Which States Do Not Tax 401k Withdrawals

Nine of those states that dont tax retirement plan income simply have no state income taxes at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. The remaining three Illinois, Mississippi and Pennsylvania dont tax distributions from 401 plans, IRAs or pensions.

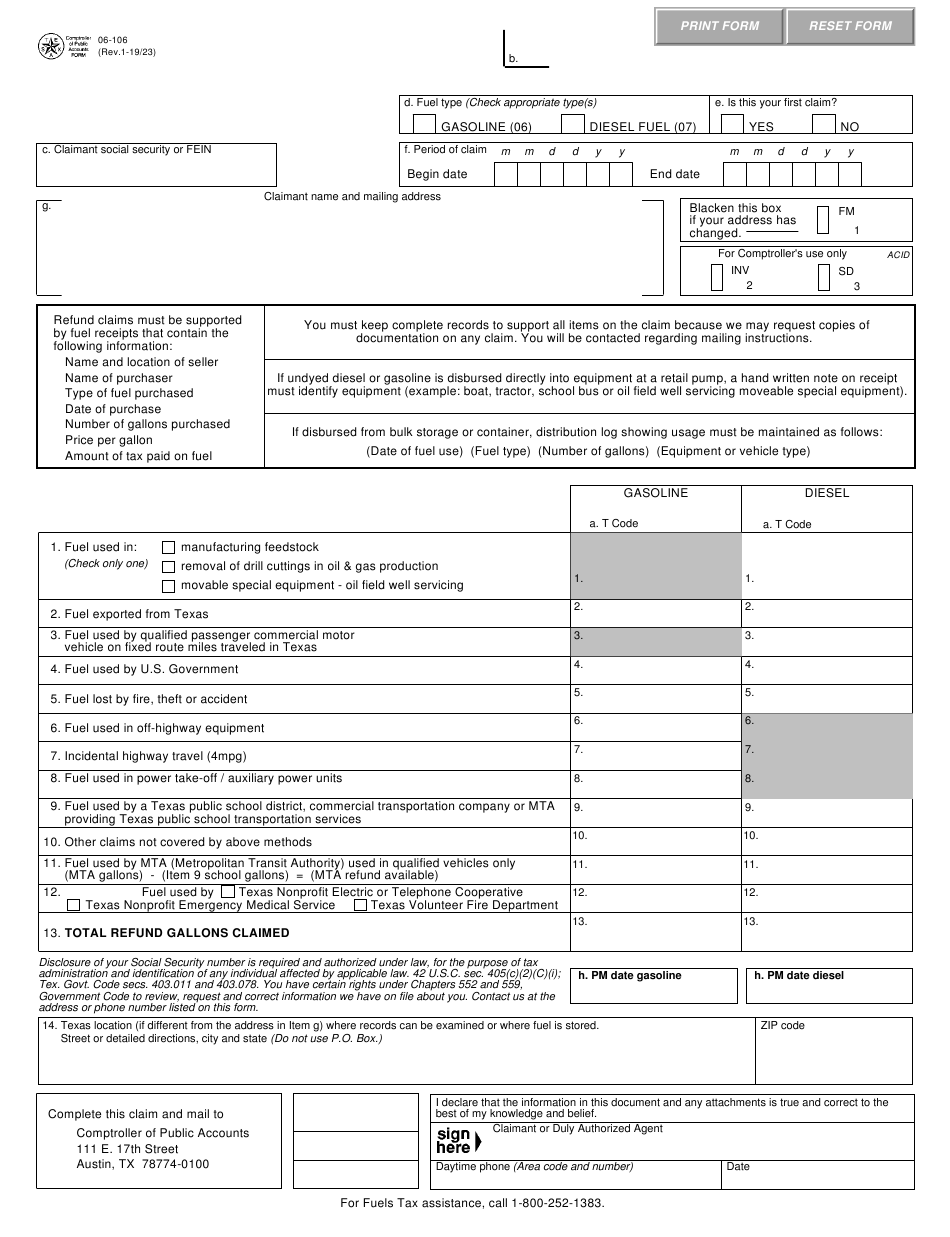

Auxiliary Equipment Power Take

Gasoline used in Ontario to power auxiliary equipment located on a licensed vehicle qualifies for a tax refund. A unit powered from an engine which uses gasoline from a vehicle’s fuel tank is considered a Power Take-Off function and qualifies for a PTO refund. To qualify for the refund, the licensed vehicle cannot be principally used for the transportation of passengers or for pleasure or recreational uses.

In most of these cases, it is not possible to accurately measure the amount of gasoline used. As a result, refund allowances are based on the equipment manufacturer’s fuel consumption specifications as approved by the ministry. Refund allowances have been established for a number of PTO operations and are available on request from the ministry.

Line 9941 Optional Inventory Adjustment Included In The Current Year

If you want to include an inventory amount in income, read this section.

For the OIA, unlike for the MIA, the inventory does not have to be purchased inventory. It is the entire inventory you still have at the end of your 2020 fiscal period.

Enter the amount of your OIA on line 9941. You must deduct this amount as an expense in your next fiscal period.

Don’t Miss: How Do I Get My Pin For My Taxes

Equipment For Which A Refund May Be Claimed

- farming equipment – unlicensed tractors, combines

- construction equipment – unlicensed bulldozers, graders

- forestry equipment – unlicensed skidders, slashers

- commercial fishing vessels

- construction work boats.

Note Gasoline used outside of Ontario does not qualify for a tax refund. Gasoline used in any licensed vehicle does not qualify for a tax refund.

How Do I Submit A Mileage Claim

There are 2 different ways to submit a claim:

If you’re an employee and claiming less than £2,500: fill in a P87

Self-employed taxpayers, or employees claiming over £2,500: use the self-assessment system, this means submitting a self-assessment tax return

FreshBooks makes self-assessment easy for you in terms of record keeping and submission, whether you’re self employed or an employee.

Don’t Miss: File Missouri State Taxes Free

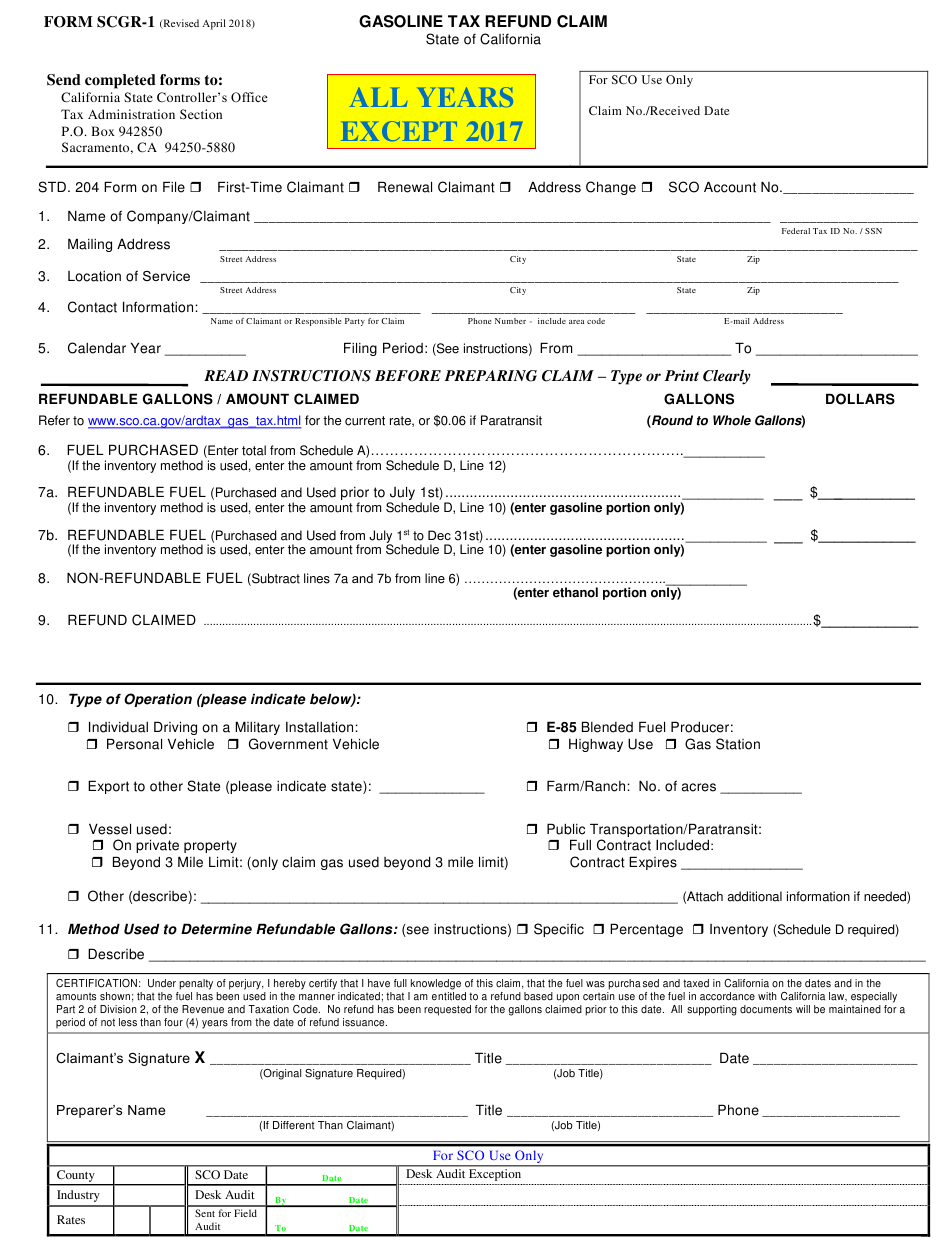

How To Claim A Gasoline Tax Refund

An application for refund must be completed and submitted to the Ministry within four years from the date the tax for which a refund is sought was paid. Any portion of a claim filed after this time period will be disallowed. Purchase invoices pertaining to the claim must be submitted with the refund application. Invoices will not be returned unless requested by the applicant at the time of filing.

Internet And Phone Bills

Regardless of whether you claim the home office deduction, you can deduct the business portion of your phone, fax, and internet expenses. The key is to deduct only the expenses directly related to your business. For example, you could deduct the internet-related costs of running a website for your business.

If you have just one phone line, you shouldn’t deduct your entire monthly bill, which includes both personal and business use. According to the IRS website, “You cant deduct the cost of basic local telephone service for the first telephone line you have in your home, even if you have an office in your home.” However, you can deduct 100% of the additional cost of long-distance business calls or the cost of a second phone line dedicated solely to your business.

Don’t Miss: Can You Change Your Taxes After Filing

Using These Tax Deductions For Your Small Business Can Save You Money

By Stephen Fishman, J.D.

It’s simple: The more tax deductions your business can legitimately take, the lower its taxable profit will be. In addition to putting more money into your pocket at the end of the year, the tax code provisions that govern deductions can also yield a personal benefit: a nice car to drive at a smaller cost, or a combination business trip and vacation. It all depends on paying careful attention to IRS rules on just what isand isn’tdeductible.

When you’re totaling up your business’s expenses at the end of the year, don’t overlook these important business tax deductions.

Who Can Claim Mileage

You can take a medical tax expense deduction only if your overall unreimbursed medical costs exceed 7.5% of your adjusted gross income . You can deduct your mileage at the standard rate of 17 cents per mile for 2020 and 16 cents per mile for 2021, or you can deduct your actual costs of gas and oil. Deducting parking costs and tolls is also allowed.

Youre allowed to deduct mileage for your own treatment, but also if youre transporting a child to receive treatment or if youre visiting a mentally ill dependent as part of a recommended treatment.

You May Like: How Much Does H& r Block Charge To Do Taxes

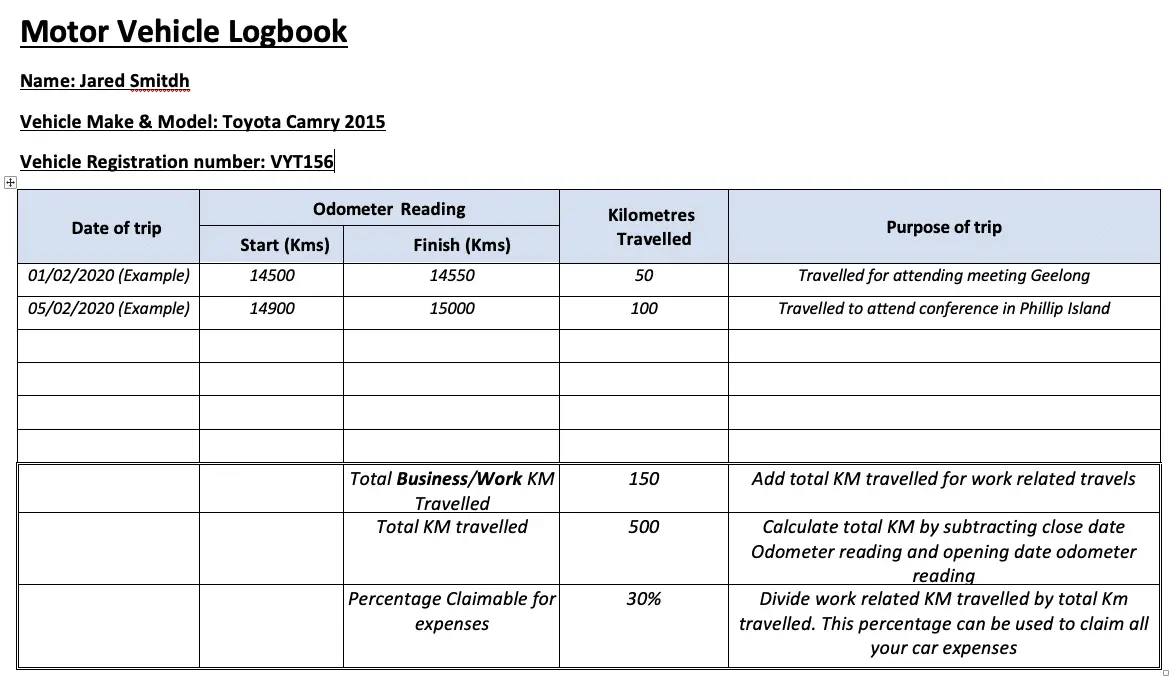

So You Need To Keep A Logbook

In practice, this means that you have to keep a Logbook of all your motor vehicle use throughout the tax year, which is what the Canada Revenue Agency recommends.

Once youve done it once, though, you may be able to use a simplified logbook, keeping detailed records for three months and then extrapolating your business use of your vehicle for the rest of the year.

What Should You Include In Your Cra Mileage Log

There are two ways you can go about it: you can either keep a full logbook, or a simplified logbook. A full logbook will include your business travel information for the entire year. Each entry must include:

- The date of the trip

- The purpose of the trip

- The distance travelled.

To claim vehicle expenses, you must be able to back up your expenses. Keep receipts for all oil changes, routine maintenance, repairs, and gas purchases. It is also a good idea to keep a record of the total kilometres you drive with your vehicle. To do this, record your odometer reading at the start and end of each fiscal period.

You May Like: What Does Agi Mean For Taxes

Keeping Motor Vehicle Records

You can deduct motor vehicle expenses only when they are reasonable and you have receipts to support them. To get the full benefit of your claim for each vehicle, keep a record of the total kilometres you drive and the kilometres you drive to earn income. For each trip, list the date, destination, purpose, and number of kilometres you drive. Record the odometer reading of each vehicle at the start and end of the fiscal period.

If you change motor vehicles during the fiscal period, record the dates of the changes and the odometer readings when you buy, sell, or trade the vehicles.

How Much Can I Claim

You may have extra costs when you are working from home including heating,electricity and broadband costs. Your employer can pay you a contributiontowards these costs or you can make a claim for tax relief at the end of theyear.

If your employer pays you a working from home allowancetowards these expenses, you can get up to 3.20 per day without paying anytax, PRSI or USC on it. If your employer pays more than 3.20 per day tocover expenses, you pay tax, PRSI and USC as normal on the amount above3.20. You should note that employers are not legally obliged to make thispayment to their employees.

If your employer does not pay you a working from homeallowance for your expenses, you can make a claim for tax relief atthe end of the year. You will get money back from the taxes you paid.

If you share your bills with someone else, the cost is dividedbetween you, based on the amount paid by each person see Example 2below.

Your refund of tax is based on:

- How many days you worked from home

- The cost of the expenses

- Revenues agreed rate for calculating the cost of running a home office

Revenues rate for the cost of running a home office is 10% of thecost of electricity and heating. This means that you can claim 10% ofthe total amount of allowable utility bills against your taxes. You can alsoclaim 30% of broadband costs for the tax year 2020. Thisapplies for the duration of the COVID-19 pandemic.

Example 1

To find out how much tax she can claim back, Mary:

Example 2

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Indiana Deductions From Income

- Current: Indiana Deductions from Income

Indiana deductions are used to reduce the amount of taxable income. First, check the list below to see if you’re eligible to claim any of the deductions. If you are, you’ll claim them when you file your annual Indiana income tax return – or .

Important: Some deductions available for earlier tax years may not be listed below. Find information on deductions on their respective webpages.

-

Details

If you received a civil service pension and are at least 62 years of age, then you may be eligible for up to a $16,000 deduction. Beginning with tax year 2015, a surviving spouse may be eligible to claim the deduction.For each qualifying individual, the deduction is limited to:

- the lesser of the amount of taxable civil service annuity income included in federal adjusted gross income or $16,000,

- less all amounts of Social Security income and tier 1 Railroad Retirement income received by the qualifying individual .

Example: The taxable amount of your civil service annuity is $6,000. You received $1,200 in Social Security income. You are age 67.

Here is how to figure your deduction.Lesser of the taxable amount of the annuity or $16,000…………… $6,000Total of Social Security/tier 1 Railroad Retirement income …….. – $1,200Allowable deduction ……………………………………………………………….. $4,800*See for information about the taxability of military pension income.

Who is eligible?

Additional Forms

Who is eligible?

Where To Claim Car Expenses Like Gas

As you know now, freelancers, independent contractors, and small business owners who sometimes drive for work, can claim gas on their taxes if they choose to write off actual vehicle expenses.

If youâre a sole proprietor , then claiming car expenses like gas is very straightforward. You’ll just enter them in Line 9 of your Schedule C, following the instructions given by the IRS.

Don’t Miss: Have My Taxes Been Accepted

How Do I File Gasoline Tax Returns

To maintain gasoline tax accountability, the ministry requires registrants to file monthly gasoline tax returns. Fines and penalties may apply if returns and payments are not received by the due date, are incomplete or tax is not remitted in full.

Once you register with the Ministry of Finance, the ministry will forward a personalized return each month. You must complete this return, even if you did not have any activity during the reporting period.

Captains Of Fishing Boats

As the captain of a fishing boat, you can deduct expenses for which the owner did not pay or reimburse you. These expenses include the cost of personal navigation aids and rubber gear. You can also deduct motor vehicle expenses you paid to transport crew members and to get supplies and parts to use on the boat. You may be able to deduct business-use-of-home expenses and the cost of travel between your home and the fishing boat if you meet certain conditions. For more information, see Line 9281 Motor vehicle expenses and Line 9945 Business-use-of-home expenses.

Read Also: How To File Missouri State Taxes For Free

Can You Write Off Gas On Your Tax Return

Deductions may be on your mind if you’re preparing to get your 2020 taxes finished and filed. Can you write off gas on your tax return? The answer comes down to why and where you’re driving as part of your work. Take a look at what you need to know about taking advantage of tax deductions for gas costs.

Line 9798 Custom Or Contract Work

Enter the expenses you incurred for custom and contract work, and machinery rental. For example, you may have had a contract with someone who cleaned, sorted, graded, and sprayed the eggs your hens produced, or someone who had facilities to age the cheese you produced. You may have also contracted someone to do your harvesting, combining, crop dusting, or seed cleaning.

You May Like: How To Buy Tax Lien Properties In California

Line 9795 Building Repairs And Maintenance

Deduct repairs to fences and all buildings you used for farming, except your farmhouse. Do not include the value of your own labour. If the expenditure improved a fence or building beyond its original condition, the costs are capital expenditures. Add the expenditure to the cost of the asset on your CCA charts on Form T2042. CCA charts are explained in Chapter 4.

If you used your farmhouse for business reasons, see Line 9945 Business-use-of-home expenses.

Will I Have To Post Security

Before the minister issues you a permit, registration certificate or a designation, you may need to provide security through a surety bond or letter of credit.

In most cases, the amount of security required is an amount equal to three months’ average tax collectable and payable or $1 million, whichever is greater.

Acceptable forms of security include:

- Irrevocable Letters of Credit issued by and redeemable at an Ontario branch of a Canadian Chartered Bank in the standard form approved by the ministry.

- Surety Bonds issued by financial institutions registered with the Financial Services Commission of Ontario to deal in surety. See list of registered financial institutions.

- Cash .

Following are links to approved forms:

A new legal entity, which results from the reorganization of an existing collector or registrant, or any entity that undergoes a substantial change in ownership or control, must apply to the ministry for a new designation or registration certificate and must provide new or revised security to reflect the new designation.

Recommended Reading: Do You Have To Report Roth Ira On Taxes

Frequently Asked Questions About Tax Deductions For Businesses

Q: I am self-employed and I need to buy appropriate business attire to meet my clients. Can I deduct these wardrobe purchases as an expense?

A:You cannot deduct the clothing that you will wear. Any personal expenses are not deductible, says the CRAs Trépanier.

Q: I got a parking ticket after a meeting with a client ran late. Can I deduct it?

A:Penalties such as fines and parking tickets cannot be claimed, she says.

Q: I have one cellphone that I use for work and home. How do I claim that as an expense?

A: You have to determine the portion that is used for business and you deduct only that, Trépanier says.

Q: I have a cleaning service and I buy the cleaning supplies for my business. What can I deduct?

A: You can claim the cost of your cleaning staff and your cleaning supplies for your business. If you operate your business at home, you can make these deductions if they are related to your work space, according to Trépanier.

Q: I have the Internet at work. Can I claim it as an expense?

A: It can be claimed 100% at your principal place of business. However, if its a home office, only a portion of the Internet can be claimed for its use in your work space. You have to evaluate the time that you use the Internet for your home business.

Q: I own a small business and I have one car that I use for both work and my family. What is my motor vehicle deduction?

Q: I have an office at my business and at my home. Can I claim both as an expense?

Reimbursing Employees For Gas And Other Car Expenses

Now, what if you run a business with employees who also drive for work?

Say you have employees who drive company cars, or use their personal cars for work. Then you’ll need to reimburse them for what they’re spending on their auto expenses.

Prior to the 2018 tax year, employees were allowed to deduct unreimbursed expenses that exceed 2% of their adjusted gross income if they itemized their deductions. After 2018, though, employees can’t write off unreimbursed gas anymore â you’ll have to pay them back for it.

Soo Lee

Soo has over 10 years of experience in publicly traded companies and public accounting firms offering tax, accounting, payroll and advisory services to clients in diversified industries including manufacturing, wholesale/retail businesses, construction, real estate development and investment, banking, finance and professional/legal consulting service. In Particular, when Soo was at Pricewaterhouse Cooper, Soo worked with many foreign owned U.S. companies and advised clients on a broad range of issues including federal and state tax minimization especially through R& D tax credit, determination of the optimal structure for new foreign investments, restructuring and reorganization for existing operations.

Recommended Reading: How Can I Make Payments For My Taxes

Who Can Claim Gasoline Or Mileage On Taxes

You can claim car-related deductions if you’re self-employed, a small business owner or a freelancer. Those with a 1099 tax form can easily claim a mileage deduction every year. If you’re a W2 employee, you can deduct car-related expenses if you itemize your deductions and it exceeds 2 percent of your Adjusted Gross Income.

How To Report Your Oil And Gas Royalties On A Tax Return

When gas or oil production is started on a plot of land, the owner of the land is entitled to royalties, or a percentage of the lease minus production costs. While oil and gas leasing can generate substantial revenue for a landowner, there are tax implications. Depending on the state, there may be state and local taxes in addition to federal taxes.

Here is how compensation works for oil and gas leasing and how its reported on a tax return.

1. Typical Compensation for Mineral Rights

In most cases, landowners receive two types of compensation for leasing mineral rights: a signing bonus per acre and the percentage of the money generated by the gas and oil from the property. The bonus is most often $200 to $500 per acre. The standard royalty for oil and gas production is 12.5%, but it can be as high as 18% to 25%, according to Blackbeard Data Services. Sometimes the bonus is the only money the landowner receives if no gas or oil is found or the company abandons the prospect.

2. Taxation on Oil and Gas Royalties

The IRS treats royalty payments as regular income. They are subject to the landowners marginal or highest income tax rate. Anyone who receives oil and gas royalties should receive a 1099 form if they received more than $600.

3. Allowed Expenses for Royalties

Landowners can also write off their share of property taxes, production taxes, transportation expenses, marketing costs, accounting fees, and legal fees associated with the royalties.

Recommended Reading: Michigan.gov/collectionseservice