Introduce Basic Tax Forms

Here are some of the fundamentals of common tax-related documents and forms. Click on the link to see actual examples of the forms.

When your teen begins a new job, he or she will be asked to complete a Form W-4. Filling out a W-4 helps the employer calculate the correct amount of federal income tax to withhold. To determine the appropriate number of allowances, you can use the withholding calculator at IRS.gov.

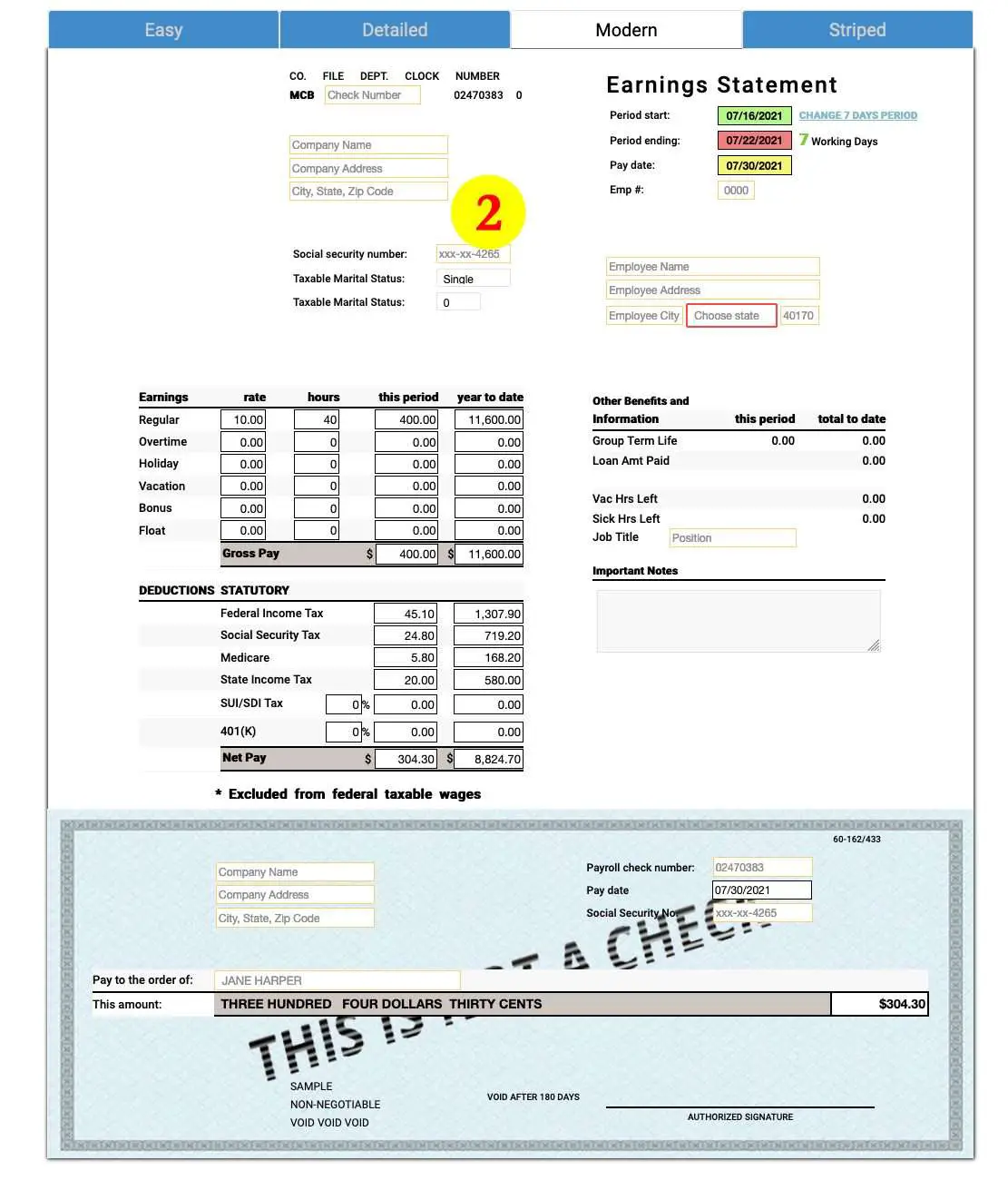

Every paycheck should be accompanied by a pay stub, with information about the employee and the pay period. When your teen receives the first paycheck, be sure to confirm that all of the personal information is correct.

A W-2 reports an entire year’s earned income . Tip income should be tallied daily, reported to employers monthly and included on an annual income tax return, where it’s reported as wages. Employees usually receive at least three copies of the W-2: one for filing with the federal tax return, one for filing with the state tax return and one for filing away in their own records.

What Else You’ll Need

The information listed above will all be on your pay stub. This should be sufficient to file your taxes. However, to make sure you have calculated the right amount and that you aren’t paying too much , you’ll need a tax calculator.You should always do this before going to file your taxes with pay stub. There is no shortage of trustworthy and accurate tax calculators out there on the web. You’ll be able to calculate it accurately by adding in your year-to-date taxable income alongside any leftover taxable income that is not in the pay stub you are using to file your taxes.You should also provide the calculator with further information. If you have any dependents or other similar outgoings, make sure to include those. Also, try and include any tips or expenses that may be relevant. It’s important to make sure the tax calculator you are using is up to date and relevant to the current tax year.Once ran all of this information through a calculator, you should be able to determine if you’re owed a big fat refund by the IRS. Make sure to run the information through several times in order to confirm that your result is accurate.If you find that you’re owed a particularly large refund, it may be that your employer is withholding too much from your paycheck for deductions. Likewise, if you’re unfortunate enough to owe a lot of extra money to the IRS, you should consider arranging more to be withheld from your paycheck for tax purposes.

Why Do You Need To Understand Wage Deductions

Each pay stub includes year-to-date fields for each withholding category so you can track how much money youve paid for taxes, Social Security and Medicare throughout the year. Many employers include a similar listing for contributions to retirement savings plans and health plans. Youll generally see these fields marked as the acronym YTD on your pay stubs.

Any errors in your deductions are your responsibility to report. The last thing you want is for an error to be repeated through several pay periods. If you have questions about any of the information listed on your pay stub, be sure to contact your payroll provider.

Read Also: Taxes On Plasma Donation

Automate The Pay Stub Process With Hourly

Issuing pay stubs to your employees is a must. But manually tracking all the information you need to include on pay stubs is a time-consuming hassle. With Hourly, thereâs no need to worry about keeping track of employee hours or deductions. Our app automatically tracks wages, hours, and deductions, allowing you to issue accurate, up-to-date pay stubs with a few simple clicks.

Ready to simplify your payroll process? Get started with a free trial of Hourly today!

How To Read A Pay Stub

For those who get paychecks, pay stubs can be very important. They must know what to search for and how they should be interpreted. This information is vital for managing money, and avoiding IRS problems. However, the number of people who review their pay stubs remains low. This article will show you how to read your pay stub. Here are some tips to help you understand it better. If you have any inquiries relating to where and exactly how to utilize make pay stubs, you could call us at our own web site.

Identify the main sections of your pay stub. There are three main sections on your pay stub: taxes paid, deductions, and amount. Those related to taxes are usually the most complicated. Some common deductions include different types of insurance, retirement plans, and other expenses. The first number on your pay stub represents your salary. This is the most obvious figure. Similar to the first section, the second contains your tax payments.

Your pay stubs should also show you whether you are paying taxes or not. This information is not always available from employers. This can leave you wondering how you can get more from your paycheck. Fortunately, there are several ways to find your pay stub. You can ask your manager or the human resources department to help you find it. Your pay stub will usually be stored on the payroll services website. This website requires a password. You can then download your stub.

Heres more info regarding make pay stubs review our own web site.

Don’t Miss: Internal Revenue Service Tax Returns

The Difference Between A W

As fall ends and winter begins, employers and HR directors start preparing for the upcoming tax season. One question your employees might ask revolves around the difference between the W-2 vs last pay stub. When employees receive their W-2s each year, they sometimes notice a difference between their last pay stub and whats written on their W-2 form.

Regardless of whether youre new to payroll taxes or youre a seasoned payroll veteran, this topic can be confusing to navigate. But, if youre going to help your employees this tax season, you must comprehend gross pay vs W-2 wages. Weve created this article to help you understand the difference between a pay stub and a W-2, so you can help your employees navigate tax forms successfully.

Creating Contractor Pay Stubs

Before we dive into your contractor pay stub needs, lets discuss how employers typically address pay stubs and all considerations around this. A pay stub is a document that summarizes an employees wage and deductions for a given pay period. It can be used for many different reasons, such as payroll tax calculation, reporting to government agencies such as the Internal Revenue Service , and employee benefits tracking. Employers may also provide pay stubs as a way of providing transparency to employees about how their wages are computed.

Employers use a variety of methods for generating pay stubs. Some choose to generate them in house while others use a third party vendor like Paychex or ADP. Regardless of who generates the pay stubs, employers with a payroll service provider generally provide information on their employees total hours worked and other information like itemized deductions up front to the service provider, which generates the paycheck and pays the employer after withholding any taxes due from gross wages.

Some employers print out paper pay stubs for their employees while others print them out through an online portal that they access through an app on their mobile phone. The decision to print paper pay stubs is often based on how many employees are being paid each paycheck because it can be costly to print a large amount of copies at one time. Out-of-date checks and late payments can present challenges for collecting payment from clients or customers.

Read Also: Protest Property Taxes In Harris County

Can You Use Your Last Pay Stub To File Taxes

If you are unable to obtain your W-2 form, you might be able to file online using your final pay stub for the applicable year. This is because your December stub shows your cumulative figures as well as figures withheld. However, you will need to have your employers unique Employer Identification Number, and since it is not typically printed on pay stubs, you will have to request it from the employer.Providing an incorrect Employer Identification Number could see to your processing period being lengthened or getting audited. If you have this information, you can start filling out your tax return. Nonetheless, when it comes to filing taxes online, the IRS has it that the service is only free to those earning less than $57,000.If you earn more than that figure in a year, you are required to file taxes by printing and mailing the return. The service is also unavailable to those under the age of 16. Additionally, if you currently live in Guam, the Commonwealth of the Northern Mariana Islands, the U.S Virgin Islands, or American Samoa, you might also not be able to file.You will be able to prepare your tax return online but will need to print and mail it.

How Is A Paycheck Or Pay Stub Related To A W

A W-2, Wage and Tax Statement, is issued at the end of the year as a legal tax document. It summarizes the entire years worth of paycheck information in one document. Employers send one copy to the IRS and employees use their copies to file their personal income taxes.

- W-2s are due to are due to the Social Security Administration and employees by January 31 each year.

- The amounts in a W-2 should match the employees final pay stub of the year.

Each time an employee receives a paycheck, he or she should review the pay stub and ask questions if something doesnt make sense or is possibly incorrect.

The longer any error is unfixed, the greater the potential tax and financial implications. For example, if the income tax withholding isnt high enough, the employee will face a larger personal income tax bill. Or, if the employer isnt contributing the right payroll tax amounts, itll cost more to fix the longer it goes on undetected.

In terms of record keeping, employees should keep pay stubs for about a year and W-2s should be kept a minimum of three years. The standards for employers are more difficult to define due to the many labor and tax laws involved. The IRS recommends that employers keep payroll tax records for a minimum of four years. However, as payroll records touch so many areas of compliance, employers should be sure to check all the applicable guidelines.

Also Check: Www.myillinoistax

What Is A Pay Stuband What Does It Need To Include

When you pay your employees each pay period, youâre compensating them for the time they worked, whether theyâre exempt or hourly employees.

But if your employees just get a check or a direct deposit, all they see is their net payâand they might have questions as to how you got to that number. For example, how much of their pay was taken out for income tax? How many hours were they compensated for in the pay period? Or how much have they been compensated this year?

Thatâs where a pay stub comes in. Pay stubs give your employees key insights into their gross payâand what deductions are being taken out of their checks each pay period.

But what, exactly, is a pay stub? What information does it give your employees? And as a small business owner, are you required to give your employees a pay stub with each paycheck or direct deposit?

What Happens To The Payroll Taxes That The Employer Takes Out Or Adds To A Paycheck

The money for federal and state income tax, Medicare, Social Security and federal unemployment payments are all sent to the IRS. Depending on several factors, the funds are deposited on a weekly, monthly, yearly or next-day schedule.

State and local taxes are forwarded and reported to the appropriate state and local tax authorities. Automating this process of depositing and reporting payroll taxes is one of the main reasons businesses use payroll software.

Recommended Reading: Is Door Dash 1099

What Is A Pay Stub

A paycheck stub is a paycheck attachment that goes into the details of an employeeâs current pay as well as their YTD amount. If you give your employees physical checks, the paper pay stub is an actual attachment to their paper check. If you pay your team electronically, their paycheck stub would be digital. Here’s a paycheck stub example, automatically generated by the Hourly app:

Pay stubs help your employees get a better sense of their compensation, including their rate of pay, gross earnings , and any deductions that are being taken out of their pay, like income tax and employee benefits. They can also help employees with proof of income when needed, like for a car loan or to lease an apartment. And, if you provide your team with an online pay stub, they won’t need to ask you every time they need to show that proof of income.

State Requirements For Pay Stubs

The federal government does not have a pay stub law that allstates must follow. However, the Fair Labor Standards Act requires employers tokeep employeetime and pay records. Your states Department of Labor website determines thepay stub rules for your state.

First, you must verify is an opt-out or opt-in state:

Recommended Reading: How Much Tax For Doordash

Whats A Paycheck Checkup

Its barely made the news that, given the recent changes to the tax laws, the Internal Revenue Service is recommending that everyone should do a paycheck checkup. Ever heard of the IRS withholding calculator?

For that matter, whats a withholding amount? Whats the difference between a paycheck and a pay stub? And whos this FICA person anyway?*

This classic moment from Friends pretty much sums things up

How To Request Pay Stubs For Your Small Business

Pay stubs are extremely important for similar web-site a small business. If you beloved this report and you would like to obtain more data about make pay stubs kindly visit our own webpage. The accounting team and human resource department are critical to a small businesss success. Pay stubs are essential for keeping track of employee income. This will allow you to keep your business safe from identity theft and employee turnover. Pay stubs are not only important for requesting raise adjustments, but they can also be used to prove your identity or income in the case of an accident.

While the process for requesting a pay stub may differ from one state to another, it is generally possible to contact your employer to request them. Your request can be directed to the accounting and payroll departments by the human resources department. You can also send your request via email, regular mail or fax. First, you need to locate the payroll service website. Once you have found it, log in to view your pay stubs.

Pay stubs can be important for many reasons. One reason is for tax returns. The stubs are necessary documents to file taxes, so its important to have them handy when filing. Using a paystub generator will allow you to create the documents in minutes, so you wont have to worry about making mistakes. The IRS may sue you if your company fails to provide pay stubs on time.

Don’t Miss: Efstatus/taxact

Understanding The Tax Deductions On Your Pay Stub

- Income tax

- Employee contributions to Employment Insurance

- Employee contributions to the Canada Pension Plan

These deductions mean that the amount on your paycheque will be less than the total you earned. Your employer must withhold and remit these amounts directly to the Canada Revenue Agency . However, you do get credit for having paid these amounts, which are reported on your T4, when you file your annual tax return.

Depending on how you get paid, your pay stub will either be attached to your cheque or to a direct deposit statement. This sample pay stub illustrates the following common terms:

What If Your Pay Period Is Not In This Guide

This guide contains the most common pay periods: weekly, biweekly , semi-monthly, and monthly. If you have unusual pay periods, such as daily , or 10, 13, or 22 pay periods a year, go to the Guide T4008, Payroll Deductions Supplementary Tables, or the Payroll Deductions Online Calculator to determine tax deductions.

You May Like: How To Calculate Doordash Taxes

Deducting Tax From Income Not Subject To Cpp Contributions Or Ei Premiums

We have built the tax credits for CPP contributions and EI premiums into the federal and provincial tax deductions tables in this guide. However, certain types of income, such as pension income, are not subject to CPP contributions and EI premiums. As a result, you will have to adjust the amount of federal and provincial income tax you are deducting.

To determine the amount of tax to deduct from income not subject to CPP contributions or EI premiums, use the Payroll Deductions Online Calculator, available at canada.ca/pdoc. On the “Salary calculation” and/or on the “Commission calculation” screen, go to Step 3 and select the “CPP exempt” and/or “EI exempt” option before clicking on the “Calculate” button.

Canada Pension Plan And Employment Insurance

These programs are run by the federal government and participation is mandatory. You may benefit in the future by receiving payments from these programs. For example, EI protects workers who become unemployed by paying out benefits to those who apply and qualify. If you retire after age 60, the CPP pays benefits to seniors who qualify.

In addition to the amounts that are deducted and withheld from your pay, your employer also makes contributions to EI and CPP on your behalf. The amount depends on how much you contribute.

You May Like: When Do You Do Tax Returns