Oregon To Return $10 Million Of Unclaimed Funds

PORTLAND, Ore. Check your mail! Some Oregonians will be receiving checks ranging from $50 to $10,000 in the coming months, according to the state Treasury.

In a release on Tuesday, Treasurer Tobias Read announced about $10 million in unclaimed funds will be returned by summer 2023. The disbursement of unclaimed funds is part of the Checks Without Claims initiative that aims to connect forgotten funds to the rightful owners.

These unclaimed funds come from a slew of sources, including uncashed checks, forgotten bank accounts and tax refunds.

The disbursement process begins in February, with the Treasury returning unclaimed funds that were reported to the state in 2018. For unclaimed funds reported in 2019, checks will be distributed to verified owners during the month of April. The final disbursement of unclaimed funds, which were reported to the state in 2020, will be made in June.

Individuals determined to be the owners of unclaimed funds will reportedly receive a letter notifying them of the anticipated payment. The Treasury will then mail a check and a confirmation letter to the verified owner.

Individuals can search for unclaimed money on the Treasurys website and file an online claim to recover it. The Unclaimed Property Program, however, asks Oregonians who receive a letter as part of the Checks Without Claims initiative to wait for their check before submitting a claim.

Know How To Check Income Tax Refund Status

Blog»Know How to Check Income Tax Refund Status

The income tax department offers us an online facility for tracking the status of refunds. You can do this by filling in details in the income tax refund form through the Income Tax departments website. also do this on the TIN NSDL website. Your PAN number and assessment year should be accurate to check the status of your IT return. You are eligible for an income tax refund if you pay more than the actual amount of tax liability for the financial year. Income tax refund status can be viewed 10 days after the department sends the refund. Read on for a step-by-step guide that will provide information on how to check income tax refund status

Dont Miss: When Are Tax Returns Due This Year

Mailing My Return What Do I Need To Mail

When you select “File by mail” in TurboTax, all forms required for mailing will print with your Federal and State returns. You will mail Federal returns to the IRS address listed in the instruction printout, and you will mail your State returns to the state address listed in the instructions.

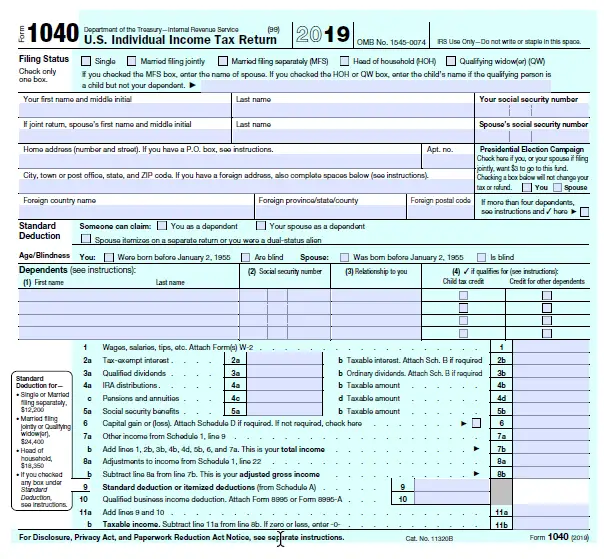

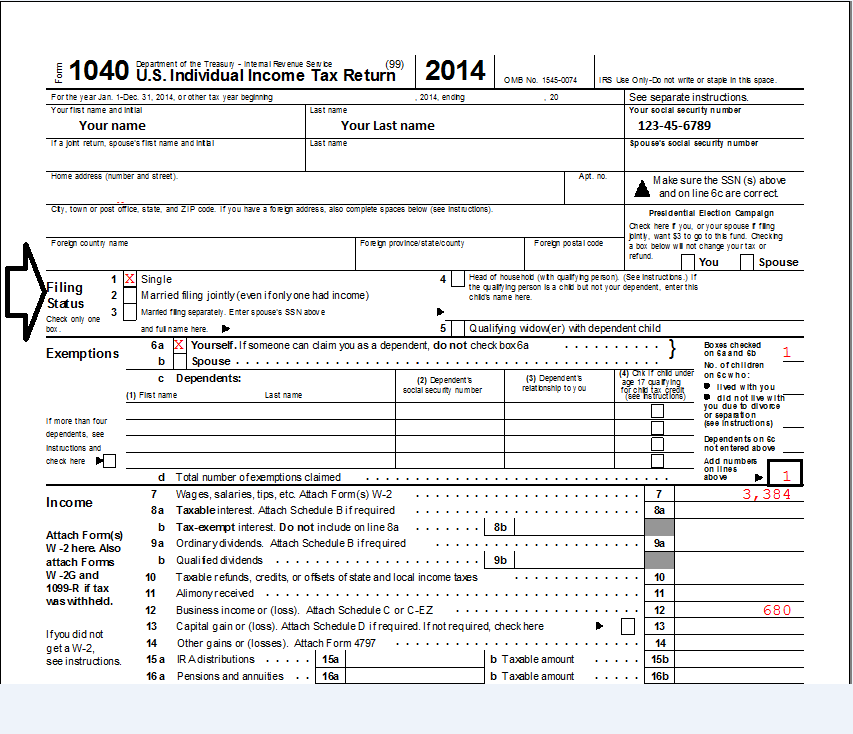

If you are not filing your return electronically, you will print and mail Form 1040/1040A/1040EZ along with any schedules that you have completed for the return . Please note that Form 1040EZ will not have any additional schedules for you to file with this form.

An easy way to tell if the form should/should not be mailed to the IRS is to look at the top of the form and if you see text similar to “Complete and attach to Form 1040A or 1040” then this means you need to mail the form with your tax return.

Most worksheets do not have to be mailed with your return and may say “keep for your records”.

Please also see this link on how to prepare your return for mailing:

From the IRS website, items you should mail with your returns also include:

- Form 1099-R. If you received a Form 1099-R, showing federal income tax withheld, and you file a paper return, attach a copy of that form in the place indicated on the front page of your return.

- Form 1040EZ. There are no additional schedules to file with Form 1040EZ.

Recommended Reading: How Is My Tax Refund Calculated

When To File Your Return

If you file your return on a calendar year basis, the 2020 return is due on or before . A fiscal year return is due on the 15th day of the 4th month following the end of the taxable year. When the due date falls on a Saturday, Sunday, or holiday, the return is due on or before the next business day. A fiscal year return should be filed on a tax form for the year in which the fiscal year begins. For example, a 2020 tax form should be used for a fiscal year beginning in 2020. See Directive TA-16-1, When a North Carolina Tax Return or Other Document is Considered Timely Filed or a Tax is Considered Timely Paid if the Due Date Falls on a Saturday, Sunday, or Legal Holiday.

Out of the Country: If you are out of the country on the original due date of the return, you are granted an automatic four month extension to file your North Carolina individual income tax return if you fill in the Out of Country circle on Page 1 of Form D-400. Out of the Country means you live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or you are in military service outside the United States and Puerto Rico. The time for payment of the tax is also extended however, interest is due on any unpaid tax from the original due date of the return until the tax is paid.

Nonresident Aliens: Nonresident aliens are required to file returns at the same time they are required to file their federal returns.

What If My Refund Was Lost Stolen Or Destroyed

Generally, you can file an online claim for a replacement check if its been more than 28 days from the date we mailed your refund. Wheres My Refund? will give you detailed information about filing a claim if this situation applies to you.

For more information, check our Tax Season Refund Frequently Asked Questions.

Don’t Miss: What Is The Tax Rate In Georgia

How Can I Check My State Refund Status

You can check your refund status by visiting the website for your states department of revenue. Most states have a Wheres My Refund tool similar to the IRS.

If you filed online, it usually takes anywhere from 24 hours to a week for your tax return to show as received.

If you filed by mail, you may not see a refund status for 2-4 weeks or even longer. When you file by mail, your tax return has to go through the postal system first. Then it could spend a few days or weeks in your tax departments mailroom or warehouse before a worker updates it in the system as accepted.

If youre worried about making sure your paper tax return arrived, you may want to use a mailing option with tracking.

Read Also: Can I Pay My Pa State Taxes Online

Closing Of Individual Po Box Addresses Could Affect Your Clients

Effective January 1, 2022, certain Post Office Boxes will be closed in Hartford, CT and San Francisco, CA. If you have pre-printed mailing labels for one of these payment addresses, destroy them now. To avoid delays, use the current address shown below. IRS encourages the use of electronic payment options available on IRS.gov.

You May Like: How Are Brokerage Accounts Taxed

Heco Working With Fbi After Oahu Power Plant Receives Several Letters With Threatening Innuendos

HONOLULU – Officials at Hawaiian Electrics Kahe Power Plant in Leeward Oahu confirm theyre working with the FBI after receiving several letters with threatening innuendos.

The development comes a month after federal authorities posted a terrorism alert bulletin warning of threats to critical infrastructure. Law enforcement sources tell HNN that the letters dont appear to be an isolated incident. The sources say that multiple power plants across the country have received similar messages.

Security at HECO Kahe Power Plant turned over a total of three letters containing the innuendos to the FBI and HPD on Tuesday morning, sources told Hawaii News Now.

The messages arrived via the U.S. Postal Service and are believed to have been sent from Michigan, they said.

A HECO spokesperson confirms the agency is cooperating with law enforcement.

The letters come just weeks after federal authorities posted the terrorism alert bulletin warning. Since mid-November, there have been a series of attacks on power stations in Washington, Oregon and North Carolina.

According to CBS News, several substations were damaged by gunfire leaving tens of thousands of residents without electricity for days. Its unknown if any of those attacks are related to the disturbing letters.

Retired FBI counterterrorism agent Tom Simon said using the mail to send a threat violates federal law.

Meanwhile, HECO officials confirm there were no evacuations or service disruption related to the incident.

Most Read

Filing A Paper Income Tax Return

Before starting your Minnesota return , you must complete federal Form 1040 to determine your federal taxable income.

We use scanning equipment to process paper returns. Follow these instructions to ensure we process your return efficiently and accurately:

- Use your legal name, not a nickname.

- Use whole dollar amounts. Round your amounts to the nearest whole dollar.

- Leave lines blank if they do not apply to you or if the amount is zero.

- Do not write extra numbers, symbols, or notes on your return, such as decimal points or dollar signs. Enclose any explanations on a separate sheet unless you are instructed to write them on your return.

- Place a copy of your federal return and schedules behind your Minnesota forms. Do not include your federal Forms W-2 or 1099.

- Sign and date your return. Your spouse must also sign if you are married and filing a joint return.

- Do not use staples or tape on your return. You may use a paper clip.

Note:

Don’t Miss: When Do You File Taxes 2021

Requesting An Extension Of Time For Filing A Return

Revised Statute 47:103 allows a six-month extension of time to file the individual income tax return to be granted on request. The extension request must be made before the state tax filing due date, which is May 15th for calendar year filers or the 15th day of the fifth month after the close of a fiscal year.

The five options for requesting an extension are as follows:

An extension does not allow an extension of time to pay the tax due. Payments received after the return due date will be charged interest and late payment penalty.

Heres how the Treasury Offset Program works:

Where To File Your Return

Taxpayers using eFile will have their returns processed electronically once they are submitted.

For taxpayers filing using paper forms:

- If you expect a refund, be sure to mail your return to the North Carolina Department of Revenue, PO Box R, Raleigh, NC 27634-0001.

- If you owe taxes, mail your return and payment to the North Carolina Department of Revenue , PO Box 25000, Raleigh, NC 27640-0640. Make your check or money order payable to the NC Department of Revenue. Important: The Department will not accept a check, money order, or cashiers check unless it is drawn on a U.S. bank and the funds are payable in U.S. dollars.

Read Also: Where Do You Mail Federal Tax Returns

Penalty For Failure To Pay Or Underpayment Of Estimated Tax

Revised Statute 47:118authorizes a penalty for failure to pay or underpayment of estimated income tax. The penalty is 12 percent annually of the underpayment amount for the period of the underpayment.

Determination of the Underpayment Amount

Determination of the Underpayment PeriodThe underpayment period is from the date the installment was required to be paid to whichever of the following dates is earlier:

Notification of Underpayment of Estimated Tax Penalty

How To Check Your Refund Status

Use the Wheres My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Also Check: Sales Tax In New York

Also Check: Do I Need To File Federal Taxes

Nonresident Athlete Individual Income Tax

A nonresident individual who is a member of the following associations is considered a professional athlete and is required to electronically file a Louisiana income tax return, IT-540B reporting all income earned from Louisiana sources:

- Professional Golfers Association of America or the PGA Tour, Inc.

- National Football League

- East Coast Hockey League

- Pacific Coast League

Income from Louisiana sources include compensation for the services rendered as a professional athlete and all income from other Louisiana sources, such as endorsements, royalties, and promotional advertising. The calculation of income from compensation is based on a ratio obtained from the number of Louisiana Duty Days over the total number of Duty Days. Duty Days is defined as the number of days that the individual participated as an athlete from the official preseason training through the last game in which the individual competes or is scheduled to compete.

If You Do Not Have A Personal Tax Account

You need a Government Gateway user ID and password to set up a personal tax account. If you do not already have a user ID you can create one when you sign in for the first time.

Youll need your National Insurance number and 2 of the following:

- a valid UK passport

- a UK driving licence issued by the DVLA

- a payslip from the last 3 months or a P60 from your employer for the last tax year

- details of your tax credit claim

- details from your Self Assessment tax return

- information held on your credit record if you have one

Read Also: How Much Does 401k Get Taxed

File And Pay My Return

- As a direct debit with your return when supported by the software or

- Mail form 5122, City Income Tax E-file Payment Voucher with your payment after you e-file your City of Detroit Income Tax Return. Do not use this voucher to make any other payments to the Michigan Department of Treasury.

Note: Do not use the Michigan Individual Income Tax e-Payments service to make a payment for your City of Detroit Income Tax Return.

Make your check payable to the State of Michigan Detroit. Print the tax year, CITY-V and the last four digits of your Social Security number on the check. If paying on behalf of another filer, write the filers name and the last four digits of the filers Social Security number on the check. For accurate processing of your payment, do not combine this payment with any other payments.

Place both items separately in an envelope and mail to:

Michigan Department of Treasury

File and pay a paper return

For a tax due return, make your check payable to the State of Michigan Detroit and print the last four digits of your Social Security number on the check.

Place both items separately in an envelope and mail to:

Michigan Department of Treasury

Recommended Reading: Is Hazard Insurance Tax Deductible

If You Need Help With Your Return

If you are unable to get help filling out your North Carolina return, you can contact a service center for assistance or call toll-free at 1-877-252-3052. Your federal return must be completed before we can assist you in filling out your North Carolina return.

If you are disabled, have a low income, or are a senior citizen, income tax returns can be prepared free of charge through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. For location and dates of assistance call the Internal Revenue Service toll-free at 1-800-829-1040.

You May Like: How To Not Pay Taxes Legally