How Do Sources Of Revenue In The Us Compare To Those In The Rest Of The World

In many ways, the United States is unique in how it raises revenue. One important difference is that it relies significantly more on individual income taxes compared to other countries in the Organisation for Economic Co-operation and Development , a group of 36 countries with advanced economies.

The United States also relies much less on consumption taxes. This is because all OECD countries except the United States levy a value-added tax at a relatively high rate. State and local sales tax rates in the United States are low by comparison.

Earned Income Tax Liability

Working individuals are generally required to pay federal income tax, and possibly state and local income taxes, on their earnings.

Employers withhold income tax liabilities from employee wages. But when you are a small business owner, you wont receive wages . And when you dont receive wages, you do not have income taxes withheld from your earnings.

Your earned income tax liability also may include tax from your businesss income, unless you are a C corporation. You can also pay your earned income tax liability by making estimated tax payments throughout the year.

How Do I File A Zero Tax Return

Filing a nil return is no different from filing a regular income tax return.

Don’t Miss: Www..1040paytax.com

Withholding On Pension And Annuity Payments

Individuals receiving regularly scheduled payments from pensions or annuities that are included in their Arizona gross income may elect to have Arizona income tax withheld from those payments. Complete Arizona Form A4-P and submit it to the payer of your annuity or pension to make this election

NOTE: You may use Arizona Form A4-P to elect to have Arizona income tax withheld if you receive regularly scheduled from any of the following:

- Retired or retainer pay for service in the military or naval forces of the United States,

- Payments received from the United States civil service retirement system from the United States government service retirement and disability fund,

- Pensions,

- Traditional Individual Retirement Accounts, or

- Any other annuity.

Property Acquired By Insurers On The Settlement Of A Claim

Transfer to insurers s 184

119. An insurer who makes a supply of property that has been transferred to the insurer in the course of settling an insurance claim is considered, except where the supply is an exempt supply, to have made, at that time, a supply in the course of commercial activities. If the insurer to whom property has been so transferred begins to use the property, the insurer is deemed to have made a supply and to have collected tax equal to the GST/HST on the fair market value of the property.

You May Like: Do You Have To Pay Taxes On Plasma Donations

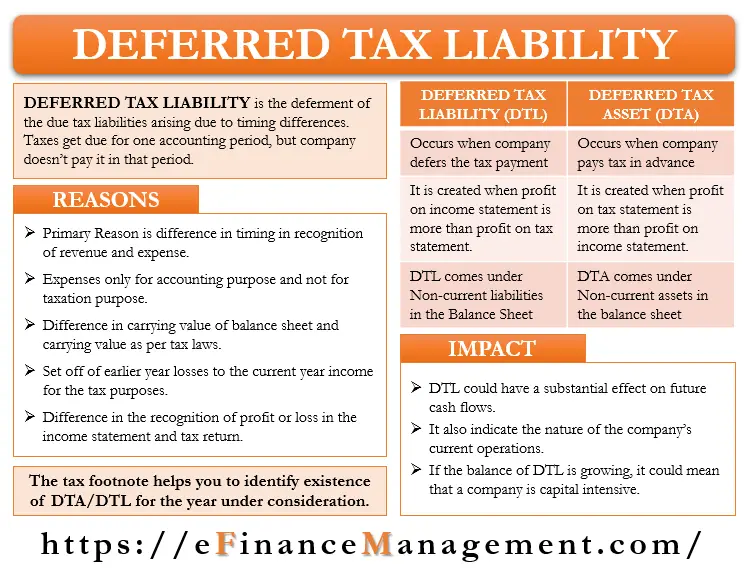

How Does A Tax Liability Work

A tax liability might also be called a ‘tax .’

A tax authority — such as a local, state or national government — imposes upon individuals, organizations and corporations to social programs and administrative roles. include earning , having , receiving or issuing , etc.. These taxes are legally binding.

The is generally calculated by multiplying the by the . The taxing authority has various legal options to enforce these payments.

Example Of An Allowance

If a registered Canadian corporation pays its employee $107 as an allowance for tools to be acquired in a non-participating province in relation to the activities engaged in by the corporation, and the corporation is allowed to deduct that amount as an expense for income tax purposes, the corporation will be deemed to have received a supply of the property and to have paid GST equal to $107 x 7/107= $7. The corporation will, therefore, be entitled to claim an ITC of $7, provided that all other conditions under the Act are satisfied.

Reimbursement ss 175

108. Where a person reimburses an employee, partner or volunteer for property or services incurred on behalf of the person, the person is deemed to have received a supply of the property or service and any GST/HST included in the amount of the supply, which is reimbursed, is deemed to have been paid at the time the reimbursement is paid by that person.

Amount of ITC or rebate claimable for reimbursement

109. The amount of the ITC or rebate in respect of a reimbursement can be claimed on the actual tax paid or on a factor of deemed tax paid for the property or services reimbursed. The factor 14/114 can only apply if 90% or more of the supplies for which the reimbursement is paid were subject to the 15% HST. The method chosen must be used consistently within each category of expenses.

Exception ss 175

Additional information

Don’t Miss: Cook County Appeal Property Tax

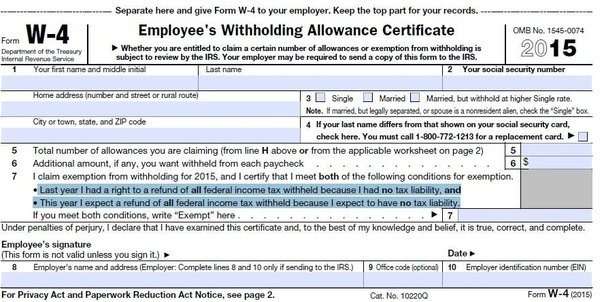

Am I Exempt From Federal Withholding

You use a Form W-4 to determine the determine how much federal tax withholding and additional withholding you need from your paycheck. Form W-4 tells an employer the amount to withhold from an employees paycheck for federal tax purposes.

As you fill out the form whether you take a new job or have a major life change you might wonder am I exempt from federal withholding?

How To Claim Exempt Status

On your W-4, enter your identifying information, such as your name, address, and Social Security number. Do not complete lines 5 and 6 and write Exempt in the box on line 7. Sign and date the form and return it to your employer.

Your employer will stop withholding federal tax after receiving your completed Form W-4. If your situation changes after submitting the form to your employer so that you will owe tax, you must complete a new W-4 within 10 days showing your allowances and additional withholding, if any, and leaving line 7 blank.

Also Check: Do You Have To Report Plasma Donations On Taxes

What Is Double Taxation

Double taxation is when taxes are paid twice on the same dollar of income.

For example, the United States tax code places a double-tax on corporate income with one layer of tax at the corporate level through the corporate income tax and a second layer of tax at the individual level through the dividend and capital gains taxes paid by shareholders.

Additionally, the estate tax creates a double-tax on an individuals income and the transfer of that income to heirs upon death.

Corporate integration and the removal of the estate tax would address these instances of double taxation.

Businesses and individuals residing in one country but earning income in other countries could also face double taxation if more than one country taxes their earnings. Credits for foreign taxes, territorial taxation, and tax treaties can minimize the likelihood of double taxation of foreign income.

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

You May Like: How Much Does Doordash Take In Taxes

Card Issuers With $0 Fraud Liability

Under the Fair Credit Billing Act , you can only be held liable for up to a maximum of $50 in the event of fraudulent charges on your credit card account, as long as you report it within 60 days. However, a number of major issuers take this a step further and guarantee zero liability with the caveat that you have to act quickly when something’s not right.

Since zero-liability guarantees are dependent upon how fast you report fraudulent charges, many of the below issuers also offer 24/7 monitoring to watch for suspicious activity. Each issuer has their own parameters as to what’s considered suspicious, but they usually flag the account when there are large purchases made far away from where you live, or a series of uncharacteristic purchases made back-to-back. Card issuers often send secure messages, text for a confirmation or sometimes even call the primary cardholder to verify that suspicious transactions are legitimate.

Below are three major card issuers who guarantee $0 liability.

Benefits Of Claiming Zero

When you claim zero allowances on your tax return, your employer will withhold a larger portion of your income to pay your income tax liability. Claiming zero makes it less likely that you will end up owing additional taxes to the IRS when you file your tax return at the end of the year. In some cases, claiming zero might entitle you to a tax refund when you file your tax return.

Recommended Reading: Pastyeartax.com Review

Who Pays Taxes In The Us

The simple answer is that everyone pays taxes. The reality of who pays how much is more complicated.

The amount of taxes an individual pays is highly dependent on where they live, how much they earn, what they buy, and what they own, among other factors.

As with any progressive income tax system, U.S. taxpayers with higher incomes pay higher income tax rates. The result: half of taxpayers pay 97 percent of all income taxes.

In fact, after factoring in tax credits aimed at helping low-income individuals, about one-third of U.S. taxpayers pay no income tax at all.

Income taxes are only part of the story, though. Most Americans pay more in payroll taxes than they do in income taxes.

Unlike income taxes, payroll taxes, as well as sales and excise taxes, are regressive. That means lower-income individuals contribute a greater share of their total income towards these taxes than do higher-income individuals.

Even taking this into account, a steeply progressive income tax rate schedule, paired with tax credits that redistribute income from the rich to the poor, ensures that the U.S. tax code is progressive overall. As the chart below shows, the wealthy in America pay a disproportionate share of total federal taxes compared to their share of income.

What Is Tax Liability

Tax liability is the payment owed by an individual, a business, or other entity to a federal, state, or local tax authority.

In general, a tax liability is incurred when income is earned and when income is generated by the sale of an investment or other asset. A local or state sales tax may be incurred when goods are purchased.

It is possible for people to have no income tax liability if their total tax owed was zero or if their income was below the level that would require them to file tax returns.

Don’t Miss: Www.michigan.gov/collectionseservice

Am I Required To Make Estimated Tax Payments

The Michigan Income Tax Act requires that a person must make quarterly estimated payments if the person’s income tax liability, after credits and withholding, will be $500 or more for the year.

Failure to file and make the required estimated payments may result in an assessment or bill for the penalty and interest being issued by the Michigan Department of Treasury.

The Michigan Department of Treasury follows the Internal Revenue Service guidelines for estimated tax requirements. Based on the IRS estimated income tax requirements, to avoid penalty and interest for underpaid estimates, your total tax paid through credits and withholding must be:

90% of your current year’s tax liabilityor 100% of your previous year’s tax liability,or 110% of your previous year’s tax liability if your previous year’s adjusted gross income is more than $150,000 .

Farmers, fishermen and seafarers may have to pay estimates but they do have other filing options. For more information refer to the MI-1040 Instruction Booklet.

Penalty is 25% for failing to file estimated payments or 10% of underpaid tax per quarter. Interest is 1% above the prime rate.

For more information view:

Determining The Nature Of A Supply

Determining the nature of a supply

51. Determining the nature of a supply is important because different treatment under the GST/HST is accorded to different types of supplies. For example, for the purposes of the rules of timing of liability for the tax, the general rule in respect of a taxable supply is that the tax is payable by the recipient on the earlier of the day on which the consideration for the supply is paid and the day on which the consideration for the supply becomes due. However, in the case of a taxable supply by way of sale of real property , the tax is payable on the earlier of the day on which ownership of the property is transferred to the recipient and the day on which possession of the property is transferred to the recipient under the agreement for the supply.

Deemed supplies

52. The provision of a supply generally involves a transaction between two or more persons. There are exceptions to this principle for certain cases where the Act deems a supply to have been made. Refer to paragraphs 81 to 103 for information on deemed suppliers.

Various types of property and services

53. Although the tax applies to all taxable supplies of property and services, special rules for both GST and HST often apply to supplies of different categories and particular kinds of property and services. Therefore, it is necessary to distinguish between the various types of property and services.

Classes of property

Also Check: Will A Roth Ira Reduce My Taxes

What Is A Refundable Credit

A refundable credit is a tax credit that is refunded to the taxpayer no matter how much the taxpayer’s liability is. Typically, a tax credit is non-refundable, which means that the credit offsets any tax liability the taxpayer owes, but if the credit takes this liability amount down to zero, no actual money is refunded to the taxpayer. In contrast, refundable credits can take the tax liability down below zero and this amount is refunded in cash to the taxpayer.

How Is Tax Liability Calculated

Now, lets put all the pieces together. Taking each of the concepts outlined abovemarginal tax rates and brackets, refundable and nonrefundable credits, and standard and itemized deductionshere is an example of how a taxpayers overall liability might be calculated.

Nate is an engineer and earns $75,000. Emily teaches 7th grade and earns $50,000. The couple has two children, ages 7 and 9. In Scenario 1 they rent a townhouse and have no itemized deductions. In Scenario 2, they own their own home and pay $16,000 annually in mortgage interest. They pay a combined $10,000 in property taxes and state income taxes and contribute $2,000 to their church and various charities.

Lets compare their tax liability in the two scenarios:

You May Like: Protesting Property Taxes In Harris County

Whats The Difference Among Tax Credits Deductions And Exemptions

Lets start at the top of the 1040 tax form with your total income, or what is known as Adjusted Gross Income AGI). From your AGI, you subtract your deductions, the largest being either your standard deduction or your itemized deductions. Whats left is your taxable income, the amount upon which you begin to calculate how much you owe in income taxes.

Tax deductions indirectly reduce the amount of taxes owed by reducing taxable income. If a taxpayer earns $200 in income taxed at 10 percent, they will owe $20 . If the same taxpayer receives a $50 deduction, their taxable income will be reduced to $150 and they will owe $15 instead .

Once you have determined your taxes owed, there is one more step. This involves subtracting any tax credits you may be eligible for, such as the Child Tax Credit or various education credits. Tax credits directly reduce the amount of taxes you owe, dollar-for-dollar. So if you owe $100, a $100 tax credit reduces the amount of income taxes you owe to zero a $50 tax credit would reduce the taxes you owe to $50.

How To Figure Out Your Tax Rate If Youre A C Corp

The Tax Cuts and Jobs Act greatly simplified tax calculations for C corporations by replacing the graduated corporate tax rate schedule that included eight different tax rate brackets with a flat 21% tax rate.

In other words, if you own a C corporation, no matter how much taxable income your business has, your income tax rate will be 21%.

Recommended Reading: License To Do Taxes

Ceasing To Be A Registrant

Ceasing to be a registrant ss 171

112. Where at any time a person ceases to be a registrant, that person is deemed immediately before that time to have made a supply of each property consumed, used or supplied in the commercial activity of the person and to have collected tax in respect of the supply based on the fair market value of that property. The person is also deemed to have received that supply. As a result, the person will be required to account for tax on the deemed supply in the person’s last GST/HST return as a registrant.

Capital property deemed non-commercial when ceasing to be a registrant

113. Where at any time a person ceases to be a registrant and that person was using capital property in its commercial activities, that person is deemed immediately before that time to have ceased using the capital property in commercial activities and to have collected tax equal to the basic tax content of the property.

Additional information

114. More information on the responsibilities and obligations of a registrant regarding the treatment of its property upon cancellation will be available in Chapter 8, Input Tax Credits: Eligible ITCs.