What If I Only Drive Part

If youre doing rideshare part-time on top of another job, this deduction also only applies to your rideshare income and not the wages from your job.

For example, if you make $50,000 a year at a job that you get a W-2 from plus $5,000 from rideshare driving, then youd get an additional deduction of $1,000.

Tax Requirements In New Zealand

As an Uber partner, you independently provide transportation services. You are not an employee of Uber and will be responsible for reporting and paying any applicable income tax or GST earned from your trips with Uber to the Inland Revenue Department . Uber does not withhold or file any tax on your behalf.

We expect all of our partners to meet their own tax obligations like everyone else. This would include declaring your earnings from providing services as an Uber partner. You may also be able to claim your Uber related expenses through your tax return.

Tax can be tricky! We want to help you understand and meet your tax obligations, but its important to note that Uber is unable to provide tax advice. To answer your questions, you can read the information and FAQs below or contact the IRD directly.

Calculating Gst On Uber Income & Expenses

The ATO calculation of GST on Uber fares and GST on Uber fees can be confusing. Instead of simplifying things and just asking rideshare drivers to pay GST on their net profits, the ATO want us to calculate things the long way around. But do rest assured, you will only pay GST on the profits that go into your pocket, and not on Ubers money! Let me show you how it works.

You May Like: Michigan Gov Collectionseservice

What Licence Do I Need To Be An Uber Driver

Youll also need a Private Hire Vehicle licence . You can apply for this through your local council. Costs may vary according to where you live.

Stephen Rowland from Newcastle joined Uber in November 2015. He was looking for work with flexible working hours after leaving his job as a college lecturer when his mother became ill.

He had to shell out for his private hire licence, which included a Disclosure and Barring Service check and interview, and had to pay £95 for a medical.

He said the whole process took six weeks.

When you apply for your licence, your council needs to be convinced that your car is roadworthy. He explained: The initial test cost £240 with repeat MOT style tests every six months which cost £80 a time.

Deborah Tucker from London paid a one-off fee of £450 for her private hire licence after going through a company that promised to fast track her application, but the process ended up taking months.

She says now that its a job she could have done herself, and for less money. If you want to learn more about the requirements, you can find more details on driving for Uber in the UK here.

Pay Attention To That 1099 Form

As tax season approaches, youll likely receive a version of Form 1099 in the mail from the company through which you contract your business. The total of your customers processed payments are reported on Form 1099-K, Payment and Third Party Network Transactions.

Keep in mind this amount will likely be higher than the dollar amount you saw hit your bank account as it includes the ride-share companys commissions and other services fees.

Any other payments you received, such as referrals or non-driving related bonuses, are reported on Form 1099-MISC. This form should arrive in your mailbox around the same time. All of the income documented on these forms needs to be reported on Schedule C when you complete your tax return.

There is a small chance you wont receive a 1099-K if the company through which you provide services processed less than $20,000 in payments or fewer than 200 transactions under your name.

Even if you dont get that form, youll still need to report any earned income on Schedule C and pay taxes on the income you earned.

Recommended Reading: Cook County Appeal Property Tax

Choosing Your Gst Registration Date

You can only register for GST once you have started the application process for Uber or another rideshare company. If possible you should do this before you start spending money on startup costs such as vehicle checks, permits and other fees so that you can claim back any GST you paid on these expenses. The same is true if you plan to buy a car for Uber. By starting the Uber application process and registering for GST before you buy the car, you may be able to claim back the GST on buying your car for Uber.

Mobile Phones And Chargers

You cant use Uber without a cellphone, so your smartphone is technically a business asset, even if you originally purchased it for personal use. You may deduct the cost of chargers, phone upgrades, and service expenses only as a percentage of the time that you use it for Uber-related calls and texts.

Also Check: Efstatus.taxact

Who Must File Taxes

If you earn more than $400 from Uber or Lyft, you must file a tax return and report your driving earnings to the IRS. Most Uber and Lyft drivers report income as sole proprietors, which allows you to report business income on your personal tax return. If you earned less than $400 from Uber or Lyft, you may still have to file and report your earnings if you have to file for other reasons.

Choose How You Want To File

Pick one of theses methods.

File by hand

Filing your taxes the old fashioned way involves sitting down with a pen and the necessary IRS forms downloaded from IRS.gov. Filing by hand is an affordable and educational option for taxpayers who want to learn more about the taxation process. However, it can be tedious for self-employed individuals who usually have more complicated tax situations. Uber drivers are recommended to choose another filing method to avoid losing money in forgotten deductions and credits.

File using a tax software program

Tax software programs can guide you through the filing process with simple questionnaires and in-program assistance. Tax software for self-employed individuals can help you maximize your deductions and comes pre-loaded with tools that you can use to minimize your tax liability. Filing through tax software is a great option for anyone with one or two streams of income and relatively simple taxes.

Filing through a CPA or service

You may choose to work with an accountant or tax filing service to assist you in figuring out your return. Filing through a tax professional gives you the benefit of a human touch on your return. It can also help taxpayers with very complicated situations figure out how best to avoid auditing. Filing with a tax pro is also usually the most expensive option but its typically the best choice for men and women with multiple streams of income or a very high annual household income.

Don’t Miss: Cook County Assessor Deadlines

Getting An Abn For Uber

ABN stands for Australian Business Number. Every rideshare and food delivery driver in Australia must have an ABN. You can register for an ABN on the ATO website yourself for free, or you can use DriveTaxs free ABN application service.

We only get one ABN for our whole lifetimes, and we must use this one ABN for all of our business activities. So if you already have an ABN or you have had one in the past then you must use this same ABN for Uber as well. If your past ABN is now cancelled or inactive, you will need to reactivate it to use as your Uber ABN. You can look up your current or past ABN on the Australian Business Register.

> Free ABN & GST Application as part of the DriveTax Free Uber Tax Info Pack

Get Ready For The New Year

After youve filed your return, youll want to take steps to ensure that youre recording your mileage, fuel costs, and toll charges throughout the next year to make taxes easier. Keeping a notepad to record mileage in your vehicle along with a folder to save any receipts you get for business-related expenses can save you tons of time and stress when tax season rolls around again.

Recommended Reading: Louisiana Payroll Calculator

Taxes For Rideshare/uber Drivers

If you recently began driving for Uber, whether full-time or just to make some cash for holidays, you need to know about the tax implications of providing ridesharing services. When you are self-employed, as is the case with Uber drivers, your income tax filing requirements are completely different than those for employees. To prevent any unpleasant surprises, such as back taxes, lets review what changes are in store once you start working for yourself, and discuss your new tax filing process.

Easy Article Navigation

Do Uber Drivers Need To Pay Estimated Taxes

![Ultimate Tax Guide for Uber & Lyft Drivers [Updated for 2021] Ultimate Tax Guide for Uber & Lyft Drivers [Updated for 2021]](https://www.taxestalk.net/wp-content/uploads/ultimate-tax-guide-for-uber-lyft-drivers-updated-for-2021.jpeg)

Self-employed people are not allowed to wait until April 15 to pay all the income and self-employment taxes they owe for the prior year. Instead, they are required to prepay their taxes by making estimated tax payments to the IRS four times per year.

You must pay estimated taxes if you expect to owe at least $1,000 in federal tax for the year from your ride-sharing business. You’ll probably need to earn a profit of at least $5,000 or $6,000 from your business to owe this much tax.

The IRS imposes modest interest penalties if you don’t pay enough estimated tax. To avoid the penalties, you must pay at least the smaller of:

- 90 percent of your total tax due for the current year

- 100 percent of the tax you paid the previous year or 110 percent if you’re a high-income taxpayer

High-income taxpayers-those with adjusted gross income of more than $150,000 -must pay 110 percent of their prior year’s income tax.

Also Check: 1040paytax.com Official Site

Uber Gst Explained The Complete Guide To Gst For Uber Drivers

Uber GST is one of the biggest learning curves for new rideshare drivers. Thanks to specific ATO GST laws for Uber drivers, we have to register for GST, lodge BASs, and pay additional taxes to the ATO, things that most Australian small businesses dont have to worry about.

So my goal in this blog post is to make Uber GST as simple and stress-free as I can. Ill explain the rules on whether you have to register for GST as an Uber driver, how GST on your rideshare income is calculated, and how to lodge your Uber BAS to the ATO.

Drivers Pay Taxes On Uber Or Lyfts Fees Rather Than Deducting Them

Did you know that as many as 50% of Uber drivers dont deduct the commissions and fees that are included in their 1099-K income?

Lets break that downwhen Uber and Lyft issue 1099-K forms to drivers, these forms include ALL of the money passengers paidincluding Uber or Lyfts cut . Since Uber and Lyft are classified as third party network payment providers and facilitate payments between drivers and passengers, they have to report all of the income that passes through the app.

This means that the income reported on your 1099-K includes commissions and fees that never hit your bank account. These fees are deductible as a business expense, but about half of rideshare drivers arent deducting them.

When you go to file your taxes, youll want to have your Uber Tax Summary in front of you so that you can see how much you can deduct in fees. Youll also want to compare your 1099 income to what was actually deposited into your bank account to make sure your 1099s are reflecting accurate information!

Read Also: Turbo Tax 1099q

How To Write Off Your Car Expenses

Once you have your business income from your 1099 forms, it’s time to put together a record of all the business expenses you can deduct. You’ll use this information to fill out your Schedule C, the form that summarizes your ridesharing business’s profits and losses.

Chances are good that the bulk of your business expenses will be related to your car. In order to write these off, you’ll have to choose between the two possible methods for deducting the business use of your car: the actual expenses method and the standard mileage method.

Calculate Your Gross Income From Rideshare Driving

You may receive two 1099 forms from Uber or Lyft, but not always.

-

Form 1099-K. You should receive a 1099-K if you had more than 200 rides and generated over $20,000 in customer payments.

-

Form 1099-NEC. If you make more than $600 in non-driving income, such as bonuses, referral fees, and other awards, you may receive a 1099-NEC for this income.

Even if your income from Uber and Lyft doesnât rise to the level of receiving a 1099 form, you still need to report your income to the IRS. So go into your driver dashboard and download your income details for the year.

These forms will typically report a higher income than what you actually received. This is because it reports the total of what your customers paid before Uber or Lyft takes their fees. These fees are tax deductible as a business expense.

Your gross income from rideshare driving goes on Line 1 in Part I of Schedule C. If you drove for both Uber and Lyft during the year, you donât need to complete two separate forms. Just add the income from both rideshare companies together and include the total on one schedule.

Don’t Miss: Appeal Property Tax Cook County

Drivers Underestimate Their Tax Prep Costs For The First Year

If youve ever filed your taxes online, youll see that there are usually several different versions of a particular tax filing software that you can use. Most tax filing software will price their products according to what forms you need to file.

When youre a rideshare driver, youll need to file a Schedule C in order to report your income and expenses. However, tax prep companies charge extra for the forms associated with self-employment. Even though you can deduct these costs as a business expense in the next year, they can still take a toll on your wallet.

This means that even if youve been using the free version of TurboTax for years, youll now need to pay around $80 for TurboTax Self-Employed just so you can file a Schedule C!

When youre headed into tax season, try to avoid sticker shock when youre told youll need to pay extra to report your rideshare income.

Tax Obligations Of Uber Drivers

UBER has grown to be part of Canadas transportation landscape. Many Canadians are either earning their income primarily as UBER drivers, or are supplementing their income by driving when not otherwise working. UBER has caused a disruption in the taxi industry by providing a very large pool of potential transportation providers that are easy to access and drive a variety of vehicle. So, with UBER likely here to stay, and more sharing economy disruptors likely to appear and dominate, what are the tax consequences of being an Uber driver? And what are the uber driver tax tips to save money. Given that taxi drivers have to register for HST/GST and remit this, and pay tax on their incomes, how are UBER drivers treated by the tax man?

Almost all UBER drivers are in business, meaning that their earnings are business income. This means that Uber drivers have to report their revenues and get to deduct their expenses come tax time, and they have to pay tax on their profits. The CRA also required Form T2125 to be included with the Uber drivers tax return. What is less well known is that Uber drivers also have GST/HST obligations.

You May Like: Property Tax Protest Harris County

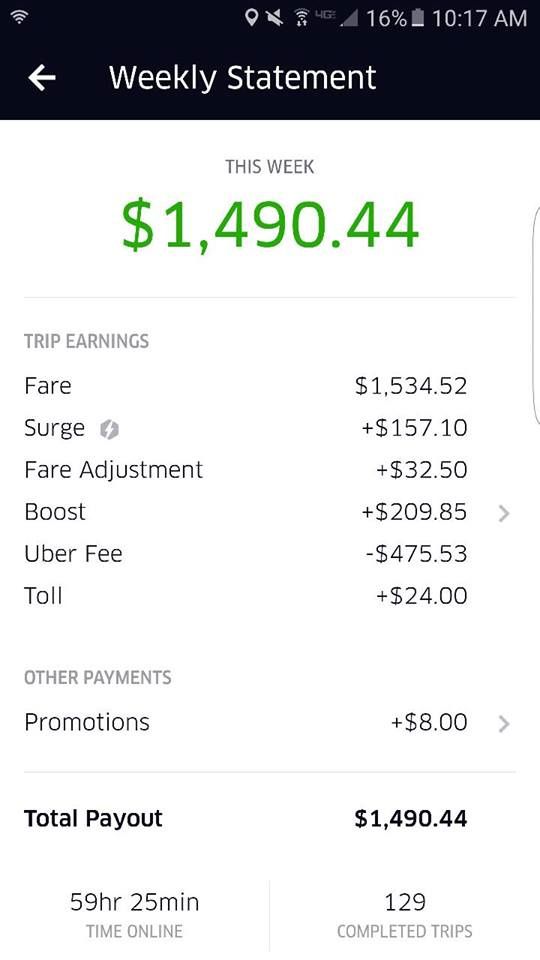

How Much Will Uber Drivers Make

When talking about Uber driver pay breakdown, there is actually no limitation on how much you can make from being an Uber driver. You actually can earn a lot of money as much as you. Simply, when you drive more, you will earn more.

In addition, you will also get your weekly fares that will be automatically transferred into your personal bank account. Moreover, Uber also has a feature of Instant Pay that will pay your fares within a few seconds.

How do we calculate Uber fares. The Uber fares calculation actually depend on the distance of the trip and the time spent on each ride you take.

What Receipts Do You Have To Keep For Uber

The ATO require you to have receipts or records of all business related deductions. For your tax return any receipt or records is acceptable, including bank statement records. However for GST credits on your BAS the rules are a little stricter. For expenses over $82.50 you must have a tax invoice. For expenses below $82.50 any receipt or record is acceptable.

I always recommend paying all expenses by bank card rather than cash so that even if you lose the receipt you will still have bank records, and therefore you will still be able to claim most GST credits and all tax credits.

Keeping receipts of your Uber expenses can be a pain. Its easy to miss expenses or loose receipts, which means youre missing out on tax deductions. So its important to have a system for keeping your receipts.

The easiest way to keep your paper tax receipts is to buy an expanding file like this one. Mark each section with a category of expenses, for example fuel, other car expenses, phone bills, water & mints, stationery etc. Then grab a large envelope to keep in the glove box of your car to collect receipts while youre on the go. File these into your expanding file on a regular basis.

To track and add up your expenses, you have two main options.

Don’t Miss: Have My Taxes Been Accepted