Need Help Avoiding Monthly Alimony Payments Talk To An Attorney

Alimony payments, whether you want a monthly payment or a lump sum, come with benefits and drawbacks. You should know the consequences of your choices to make the right decision. If you would like to know more about your options for paying or receiving alimony, consider consulting with a qualified divorce attorney in your area.

Thank you for subscribing!

Income Tax Savings And Severance

There are several ways to minimize paying tax on severance.

01. The most popular way to minimize tax on severance is to direct all or a portion of a lump-sum severance into an RRSP account. The lump-sum payment is then not subject to any tax withholdings, and RRSP contributions are deductible from income, allowing individuals to minimize taxes at the end of the year. Note: this method not possible with a salary continuance.

02. The second way to minimize taxes on a severance package is to deduct legal fees incurred in securing the severance package on the tax return. This is a deduction that makes income in the tax year lesser, meaning individuals who take advantage of this will have a lower tax bill.

03. The third way to minimize taxes on a severance package is to structure some of the settlement as general damages which are not income and therefore not taxable.

With regard to the third way to structure a settlement package for tax purposes, if an individual settles their severance package for $100,000, they can call some of that, for example, $35,000 as general damages . This would mean the employee only owes income tax on the $65,000.

General damages include various legal remedies like human rights damages and tort damages like intentional infliction of emotional distress.

Just because the general damages are not proven in court does not mean someone is not allowed to claim them to minimize taxes if there is a settlement before trial.

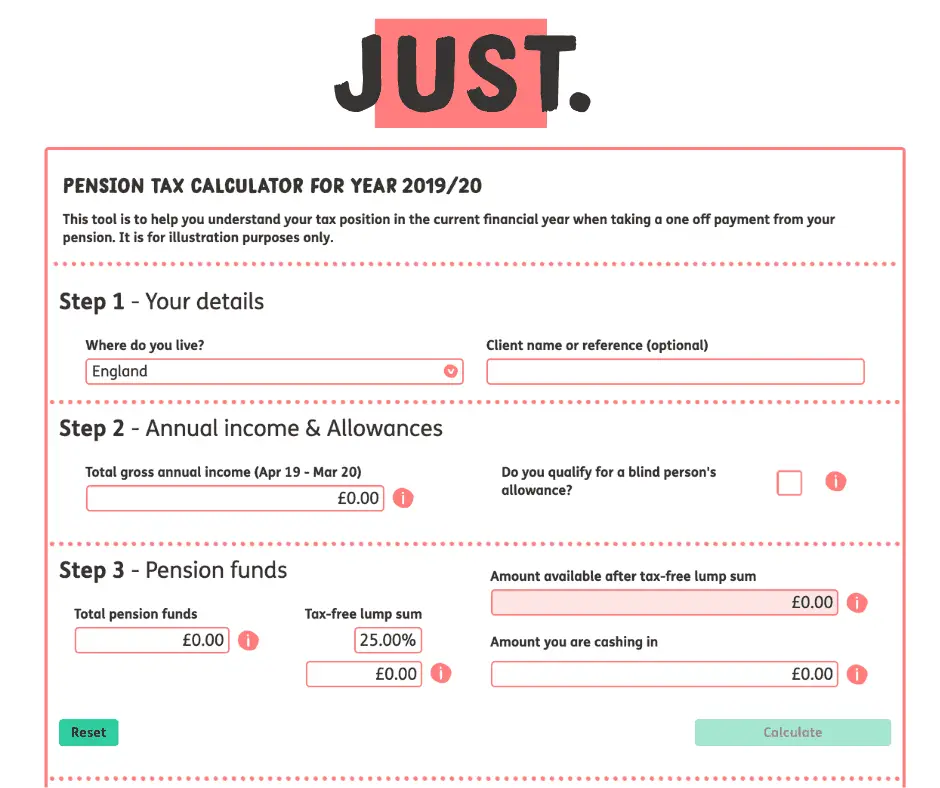

Income From More Than One Source

In later life, its common to have income from different sources. For example, you might still work part-time and have an income from one or more pensions, as well as perhaps from some savings.

If you have income from more than one source, make sure HMRC know this so you pay the right amount of tax against each income.

Your Personal Allowance will normally be allocated against your main job or pension usually the income thats more than the Personal Allowance.

If this is the case, any other income you get will all be taxed according to which tax band the other income falls into.

Details of the current tax bands for the UK are on the GOV.UK website

Your PAYE tax code will have letters against it, which tells you how much tax will be deducted from each income source.

Do you have income from different sources below the Personal Allowance ? Then ask HMRC to spread your Personal Allowance between the different sources of income to make sure you dont pay too much tax.

If you do overpay tax, you can claim this back at the end of the tax year.

Make sure you check the tax code so you know that the right amount of tax is deducted.

Not sure whether your tax code is correct? The charity the Low Incomes Tax Reform Group have more information on their website

If you continue to work and are self-employed or your total income is £100,000 or more for the tax year, youll have to fill in a Self Assessment tax return.

Also Check: Do You Have To Pay Tax On Doordash

Taxes On Pension Income

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs, 401s, 403s and similar retirement plans, and tax-deferred annuitiesin the year you take the money. The taxes that are due reduce the amount you have left to spend.

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money. In either case, your employer will withhold taxes as the payments are made, so at least some of what’s due will have been prepaid. If you transfer a lump sum directly to an IRA, taxes will be deferred until you start withdrawing funds.

Smart Tip: Taxes on Pension Income Vary by StateIts a good idea to check the different state tax rules on pension income. Some states do not tax pension payments while others doand that can influence people to consider moving when they retire. States cant tax pension money you earned within their borders if youve moved your legal residence to another state. For instance, if you worked in Minnesota, but now live in Florida, which has no state income tax, you dont owe any Minnesota income tax on the pension you receive from your former employer.

Tax Rate On Vacation Payout

The federal supplemental flat tax rate is 22% for federal income tax only. But, there are different methods to withhold income taxes for the supplemental payment of a lump-sum vacation payout.

The IRS says that the way you withhold depends on two factors:

Here are the ways to withhold FIT on vacation payouts, according to Publication 15:

Is the vacation payout tax rate in addition to standard federal income tax withholding?

You May Like: Can Home Improvement Be Tax Deductible

How Severance Is Paid In Canada

Whenever an employee settles a severance package with their employer, there are three lawful ways an employer can pay the severance:

Generally, it is up to the employer to determine how severance is paid. However, an employer cannot choose to pay deferred severance payments without the employees permission.

Why Should You Avoid A Lump Sum Payout

- Lump sum payouts are usually slapped with hefty taxes, so expect your prize to be smaller than what was advertised. For example, if you won the $1.5 billion Powerball jackpot last year and chose the lump sum payout, that would have been a one-time payment of $930 million. By the way, thats a pre-tax figure. If you live in the United States, you would have paid a whopping $368 million in federal income taxwhich leaves you a little over half a billion dollars.

- Its easier to succumb to nasty spending habits when you have immediate access to all your winnings. Im not saying it will happen, but so many lottery winners have proven that it doesnt take much to go from riches to rags.

Don’t Miss: Do I Have To Report Plasma Donations On Taxes

Talk To A Disability Lawyer

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Contribute To A Retirement Account

One easy way to pay fewer taxes on severance pay is to contribute to a tax-deferred account like an individual retirement account . The contribution limit is $6,000 for the 2021 tax year. You can put in an additional $1,000 if you’re over 50, which counts as a catch-up contribution.

Financial experts say you should try to sock away as much as you can. According to Brunch and Budget’s Pamela Capalad, a certified financial planner , you should try to contribute the maximum amount if you can take advantage of that opportunity.

Some employers may even allow you to put your severance pay into your 401. The 2021 limit is $19,500. You can save an additional $6,500 if you’re over 50.

Recommended Reading: Www.michigan.gov/collectionseservice

Spreading Out Social Security Backpay To Lower Your Taxes

One bright spot is that the IRS allows disability recipients to apportion disability backpay to previous years’ tax returns, which often lowers or eliminates the taxable portion of the lump sum. Moreover, disability recipients need not file amended returns for previous years the situation can be addressed on one’s current tax return. For more on this method, consult IRS Publication 915: Social Security and Equivalent Railroad Retirement Benefits. In practice, most individuals and couples whose only income comes from disability benefits will face little to no taxes if their lump sum is apportioned to previous years.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: 1040paytax Irs

Final Thoughts On Lump Sum Payouts

If you prefer taking home all your winnings and dont like waiting for two or three decades to get everything, choosing the lump sum option on your lottery win is a good idea. Sure, because of hefty taxes, youre more likely going to get a fairly small sum compared to the entirety of what youd get if you chose the annuity option. But then again, you could invest that lump sum and easily make it grow.

On the other hand, getting all your winnings as a lump sum might not be advisable if youre the type who has a hard time controlling your urge to go on a lavish shopping spree. Having the entirety of your prize readily available is a huge temptationone that could drive you to bankruptcy in no time. As always, it is better if you get help from a financial adviser after winning and plan out your finances.

Have Investment Income We Have You Covered

With TurboTax Live Premier, talk online to real experts on demand for tax advice on everything from stocks, cryptocurrency to rental income.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: Do Tax Preparers Have To Be Licensed

Planning For Gifts And Bequests

As you look ahead, you may be thinking about giving some of your assets to family members or friends, which is often beneficial to both you and them as long as you can afford to live comfortably on your remaining retirement income.

Transferring wealth is often a good way to avoid incurring estate taxesand that’s in turn good because these taxes can take a larger bite of your assets than even the highest income tax rate. In addition, some states impose inheritance taxes at various rates on what your heirs receive from your estate.

But the good news is that prior to your death, you can make gifts to whomever you wishand you can do so up to a certain amount without paying taxes. The IRS ceiling for individuals and married taxpayers changes from time to time.

In addition, you can make larger gifts tax-free to your beneficiaries over the course of your lifetime. You have to follow IRS rules carefully to comply with the lifetime exclusion provisions. For more details, read the instructions for IRS Form 709.

There are pros and cons to making tax-free gifts. On the upside, giving the money away reduces your taxable estatethat is, what will be subject to estate taxes when you diewhile also helping your beneficiaries. But on the downside, once the gift is given, if you need access to that money later in your retirement, it’s gone.

Should You Combine Your Pensions Before Taking It A Bit At A Time

If you want to take your pension pot a bit at a time with The Peoples Pension, you need to have more than £10,000 in your pot to get you started. So if you have less than £10,000 in your pension pot with us at the moment you might be able to take your amount over £10,000 by transferring your other pensions into your pot with us. And that would mean the option of taking your pension pot a bit at a time would become available to you.

Read Also: Www Michigan Gov Collectionseservice

Combined Income And Income Thresholds

If either you or your spouse receives SSDI benefits and have one or more additional sources of income, it’s likely the IRS will tax those benefits. What’s more, if your income is sufficiently high that your disability benefits are taxed, then it’s doubtful that you qualify for SSI benefits, which are paid to low-income applicants. Regardless, the income limits that apply to your SSDI benefits would likewise apply to SSI recipients.

Whether you owe tax on your disability benefits depends, in part, on IRS-defined income thresholds and your “combined income.”

Combined Income 2020: Whether you file an individual tax return or file jointly, your combined income governs the percentage of your Social Security disability benefits that are taxed at the federal level. In either case an individual or a joint return filing combined income is the sum of your adjusted gross income, nontaxable interest and one-half of your SSI or SSDI benefits.

Income Thresholds 2020: If your combined income is greater than $25,000 per year and you file an individual federal tax return, you may be taxed on as much as 50 percent of your Social Security benefits. If your income is $34,000or more, 85 percent of your benefits may be taxed.

In turn, if you and your partner file jointly and your annual income is greater than $32,000, you may be taxed on 50 percent of your Social Security benefits. If your income is $44,000 or more, 85 percent of your benefits may be taxed.

Taxes On A Lump Sum Social Security Disability Payment

Did you just receive a Social Security Disability Insurance award with a lump sum payment? While it is a relief to finally get your benefits, it brings the question of how much tax you might owe on it. This money is not tax-free, but whether you will have to pay tax depends on your income, deductions, and several other factors. The IRS provides a worksheet to determine how much you will owe.

Applying for SSDI benefits and waiting for a judgment can be a long process, sometimes taking months or years. It generally takes 3-5 months. Many people who are awarded SSDI benefits receive a lump-sum payment to cover back pay for the months between their official date of disability onset and when they were finally awarded benefits. Some of that big check, however, may be going back to Uncle Sam as taxes. Income tax is not automatically withheld, so you do not want a nasty surprise a few months down the road.

Also Check: Doordash Pay Calculator

Should I Take A Lump Sum Pension Buyout

Some pensioners may decide taking the lump sum is the better option. That can be a good decision if they have done the math and analyzed their situation. For example, taking a buyout may be a good option for someone who may be in poor health, or may not have a long life expectancy based on his or her family history.