During A Real Estate Or Loan Transaction

If youâre in a real estate or loan transaction, your escrow, title, or mortgage company should help resolve your lien during escrow. They should use eDemand to submit a lien payoff request. Once we process the request and receive payment, we will release the lien.

- If thereâs not enough to pay off all your liens, visit Insufficient funds in escrow/short sale.

- If there are competing state and federal tax lien, visit Competing liens.

- If youâre an escrow, title, or mortgage company, visit Payoff request.

Businesses

If youâre a business, you must be in good standing in order to enter into any business transactions or contracts, such as the sale of real property.

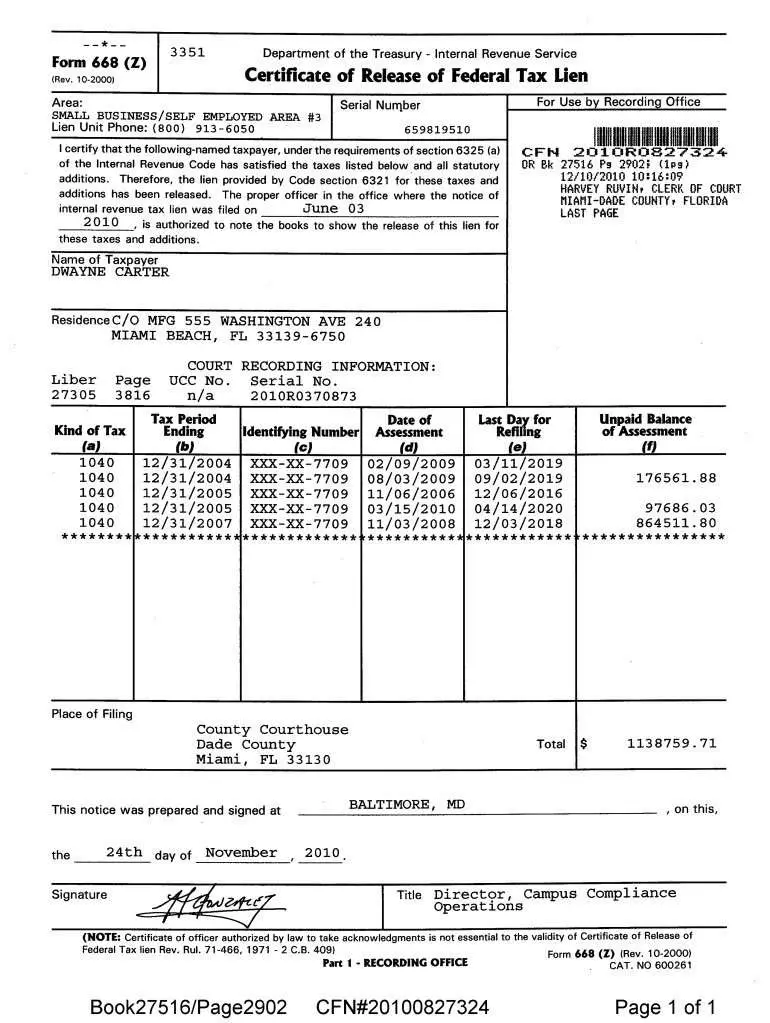

How A Tax Lien Is Placed

For placing a lien on someones property, the government first assesses the total amount of tax debt either through the substitute return field by the taxing authority or through the tax return filed by the taxpayer. A tax bill is then prepared and sent to the tax payer.

If the taxpayer does not pay the tax in the given time, the taxing authority then files a notice for a Federal Tax Lien to secure the tax amount and to inform other creditors regarding the claim that the government now has on the property of the taxpayer.

Federal Tax Liens Versus Federal Tax Levies

Both tax liens and tax levies are means the IRS has at its disposal to protect and collect past-due taxes. But they are different actions.

You can think of a tax lien as defensive enforcement action, while a tax levy is an active action. A tax lien is a public document that tells a taxpayer and the world that the taxpayer owes back taxes to the government. It puts the IRS debt in line to collect from the taxpayer’s assets.

A tax levy occurs when the IRS actually takes property to put toward a tax debt. For example, if a taxpayer owes $10,000 in taxes and has $10,000 in a savings account, the IRS can put a levy on the funds and apply them to the debt. The IRS has the right to seize or levy on funds, securities, personal assets and real property.

Read Also: Is Plasma Donation Money Taxable

Who Can Impose A Tax Lien

While the federal government is most likely to place a tax lien on anyone who has not paid tax in the given time, some other authorities can also use it as a tool to collect other types of taxes, such as unpaid property taxes, counties, state tax boards and municipalities can file tax liens, and the Internal Revenue Service can place it to collect income taxes. Use the above form to perform an IRS tax lien search.

Dealing With A Federal Tax Lien

The easiest way to deal with a lien is to not get it in the first place. The IRS goes through a specific set of steps when it believes a taxpayer owes the government. Unlike in the past, the IRS is willing to work with someone who is faced with a tax liability. Setting up a payment plan and keeping current with the payments will stop the government from taking any further action.

Once a tax lien has been filed and received, there are certain options that the taxpayer can request to lessen the burden. It is important to note that each option has eligibility requirements and that the government does not have to grant them.

A common choice for relief is referred to as the Discharge of Property. This will allow certain assets to be removed from the lien. The Subordination program allows other creditors to take priority over the governments claims. This can help the taxpayer acquire credit.

Also Check: How Do I Protest My Property Taxes In Harris County

What If There Is A Federal Tax Lien On My Home

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home. There are a number of options to satisfy the tax lien. Normally, if you have equity in your property, the tax lien is paid out of the sales proceeds at the time of closing. If the home is being sold for less than the lien amount, the taxpayer can request the IRS discharge the lien to allow for the completion of the sale. Taxpayers or lenders also can ask that a federal tax lien be made secondary to the lending institution’s lien to allow for the refinancing or restructuring of a mortgage. The IRS currently is working to speed requests for discharge or mortgage restructing to assist taxpayers during this economic downturn.

To assist struggling taxpayers, the IRS plans to significantly increase the dollar thresholds when liens are generally filed. The new dollar amount is in keeping with inflationary changes since the number was last revised. Currently, liens are automatically filed at certain dollar levels for people with past-due balances. The IRS plans to review the results and impact of the lien threshold change in about a year.

Also, the IRS is making other fundamental changes to liens in cases where taxpayers enter into a Direct Debit Installment Agreement .

With Bank Deposit Account Rates At An All

How To Lookup a Tax Lien Record. Parcels are forfeited to the county treasurers when the real property taxes are in the second year of delinquency. Because Michigan has limited electronic-search technology searches disclose only liens matching th e precise name searchednot liens such as the.

There you can type a key word or phrase of your question in the search box and then choose a resulting page matching your topic. If you need a copy of your tax return the fee is 50. Crestmark periodically submitted lien search requests to the Michigan Secretary of State using Spearings exact registered name.

You can search for a federal tax lien at the recorders office in the taxpayers home county and state or you can use a private company offering online public records searches. A federal tax lien exists after. This becomes the Federal governments legal claim against the debtors property.

Or send us an e-mail by clicking on Contact the Secretary of State also in the upper right corner and we will. Data is updated through 912017. Are tax liens a good investment.

For information regarding Michigan Department of Treasury state tax liens contact the Collections Division at 517-636-5265. In order to obtain a free federal tax lien search you can contact the IRS and see if theyll send you an electronic copy. You selected the state of Michigan.

Indenture Of 1865 Regarding An Apprentice Carpenter Waterloo Map King George Iii Duke Of Argyll

You May Like: Property Tax Protest Harris County

Federal Tax Liens Provide Protection For The Irs

The IRS takes its collection duties seriously and has more ways of securing its debts than the average creditor.

If you fail to pay your federal taxes, the IRS takes immediate action. First, it prepares a tax assessment to determine what you owe. It then forwards a bill to you for this amount. If you don’t pay or arrange for a payment plan, the IRS records a federal tax lien in your home state. The lien gives the IRS a protected interest in any real or personal property you own or that you acquire while the lien is in effect. You cannot sell your property without paying your tax debt.

Each Lien Record In The Extracted File Contains Multiple Fields Including:

- Lien ID Number

- TP Name and Address

- Lien Status

The Freedom of Information Act authorizes government agencies to recover the costs associated with processing requests for records. The government cost for producing the standard ALS database listing CD is $130.00. Make your check or money order for $130.00 payable to U.S. Treasury.

Recommended Reading: Efstatus.taxact

How A Lien Affects You

- Assets A lien attaches to all of your assets and to future assets acquired during the duration of the lien.

- Once the IRS files a Notice of Federal Tax Lien, it may limit your ability to get credit.

- Business The lien attaches to all business property and to all rights to business property, including accounts receivable.

- Bankruptcy If you file for bankruptcy, your tax debt, lien, and Notice of Federal Tax Lien may continue after the bankruptcy.

The Effects Of A Federal Tax Lien

Being the subject of a tax lien can cause many disruptions in the life of the recipient. The effects will last until the lien is satisfied or some arrangement is made with the government.

Assets that have had a lien placed on them can no longer be sold or used as collateral when trying to secure a loan. Until the lien is satisfied, any assets purchased will automatically be attached and subject to the lien requirements. Once the lien is filed, the subject?s ability to acquire credit may suffer. Furthermore, tax liens are not necessarily discharged through a bankruptcy. Business property is also subject to a lien and this can make running a business difficult.

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

How To Release Or Withdraw A Tax Lien

There are many ways to release or withdraw an IRS tax lien. You can also request a tax lien withdrawal, which removes the existence of an IRS lien from your credit report if you meet specific conditions. A tax lien can hold you back financially so its important to take action as quickly as possible. This link explains your options, and once you understand your options, you can decide which method works best for you based on your financial situation and how much tax you owe.

Benefits Of Using A Tax Lien Database

States’ differing rules and procedures for filing liens complicate your tax lien search. When you want to uncover IRS and state tax liens, you have to inquire in various state and county offices based on where the borrower lives, does business, and owns property. There’s a way to conduct a more efficient search: a state and federal tax lien database.

Tax liens are public records, which means a business can routinely pull these documents and create an easily searchable database. You can use an IRS tax lien database, a state tax lien database, or an organization that offers both records in one place.

Don’t Miss: Www.myillinoistax

Lien Solutions Can Search Any Tax Database

What’s more efficient than conducting a state or IRS tax lien search through a database? Working with a Lien Solutions partner that can search any tax lien database on your behalf. We perform the necessary due diligence, including a four-part search to uncover any state and federal tax lien records and UCC statements filed against the potential borrower.

The Fresh Start Program And Liens

The IRS doesnt want to permanently destroy taxpayers credit, but the agency is tasked with collecting the taxes that have been imposed. To give taxpayers more relief, the Fresh Start Program was rolled out in 2011 with the goal of making it as easy as possible for those who owe. One major part of this program was to set the threshold for which liens could be placed at $10,000 or more. So if your tax debt falls below that, you wont have to worry about that part of things.

At the same time, though, the Fresh Start Program also came up with ways that the IRS can help taxpayers get that notice withdrawn. Youll still owe the taxes that prompted the lien, but it will at least remove that stressor. There are two ways you can have the lien withdrawn: if you pay the debt in full or if you are actively paying your IRS debt down through a direct debit installment agreement.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

Free Federal Tax Lien Search

Because federal tax liens public records, you can find out if the federal government has filed a tax lien against you or your spouse, or anyone else.

In order to fulfill their function of providing public notice of a government’s claim on a taxpayer’s assets, tax liens must be officially recorded. The IRS records these liens in the taxpayer’s home state with the state recorder’s office. This office goes by different names in different states, but it is usually the same place you record a property deed.

The state recorder office often provides an online index of recorded documents. For example, in California, federal tax liens are filed with the County Clerk Recorder. The San Francisco Assessor-Recorder’s Office has a searchable databank of documents recorded in that county. You can run an online search to verify the existence of a lien. Search by name, document number, type of document, or Assessors Parcel Number .

You’ll also find various companies offering tax lien searches online. They usually charge fees for this service. A title company can run a title search, which will also turn up tax lien information.

Get Answers 100% Free Tax Lien Consultation Right Now

If youre facing a tax lien then you need professional ANSWERS you can count on, but you dont want to pay to get this information do you? This is why we offer a 100% free consultation with a seasoned tax professional. Our honest, licensed professionals will evaluate your situation and provide you with the answers you need, so you can have the peace of mind and security of understanding your options. Chat with us live right now or call us if you prefer. We are NOT sales people, were true tax professionals.

You May Like: Protesting Harris County Property Tax

Online Free Federal Tax Lien Search By Name

In order to obtain a free federal tax lien search you can contact the IRS and see if theyll send you an electronic copy. Many times theyll charge a nominal fee for a certified copy. If you need a copy of your tax return the fee is $50. The easiest way to view your federal tax record is to use an online repository like SearchQuarry.com. You can search by name and quickly locate most anyones tax lien records. Currently were offering a 5 day free trial so you can get a free federal tax lien search without obligation.

Other Sources Of Information

While you can find out the information directly from the IRS, other sources exist that may uncover a lien that isn’t yet showing in the IRS records. Tax liens are generally placed with authorities that are local to your city or county. You can find out more information by visiting the website for your secretary of state.

On the website, locate and choose a selection titled “lien filings” or “UCC Search.” You may need to enter the name of your state and some identifying information to complete the search.

If you subscribe to the legal database Lexis Nexis, you can look up tax liens in the RiskView Liens & Judgements database. Here, you can find current data on tax liens and, if necessary, dispute any incorrect information by using the site’s dispute resolution process.

You May Like: Is Past Year Tax Legit

Looking Up A Federal Tax Lien

Chances are if theres a lien against your property, you at least strongly suspect it. At the very least, youre aware that you didnt pay your taxes when you were supposed to at some point. You may have seen some of your refund withheld for subsequent returns or you possibly ignored one or more IRS notices. However, if youve moved, you may not be 100 percent sure if the IRS has sent you a mailing.

You can be even less aware that a lien has been placed on your property. The IRS is a government agency, so it can work directly with local governments and even your creditors to place a lien on your property. It does this through a notice directly to those entities. To find out if theres a lien on your property, you can contact the IRS Centralized Lien Unit at 913-6050. You can also check to see how much you owe the IRS and pay the balance due, if no lien has been placed yet, by visiting the IRS website and searching for Check Your Balance or Pay Your Taxes By Debit or Credit. However, if you have a lien placed, youll want to work with the IRS lien unit directly to make sure the lien is lifted as you pay everything off.

The Highest Bidder Now Has The Right To Collect The Liens Plus Interest From The Homeowner

In 2017, approximately $14 billion in property taxes were not paid, according to brad westover, executive director of the national tax lien association . Sep 10, 2021 · tax liens can sport high yields, but they aren’t suitable for the faint of heart. Apr 16, 2021 · tax liens. A tax lien is a legal claim that a local or municipal government places on an individual’s property when the. The parliament of canada entered the field with the passage of the business profits war tax act, 1916 . While working over 16 years at the irs and in private practice helping taxpayers like you, michael has personally resolved thousands of back tax cases and settled over $100 million dollars worth. It was replaced in 1917 by the income war tax act, 1917 . There are also several statutory liens, meaning liens created by law, as opposed to those created by a contract. Jun 29, 2021 · tax liens by the numbers. These liens are very Requesting information about liens from the seller purchasing a vehicle history report which includes a detailed lien search from carfax canada for a private sale in some provinces and territories, the seller is required to provide information about existing liens to buyers before ownership of the car can. It is now june 1st, 2020 instead of april 30th, 2020. It depends on where you live, whether you have other forms of income and which income tax bracket you fall into, and what adjustments may have been made by the government to relevant tax rules.

Don’t Miss: Www Michigan Gov Collectionseservice