to state data from 2018, but just 30,000 reported making more than $1 million a year. And only about 4,000 of those people made more than $5 million. Thats about the population of Armonk, the wealthy New York City suburb that is home to IBM headquarters.

And remember: That 52% surcharge is a marginal rate paid on the income above $25 million. High-wage earners will still pay a lesser, combined all-in rate of 44% on income below $1 million.

New York City Income Tax

New York City has a separate city income tax that residents must pay in addition to the state income tax. The city income tax rates vary from year to year. The tax rate you’ll pay depends on your income level and filing status, and it’s based on your New York State taxable income. There are no city-specific deductions, but some tax credits specifically offset the New York City income tax.

If you work for the city but don’t live there, you must still pay an amount equal to the tax you would have owed if you had lived there. This rule applies to anyone who began employment after Jan. 4, 1973.

Read Also: Efstatus Taxact Com 2016

Are New York Property Taxes Paid In Advance

Property Taxpaypaymentpayproperty taxestaxadvance

. Similarly, you may ask, what month are property taxes due in NY?

Due Dates. NYC’s Property Tax Year is July 1 to June 30. Finance mails property tax bills four times a year. You either pay your property taxes two or four times a year, depending on the property’s assessed value.

Also Know, can I see my property tax bill online? To use the Real Property Tax eCheck online payment system: Search the Real Property Assessment Database and enter your square and lot or your address. Click on your property to retrieve your account information. Click on View Tax Information at the bottom of the page.

Hereof, when should I receive my property tax bill?

In most counties, property taxes are paid in two installments, usually June 1 and September 1. If the tax bills are mailed late , the first installment is due 30 days after the date on your tax bill.

Are property taxes for the previous year?

Common sense tells us that the seller should pay the taxes from the beginning of the real estate tax year until the date of closing. The buyer should pay the real estate taxes due after closing. This way, the buyer and seller only pay the real estate taxes that accrued during the time they actually owned the property.

New York Property Tax Rates

Tax rates in New York State are applied to the assessed value of your home. A number of different rates appear on your real estate tax bill, including a rate for your county, your city and your school district. In some areas, there may be additional special rates for tax districts to fund services or projects like libraries and parks.

Rates are recalculated each year based on the total value of real estate in a tax district and the amount of revenue the tax authority needs. Increases in property taxes are limited in most districts to the lower of 2% or the rate of inflation, so rates dont change much year-to-year. However, that cap can be overridden by a 60% vote of a local government board or the voters in a district.

Real estate tax rates in New York are given in mills, or millage rates. A mill is equal to $1 of tax for every $1,000 in property value. Since these can be a little confusing, it is also useful to look at effective tax rates. These are actual tax amounts paid as a percentage of home value. The table below shows the average effective tax rates for every county in New York State.

| County |

|---|

Looking to calculate your potential monthly mortgage payment? Check out our mortgage payment calculator.

Recommended Reading: How Do I Get My Pin For My Taxes

Nyc Mci And Green Roof Tax Break

You can also get a one-time tax break for a green roof or growing plants on the roof that will absorb rainwater and help reduce cooling costs.

The benefit is capped at whatever is less: $100,000 or the amount of property taxes due for the building last year.

The same goes for Major Capital Improvements approved by the city.

Check out nyc.govs section on property taxes for more info on green roof and MCI exemptions.

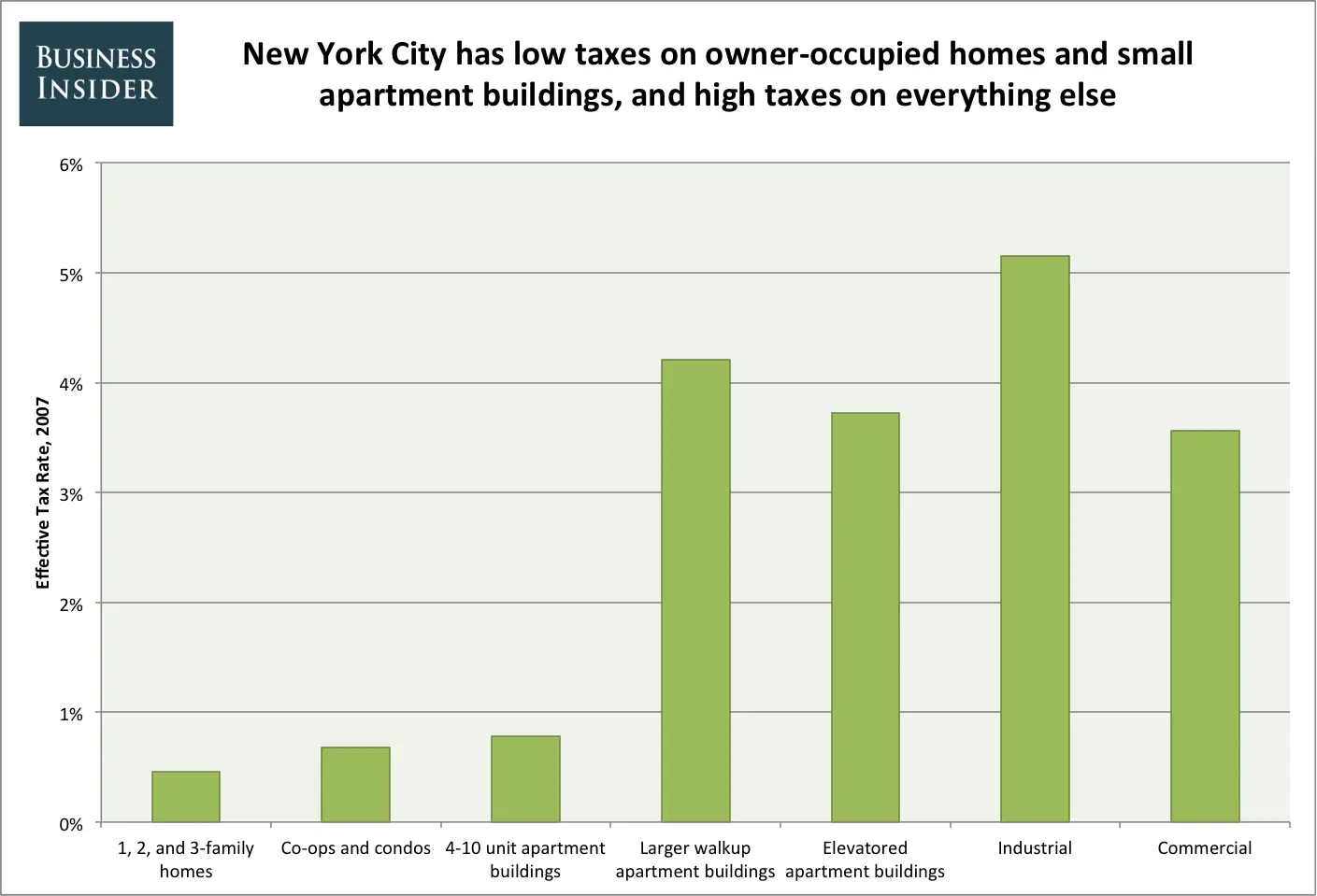

The Tax Rate Paid By Owners Varies Widely Within Each Of The Major Property Types

Perhaps more concerning to taxpayers than discrepancies in rates between different property types is the wide disparities in ETRs among similar properties. Properties of the same type and valued at the same amount often pay very different tax bills. These disparities exist among all property types.

Among small homes the median ETR is 0.87 percent and ranges from a low of almost zero to a maximum of 1.2 percent, with about 5 percent of homes at the maximum rate. A single-family home worth $500,000, for example, could see a tax bill anywhere from less than $100 to $6,000.

For condos and coops, the median ETR is 1.02 percent, which would mean a tax bill of $9,180 for a $900,000 unit.9 At the higher end of the distribution 5 percent of all units pay ETRs above 1.21 percent or $10,890 in taxes for a $900,000 apartment. As with small homes, some coops and condos have an ETR close to 0 percent that leads to a very low tax bill.

These disparities generally have two causes: tax law provisions intended to limit annual growth in tax bills and exemption programs that reduce tax bills for eligible properties.

To see how wide the disparity is in effective tax rates by type of property, click here.

Tax Law

The city estimates the market value of each property and calculates tax liabilities based on an assessed value that is a fraction of the market value. There are different assessment rules for each type of property. The growth in assessed value is constrained through caps or phase-ins.

You May Like: Pastyeartax

Definition Of Qualified New York Manufacturer Changes

For tax years beginning on or after January 1, 2018, the definition of a qualified New York manufacturer has been changed to use the New York State adjusted basis rather than the federal adjusted basis when determining whether a manufacturer meets the $1 million or $100 million property thresholds for determining eligibility for the manufacturers tax rate reductions and the real property tax credit. A qualified New York manufacturer is a manufacturer that is principally engaged in the production of goods by manufacturing, processing, assembling, refining, mining, extracting, farming, agriculture, horticulture, floriculture, viticulture, or commercial fishing during the tax year that either has property in New York State of the type described for the investment tax credit that has an adjusted basis for New York State tax purposes of at least $1 million at the end of the tax year, or has all of its real and personal property in New York State. C, I, 10/18/2019.)

Who Owes Nys Property Taxes

If you own property in New York, you will be required to pay taxes on it. So, if you own any property as an individual, business, you pay property tax on it. Even if the property was gifted to you through an estate or you own a rental property, you are still required to pay it.

There is no minimum or maximum amount to pay on your property in New York to pay property taxes. Whether you have a $50,000 or $5,000,000 house, you will owe property taxes in New York.

If your property was purchased mid-year, there is a chance your realtor will work it out that you and the seller split the cost of property taxes within the calendar year. Your mortgage interest statement provides documentation if this is the case or not.

Don’t Miss: Michigan Gov Collectionseservice