Whats The Difference Between Property Taxes And Real Estate Taxes

Property taxes and real estate taxes are interchangeable terms. The IRS calls property taxes real estate taxes, but they are the same in all aspects. The money collected helps the government fund services for the community.

Sometimes youll also see a special assessment tax. This occurs when your locality needs to raise money to fund a specific project.

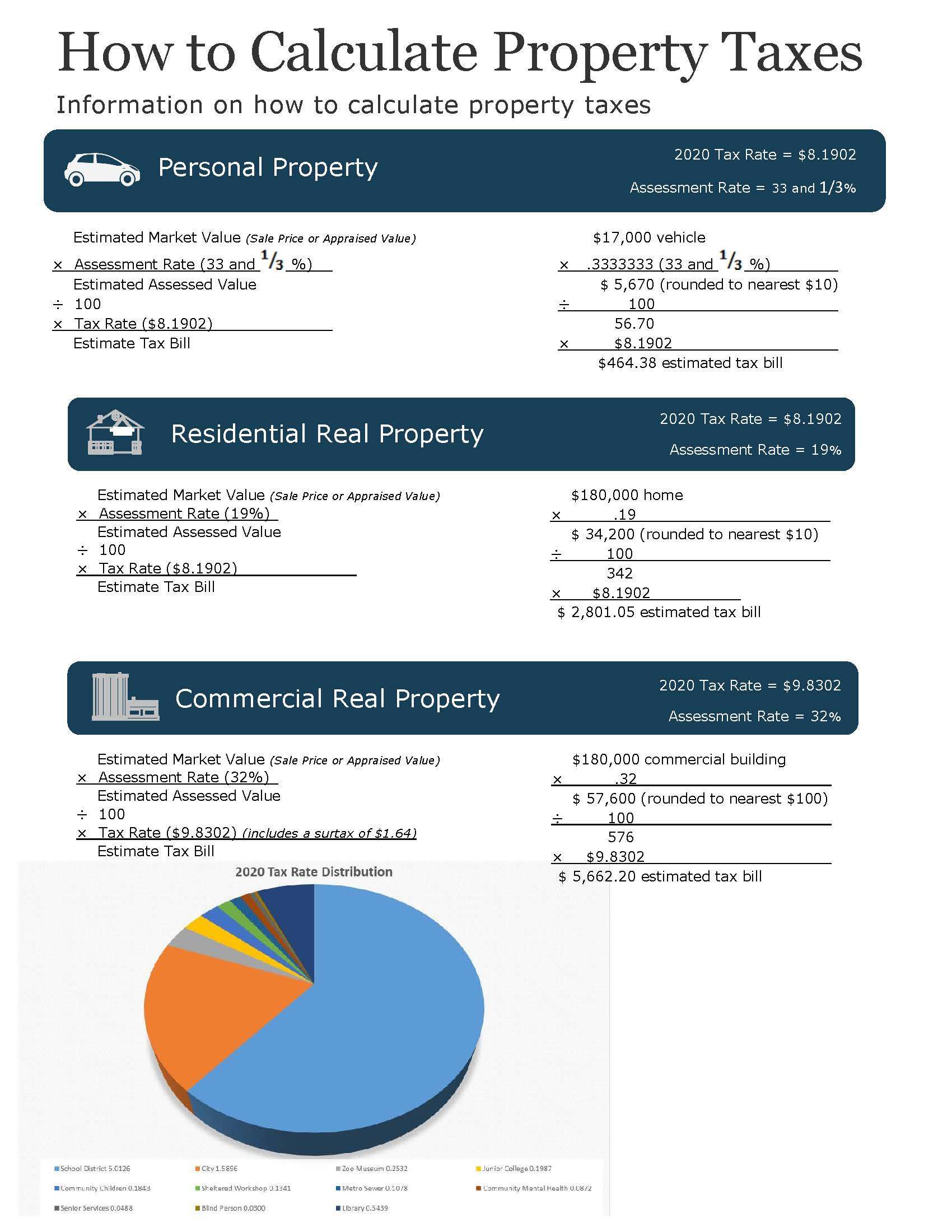

How The Tax Is Calculated

Property tax is calculated based on the:

- general municipal tax rate and any additional municipal tax rates for special services provided by your municipality

- property value

Municipal tax rate

Municipal tax rates are established by your municipality and can vary, depending on the type of property you own.

Each year, municipalities decide how much they want to raise from property taxes to pay for services and determine the tax rate based on that amount.

To learn about the tax rates in your municipality, contact the finance or treasury department of your local municipality. Some municipalities may have a property tax calculator available on their website.

Education tax rate

Education taxes help fund elementary and secondary schools in Ontario. Education tax rates are set by the provincial government.

All residential properties in Ontario are subject to the same education tax rate. The education tax rates can be found in Ontario Regulation 400/98.

Find The Assessed Value Of The Property

To find your propertys assessed value, the local government will order an appraisal on the property. Some areas conduct annual appraisals. Others do them every 3 years or less frequently .

Some localities use the market value and others use the appraised value . Either way, they take a percentage of this value to come up with the assessed value.

The percentage they use is called the assessment ratio or the percentage of the homes value thats taxable. The ratios vary drastically around the country.

For example, if your homes market value is $300,000 and your local government taxes 60% of the value, youd pay taxes on $180,000 rather than $300,000.

You May Like: Is Summer Camp Tax Deductible

How Idaho Property Taxes Compare To Other States

Like most taxes, Idaho’s property taxes are lower than the national average. A recent report from the Idaho State Tax Commission shows that for a typical family of three in Boise earning $75,000 per year, “income taxes were 3% lower than the national average, sales taxes 7% lower, and property taxes 26% lower”.

When you look at property taxes in Idaho versus its neighbors, Idaho mostly comes out on top . And when you consider all of the U.S., Idaho’s per-capita property taxes rank 42nd in the nation.

Property Tax Analysis 2020

The city has partnered with the Idaho Policy Institute to conduct a third-party analysis to better understand the significance of property taxes as a revenue source for the city and address two research questions:

Also Check: When Does Tax Season End

What Is A Homes Fair Market Value

The market value of a home is basically the amount a knowledgeable buyer would pay a knowledgeable seller for a property, assuming an arms-length transaction and no pressure on either party to buy or sell. When a property sells to an unrelated party, the sales price is generally assumed to be the fair value of the property.

Save Money By Paying Early

Property tax is payable November 1 to March 31. Save money by taking advantage of early payment discounts.

Discounts for early payment are:

- 4% in November if paid/post marked by November 30

- 3% in December if paid/post marked by January 3*

- 2% in January if paid/post marked by January 31

- 1% in February if paid/post marked by February 28

There is no discount for payments made in March.

Recommended Reading: How To File Previous Years Tax Returns

What Is The Education Property Tax Credit Advance How Do I Apply For It

The Education Property Tax Credit is a credit for homeowners and tenants offsetting occupancy costs – property tax for homeowners and 20% of rent for tenants â payable in Manitoba. The Advance is the Education Property Tax Credit applied directly to the municipal property tax statement for homeowners.

The Education Property Tax Credit Advance can only be claimed on a homeownerâs principal residence. The maximum Education Property Tax credit is $700.00. If the EPTCA is not included in you tax bill, you can apply for the credit in the following ways:

- If you notify our office before the printing of the property tax bill for the year, we could directly apply the credit to your tax bill starting in that year.

- If you notify our office after the printing of the property tax bill for the year, you may claim the credit on your personal income tax return for that year and will receive the credit on your property tax bill in subsequent years.

Why Are My Taxes Higher Than My Neighbors

There are many reasons why the taxes on one property may be different than the taxes on another.

Generally your taxes would be higher than your neighbors because your property value is higher than your neighbors . This may be caused by

-

Improvements to the property made in prior years

-

Differences between your property and your neighbors such as square footage, lot size, condition, construction quality, or other differences.

-

Your neighbor may have an exemption on their property

In some cases, properties in close proximity with similar values may be in different Levy Code areas.

For information regarding the taxes for a specific property, please contact our customer service department by live chat, phone 988-3326 or by email at .

Recommended Reading: How To File Taxes Without W2 Or Paystub

What Is My Tax Rate

Tax rates are comprised of individual rates for the different taxing jurisdictions in your Levy Code Area. The Levy Code Area number can be found at the top middle of your tax bill between the legal description and account number.

Once you have located the Levy Code Area number, refer to the Rate Sheet for your tax rate.

Ways To Assess Your Property’s Value

There are three common ways that appraisers determine home values.

- Sales comparison method: This method uses recent sales of comparable properties to determine the value of your home. It works well when there are a lot of homes selling in your area. When the market is stagnant, or your neighbors don’t often sell, it can be difficult to get accurate comps to determine your home’s value.

- Replacement method: Also known as the cost approach to real estate valuation, this method adds the value of the parcel of land to the value of the improvements on it to determine your property’s value.

- Income method: If you own income-generating property, the income method is the proper way to assess its value. This approach combines sales comparisons to determine the rate at which similar properties are appreciating in value with the income the building generates. To calculate valuation, divide the net income by the capitalization rate.

For the most part, however, you don’t have a say in how your property value is assessed for tax purposes. Your home’s assessed value is determined by your local tax assessor. Because tax assessors are responsible for determining the value of hundreds or thousands of properties each year, they aren’t able to do the kind of in-depth analysis that an appraiser will when you sell or refinance.

Recommended Reading: How Much Federal Taxes Deducted From Paycheck

Useful Property Tax Information

Most property tax assessments are done either annually or every five years, depending on the community where the property is located. After the owner has received their assessment with its property valuation, a property tax bill is mailed separately.

The information the assessor has is considered part of the public record. Owners can see how much they must pay by going to the assessors website and entering their address. Sometimes they may be charged a small fee for accessing this material. Another option is to go to the assessors office in the county courthouse. Once you are at the county courthouse, you can look up the information and print out a copy for a nominal fee.

All About Property Taxes

When you purchase a home, you’ll need to factor in property taxes as an ongoing cost. After all, you can rely on receiving a tax bill for as long as you own property. Its an expense that doesnt go away over time and generally increases over the years as your home appreciates in value.

What you pay isnt regulated by the federal government. Instead, its based on state and county tax levies. Therefore, your property tax liability depends on where you live and the value of your property.

In some areas of the country, your annual property tax bill may be less than one months mortgage payment. In other places, it can be as high as three to four times your monthly mortgage costs. With property taxes being so variable and location-dependent, youll want to take them into account when youre deciding on where to live. Many areas with high property taxes have great amenities, such as good schools and public programs, but youll need to have room in your budget for the taxes if you want to live there.

A financial advisor can help you understand how homeownership fits into your overall financial goals. Financial advisors can also help with investing and financial plans, including taxes, retirement, estate planning and more, to make sure you are preparing for the future.

Also Check: How Can I File My 2015 Taxes For Free

Idaho State Tax Commission

VISIT »Property Tax Hub for a complete listing of all property tax pages

Property taxes are used to pay for schools, cities, counties, local law enforcement, fire protection, highways, libraries, and more. The state oversees local property tax procedures to make sure they comply with Idaho laws. Also the Idaho State Tax Commission sets property tax values for operating property, which consists mainly of public utilities and railroads.

Most homes, farms, and businesses are subject to property tax. Taxes are determined according to a property’s current market value minus any exemptions. For example, homeowners of owner-occupied property may qualify for a partial exemption. Also, qualified low income homeowners can receive a property tax reduction.

Forms: Property Account Assessment And Taxes

School Support Declaration – for corporations

Mailing Address and Ownership Changes

Corrections or changes to mailing addresses, owner names and changes of ownership are administered by Alberta Land Titles. The City of Edmonton receives these updates electronically once they have been processed by Alberta Land Titles.

You can request a change of mailing address by submitting a Change of Address form. Changes or corrections to owners name and changes of ownership can be made by submitting the appropriate forms to Alberta Land Titles.

If you receive a “Please wait….” message opening PDF forms1. Right click on the link2. Choose the option to Save or Download the form to a known location on your computer, such as your desktop3. Locate the file on your local computer4. Open the file using Adobe Reader

Read Also: What Is Ca Use Tax

Performing A Sales Evaluation

The assessor values the property using comparable sales in the area. Criteria include location, the state of the property, any improvements, and the overall market conditions. The assessor then makes adjustments in the figures to show specific changes to the property, such as new additions and renovations.

A Right To Know How Your Property Tax Dollars Are Being Spent

The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts. While taxpayers pay their property taxes to the Lake County Treasurer, Lake County government only receives about seven percent of the average tax bill payment. School districts get the biggest portion .

You May Like: Is Us Tax Shield Legit

Why Are Residential Property Taxes More Likely To Increase

While values are generally increasing for all property types, residential is growing more quickly than commercial. As a result, residential property owners are paying a rising share of all property taxes. Thats how a commercial propertys value can increase from one year to the next while its tax bill goes down.

1 Changes in property taxes for Boise properties from 2019 to 2021. We used 2019-2021 to take out the impact of the Governors Public Safety Grant Initiative which gave property taxpayers a one-time property tax reduction in 2020.

2 Changes in property taxes for Boise properties from 2019 to 2021. Typical, in this case, is defined as the property in each type with the median percent growth in taxes.

How Property Taxes Are Calculated

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Every year, millions of homeowners pay property taxes. Rather than just paying the tax bill when it’s due, it’s important to understand the calculations behind how property taxes are assessed by the property appraiser’s office in your community. This way you can make sure you are not being overcharged.

Read Also: How To Include Unemployment On Taxes

How Is My Property Tax Calculated

Property tax is based on the assessed value of your property. Manitoba Municipal Relations, Assessment Services branch assesses each property for both the land and the buildings of that property by comparing lot sizes, location, local improvements, building age, size, condition and the quality of the construction.

Property taxes that are collected are provided to school divisions for school taxes and the northern affairs communities to cover the cost of municipal service provided to property owners.

Important Information For 2022

Due to processing delays at the Province of Alberta Land Titles Office, recent ownership and mailing address changes were not reflected on the property tax bills mailed in late May.

The City of Calgary is not responsible for delays. Non-receipt of your property tax bill does not exempt you from late payment penalties.

The Alberta Government introduced a Property Tax Late Penalty Reimbursement. If you recently purchased property, did not receive a tax notice, and paid a late payment penalty, you may be eligible for reimbursement. You are still responsible for ensuring your outstanding property tax is paid in full. The Government of Alberta will not reimburse additional late penalties incurred for non-payment. Visit www.alberta.ca/property-tax-late-penalty-reimbursement for more information.

Don’t Miss: Is H& r Block Tax Identity Shield Worth It

What Is Lake County Doing To Lower My Bill

Lake County has more than 200 individual entities that levy property taxes, which is why the Lake County Board is pursuing partnerships and looking for consolidation opportunities to reduce this number. Consolidation efforts are centered around partnerships that will enhance efficiency, accountability, and cost savings.

- Learn how the County Board has kept the tax levy flat for Fiscal Years 2020 and 2021.

- Learn more about consolidation efforts and how your property tax dollars are used to help make Lake County a great place to live, work and visit.

How To Pay Your Property Taxes

Save time by paying your property taxes online through your financial institution. Other convenient payment methods include by mail, drop box, through your mortgage company, and credit card. See the “Payment Options” information below for further details. Our customer service team is happy to assist you over the phone at 250.361.0228 or by email at .

You can also pay your property tax in person at City Hall. Wearing a face mask is optional. Located on the ground floor, the Public Service Centre is open Monday to Friday from 8 a.m. 4:30 p.m. excluding statutory holidays.

Recommended Reading: How Much Is The Earned Income Tax Credit

Property Assessments In Manitoba

Properties in Manitoba are assessed every two years by the district assessment office. Most properties are assessed using a market value-based approach. There are three ways to determine a propertys market value:

Residential properties are valued under this approach. This compares the sales of similar properties in the assessment year to determine a valuation for the property. The assessed value may not equal the actual market value or sale value of a property.

Unique and rarely traded properties are valued under this approach. This uses the cost of the property if someone were to rebuild it to determine a valuation for the property minus depreciation due to age or other factors. This includes the price of the land and the price of all improvements on top of it. While this takes into account the market value of the land, it does not consider the market value of the property as a whole.

For properties that are dedicated to generating income like rental properties or offices, an income-based approach is used. This approach uses the income generated by the property as well as the sales price to determine its assessed value.

How To Appeal Your Assessed Property Value

Lets say you disagree with the assessed market value of your property. If this is the case, youre within your rights to appeal it.

On the assessment notice you received in the mail, youll find your appraiser’s contact information and the deadline to appeal. The assessors office encourages you to attempt to settle disputes by calling their office or your appraiser.

If you still arent satisfied, you can appeal by filling out a property assessment appeal form. From there, youll go before the Ada County Board of Equalization, where you have a chance to prove that the assessed value of your property isnt accurate.

A helpful tip from the Ada County Assessor notes, In presenting your appeal, the best evidence is typically sales data from the marketplace, written analysis from a realtor or other professional source.

Its also good to note that residents cant protest values from previous years, so if youre using sales data to support the valuation of your property, it should be taken within the previous year.

Don’t Miss: How Do You Have To Make To File Taxes