How Do Rich People Avoid Paying Taxes Its Easy Actually

Water and oil, night and day, billionaires and paying their fair share in taxes this is just a short list of iconic opposites. Its probably not surprising that rich people go to great lengths to avoid paying any more taxes than they absolutely have to, but a new ProPublica investigation, published today, reveals in brutal detail how they get away with paying virtually nothing. Using over 15 years of tax returns from the ultra-rich, the investigation calculates the amount of taxes the 25 richest Americans paid contrasted with how much their net worth grew each year, to get what it calls their true tax rate.

Lets get specific, here, because ProPublica names names. Berkshire Hathaway billionaire Warren Buffets true tax rate is 0.10%. Amazons Jeff Bezos is 0.98%. Failed presidential candidate Michael Bloombergs? 1.30%. Meanwhile, father of Grimes child, Elon Musk paid a comparatively high rate of 3.27%. No wonder hes such a fan ofmeme stocks truly a man of the people.

Like what you see? How about some more R29 goodness, right here?

How Does Your Personality Type Affect Your Income

Youve just finished giving a presentation at work, and an outspoken coworker challenges your ideas. Do you:

a) Engage in a friendly debate about the merits of each argument, or

b) Avoid a conflict by agreeing or changing the subject?

The way you approach this type of situation may influence how much money you earn.

Todays infographic comes to us from Truity, and it outlines the potential relationship between personality type and income.

Using A Trust To Avoid Paying Estate Tax

Among the rich theres a funny saying that goes like this:

A person doesnt know how much he has to be thankful for until he has to pay taxes on it.

Unless youre rich you might now be aware of this: If youre rich and you die, the state taxes up to 45% of the wealth you want to pass down to your children. Its called an estate tax.

The US qualifies you as rich if youre worth more than 11.7 million dollars!

For everyone worth less than that there isnt an estate tax or it is considerably lower.

11.7 million might sound like a lot of money to the average person, but were living in the realms of billionaires and were likely going to have our first trillionaire in this lifetime.

With inflation the way its going right now, everyone will be a millionaire eventually.

The way rich people are structuring their wealth in order to keep the state from taking it away is by using TRUSTS.

If you put things into a trust then, provided certain conditions are met, they no longer belong to you, so its not yours to pass them down onto your children.

Once the property is held in trust, its outside anyones estate for inheritance tax purposes.

It also protects you from putting all your wealth under the name of your child because they could easily blow through it if they decided to, so the control remains with you while youre alive.

15

You May Like: What Does H& r Block Charge

How The Wealthy Avoid Paying Taxes In 2018

March 21, 2018 By Jackie Cohen

The more money you have, the more opportunities you have to make it earn more for you and this has become more pronounced following the recent wave of tax reform. Heres how the wealthy avoid paying taxes in 2018.

People in the highest income brackets get the most generous tax refunds under the terms of the Tax Cuts and Jobs Act. Americas top 0.1% earners got an average tax refund of $193,000, according to the Joint Economic Committee Democrats.

Estimates of the average refund for the upper echelon of earners keeps going up as the tax deadline approaches and more returns come in.

What Conservatives Say And Why Its Wrong

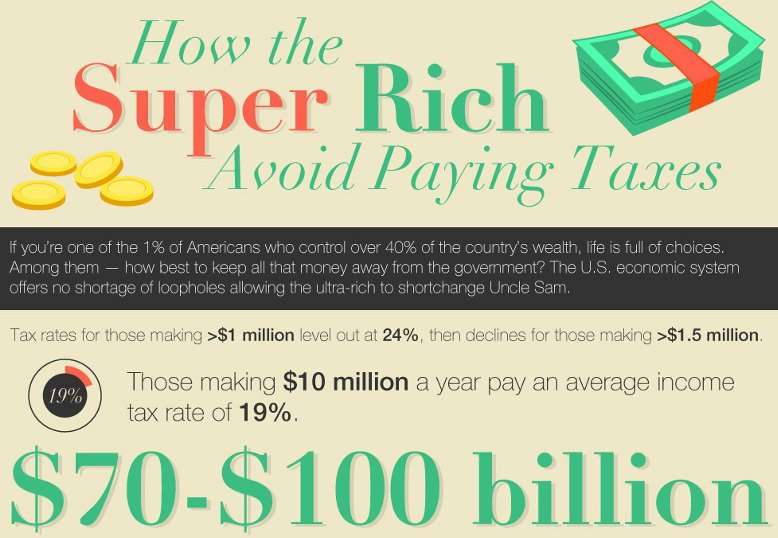

Conservatives claim the wealthy are overtaxed. But the overall share of taxes paid by the top 1% and the top 5% is about their share of total income. This shows that the tax system is not progressive when it comes to the wealthy. The richest 1% pay an effective federal income tax rate of 24.7%. That is a little more than the 19.3% rate paid by someone making an average of $75,000. And 1 out of 5 millionaires pays a lower rate than someone making $50,000 to $100,000.

Conservatives claim that the estate tax is a death tax, wrongly implying that the tax is paid when every American dies. In fact, the tax primarily is paid by estates of multi-millionaires and billionaires. The vast majority of deaths 99.9% do not trigger estate taxes today.

–

You May Like: Where Is My Tax Refund Ga

Even Taxable Income Often Enjoys Advantages

Even the income that wealthy people have to include on their annual tax returns often enjoys favorable tax treatment. This includes a top tax rate thats low by historical standards, a substantially lower rate for capital gains than for wages and salaries, and a new deduction for certain pass-through income.

Depreciating Assets On Paper To Outweigh The Cash Income

Accounting is the language of money so if you want to be rich you better learn how to speak it, or at least understand it.

In simple terms: Depreciation is a deduction that enables a business to write off the cost of the investment it buys, be it a car, a machine and so on.

Its spread out for the life of the investment. The reason behind spreading deductions for the cost of property is to enable a business to be in a position to replace the property at the end of its life.

Now lets say you buy a factory for 10 million dollars and intend to use it to make those ugly looking face-shields for the next 10 years.

From an accounting perspective, every year, the value of the factory will be depreciating by 1 million dollars.

If you make less than 1 million dollars per year from selling your face shields, there is no profit left to tax.

Equipment, vehicles and even offices can be depreciated from an accounting perspective allowing you to keep paying less and less tax.

If people knew how to optimise their money, their businesses would grow at much faster rates, allowing them to hire more people and create better products.

You are under no obligation to pay more taxes than it is legally required!

Taxation was meant to help the poor, but since everything is privatized and optimised for profit it doesnt work the way it was intended.

Question:

We have a large audience from everywhere around the world so were curious to know: What % do you pay in taxes in your country?

You May Like: Www.1040paytax

How Long $1 Million Would Last In 50 Cities

To compile this data, GOBankingRates calculated the average expenditures of people aged 65 or older in each city, using data from the Bureau of Labor Statistics and cost-of-living indices from Sperlings Best Places.

That figure was then reduced to account for average Social Security income. Then, GOBankingRates divided the one million by each citys final figure to calculate how many years $1 million would last in each place.

Perhaps unsurprisingly, San Francisco, California came in as the most expensive city on the list. $1 million in retirement savings lasts approximately eight years in San Francisco, which is about half the time that the typical American needs their retirement funds to last.

| City |

|---|

Claim Your Yacht As Your Second Home

Heres an interesting observation when it comes to taxes:

Governments love home-owners and despise the super wealthy who like to splurge, they really want to tax these show-off #taxtherich its actually trending all around the internet right now.

So what do rich people do to combat this? They claim their yachts as secondary homes to get better taxation rates.

At the end of the day its true, theyre using it as a holiday home when theyre travelling to Mykonos during the Summer.

As long as the boat has sleeping, cooking and toilet facilities, then the IRS treats the boat as a second home.

Motor-homes can also be used in the same way.. But how many super-rich people are buying motor-homes anyway?!

14

Read Also: Where’s My State Refund Ga

Put Your Money Offshore

Investment schemes exist that let you hold money in an offshore fund and roll-up the interest you earn on it. You will have to pay tax when you eventually withdraw the money, but in the meantime you can withdraw 5% a year without a tax liability. You can choose when you realise your investment, so you can plan it to fall when you are a basic rate rather than a high rate taxpayer.

This article was amended on 25 April 2012. The original said investing £1m in an EIS scheme would give tax relief on £300,000 of earnings. This has been corrected.

Using Corporations And Holding Companies

Corporations have multiple advantages when it comes to avoiding taxes. If you own a business or corporation you can write off or not pay taxes on a lot of expenses. Plus combining a holding company and your active business allows you to take advantage of even more benefits like inter-corporate dividends.

Some of these expenses include:

- Office Supplies

- Shipping and freight

- Fees and Dues

Even after that long list, there is still more that can be written off by a business. The advantage here is that the business will be able to purchase or pay for these expenses pre-tax or tax-free by claiming them as a business expense on their tax filing.

For the owner of that business, this is a HUGE advantage. If you were to own this business you can essentially lower your income by thousands of dollars every year in expenses and not pay tax on them. Yet, still, own the assets you have written-off.

The bonus on top of being able to write off these expenses is you can pay for them with pre-tax dollars. Whereas when you are an employee and getting a paycheque every other week your tax liabilities are taken off automatically. THEN you can make these purchases. Therefore, as an employee, you only see the money from your write-offs the next year not throughout that year.

As an employee you dont get the option to make purchases BEFORE paying tax, you have to make purchases AFTER paying tax as well as not having the advantage of many write-offs.

Recommended Reading: Have My Taxes Been Accepted

Put It In The Freezer

- Trust Freezing: A way to transfer valuable assets to others while avoiding the federal estate tax.

- “Freeze” the value of assets many years before you plan to pass them on to exclude all asset appreciation from the estate, and any taxes.

- Popular method: Trade common for preferred stock.

- Problem: If you sell your common stock you might owe a large amount of capital gains tax.

- Solution: Trade your common stock for preferred stock, then put some of the preferred stock in a trust and live off the dividends.

In Recent Decades The Richest Americans Have Seen Stratospheric Gains

The past several decades in the United States have been characterized by increasing income and wealth inequality and slowing productivity and economic growth. The incomes of the richest 1 percent have skyrocketed in relation to those of ordinary Americansand the very richest 0.1 percent have seen their after-tax incomes shoot upward even faster.

Figure 1

If the after-tax incomes of all Americans had grown together at the same pace since 1979, then by 2018, the total income of households in the richest 1 percent, after taxes, would have been $850 billion less.

Wealth inequality has also worsened. According to the World Inequality Database, the share of aggregate wealth held by the top 1 percent rose from 22.9 percent in 1979 to 34.9 percent in 2019, while the share held by the middle 40 percent declined from 33.3 percent to 27.8 percent.6 As Figure 2 shows, the top one-tenth of the top 1 percent of Americans now hold nearly one-fifth of the nations wealtha number that has nearly doubled over the past 40 years.

Figure 2

This inequality has exacerbated the racial wealth gap. For example, depending on the measures used, white Americans are estimated to own at least four times and as much as seven times the wealth that Black Americans own.7 The racial wealth gap is the result of centuries of systematic oppression and discrimination, exacerbated by more recent trends in overall wealth inequality.8

You May Like: Form 5498 H& r Block

Targeted Capital Gains Tax Breaks

The tax code contains other ways to defer or avoid capital gains tax. These special tax breaks are often targeted to a specific industry, such as real estate, or are intended to encourage certain types of supposedly socially beneficial investments, but instead often reward wealthy investors for making investments they likely would have made anyway.

One example is the like-kind exchange loophole, which allows people to sell certain types of assets and still avoid paying tax on the realized capital gain in the year of the sale. Originally meant to exempt small-scale and barter transactions from taxation, like-kind exchanges are now used extensively in the commercial real estate industry.

For example, suppose an investor buys a small office building for $10 million and its value rises over time to $15 million. She thinks it has little additional potential to gain in value and wishes to invest in real estate somewhere else. If she sells the building for $15 million, shell owe tax on the $5 million capital gain. But if she exchanges it for a ski lodge, for example, the $5 million wont be subject to tax until she sells the ski lodge and she could continue deferring tax by exchanging that property for yet another.

Donations To Charitable Organizations

While donating to charitable organizations is certainly something to be proud of, not every wealthy person does it for the right reason.

The deduction limits of charitable donations vary but can go as high as 60%. The uber-rich have also learned a unique way on how to avoid paying taxes by combining this strategy and incorporation.

A corporations tax write off may be as high as 25% of its taxable income as well, so many will choose to kill two birds with one stone.

Some rich people will also work with land conservation trusts to take charitable deductions from the value of conservation easements puts on owned properties.

Going deeper, gifts can be given to anyone and if they are under $13,000 then they are tax-excluded. Therefore, many wealthy people will circulate money within their families and write those amounts off to reduce their taxable income.

Recommended Reading: How To Buy Tax Lien Properties In California

Managing Gains And Increasing Equity

On the topic of equity, those who have achieved remarkable wealth can invest so much money into equity options that they can live off dividends, which are taxed at a lower rate than most income taxes.

A key problem with this strategy, though, is that assets need to be held for longer than a year to really see the benefits. Therefore, many of the wealthy will set aside large amounts of funds to funnel into equity options on a consistent basis to always increase the dividends.

Depending on your income level, capital gains are taxed at 0%, 15%, or 20%. Some wealthy people choose to set aside tens of thousands of dollars into safe and nonvolatile investments for just over a year in order to take the 20% tax.

Considering the alternative could be as high as 37%, this strategy could save wealthier people up to 17% in taxes.

Timing The Sale Of Assets

Sometimes the wealthy dont bother looking for ways to reduce the actual tax amount on assets such as stocks or real estate.

Many choose to stockpile their asset and wait for an opportune moment to sell. This often comes at a time when an investor has major capital losses, which they will then use to offset their reported gains.

Capital gains typically account for more than 33% of the assets owned by the wealthiest taxpayer, which shows just how impressive this contingent strategy is. The maximum deduction for a capital loss is $3,000 for those who are single filers.

If, however, you had $4,000 in capital gains, you would only be responsible for paying a tax on $1,000. This can be a trickier strategy, but those knowledgable in investing can use this loophole to reduce their overall tax rate.

Don’t Miss: How Much Is H& r Block Charge

Investing In A Business

For many entrepreneurs, the dream of owning a business is a scary adventure. Fortunately, there are at least some parts of the adventure that can help your tax burden.

If you are an aspiring entrepreneur or one with some free cash floating around, you can start a new business and have a nice write-off come tax time.

If you start a business, the Canada Revenue Agency allows you to deduct your start-up costs as allowable business expenses. However, the expenses must be incurred after the day your business commences to qualify for this deduction.

This is one of the many ways that the rich use to avoid taxes and in starting a business they are creating another income stream for years to come!

Other rules apply for when and how much you can write-off but, investing in your business is a great way to lower your tax burden.

The Rich also Invest in businesses that have already been started. Starting your own business or buying one requires you to have some knowledge of financial statements, after all, financial statements are all about how the business is making money!

To get a foot above everyone around you Start Right Now with the Beginners Guide to Analyzing Financial Statements!