Filing Requirements For An Llc Partnership

An LLC that is taxed as a partnership is subject to the same federal income tax return filing requirements as any other partnership. The LLC must file an informational partnership tax return on tax form 1065 unless it did not receive any income during the year AND did not have any expenses that it will claim as deductions or credits.

Thus, an LLC with no business activity that is taxed as a partnership is not required to file a partnership tax return unless there are expenses or credits that the LLC wants to claim.

How To Pay Estimated Taxes

An electronic payment is the fastest, easiest and most secure way for individuals to make an estimated tax payment. Taxpayers can securely log into their IRS Online Account or use IRS Direct Pay to submit a payment from their checking or savings account. Taxpayers can also pay using a debit, credit card or digital wallet. Taxpayers should note that the payment processor, not the IRS, charges a fee for debit and credit card payments. Both Direct Pay and the pay by debit, credit card or digital wallet options are available online at IRS.gov/payments and through the IRS2Go app.

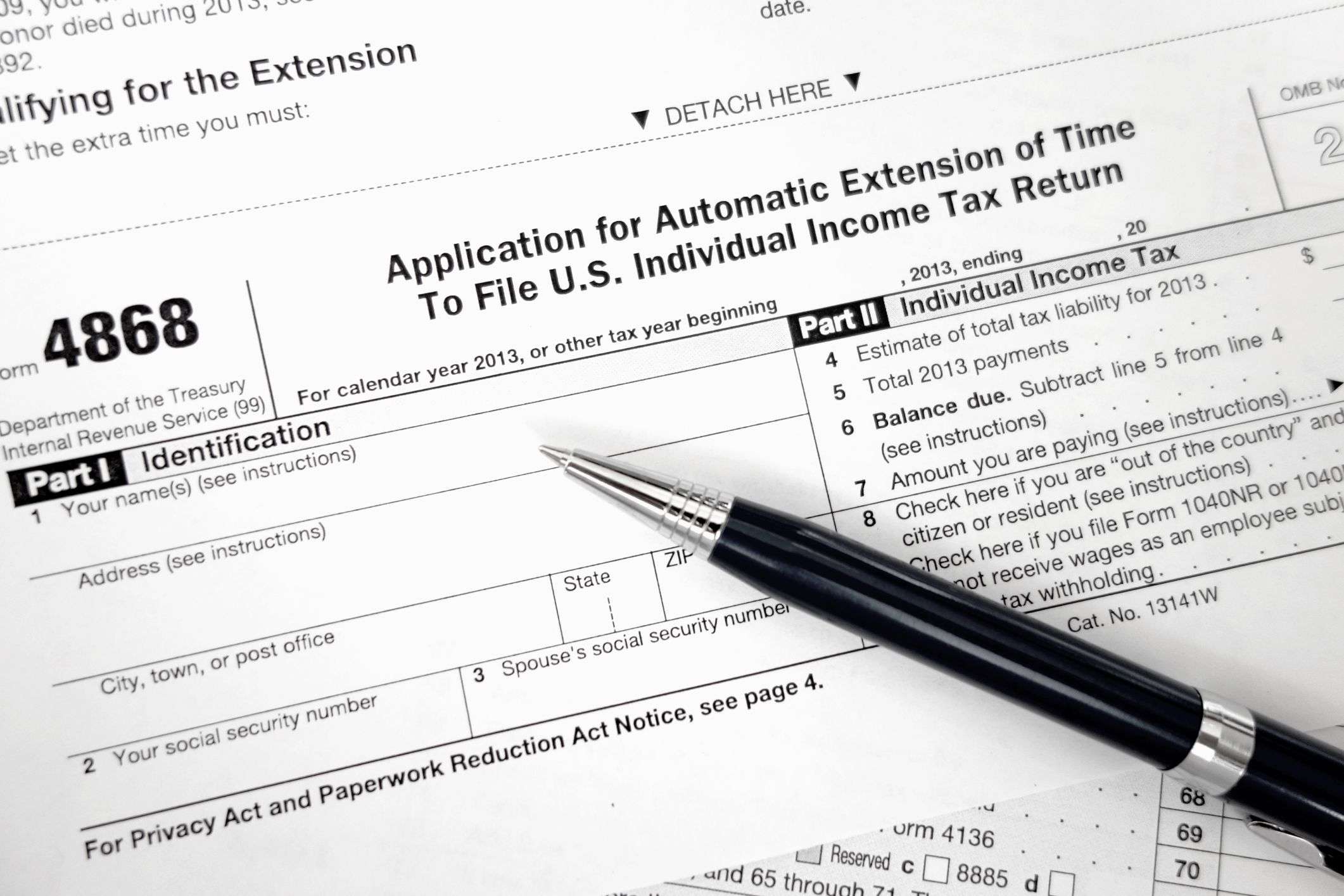

How Do I Know My Tax Extension Request Has Been Approved

If you sent Form 4868 electronically to the IRS, you should receive an email within 24 hours confirming that it has been received. For mail applications, you wont receive an email and will most likely need to call the IRS for confirmation that your request is in the right hands.

Silence is normally a good sign. The IRS won’t contact you following the filing of a tax extension unless there is an issue with it. That doesn’t happen too often, although there are occasions when a tax extension request may be denied.

Recommended Reading: 1099 Form Doordash

Us Income Tax System Basics

- The U.S. tax system is a pay-as-you go system in that there are usually automatic tax withholdings from your paycheck, stipend or financial aid.

- This amount is estimated based on information you provided in your W-4 or other tax documents as well as your tax filing status and possibly your residency .

- This means that your available income may be reduced by tax withholdings. Look carefully at your first Yale paycheck to make sure the amount of taxes withheld is accurate.

- The Internal Revenue Service, usually referred to as the IRS, is the name of the U.S. tax collection agency.

- When you file your annual tax return in April for the preceding year, you will use a tax software to calculate the exact amount of your tax liability for that calendar year based on your total income and other personal circumstances. Your actual tax liability will be compared to the amount that you had paid so far. Some years you may get a tax refund and in others you may owe and need to pay additional taxes.

- In addition to filing a federal return, some students and scholars must also file a CT state return.

Sharing Or Gig Economy

If you earn incomeas a rideshare driver,rental host,or online seller,your business is part of the gig economy.

The gig economy, also called sharing economy,or access economy,is any activity where people earn incomeproviding on-demand work,services, or goods.

Often, it’s through a digital platformlike an app or website.

Visit the irs.govGig Economy Tax Center,where you will find general information abouttax issues that arise in the gig economyand how to file your taxes.

Don’t Miss: How Do You File Taxes For Doordash

Are My Social Security Benefits Taxable

As a very general rule of thumb, if your only income is from Social Security benefits, they wont be taxable, and you dont need to file a return. But if you have income from other sources as well, there may be taxes on the total amount.

If youre married and file a joint return, both spouses must combine their incomes and Social Security benefits when figuring taxable amounts. This applies even if the spouse did not have any benefits.

The IRS offers a worksheet to calculate taxable benefits.

Health Coverage Tax Credit

The health coverage tax credit helps certain displaced workers and pre-retirees pay for health insurance. Specifically, it is available to people eligible for Trade Adjustment Assistance allowances because of a qualifying job loss, and people between 55 and 64 years old whose pension plans were taken over by the Pension Benefit Guaranty Corporation. The credit is worth up to 72.5% of payments for qualified health insurance coverage.

As with the other credits we’ve mentioned, the health coverage credit is refundable. So, if you can claim the credit, you’ll want to file a tax return just to claim the credit, even if you’re not required to file a return. By doing so, you can get a federal income tax refund check sent to you.

As with the premiums tax credit, the health coverage credit can be paid in advance. That also means that your refund will be smaller if the advance credit payments are greater than your actual allowable credit. There’s no suspension of 2020 excess payments of the health coverage credit like there is for the premium tax credit.

Also note that the health coverage credit was set to expire at the end of 2020, but it was extended to December 31, 2021.

9 of 9

Read Also: Does Doordash Send You A 1099

Do I Need To File A Tax Return For An Llc With No Activity

Even if your LLC didnt do any business last year, you may still have to file a federal tax return.

Sometimes a limited liability company has a year with no business activity. For example, a newly formed LLC might not have started doing business yet, or an older LLC might have become inactive without being formally dissolved.

But even though an inactive LLC has no income or expenses for a year, it might still be required to file a federal income tax return.

LLC tax filing requirements depend on the way the LLC is taxed. An LLC may be disregarded as an entity for tax purposes, or it may be taxed as a partnership or a corporation.

Filing Requirements For Disregarded Entities

An LLC that is not considered a separate entity for federal income tax purposes is taxed in the same way as a sole proprietor: the LLCs income and expenses are reported as self-employment income on Schedule C of the members personal tax return. You are required to file Schedule C if your LLCs income exceeded $400 for the year.

If a one-member LLC did not have any business activity and does not have any expenses to deduct, the member does not have to file Schedule C to report the LLCs income. However, the member will still have to file a personal tax return if he or she had other income, and may have to file a Schedule C if there was self-employment income from another business.

Recommended Reading: How Does Doordash Do Taxes

Is There Such A Thing As A Free Tax Extension

Yes, there is. If your adjusted gross income falls below the annual threshold, you can use the IRS Free File program to electronically request an automatic tax-filing extension. Higher earners can use the IRS’ free fillable forms, assuming they are comfortable handling their taxes. If that’s not the case, there are several tax-software companies that offer free filing under certain conditions.

Why You Might Want To File A Tax Return Anyway

You might want to file a return even if you’re not required to do so, if it will result in receiving a tax refundotherwise, you’re just letting the IRS keep that money. This would be the case if, for example, you had any taxes withheld from your income, such as withholding on wages or retirement plan distributions, so you overpaid your taxes because the income falls below these filing thresholdsno tax would be due. You’d be entitled to a refund of the money that was withheld, because you don’t have a tax liability.

Filing could also generate a tax refund if you’re eligible for one or more of the refundable tax credits, such as the Earned Income Credit, the Child Tax Credit, or the American Opportunity Tax Credit. You’d have to file a tax return to calculate and claim these credits and to request a refund from the IRS.

The IRS has certain time limits, called “statutes of limitations,” for issuing tax refunds, conducting audits, and collecting taxes that someone might owe. It generally has three years from the date a tax return is filed to begin an audit, and it has 10 years to collect a tax.

These time limits never begin running if a return isn’t filed, so the IRS would effectively have forever to look into your tax situation. Filing a return starts the clock ticking on these statutes of limitations.

Don’t Miss: What Does It Mean To Grieve Taxes

You Must File An Income Tax Return If:

- You owe tax to the CRA.

- Youve participated in the Home Buyers Plan or Lifelong Learning Plan and have repayments owing.

- You disposed of capital property. If you sold your home, you must file a tax return even if you dont have to pay capital gains tax on the sale .

- You have received a Canada Workers Benefit advance payments in the tax year.

- The CRA has sent you a Request to File.

- If the CRA has sent you a Demand to File, then that means they are serious about your lack of filing and you had better get to it.

Why Might A Tax Extension Request Be Rejected

Nine times out of ten, if you file on time and fill out the form correctly, you should have no issue getting an extension.

In most cases, applications are rejected for minor discrepancies that can easily be rectified. If it comes down to a misspelling or providing information that doesn’t corroborate with IRS records, the tax authority will usually give you a few days to sort out those errors and get the form filed againthis time accurately.

The IRS tends to take less kindly to unrealistic tax liability estimates. If it disagrees with your figures, your application for an extension may be denied and you could even be hit with a penalty.

Also Check: How To Appeal Cook County Property Taxes

When And Where To File

If you are an employee and you receive wages subject to U.S. income tax withholding, or you have an office or place of business in the United States, you must generally file by the 15th day of the 4th month after your tax year ends. For a person filing using a calendar year this is generally April 15.

If you are not an employee or self-employed person who receives wages or non-employee compensation subject to U.S. income tax withholding, or if you do not have an office or place of business in the United States, you must file by the 15th day of the 6th month after your tax year ends. For a person filing using a calendar year this is generally June 15.

File Form 1040-NR at the address shown in the instructions for Form 1040-NR.

When You May Want To Submit A Tax Return To Claim A Tax Refund

With all the above being said, there are years when you might not be required to file a tax return but may want to. If you have federal taxes withheld from your paycheck, the only way you can receive a tax refund when too much was withheld is if you file a tax return.

- For example, if you are a single taxpayer who earns $2,500 during the year, with $300 withheld for federal tax, then you are entitled to a refund for the entire $300 since you earned less than the standard deduction.

- The IRS doesn’t automatically issue refunds without a tax return, so if you want to claim any tax refund due to you, then you should file one.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Recommended Reading: Cook County Appeal Property Tax

Are There Any Reasons To Only File Federal Taxes But Not State Taxes

For the same reasons as above, its usually not a good idea to only file your federal tax returns but not file your state tax returns.

If you need more time to file your state taxes, the best option is usually to:

- Complete your federal tax return but not file it.

- Pay any balance that you owe by the filing deadline.

- Request an extension of time to file for both your federal and state taxes.

- File your federal tax return when youre ready to file your state tax return.

Filing Requirements For Dependents

The IRS has different tax filing requirements for people claimed as dependents on another persons return. For dependents, filing status and age are factors, but so is the type of income received, whether earned or unearned.

- Earned income includes salaries, wages, tips, professional fees, and taxable scholarships and fellowship grants.

- Unearned income includes taxable interest, ordinary dividends, capital gain distributions, unemployment compensation, taxable social security benefits, pensions, annuities, and distributions from a trust.

Here are the minimum income limits from the Draft 2021 Form 1040 Instructions:

| Filing Status | |

|---|---|

|

|

| Gross income of at least $5 and your spouse files a return and itemizes deductions |

Dependent children can avoid filing a tax return if they have only interest and dividend income and a parent elects to report the childs income on their own return. To make this election, you have to meet all of the following requirements:

If you meet all the requirements outlined above, youll report the childs income on Form 8814 and file it with your Form 1040.

Recommended Reading: How To Calculate Doordash Taxes

How Do I Pay Quarterly Taxes

To submit your payment, you have a few options including:

Minimum Income Requirements Based On Age And Status

There is no set minimum income for filing a return. The amount varies according to both filing status andage. The minimum taxable income level for each group is listed in the following chart. If your income fallsbelow what is listed for your age group and marital status, you are not required to file a return.

| Filing Status | |

|---|---|

| 65 or older 65 or older | $24,800 |

| Qualifying Widow with Dependent Children | Under 65 |

| $400 |

Recommended Reading: Doordash Tax 1099

Consider Your Gross Income Thresholds

Most taxpayers are eligible to take the standard deduction. The standard tax deduction amounts that you’re eligible for are primarily determined by your age and filing status. These amounts are set by the government before the tax filing season and generally increase for inflation each year.

The standard deduction, along with other available deductions, reduces your income to determine how much of your income is taxable. As long as you don’t have a type of income that requires you to file a return for other reasons, like self-employment income, generally you don’t need to file a return as long as your income is less than your standard deduction.

For example, in 2021, you don’t need to file a tax return if all of the following are true for you:

- Under age 65

- Don’t have any special circumstances that require you to file

- Earn less than $12,550

Do I Need To File An Income Tax Return Every Year

Contrary to popular belief, some people do not have to file a tax return every year. To put it bluntly, if you don’t owe the Internal Revenue Service and the IRS doesn’t owe you, you might not be required to file. For instance:

- You do not need to file if you are single, under the age of 65, and your gross income was below $12,400 in 2020.

- You don’t need to file if you are married filing jointly, both spouses are under 65, and your joint income was less than $24,800.

- You don’t need to file if you are the head of the household and under age 65, and your gross income was less than $18,650.

It’s important to remember, though, that you may be missing out if you don’t file. If your income is low, you may be eligible for tax credits that you won’t know about unless you file. That means the IRS will pay you.

If you have any doubts about whether you need to file, the Internal Revenue Service supplies a short survey to help you figure it out.

Read Also: Plasma Donation Taxes

Learn Which Credits And Deductions You Can Take

Getting a sense of which can help you pull together the proper documentation. Here are a few to consider:

- Savers credit. If you are not a full-time student and are not being claimed as a dependent, you may be eligible for a tax credit if you contribute to a retirement plan. The amount of the credit depends on your filing status and adjusted gross income. For the 2021 tax year, if your filing status is single, you may be eligible if your adjusted gross income is $33,000 or less. If you are married and are filing jointly, you may be eligible if your adjusted gross income is $66,000 or less. However, these numbers are subject to change in future tax years.

- Student loan interest. You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

- Charitable deductions. Donating to your alma mater or a favorite charity? Generally, you can deduct those donations if you itemize your taxes.

- Freelance expenses. If you are self-employed, you may be able to claim deductions for work-related expenses such as industry subscriptions and office supplies.

If you think you may qualify for additional credits or deductions, check the IRS website.