What Happens If I File My Vat Return Late

If you are a VAT registered business, youll have to submit returns via the HMRC website portal every three months. You can find your business deadline for submission and payment on your HMRC VAT online account.

If HMRC doesnt receive your return by the deadline, or if you dont make the full payment of your VAT bill by the date required, then you will be issued with a default on your HMRC account. For your first default, then you will not be issued with a penalty fine. Afterwards, you may enter what is called the surcharge period.

What Is A Second Default

Youll get a second default if you are late for submission again. HMRC will then place businesses with less than £150,000 turnover in the surcharge period for a year where they will be charged interest on the owed VAT amount. If the company misses another deadline in that year, HMRC will extend the surcharge period by another year, where charges will continue to build upon every VAT payment made.

When the charges start to build up, the VAT bill will continue to rise. The added extra percentage charges on top of the bill you owe can make paying very difficult to manage.

You can ask an accountant to file your tax returns for you, whether it is for VAT or your self-assessment. Of course, you need to authorise them through HMRC to submit this information for you, but this could help if you find it challenging to manage your businesss tax obligations.

What Is The Option Now After The Last Date Is Out

The deadline for filing Income Tax Return for the financial year 2020-21 was 31 December 2021, which has now passed. But this does not mean that now there is no option left to file ITR for the financial year 2020-21. Those who have missed the deadline of December 31, can still file billed ITR. After the original deadline for filing ITR for a financial year is over, there is an opportunity to file a belated return but with a penalty. The deadline for filing belated ITR for the financial year 2020-21 is 31 March 2022.

Recommended Reading: License To Do Taxes

Pay Taxes Due Electronically

Those who owe taxes can pay with IRS Direct Pay, by debit or credit card or apply online for a payment plan . For more electronic payment options visit IRS.gov/payments. They are secure and easy to use. Taxpayers paying electronically receive immediate confirmation when they submit their payment. With Direct Pay and the Electronic Federal Tax Payment System , taxpayers can opt in to receive email notifications about their payments.

Interest On Taxes You Owe

If you have a balance owing for the current tax year and are unable to pay it by the April 30 payment due date, the CRA will start charging you compound daily interest as of May 1, 2021. This includes any balance owing if your return has been reassessed.

The rate of interest the CRA will charge on current or previous balances can change every 3 months based on prescribed interest rates.

Also Check: How To File Uber Taxes On Taxact

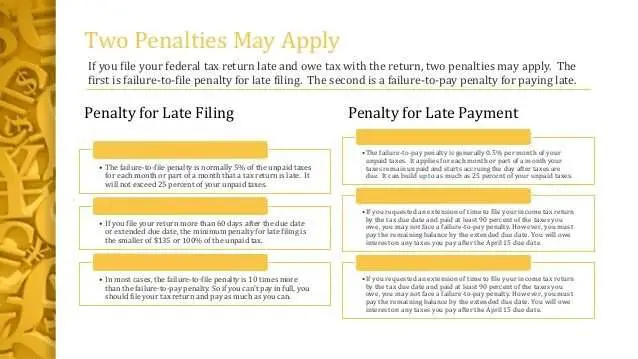

How We Calculate The Penalty

We calculate the Failure to File Penalty based on how late you file your tax return and the amount of unpaid tax as of the original payment due date . Unpaid tax is the total tax required to be shown on your return minus amounts paid through withholding, estimated tax payments and allowed refundable credits.

We calculate the Failure to File Penalty in this way:

- The Failure to File Penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late. The penalty won’t exceed 25% of your unpaid taxes.

- If both a Failure to Pay Penalty are applied in the same month, the Failure to File Penalty is reduced by the amount of the Failure to Pay Penalty for that month, for a combined penalty of 5% for each month or part of a month that your return was late.

- If after 5 months you still haven’t paid, the Failure to File Penalty will max out, but the Failure to Pay Penalty continues until the tax is paid, up to its maximum of 25% of the unpaid tax as of the due date.

- If your return was over 60 days late, the minimum Failure to File Penalty is $435 or 100% of the tax required to be shown on the return, whichever is less.

Payroll Penalties And Interest

Payroll penalties are assessed for errors in calculation, deductions, paying or filling. If you do not pay an amount that is due, the CRA may apply interest from the day your payment was due.

Penalties are assessed for:

If you do not pay an amount that is due, the CRA may apply interest from the day your payment was due. The CRA sets the interest rate every three months, based on prescribed interest rates. Interest is compounded daily. The CRA also applies interest to unpaid penalties.

- See quarterly prescribed interest rates

You May Like: 1040paytax Customer Service

When Are Taxes Due In 2021

The last day to file taxes is typically April 15, unless this date falls on a weekend or holiday. But this year, taxpayers get a temporary reprieve because the deadline for 2020 federal tax returns and tax payments has been extended to May 17. However, the extension only applies to individuals if youre required to file quarterly, your filing and payment deadline is still April 15.

Residents of some states might have different filing and payment deadlines. For example, due to the disaster declarations following the February storms in Texas, Oklahoma and Louisiana, residents of those states have until June 15 to file their 2020 returns.

Washington, D.C.s observance of Emancipation Day and Maines and Massachusettss observance of Patriots Day give their residents an extension when the holiday falls on tax day. In those cases, residents have until the next business day to file and pay their tax. Because of this years deadline extension, Emancipation Day and Patriots Day wont affect the 2021 deadlines.

More From GOBankingRates

How Much Youll Owe For Filing Or Paying Your Taxes Late

The penalty for not filing on time depends on how late your return is. The fine for filing up to 60 days late can be as much as 5% of your unpaid taxes each month or part of a month that you are late, up to 25%. After 60 days, the IRS imposes a minimum penalty of $435 or 100% of the unpaid tax, whichever is less. Taxpayers owed a refund wont be charged a fee for filing late.

The failure-to-pay penalty is 0.50% each month your IRS payment is late, up to 25%, according to the IRS. But the failure-to-file penalty can be reduced to 0.25% if the taxpayer files a return and requests an installment IRS payment plan to repay their debt in full.

If both the failure-to-file penalty and failure-to-pay penalty apply in the same month, the maximum amount charged for both penalties is 5% per month. Taxpayers can avoid these late filing penalties by filing on time or filling out the appropriate paperwork for a tax extension. But keep in mind, you must request the extension by the tax due date and you must have paid 90% of your tax bill to avoid a failure-to-pay penalty.

Find Out: Is Taking Out Loans To Pay Off the IRS a Good Idea?

Recommended Reading: Tax Deductible Home Improvements

Failure To File Penalty

The failure-to-file penalty is calculated based on the time from the deadline of your tax return to the date you actually filed your tax return. The penalty is 5% for each month the taxreturn is late, up to a total maximum penalty of 25%. The percentage is of the tax due as shown on thetax return. If your tax return is more than five months late, simply multiply your balance due by 25% tocalculate your failure to file penalty.

Do I Have To File Taxes

Not everyone has to file taxes. If you made more than the standard deduction for your age and filing status, claimed unemployment income, or were self-employed and earned at least $400 during the year, you must file a tax return with the IRS. Some dependents may be required to file as well.

Here are the standard deduction amounts for 2020 and 2021:

| Filing status |

Also Check: Doordash Taxes Calculator

Who Needs To File Itr

If your gross total income is more than Rs 2.5 lakh, then you are required to file ITR. This limit is 3 lakhs for senior citizens and 5 lakhs for people above 80 years. That is, if your total income is less than Rs 2.5 lakh, then you do not need to file ITR. However, if you file ITR despite low salary, then it brings you many benefits.

With So Much Going On In Life Its Not Always Easy To File Your Taxes On Time So What Happens If You File Your Taxes Late

Before we dive into the details, keep in mind that thereâs a distinct difference between paying your taxes late and filing your taxes late â a difference that may have a profound effect on your bank account.

If you file your taxes on time but donât have the cash to pay the balance owing, youâll be subject to interest.

âHowever, if you miss the filing deadline and file late, youâll automatically be subject to a late filing penalty in addition to any interest on the tax balance owing.Itâs this late filing penalty that can make filing your taxes late a real nightmare.

âLetâs take a look at what would happen if you filed a few common tax returns one month late with a 10K balance outstanding.

You May Like: Do You Have To Claim Plasma Donation On Taxes

Penalties For Failing To File Taxes Entirely In Ca

Being late with your filing is one thing, but altogether failing to file a tax return is quite another. In addition to the negative consequences articulated above, a complete failure to file may leave you in a sticky position legally. Regardless of how much you owe or if you owe anything at all, failure to file entirely could be construed as tax evasion. Tax evasion is a felony which carries a maximum sentence of up to five years and $250,000 in penalties.

For this reason, it is always better to be on time when it comes to tax filings. If you are concerned with your ability to meet your deadlines, or if you already have missed a deadline, our Sacramento tax attorneys can help. The only wrong move to make is to ignore it entirely, because the government will not be so forgiving.

The Penalty For Filing Taxes Late

The penalty for filing late is steeper at 5% of your tax due that remains unpaid as of the filing date. The penalty is a percentage for each month or part of a month that your return is late, and it will never exceed 25% of your unpaid taxes.

The clock begins ticking at your tax deadline, which is usually April 15 unless you filed for an extension by that date or the IRS otherwise extended the tax filing deadline. If you filed for an extension, you’d have until October 15 before this particular penalty kicks in.

The penalty accrues until you file your return. The longer you wait, the worse it gets.

You’ll pay at least $435 or a penalty equal to 100% of the tax you owewhichever is lessif you fail to file within 60 days of the due date.

An exception to the late-filing penalty exists. If a refund is due from the IRS, theres no penalty for filing a late return.

You May Like: Efstatus Taxact Online

What Is The Penalty For Filing Taxes Late

The good news is that if you’re expecting a tax refund and don’t file your federal income tax return on time, there’s no late charge. The bad news is that you won’t get your refund until you file. You have three years from the due date of your tax return to file and claim your refund. After that, the money goes back to the US Treasury.

But if you owe taxes and fail to file your return, the IRS essentially starts a running tab in your name. Every 30 days, you’ll be charged 5% of any unpaid tax you’re required to report on your return. Even if you file within a few weeks of the deadline, the full month penalty still applies.

When your return is filed more than 60 days after the due date, it’s subject to a minimum penalty equal to the lesser of 100% of the tax required to be paid on your return or $435, according to current IRS rules. There will also be interest accruing on your balance.

When Itr Has To Be Filed Even On Income Less Than Rs 25 Lakh

There are some situations when you have to file ITR even if the total income is less than 2.5 lakhs. If you have deposited an amount of Rs 1 crore or more in a current account or have spent Rs 2 lakh or more on foreign travel. Even if you have paid electricity bill of Rs 1 lakh or more in any year, you are still required to file ITR.

Also Check: When Does Doordash Send 1099

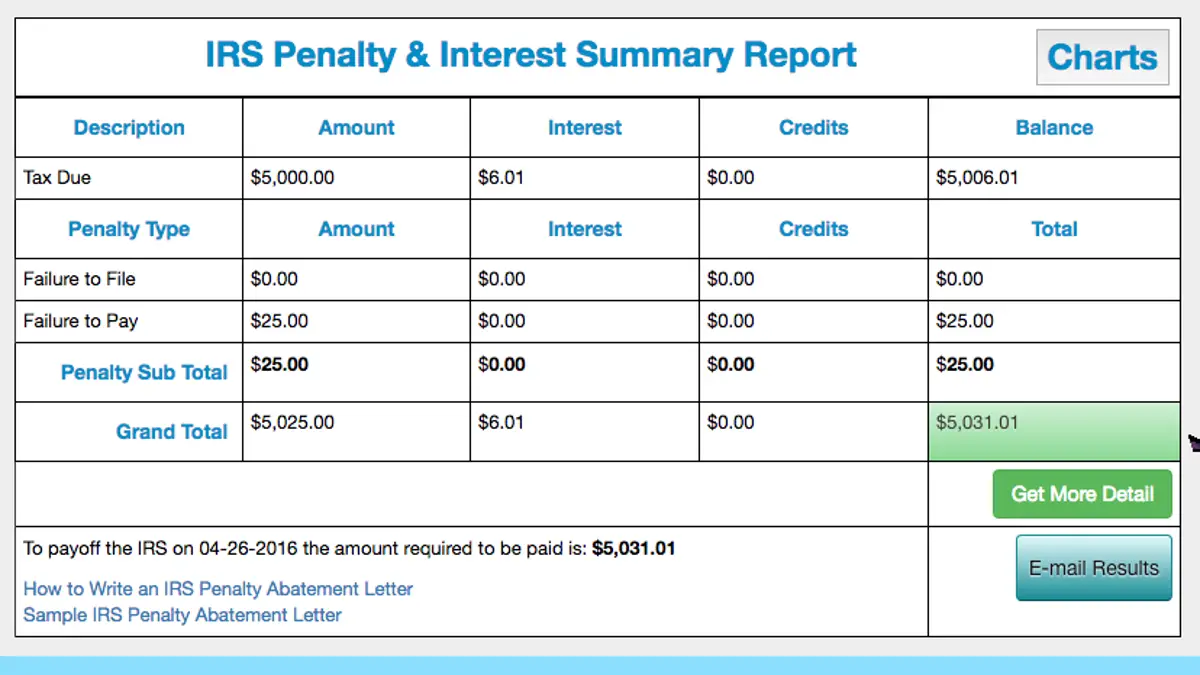

Paying Back Interest On Unpaid Taxes

For a taxpayer who owes unpaid taxes, interest will accrue on the amount owed in addition to the penalties covered earlier. This interest penalty compounds daily and is charged at a rate equal to the federal short-term rate plus 3%.

As an example, consider a taxpayer who fails to file their 2020 taxes when due on May 17. Assume the taxpayer files his taxes on June 17 and owes the IRS $2,000:

This taxpayer will be assessed a failure-to-file penalty of 5% for each month.

Next, a failure-to-pay penalty will be assessed at 0.50% each month, including the partial month of June.

Last, interest will accrue on the unpaid taxes and compound daily, at a rate of 3% above the federal short-term rate, beginning the day after taxes were due.

If the taxpayer doesnt file until July 17, which is more than 60 days late, his failure-to-file penalty will be $435 $435 being the lesser of that minimum or 100% of the tax owed.

Learn More: Everything You Need To Know About Taxes This Year

If There Is A Mistake In Filing The Tax Return

If there is any lapse while filing the original tax return, the taxpayer has a chance to file a revised or revised ITR. The last date to file revised or revised income tax return for assessment year 2021-22 is also 31 March 2022. You can also file a revised return for the default in the belated ITR return. But since the deadline for filing both billed and revised tax returns for the financial year 2020-21 is March 31, 2021, the revised returns will not be filed for last-minute belated returns.

You May Like: How To Appeal Property Taxes Cook County

Wrong Method Of Payment

Threshold 2 accelerated remitters must remit their deductions electronically or in person at their Canadian financial institution. Amounts you deduct from remuneration you pay any time during the month must be received by your Canadian financial institution no later than the third working day after the end of the following periods:

- from the 1st through the 7th day of the month

- from the 8th through the 14th day of the month

- from the 15th through the 21st day of the month

- from the 22nd through the last day of the month

All payments that we received at least one full day before the due date will be considered as having been made at a financial institution, so no penalty will be charged.

Payments made on the due date but not at a financial institution can be charged a penalty of 3% of the amount due.

All payments made after the due date can be charged a penalty calculated at graduated rates.

If You Are Getting A Refund:

This is one of the great little secrets about the federal tax law. If you have a refund coming from the IRSas about three out of four taxpayers do every yearthen there is no penalty for failing to file your tax return by the deadline, even if you don’t ask for an extension. However, this might not be the case for state taxes.

That’s not to say there aren’t very good reasons for filing on time. Even if you have a refund coming, consider the following:

- You can’t get your money back until you file, so you should file as soon as you can to get your money as soon as possible.

- The statute of limitations for the IRS to audit your return won’t start until you actually file your return. So, the sooner you file, the sooner the clock starts ticking.

- Some tax elections must be made by the due date, even if you have a refund coming. This applies to a very tiny percentage of taxpayers.

You May Like: How To Find Employer Ein Without W2

Penalty For Filing Your Tax Return Late

If you file your tax return after the due date and have a balance owing, you will be charged a late-filing penalty. Filing late may also cause delays to your benefits and credit payments.

If you cannot pay your balance owing, you should still file on time to avoid being charged the late-filing penalty.

The late-filing penalty is 5% of your 2020 balance owing, plus an additional 1% for each full month you file after the due date, to a maximum of 12 months.

If the CRA charged a late-filing penalty for 2017, 2018, or 2019 and requested a formal demand for a return, your late-filing penalty for 2020 will be 10% of your balance owing. You will be charged an additional 2% for each full month you file after the due date, to a maximum of 20 months.

Late filing penalties still apply even if you are eligible to get interest relief if you received COVID-19 benefits.