What Reforms To The Eitc Have Been Proposed

The EITC is a public policy tool that is generally considered effective. By tying the value of the credit to income through its phase in, the EITC encourages people to remain employed. And gradually phasing out the benefit at higher income levels mitigates the cliff effect, where additional earnings would trigger a loss in benefits that would make remaining in a job less attractive economically.

Generally, reforms to the credit involve addressing the following concerns:

- Equity: The EITC has increased inequity in the tax code between those with and without children. Proposals to address the credits equity issues include increasing the EITC available to those without children.

- Complexity: Proposals that aim to improve the improper payment rate would reduce the complexity of the rules surrounding the credit or increase the enforcement ability of the IRS.

- Benefits: There are a number of proposals to expand the EITC. Many of those proposals include elements such as increasing EITC benefits for childless workers, decreasing the rate at which it phases out, increasing the maximum credit amount, and expanding eligibility for the EITC to younger workers.

Earned Income Credit Calculator

The Earned Income Credit is automatically calculated in IRS form 1040, however, there are some alternatives if youd like to play with the numbers.

As noted before, the EITC is one of the most complicated tax credits in the entire tax code, with a whole host of qualifying criteria. If youd like to use a calculator to determine the amount of credit you might be eligible for, there are a few EITC calculator options:

- IRS EITC assistant: the most comprehensive the EITC goes through all of the qualifying criteria to first determine eligibility .

- Bankrate EITC calculator: gives you a quick and dirty number, not taking into account eligibility.

How Does The Eitc Work

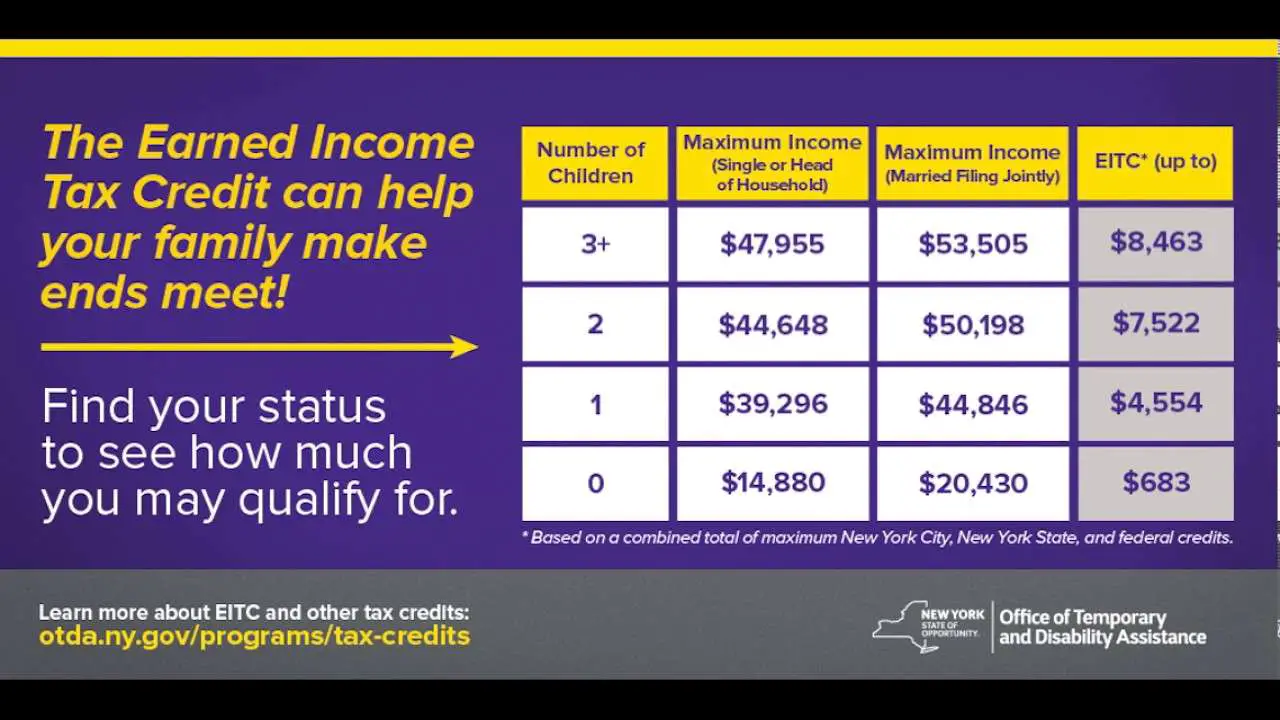

Broadly speaking, a taxpayers income determines their eligibility for the EITC, and benefits for eligible workers vary by family size and marital status. For example, for 2020, the maximum amount a single person with one qualifying child could earn while still being eligible for the EITC was $41,756. For single people with no qualifying children, only those between ages 25 and 64 and making less than $15,820 would be eligible for the EITC.

Workers receive a credit equal to a percentage of their earnings, up to a maximum amount. The credit increases with income up to a certain threshold, stabilizes, and then phases out. For 2020, the maximum EITC for a single person with one child was $3,584 the maximum credit for a childless worker was $538. The maximum EITC and income thresholds are adjusted each year for inflation. A temporary special rule in response to the COVID-19 pandemic allows taxpayers to use their 2019 earned income if it is greater than their 2020 earned income to determine their 2020 EITC.

The American Rescue Plan Act temporarily expands the EITC for childless workers for 2021 only, which will apply when individuals file their tax returns in early 2022. The legislation:

- Increased the rate at which the credit phases in

- Nearly tripled the maximum credit

- Increased the income threshold at which the credit begins to phase out

- Reduced the minimum age of eligibility from 25 to 19 for most workers

Also Check: Www Michigan Gov Collectionseservice

How Does The Earned Income Credit Work

The EIC provides support for low and moderate-income working parents in the form of tax credits. The tax credit is not as beneficial for individuals without children, but not having children does not disqualify you from the credit. Individuals receive a tax credit that can be claimed on Form 1040, which is a percentage of the individuals earnings up to a specific maximum limit.

Who Qualifies For Earned Income Credit

According to the Internal Revenue Service, to claim the EIC or EITC, your earned income and adjusted gross income must not exceed the following for tax year 2019 :

Filing Status: Single, Head of Household or Qualifying Widow

Zero Children $15,570

Filing Status: Married Filing Jointly

Zero Children $21,270

For tax year 2020, your earned income and AGI must not exceed:

Filing Status: Single, Head of Household or Qualifying Widow

Zero Children $15,820

Filing Status: Married Filing Jointly

Zero Children $21,710

In addition to staying below these maximums, additional requirements apply, including:

- Investment income must be less than $3,600 or $3,650

- You must have a minimum of $1 of earned income

- You cannot claim the earned income tax credit if you are married, but filing separately

- You must not file Form 2555, Foreign Earned Income or Form 2555-EZ, Foreign Earned Income Exclusion.

Note that the IRS has also established special rules for members of the clergy or members of the military, and those who receive disability income or care for children with disabilities.

Get Credit In Order

Recommended Reading: Where Is My Federal Tax Refund Ga

Is The Earned Income Credit Refundable Or Non

The earned income credit is a refundable credit. Refundable credits provide the most benefit because if the tax credit is larger than the tax liability on your tax return, it will result in an additional refund of the difference. Non-refundable tax credits can only offset your tax liability to $0, but these credits do not result in a refund of the excess.

Facts About The Earned Income Tax Credit

OVERVIEW

Many qualified taxpayers overlook the Earned Income Tax Credit , potentially missing out on thousands of dollars at tax time. Here are 5 facts every taxpayer should know about the EITC.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

For many Americans, it can be difficult to know which tax credits they qualify for and why. But tax credits are worth having because they provide meaningful savings on a filers overall tax contribution and, in some cases, lead to an increased tax refund.

One of the most beneficial and refundable tax credits for families with low or moderate incomes is the Earned Income Tax Credit .

The Consolidated Appropriations Act was signed into law on December 27, 2020 as a stimulus measure to provide relief to those affected by the pandemic. For tax year 2020, The CAA allows taxpayers to use their 2019 earned income if it was higher than their 2020 earned income in calculating the Additional Child Tax Credit as well as the Earned Income Tax Credit . For 2021, you can use either your 2019 or 2021 income based on whichever one provides the highest credit amount.

Here are five facts about the EITC all taxpayers should know.

Also Check: Have My Taxes Been Accepted

Iv: Fixing The Glaring Gap In The Eitc For Childless Workers

Many childless workers including adults without children as well as non-custodial parents not claiming dependents for purposes of the EITC receive little or nothing from the EITC. Largely as a result, they are the sole group that the federal tax system taxes into poverty. President Obama, House Speaker Paul Ryan, and other members of Congress including Senator Sherrod Brown and Representative Richard Neal have proposed to make the EITC more adequate for this largely left-out group. Making more childless workers eligible for the EITC and boosting the very small credit for childless workers now eligible hold strong promise of increasing employment and reducing poverty.

For more detail, see:

Childless workers are the lone group the federal government taxes into poverty. Federal taxes pushed 7.5 million childless workers below or further belowthe poverty line in 2014, in large part because they receive little if any EITC.

Childless workers receive very small EITCs. The maximum EITC for a childless worker between ages 25 and 64 is just over $500. Most workers receive far less the average credit for eligible workers was $281 in 2013, the latest year for which data are available. This was less than one-tenth the average $3,100 EITC for tax filers with children that year.

| 2,563,000 | 2,761,000 |

For more detail on each group that would benefit, see:

Earned Income Credit Qualifying Children

While it is possible to qualify for the Earned Income Credit without children, the amount of the credit increases with each qualified child. Qualified children must meet each of the eligibility tests:

Relationship Test:

- Your son, daughter, adopted child, stepchild, foster child or a descendant of any of them such as your grandchild

- Brother, sister, half brother, half sister, step brother, step sister or a descendant of any of them such as a niece or nephew

Age Test:

- At the end of the filing year, your child was younger than you and younger than 19

- At the end of the filing year, your child was younger than you younger than 24 and a full-time student

- At the end of the filing year, your child was any age and permanently and totally disabled

Residency Test:

Child must live with you in the United States for more than half of the year

Joint Return:

The child cannot file a joint return for the tax year unless the child and the childs spouse did not have a separate filing requirement and filed the joint return only to claim a refund.

Tiebreaker Rules:

Note that only one person can claim a specific qualified child . There are special tiebreaker rules.

Also Check: Www.1040paytax

Income Limits For The Eitc

There are limits on how much you can earn before you no longer qualify for the EITC. The number of children you are claiming will determine these limits.

For joint filers, the limit ranges from $21,370 to $55,952 .

The credit can provide as much as $6,557 for 2019. If the credit is more than what you owe, it doesnt just bring your tax bill to zero. It means you get the difference as a refund. For example, if according to the standard tax rate your tax due was $550, but your Earned Income Credit was $1,550, you would get a refund of $1000.

If you arent sure if you qualify for EITC, the IRS has a publication to guide you through the process.

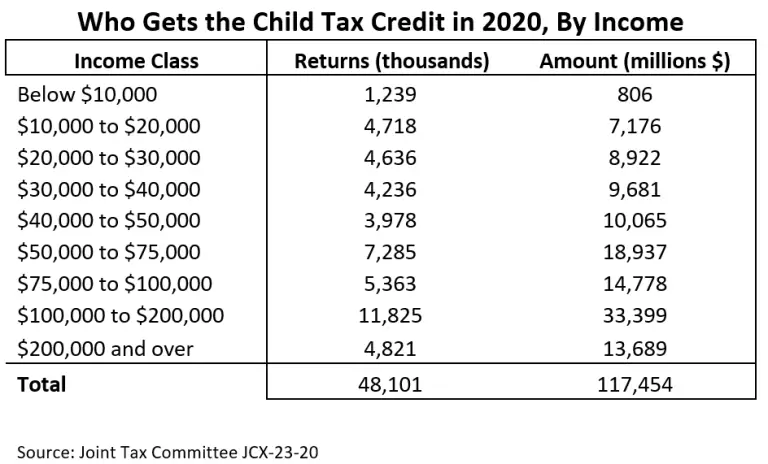

Equity: Impact On Poverty And Income Distribution

The two tax credits are designed to increase the after-tax income of low- and moderate-income individuals and families, especially those with children. Since the credits redistribute income, they can be judged on their effect on poverty, tax progressivity, and after-tax income inequality.

Impact on poverty

These tax credits can be thought of as government transfers, part of which is used to pay income tax liability and the rest available for consumption or saving . Adding the amount of the EITC and CTC to family income reduced the number of people in poverty by almost six million in 2011 . Over half of the individuals moved above the poverty threshold were children.

Poverty rates of taxpayers receiving the EITC or CTC, by tax filing status and number of qualifying children

| Filing status |

|---|

Impact on income distribution

As would be expected given the effect on poverty, the tax benefits of the credits are progressively distributed, as measured by the Suits index. The Suits index is a measure of progressivity that ranges from -1 to +1 . The Suits index is negative if the benefits are predominately received by taxpayers in the upper part of the income distribution. It is positive if the benefits are predominately received by those in the lower part of the distribution. The estimated Suits index for the EITC is 0.87, which is highly progressive . The estimated Suits index for the child tax credit is 0.28less progressive than the EITC, but still progressive .

Recommended Reading: Where Is My State Refund Ga

Claiming Children For The Eitc

If you claim children as part of your EITC, they must pass three tests to be a qualifying child:

Effects Of The Credits

One concern about the EITC is that it has a high error rate the Internal Revenue Service has estimated that between 21 and 26 percent of EITC claims contain errors. As a result of that error rate and the cost of the program, some research questions the effectiveness of the program.

However, other research supports the EITCs success in reducing the poverty rate, including the child poverty rate, which nevertheless remains a stubborn challenge in the United States. A significant amount of research suggests that children who grow up in poverty have worse outcomes than those who do not. After Medicaid, the EITC is the third-largest program that benefits children and is a significant tool for reducing child poverty. When measuring the effects of the credit on children, the EITC is often paired with the Child Tax Credit, a tax credit that helps ease the financial burden of having children. According to research by the Center on Budget and Policy Priorities, the two credits lifted 9.4 million people out of poverty in 2013, including about 5 million children.

Research from Harvard University, Columbia University, and the National Bureau of Economic Research suggests that the EITC may also improve mental health in mothers, promote better health outcomes in children, and have long-term positive effects on childrens educational attainment and potential future earnings.

You May Like: Can You File Missouri State Taxes Online

How To Claim Eitc

To claim it, you must file a tax return, even if you don’t owe any tax or aren’t required to file.

The EITC is then paid out once a year as a lump sum.

In other words, while the credit is for the 2021 tax year, you’ll only get it after you’ve filed your tax return next year.

Meanwhile, the 2020 credits for EITC should be claimed on a 2020 tax return.

The final deadline to file this is on Friday, October 15, but it only applies to those who requested an extension.

Meanwhile, child tax credit payments are set to go out to millions of families this week – we explain how much your family should get.

How Do Earned Income Tax Credits Work

If you qualify for the EITC, you can apply the credit directly toward your tax bill. For example, if you owe the U.S. government $2,300 in taxes for 2020 and you qualify for an EITC of $3,584, the U.S. government owes you $1,284. Because the EITC is a refundable tax credit, you can receive this money as a tax refund.

Income eligibility for the EITC is based on your adjusted gross income and your earned income. Adjusted gross income is all the money you made in a year minus specific deductions and credits. Earned income includes:

- Wages, salaries and tips

- Pay received for gig work or contracting

- Union strike benefits

- Certain disability benefits received before you reach minimum retirement age

- Net earnings from self-employment

Other types of income are not considered earned. These include:

- Interest and dividends

- Pay received for work while in prison

Also Check: Michigan.gov/collectionseservice

What Is A Qualifying Child

For the purposes of the EITC, your “child” does not have to be your biological child. Rather, they must live with you in the U.S. for more than half the year, and have one of the following qualifying relationships with you:

- Son or daughter

- Sibling

- A descendant of any of the above

Your qualifying child must also be younger than you are and under the age of 19 at the end of the tax year24 if they are a full-time student. A child who is permanently and totally disabled can be any age.

What Is Earned Income Tax Credit And How Much Can I Get

- Alice Grahns, Senior Digital Consumer Reporter

- 13:31 ET, Oct 12 2021

LOW-INCOME workers can get a tax break boost this year worth more than $1,500 to help them get by financially.

Known as the earned income tax credit , the maximum credit for workers without children was previously worth $543.

However, it’s been expanded to $1,502 for 2021 only under the American Rescue Plan.

Meanwhile, working families can get even more depending on how many children they have. Below we explain what you need to know.

Read Also: How Much Does H& r Block Charge To Do Taxes

Can I Get These Tax Credits

You should be able to get the Earned Income Tax Credit if you worked full-time or part-time in 2019, you have a Social Security Number and:

- In 2019, you were between the ages of 25 and 64, you did not have any children living with you, and you earned less than $15,570.

- In 2019, you had one child living with you and you earned less than $41,094

- In 2019, you had two children living with you and you earned less than $46,703.

- In 2019, you had three or more children living with you and you earned less than $50,162.

Those are the amounts for single adults. If you are married and filing jointly the amount is higher. See all the numbers on the IRS website.