How Are Dividends Taxed In Canada

There are two types of dividends in Canada: “Eligible Dividends” and “Other Than Eligible Dividends”. Corporations will designate their dividends as either âeligibleâ or âother than eligibleâ for tax purposes.

Dividends are paid out of a corporation’s after-tax profits. This means that tax has already been paid on the dividend amount. However, not all corporations have the same tax rate.

Canadian Controlled Private Corporation are eligible for the small business deduction, which reduces their corporate income tax rate. Dividends paid out by them are “other than eligible”. Since a lower amount of tax has already been paid on them, you will receive a smaller tax credit rate.

Public corporations are not eligible for the small business deduction, and so their dividends are designated as eligible dividends. As a higher tax rate applies to these public corporations, your dividend tax credit amount will be larger.

A dividend gross-up multiples your actual dividend amount by a certain multiplier, which attempts to replicate what the dividend-paying corporation had to earn in order to pay out the dividend after taxes.

Adjusted Cost Base For Real Estate

For real estate properties, the adjusted cost base includes the purchase price of the property, closing costs, and capital expenditures on the property.

Closing costsare the fees that a buyer pays to acquire the real estate property and include one-time fees such as theland transfer taxes, lawyer and legal fees, home inspection fee, and property survey fee. It is important to differentiate between capital expenditures and current expenses on your property.

Current expenses cannot be included in the adjusted cost base while capital expenditures should be included in the ACB, irrespective of when the capital expenditures were made during the entire duration of your ownership of the home.

Some examples of capital additions and improvements to your home include installing a new HVAC system, waterproofing your basement, installing a hot tub, etc. Meanwhile, current expenses are monthly costs incurred by the homeowner or a tenant, such as electricity bills, hydro bills, restorations, and short term repairs such as painting the wall or replacing broken light bulbs.

TheCanada Revenue Agency guidelines on current expenses and capitalexpenses indicate that capital expenditures are improvements that provide a long term benefit, significantly increase the value of the home, and contribute to extending the useful life of your property.

Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employees wages.

Do any of your employees make over $137,700? If so, the rules are a little different. Read more at the IRS website.

You May Like: Do Roth Ira Contributions Need To Be Reported On Taxes

The Tax Calculator Does Not Take Into Account:

- whether you receive a salary, a pension, other income or if you have wealth that is tax liable both in Norway and abroad

- lower tax rate for wealth tax when you’re a resident of Bø in Vesterålen

This calculation is only an estimate.

Here, you can find out what information your employer has sent us.

Se en film om foreløpig skatteberegning. Filmen viser hvorfor du ikke kunne få foreløpig skatteberegning i skattemeldingen din, og hva du kan gjøre for å beregne foreløpig skatt selv.

Noen få leverer fremdeles skattemelding i gammelt format i Altinn.

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Recommended Reading: Have My Taxes Been Accepted

Getting Ahead Of Your Quarterly Tax Deadlines

Quarterly tax deadlines can creep up fast, leaving you feeling unprepared for a large payment to the IRS.

Bench offers a free consultation to learn how to organize your business financials and create a budget for each estimated tax payment. Book a call with our specialists and get prepared for the deadlines now.

Income Statements And Rate Of Taxation

Income statements offer a quick overview of the financial performance of a given company over a specified period of time, usually annually or quarterly. On an income statement, you can view revenues from sales, cost of goods sold , gross margin, operating expenses, operating income, interest and dividend expenses, tax expense, and net income. The income statement is the benchmark financial statement for determining the profitability of a company.

A company does not provide its actual percentage rate of taxation on the income statement. Still, you can figure out the effective tax rate by using the rest of the information on the income statement.

Also Check: Can You File Missouri State Taxes Online

Capital Gains Tax In Canada

You realize a capital gain when you sell a capital asset and the proceeds of disposition exceeds the adjusted cost base. Capital assets subject to this tax, according to the Canada Revenue Agency, include buildings, land, shares, bonds, and trust units.

The proceeds of disposition is what you sold your capital property for, less any outlays and expenses of selling. The adjusted cost base is what you paid to acquire the capital property, including any costs related to purchasing the capital property.

The capital gains inclusion rate is 50% in Canada, which means that you have to include 50% of your capital gains as income on your tax return. WOWA calculates your average capital gains tax rate by dividing your capital gains tax by your total capital gains.

How Much Will I Receive For My October Child Tax Credit Payment

Typically, you can expect to receive up to $300 per child under age of 6 . Your monthly child tax credit payment depends on your income and the ages of your qualifying children.

For example, a mother with a 4-year-old, who files as head of household and earns $80,000, may qualify for a monthly child tax credit payment of $279. To estimate how much you may be eligible for, check out the Forbes Advisor Child Tax Calculator.

If you didnt get a July, August or September payment but youre getting your first payment this month, you still qualify for the full advance payment for 2021 . The full amount will be spread over three months, rather than six, so your monthly payment will be up to $600 per qualifying child until the end of the year.

Don’t Miss: Do You Report Roth Ira Contributions Your Tax Return

How Does The Cpp Work

You will contribute towards the CPP from your employment earnings from age 18 to 70. The CPP Investment Board then invests CPP funds. Once you retire, you will then receive a monthly retirement pension that is equal to a certain percentage of your lifetime average earnings.

The base CPP benefit provides a monthly pension of up to 25% of your contributory earnings for the best 40 years of earnings. With changes enhancing CPP contributions, the monthly pension amount can rise to up to 33.33% of your contributory earnings. This pension amount counts as income, and so you must pay income tax on your CPP benefit.

The earliest that you can receive your retirement pension is when you turn 60 years of age. If you have a disability, you may receive the CPP disability benefit if you are under the age of 65, or the CPP post-retirement disability benefit if you have already started to receive your CPP retirement pension.

If you start receiving your pension between 60 and before you turn 65, your pension amount will be permanently reduced at a rate of 0.6% for every month before age 65, for a maximum reduction of 36%.

Every month after age 65 permanently increases your pension amount by 0.7%, up to a maximum of 42% when you turn 70.

How To Arrive At Your Tax Due

After you’ve figured out your taxable income, there are a few more steps to arriving at your actual tax due.

- Subtract any payments and/or credits from your taxes owed.

- On lines 75 and 76, you will determine whether you owe taxes or will receive a refund.

If you’re getting a big refund, you’re probably having too much withheld from your paycheck. In effect, this means you’re giving the government an interest-free loan. On the other hand, if you have too little withheld, you may be charged an underpayment penalty.

Also Check: Do You Have To Report Your Roth Ira On Your Taxes

How To Calculate Fica Payroll Tax

Social Security withholding

To calculate Social Security withholding, multiply your employeeâs gross pay for the current pay period by the current Social Security tax rate .

This is the amount you will deduct from your employeeâs paycheck and remit along with your payroll taxes.

Example Social Security withholding calculation:

$5,000 x .062 = $310

Medicare withholding

To calculate Medicare withholding, multiply your employeeâs gross pay by the current Medicare tax rate .

Example Medicare withholding calculation:

$5,000 x .0145 = $72.50 (Medicare tax to be deducted from employeeâs paycheck

Employer matching

As an employer, you are responsible for matching what your employees pay in FICA taxes. So in this case, you would also remit $310 for Social Security tax and $72.50 for Medicare tax.

Estimate Taxable Income For The Year

Letâs start with Stephanieâs income tax. In order to estimate how much income tax she will have to pay for the year, Stephanie estimates her income for the year . She then subtracts any above-the-line deductions she thinks sheâll incur for the year.

$90,000 minus $15,000 = $75,000. This new number is Stephanieâs âadjusted gross income.â

Then, she subtracts the standard deduction for single tax payers in 2020, which is $12,550.

Stephanie can also deduct 50% of her self-employment tax of $12,716.59 . She can deduct $6,358.

So her total estimated taxable income is $56,092.

Read Also: How Can I Make Payments For My Taxes

How To Stay In A Lower Tax Bracket

You can reduce your tax bill with tax deductions and tax credits. Another way to reduce your taxable income, and thus stay in a lower tax bracket, is with pre-tax deductions.

A pre-tax deduction is money your employer deducts from your wages before withholding money for income and payroll taxes. Some common deductions are:

- Contributions to a 401 plan

- Contributions to a Flexible Spending Account

Returning to the example above, lets say you decide to participate in your employers 401 plan and contribute $1,500 per year to your account. Now, your taxable income is $39,000 contribution + $1,700 in other income $12,500 standard deduction). You remain in the 12% tax bracket while saving for retirement. Its a win-win.

For 2020, you can contribute up to $19,500 to a 401 plan. If youre age 50 or above, you can contribute an additional $6,500 in catch-up contributions, for a total of $26,000. In 2021, the contribution limit will remain at $19,500, or $26,000 if youre age 50 or older.

If youre self-employed or dont have access to a 401 plan at work, you can still reduce your taxable income while saving for retirement by contributing to a Traditional IRA or through a broker or robo-advisor like SoFi Invest. These contributions reduce your AGI because they are above-the-line deductions .

For 2020, you can contribute up to $6,000 to a Traditional IRA . The contribution limits are the same for 2021.

How Much Tax Should I Pay On The Salary

The amount of tax payable depends on the annual income and tax scheme one chooses. Tax laws divide taxpayers into different groupings as per their taxable income. The grouping is called income-tax slabs.

| Income Tax Slab 2019-20 | |

| 30% | 30% |

One can use the Scripboxs Income Tax calculator at the top of the page to calculate their tax liability on the salary earned.

Don’t Miss: Www.1040paytax.com

How To Use Bankbazaar’s Income Tax Calculator

If you want to save time and still get an accurate calculation of your income tax, all you have to do is use BankBazaar’s free online income tax calculator. Just follow the steps given below:

- Step 1: Select the assessment year for which you want to calculate your income tax

- Step 2: Select your gender and if you are a senior citizen or super-senior citizen

- Step 3: Click on the “Income” field

- Step 4: Enter the figures required in the fields under “Income”

- Step 5: Click on the “Deductions” field

- Step 6: Enter the figures required in the fields under “Deductions”

- Step 7: Click on “HRA Exemptions”

- Step 8: Enter the required details

- Step 9: Click on the “Calculate” button

Your total tax liability will be displayed instantly on the screen.

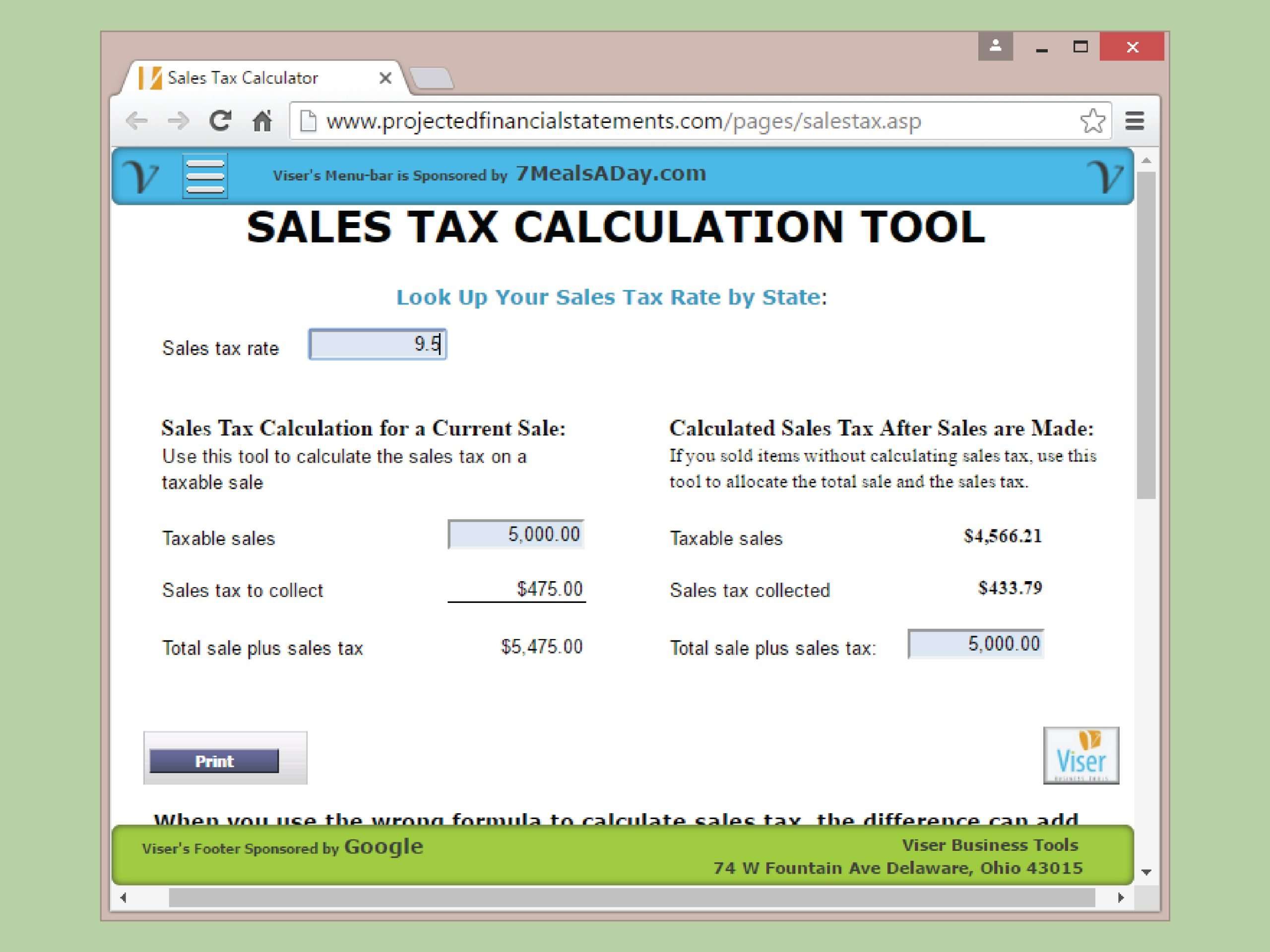

How To Calculate Sales Tax In Excel

As we know, we always pay the sales tax when shopping except purchasing duty-free goods. But do you know how many sales tax you have paid? There are two conditions to calculate the sales tax in Excel.

Calculate sales tax if you get price exclusive of tax

Sometimes, you may get the price exclusive of tax. In this condition, you can easily calculate the sales tax by multiplying the price and tax rate.

Select the cell you will place the calculated result, enter the formula =B1*B2 , and press the Enter key.

And now you can get the sales tax easily. See screenshot:

Calculate sales tax if you get tax-inclusive price

In some regions, the tax is included in the price. In the condition, you can figure out the sales tax as follows:

Select the cell you will place the sales tax at, enter the formula =E4-E4/ into it, and press the Enter key.

And now you can get the sales tax easily. See screenshot:

Related articles:

Recommended Reading: How To Buy Tax Lien Certificates In California

Income From Other Sources

Income from sources that dont fall under the above four categories become part of the income from other sources. It usually includes interest income, dividend income, gifts , etc. These components are tracked from the credit entries in the savings account.

Additionally, interest on cumulative Fixed Deposits is not credited to a savings account. Therefore, an interest certificate needs to be obtained, although the certificate is required only when TDS is not deducted. Use Scripboxs FD calculator to calculator to calculate interest from FD.

Income Tax Return Filing Financial Year 2018

Are you unsure about whether you should file an income tax return in India? Read on to know more.

08 min read

Undeniably, the arrival of online or electronic income tax return filing portals has made the ITR filing process fairly quick and convenient in the last few years. However, many taxpayers and retirees still find the procedure daunting and tedious and can find numerous excuses to postpone this activity.

Until Assessment Year 2017-18, you could get away with putting this off even after the D-day 31 August. Now, there are some legal consequences for late filing and evasion, which this article will explore.

Letâs understand whether you are required to file an income tax return in India for FY 2018-19

You May Like: Otter Tail County Tax Forfeited Land

Capital Gains On Gifted Property

You may transfer capital property to your spouse if they are at a lower income tax bracket to save on capital gains tax as a family. Depending on the type of property, you will transfer them to your spouse at either the Adjusted Cost Base or the Undepreciated Capital Cost . After the transfer, you will not incur capital gains tax but when your spouse sells the capital property, they will pay capital gains tax.

If the capital property you transferred to your spouse is eligible for theLifetime Capital Gains Exemption, then your spouse can use their remaining LCGE limit when selling the capital property to reduce their capital gains tax. Eligible properties for the LCGE include qualified small business corporation shares and qualified farm or fishing properties .

What Is The Cpp

The CPP, short for the Canada Pension Plan, is a mandatory public retirement pension plan run by the Government of Canada. All Canadians over the age of 18 with employment income are required to contribute towards the CPP, with the exception of those employed in Quebec. Instead of the Canada Pension Plan, the Province of Quebec administers a similar pension plan, called the Quebec Pension Plan.

Recommended Reading: How Much H And R Block Charge For Taxes

Important Terms And Definitions In Tax Calculation

- Assessment Year: When your income for a certain financial year is assessed in the coming financial year, it is referred to as an assessment year.

- Financial Year: The period between the current years April 1st and the following years March 31st. This is the time period wherein you are required to collate all your documents and submit your investment proofs.

- Previous Year: The financial year that acts as a precursor to the following assessment year. Your income for the current year is assessed in the next year .

- Deduction: It is a reduction in the total taxable income based on Section 80 and Chapter VI-A. Specific kinds of spending such as investment in life insurance policies and payment of childrens tuition fee help you avail a tax deduction.

- Exemption: It is a specific amount that is excluded from the gross total income before calculating tax. Exemptions are available under Sections 10 and 54. Interest earned from tax-free bonds and salary components like LTA are examples of exemptions.