How High Are Sales Taxes In North Carolina

North Carolinas total state and average local sales tax rate is 6.98%. This ranks 26th in the nation, meaning it’s very close to average. In most counties, the total rate is either 6.75% or 7%. The exceptions are Durham County and Orange County, where the rate is 7.50%.

Unlike many states, North Carolina taxes groceries, albeit at a reduced rate. The rate on most food is 2%. Prescription drugs are fully exempt from the sales tax.

How Much Is North Carolina’s Vehicle Property Tax

North Carolina policy states that all vehicles will be taxed at 100 percent of their appraised value. How much this tax will cost you depends on where you live since vehicle property tax rates vary by county. The DMV requires you to pay the property tax rate for where you currently reside. They won’t prorate the amount due to in-state relocation, which means you won’t get a tax break even if you haven’t lived in your current home for the entire year.

After the county determines your car’s value and appropriate tax bracket, they’ll mail you a bill about 60 days before your registration is going to expire. You then pay the property tax within 60 days prior to registration renewal. If necessary, you can apply for a deferment of another 60 days for payment as long as you’ve owned the car for the entire current tax year. If you haven’t owned the car for the whole year, then they’ll adjust your bill so you’ll only pay tax for the time you’ve owned the vehicle.

Current North Carolina Tobacco Excise Tax Rates

The primary excise taxes on tobacco in North Carolina are on cigarettes, though many states also have taxes on other tobacco products like cigars, snuff, or e-cigarettes. The tax on cigarettes is 45 cents per pack of 20 cigarettes, other tobacco products are taxed at 12.8% of the wholesale price and 5 cents per fluid milliliter of vapor products.

North Carolina Cigarette Tax -$0.45 / pack

In North Carolina, cigarettes are subject to a state excise tax of $0.45 per pack of 20.Cigarettes are also subject to North Carolina sales tax of approximately $0.31 per pack, which adds up to a total tax per pack of $0.76.

The average cost of a pack of cigarettes in North Carolina is $4.87, which is the 47th highest in the United States.

North Carolina Other Tobacco Products Tax -12.80% / Wholesale Price

In North Carolina, other tobacco products are subject to a state excise tax of 12.80% / wholesale price as well as federal excise taxes .

North Carolina applies a $0.05/milliliter tax to e-cigarette and vaping liquid.

You May Like: How To Do Taxes For Doordash

How To Collect Sales Tax In North Carolina

Now itâs time to tackle the intricate stuff! Tax rates can vary based on the location of your business and the location of your customer, plus the levels of sales tax that apply in those specific locations.

The state-wide sales tax in North Carolina is 4.75%.

There are additional levels of sales tax at local jurisdictions, too.

North Carolina has a destination-based sales tax system, * so you have to pay attention to the varying tax rates across the state. Charge the tax rate of the buyerâs address, as thatâs the destination of your product or service.

* Important to note for remote sellers: While this is generally true for North Carolina, some state have peculiar rules about tax rates for remote sellers. Contact the stateâs Department of Revenue to be sure.

Federal Tobacco Excise Taxes

The price of all tobacco products sold in North Carolina also includes Federal Tobacco excise taxes, which are collected from the manufacturer by the Tobacco and Tobacco Tax and Trade Bureau and generally passed on to the consumer in the product’s price. Federal excise tax rates on tobacco products are as follows:

Recommended Reading: Www.myillinoistax

General Sales Tax Regulations

NC sales tax should not be charged on sales made to customers who take delivery outside the State of NC.

For online sales, NC sales tax must be collected on sales made to customers who take delivery inside the state of NC.

Sales tax does not need to be charged on purchases made by other state agencies and nonprofit entities that can provide a tax exemption certificate.

Sales tax must always be charged to nonprofits for admission tickets to entertainment events.

Sales tax does not need to be charged on purchases made between departments.

Filing When There Are No Sales

Once you have a North Carolina seller’s permit, youre required to file returns at the completion of each assigned collection period regardless of whether any sales tax was collected. When no sales tax was collected, you must file a “zero return.

Failure to submit a zero return can result in penalties and interest charges.

Also Check: How To Buy Tax Lien Certificates In California

North Carolina Sales Tax Rates By City

The state sales tax rate in North Carolina is 4.750%. With local taxes, the total sales tax rate is between 6.750% and 7.500%.

North Carolina has recent rate changes .

Select the North Carolina city from the list of popular cities below to see its current sales tax rate.

Sales tax data for North Carolina was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Getting Your North Carolina Tax Refund

If your state tax witholdings are greater then the amount of income tax you owe the state of North Carolina, you will receive an income tax refund check from the government to make up the difference.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. E-filing your return and filing early can help ensure your refund check gets sent as quickly as possible.

Once you’ve filed your tax return, all you have to do is wait for your refund to arrive. If you want to check the status of your North Carolina tax refund, you can visit the North Carolina Income Tax Refund page.

You May Like: Protest Property Taxes In Harris County

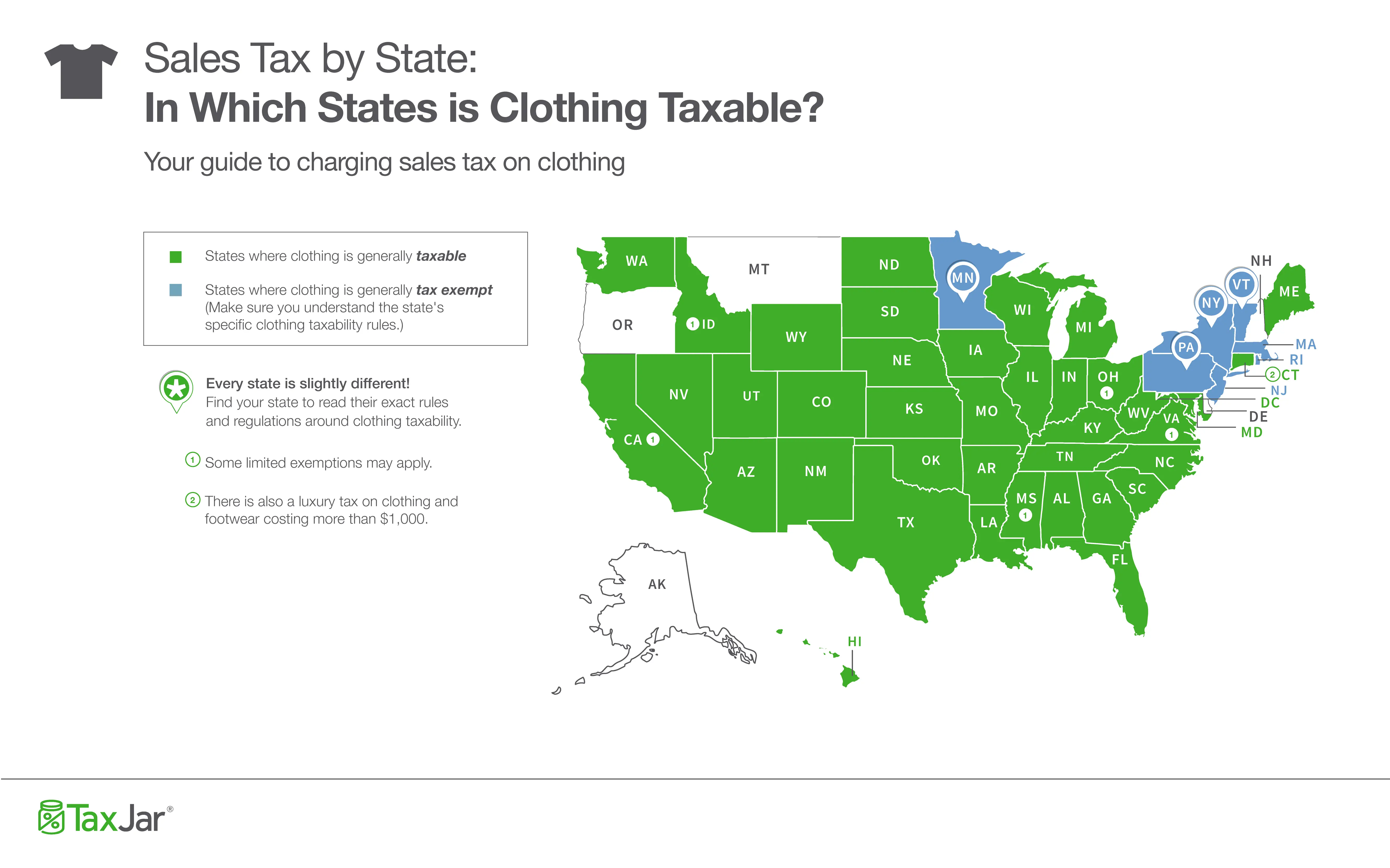

What Is Eligible For Sales Tax In North Carolina

If youve established that you must collect sales tax in North Carolina, the next step is to determine which items or services you sell are taxable in the state. Like many states, the bulk of services in North Carolina are not taxable. Here are some things to keep in mind when determining if you should collect tax:

- Services The majority of services in North Carolina are exempt from sales tax. The exception is if you are producing a good through manufacturing or production services. There are additional exceptions in certain counties. As listed on the Department of Revenue website admission charges to entertainment activities and dry cleaning and laundry services are both taxed in 72 counties in the state. Sales tax also applies to telephone and video programming services like cable TV, digital property downloads and transfers, and service contracts on installations.

- Bringing Items in From Outside the State If you purchase an item from outside the state of of North Carolina and bring it into the state you may be responsible for paying sales tax on that item directly if it was not collected by the merchant.

- Exceptions to Sales Tax in North Carolina There are limited exceptions to sales tax on physical goods in North Carolina including some types of groceries, medical devices and equipment, and certain chemicals and materials that are used in development and research.

Why Some States Have No Sales Tax And Others Have High Sales Tax

If state sales taxes help finance state expenditures, how can some states have no sales tax at all? The answer usually lies in the state income tax rates. Oregon, for example, has no state sales tax but does have high state income taxes, with the highest bracket of 9.9%. Delaware also has high income tax, although its offset by low property taxes, which are based on a tax assessors valuation. Washington, on the other hand, has high sales tax rates, with a combined state and local tax rate of up to 9.9% for individuals who make more than $125,000 and couples who make more than $250,000, but it has no state income tax.

Some states, such as California, bear the burden of high total tax rates, with state and local combined sales tax rates as high as 10.50% and a top income tax bracket of 13.3%.

Also Check: Harris County Property Tax Protest Services

How To Register For Sales Tax In North Carolina

Okay, so you have nexus! Now what?

The next crucial step in complying with North Carolina sales tax is to register for a sales tax permit. Itâs actually illegal to collect tax without a permit. So to get all your ducks in a row, start with tax registration first.

You can find directions about how to register in North Carolina on their Department of Revenue website.

When registering for sales tax, you should have at least the following information at hand:

- Your personal contact info

- Social security number or Employer Identification Number

- Business entity

- Bank account info where youâll deposit the collected sales tax

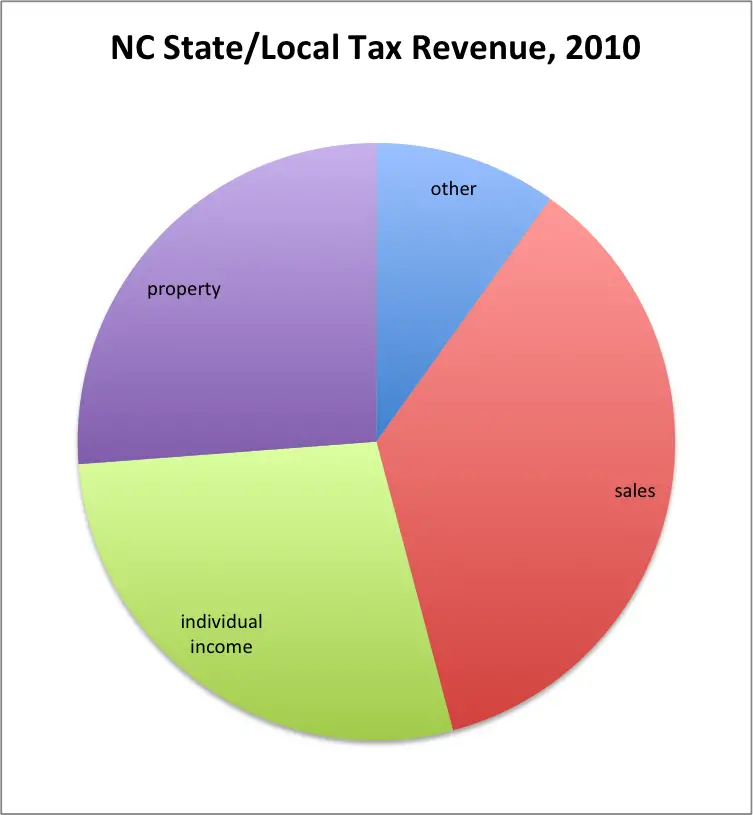

Overview Of North Carolina Taxes

North Carolina now has a flat state income tax rate of 5.25%. The average effective property tax rate for the state is below the national average. There is a statewide sales tax and each county levies an additional tax.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

Recommended Reading: Doordash Mileage Calculator

What Other Fees Are Applied To A Car Purchase

The North Carolina Department of Motor Vehicles collects additional fees from car buyers. Here are the current DMV fees to expect, as reported by Autobytel:

- Certificate of title: $40

- License plates for a passenger vehicle or truck weighing less than 4000 pounds: $28

- Registration for trucks weighing less than 5000 pounds: $43.50

- Registration for trucks weighing 6000 pounds or less: $51.60

- Plate transfers: $15

- Wake, Durham, and Orange County Regional Transportation Authority Registration Tax: $5

Another fee to know about is the documentation fee, also known as a doc fee. Dealerships will charge you this fee when you purchase a vehicle from them to cover the costs of preparing and filing sales documents. State law doesn’t place any limits on these fees, so they vary from place to place. North Carolina car buyers pay an average of $550 in doc fees.

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

You May Like: 1099 Nec Doordash

Is The North Carolina Sales Tax Destination

North Carolina is a destination-based sales tax state, which meansthat sales tax rates are determined by the location of the buyer when the transaction is completed. This means that, for orders placed via the internet/mail by a customer within North Carolina from a North Carolina vendor, the vendor must collect a sales tax rate applicable at the buyer’s address . This can significantly increase the complication of filing your sales tax return, because different sales tax rates must be charged to different buyers based on their location.

North Carolina Vacation Rental Tax Guide

Avalara free tax guides

Airbnb and HomeAway/Vrbo have changed the way vacationers travel. More and more guests are choosing to rent private homes rather than book hotels. With a bounty of popular destinations including the Great Smoky Mountains, Asheville, and the Outer Banks, the Tar Heel State offers prospective short-term rental hosts the opportunity to bring in extra income and meet new people.

But new income opportunities bring new tax implications. Like hotel and B& B stays, short-term rentals in North Carolina are subject to tax. Tax authorities require short-term vacation rental hosts to collect applicable short-term rental taxes from their guests and remit them to the proper authorities.

Failure to comply with state and local tax laws can result in fines and interest penalties. These may not catch up with vacation rental operators in the short term, but the sharing economy is under increased scrutiny so its important to address compliance before tax authorities address it for you.

Avalara MyLodgeTax has put together this guide to help you comply with North Carolina short-term rental tax laws. For more information on the tax rates and jurisdictions that apply to your rentals specific location, use our lodging tax lookup tool.

Recommended Reading: Is Plasma Money Taxable

Failure To Collect North Carolina Sales Tax

If you meet the criteria for collecting sales tax and choose not to, youll be held responsible for the tax due, plus applicable penalties and interest.

Its extremely important to set up tax collection at the point of sale its near impossible to collect sales tax from customers after a transaction is complete.

Penalties And Interest For Late Payments

If payment is remitted late, there is a 10% failure to pay penalty that will be due with the next payment. Interest will be charged as well from the date of the last received payment.

If payment is on time but filing is late, there is a failure to file penalty of 5% per month with a maximum fine of 25% for a single return.

For those with a zero return, filing is still required by the listed due date. There is no penalty for failing to file a zero return, but after 18 months, the permit may be revoked for lack of filing.

Read Also: Pastyeartax Com Reviews

North Carolina Sales Tax Calculator

You can use our North Carolina Sales Tax Calculator to look up sales tax rates in North Carolina by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

| $0.00 |

|---|

North Carolina has a 4.75% statewide sales tax rate,but also has 324 local tax jurisdictions that collect an average local sales tax of 2.188% on top of the state tax. This means that, depending on your location within North Carolina, the total tax you pay can be significantly higher than the 4.75% state sales tax.

For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in North Carolina:

What Is The North Carolina Low

Homeowners who are at least 65 with a household income of no more than $31,500 can claim the North Carolina low-income homestead exclusion. The exclusion is subtracted from taxable value and is equal to either $25,000 or 50% of taxable value, whichever is greater. For eligible seniors, this can mean hundreds in property tax savings every year.

Senior homeowners whose income is no more than $47,250 may also qualify for a property tax deferral via the Circuit Breaker Tax Deferment Program. This does not reduce property taxes, but instead defers payment of taxes owed until a later time, typically when the home is sold.

You May Like: Efstatus Taxact Online

State Sales Tax Rates

State sales tax rates are all over the map. Whereas youll find rates of 7% in Indiana, Mississippi, Rhode Island and Tennessee, California claims top billing with a sales tax percentage of 7.25%. On the other end of the scale, five states Alaska, Delaware, Montana, New Hampshire and Oregon dont have any state sales taxes at all. Heres a look at how sales tax rates vary by state:

| State |

North Carolina Property Tax

Property taxes are assessed at the local level, so youll need to consult local rates to know for sure what youll be paying. But the effective rate statewide comes to 0.855 percent and costs the typical Tarheel a little under $1,500 a year. Below are all the effective tax rates for each county in North Carolina.

North Carolina property tax rates range from a low of 0.42 percent in Watauga County to a high of 1.22 percent in Durham County.

Also Check: How To Get A License To Do Taxes