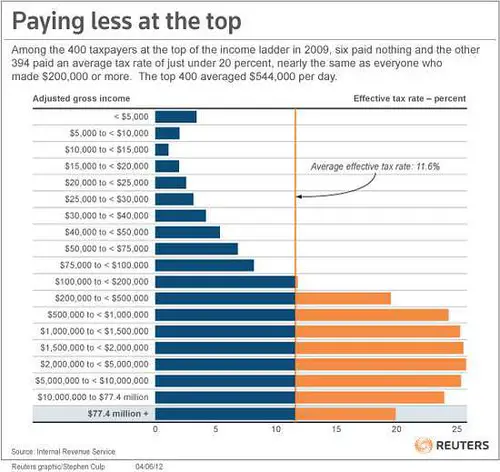

The Forbes 400 Pay Lower Tax Rates Than Many Ordinary Americans

A recent study finds that the Forbes 400 paid an effective tax rate of 8.2 percent over recent yearslower than many middle-class Americans.

A study by White House economists released on September 23 found that the 400 wealthiest U.S. families paid an average income tax rate of just 8.2 percent from 2010 to 2018. This column examines how that low tax rate compares with what ordinary people pay, using six examples of typical workers and families. It illustrates how wages are taxed at higher rates than income derived from wealth and demonstrates how this tiered rate system benefits the richest members of American society. Congress has a rare chance to fix these fundamental problems by passing the Build Back Better agenda, which would expand tax credits for working families and reform the tax treatment of income from wealth.

The Least Regressive State And Local Tax Systems

Ten jurisdictions with more equitable state and local tax systems can be found in Figure 5. Six of the ten California, the District of Columbia, Delaware, Minnesota, New Jersey, and Vermont had positive scores on ITEPs Tax Inequality Index, meaning that their state and local tax systems do not worsen income inequality. Thoughtful, progressive tax policy decisions permitted these six jurisdictions to make their tax systems somewhat more equitable for those with the least ability to pay taxes.

But none of these six tax systems are robustly progressive in a traditional sense. Rather than seeing effective tax rates steadily rise throughout the entire income distribution, some of these jurisdictions see peaks, where taxes on middle-income families are somewhat higher than at the top, or valleys, where low-income families face higher rates than the middle-class.

Several important factors define states with more equitable tax systems. Here is what they have in common:

FIGURE 5

Raising The Corporate Income Tax

The 2017 tax law sharply reduced the corporate income tax rate from 35 percent to 21 percent. There are many reasons for policymakers to revisit this tax cut and adopt the Biden corporate tax proposals. The ProPublica article should add urgency to enact the Biden corporate tax rate increase to 28 percent and the Biden international tax changes to address the long-standing and continued rampant profit shifting to tax havens. The Biden plan seeks, for instance, to strengthen the current minimum tax on certain foreign profits to ensure that more of the foreign income of U.S. multinationals faces the tax, and that its taxed at a higher rate.

The burden of a corporate rate increase would fall mostly on corporate shareholders. he corporate tax is one of the most progressive taxes in our tax system, Treasury Deputy Assistant Secretary Kimberly Clausing told the Senate Finance Committee recently. She added, economic models from organizations as varied as the U.S. Treasury, the Joint Committee on Taxation, the Congressional Budget Office, the Tax Policy Center, and the American Enterprise Institute all agree that the vast majority of the corporate tax burden falls on the owners of capital and those with excess profits. Treasury, for example, estimates that 82 percent of the corporate income tax falls on capital and 18 percent on labor.

Read Also: How To Contact The Irs About My Tax Return

Sales And Excise Taxes

Sales and excise taxes are the most regressive element in most state and local tax systems. Sales taxes inevitably take a larger share of income from low- and middle-income families than from rich families because sales taxes are levied at a flat rate and spending as a share of income falls as income rises. Thus, while a flat rate general sales tax may appear on its face to be neither progressive nor regressive, that is not its practical impact. Unlike an income tax, which generally applies to most income, the sales tax applies only to spent income and exempts saved income. Since high earners are able to save a much larger share of their incomes than middle-income families and since the poor can rarely save at all the tax is inherently regressive.

The average states consumption tax structure is equivalent to an income tax with a 7.1 percent rate for the poor, a 4.8 percent rate for the middle class, and a 0.9 percent rate for the wealthiest taxpayers. Few policymakers would intentionally design an income tax that looks like this, but many have done so by relying heavily on consumption taxes as a revenue source.

On average, states rely more heavily on sales and excise taxes than any other tax source. Sales and excise taxes accounted for 35 percent of the state and local taxes collected in fiscal year 2015. However, states that rely much more heavily on consumption taxes increase the regressivity of their state and local tax systems:

FIGURE 9

The Rich Do Pay Taxes And Other Little

Faculty expert Ed Maydew, senior executive director at the UNC Tax Center, separates rhetoric and reality in the world of tax reform.

U.S. Rep. Alexandria Ocasio-Cortez created quite a stir Sept. 13 when she showed up at the Metropolitan Museum of Art gala with Tax the Rich splashed in red across the back of her white gown.

Ed Maydew

But is tax the rich just a catchy slogan or a viable economic policy? To find out, The Well asked faculty expert Ed Maydew, senior executive director at the UNC Tax Center and the David E. Hoffman Distinguished Professor of Accounting at Kenan-Flagler Business School.

Taxes are a strange subject, Maydew said. There are few things that seem to generate more interest than tax proposals involving rich people and large corporations. As with many decisions, there are trade-offs. In tax, often there is a trade-off between equity and efficiency. Efficiency considers the effects taxes have on production, incentives and the like. Equity refers to whether the tax burden is spread fairly over people.

While researchers can help shed light on efficiency, we have less to offer about equity, because decisions about fairness depend on personal values, Maydew said.

Also Check: What Is Schedule 2 Tax Form

Other Ways To Close Tax Loopholes For The Wealthy

- Pass the Buffett Rule. The Buffett rule, inspired by billionaire Warren Buffett, would require millionaires to pay a minimum tax rate of 30%. This will guarantee that the wealthy will not pay a smaller share of their income in taxes than a middle-class family pays. It would raise $72 billionover 10 years.

- Close the Wall Street carried interest loophole. Wealthy private equity managers use a loophole to pay the lower 23.8% capital gains tax rate on the compensation they receive for managing other peoples money. We should close this loophole so that they pay the same rate as others at their income level who receive their compensation as salary. This would raise $17 billion over 10 years.

- Eliminate the payroll tax loophole for S corporations. This loophole allows many self-employed people to use S corporations to avoid payroll taxes. Used by Newt Gingrich and John Edwards to avoid taxes, closing this loophole would require treating this income as salary rather than profit, making it subject to payroll taxes. This would raise $25 billion over 10 years.

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans

Abstract: We estimate the average Federal individual income tax rate paid by Americas 400 wealthiest families, using a relatively comprehensive measure of their income that includes income from unsold stock. We do so using publicly available statistics from the IRS Statistics of Income Division, the Survey of Consumer Finances, and Forbes magazine. In our primary analysis, we estimate an average Federal individual income tax rate of 8.2 percent for the period 2010-2018. We also present sensitivity analyses that yield estimates in the 6-12 percent range. The Presidents proposals mitigate two key contributors to the low estimated rate: preferential tax rates on capital gains and dividend income, and wealthy families ability to avoid paying income tax on capital gains through a provision known as stepped-up basis.

How the wealthy enjoy low income tax: preferred rates on an incomplete measure of income

The wealthy pay low income tax rates, year after year, for two primary reasons. First, much of their income is taxed at preferred rates. In particular, income from dividends and from stock sales is taxed at a maximum of 20 percent , which is much lower than the maximum 37 percent ordinary rate that applies to other income.

Analyzing a more comprehensive measure of income

Preferred tax rates on income from stock sales and from dividends feature prominently in commonly cited tax rates as well as in our analysis.

Primary estimate and sensitivity

Method

Technical Appendix

You May Like: When Are Us Taxes Due 2021

How The Trump Tax Cuts And Jobs Act Has Benefited The Wealthy

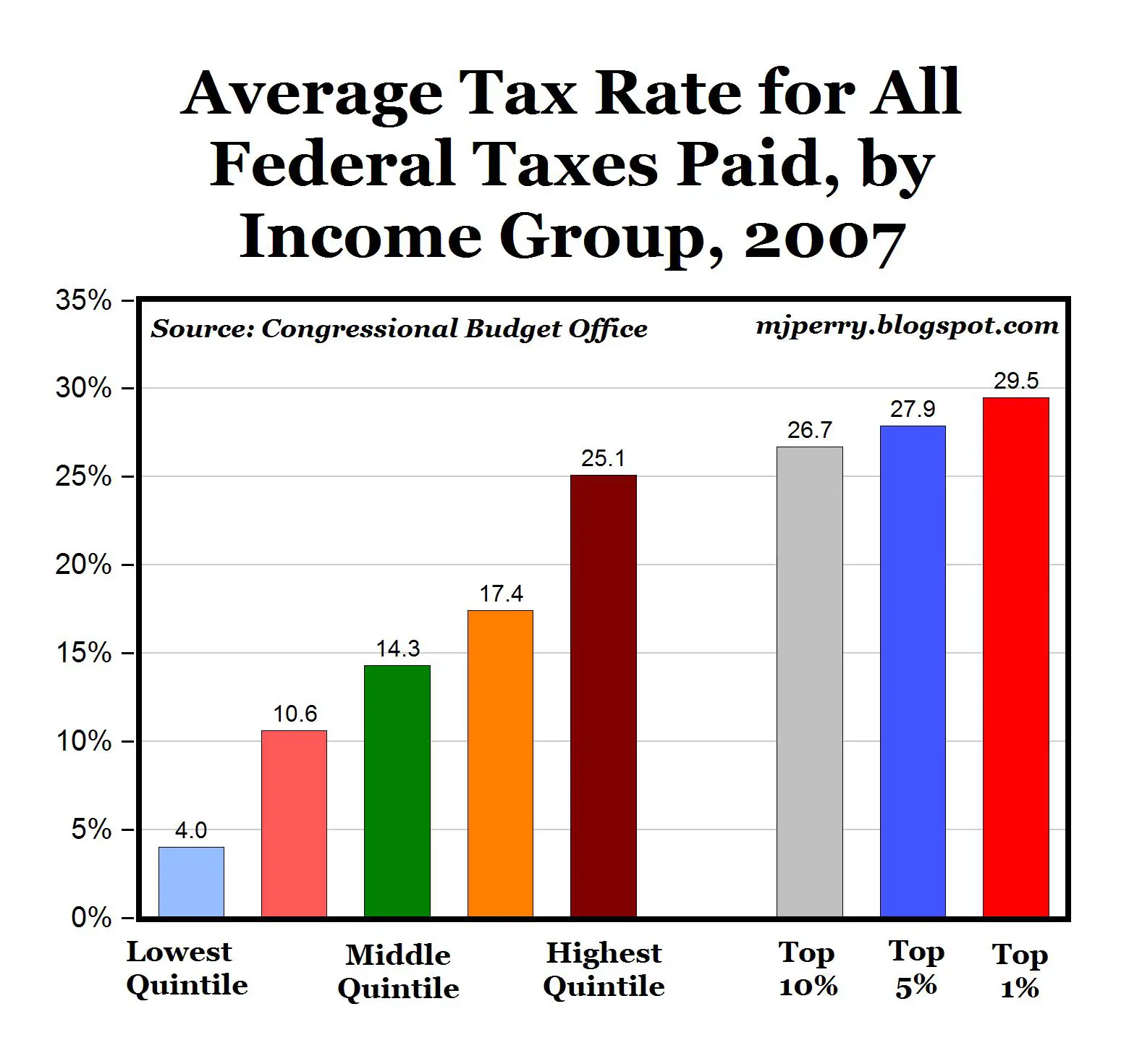

According to authors and economists Saez and Zucman, the Tax Cuts and Jobs Act have benefited the ultra-rich. According to their research, they concluded that in 2018, the top 0.1% the billionaires of America paid an average effective tax rate of 23%, which factors in all federal, state and local taxes. The bottom 50% of U.S. households, however, paid a higher rate of 24.2% toward income tax.

Us Tax System Is Most Business Dependent

Setting aside the debate over whether a low tax bill is fair, what is missed in such discussions is that American businesses are critical to the tax collection system at every level of governmentfederal, state, and local. In 2017, OECD economist Anna Milanez measured the amount of taxes that businesses in 24 countries contributed to the overall tax collection system. Her report determined that the U.S. was one of the most business dependent tax systems in the industrialized world.

The report found that U.S. businesses either pay or remit more than 93 percent of all the taxes collected by governments in the U.S. As Figure 6 shows, this includes taxes paid directly by businesses, such as corporate income taxes, property taxes, and excises taxes, as well as the taxes businesses remit on behalf of employees and customers, such as payroll taxes, withholding taxes, and sales taxes.

Without businesses as their taxpayers and tax collectors, or significantly altering the tax system, American governments would not have the resources to provide even the most basic services. Considering the role of businesses in collecting the taxes needed to support the functions of our government, one would be hard-pressed to say that the system is rigged in their favor.

Read Also: How To Stop Unemployment From Taking Tax Return

How Do I Calculate My Marginal Tax Rate

To calculate your marginal tax rate, you will need to look at the tax bracket table for the current year. First, calculate your adjusted gross income by subtracting the standard deduction or itemized deductions and any other allowable above-the-line deductions from your total income. Then multiply each portion of your AGI by the tax rate for each income level and add the totals for your total income tax obligation.

Low Taxes Or Just Regressive Taxes

This report identifies the most regressive state and local tax systems and the policy choices that drive that unfairness. Many of the most upside-down tax systems have another trait in common: they are frequently hailed as low-tax states, often with an emphasis on their lack of an income tax. But this raises the question: low tax for whom?

No-income-tax states like Washington, Texas, and Florida do, in fact, have average to low taxes overall. However, they are far from low-tax for poor families. In fact, these states disproportionate reliance on sales and excise taxes make their taxes among the highest in the entire nation on low-income families.

FIGURE 10

Figure 10 shows the 10 states that tax poor families the most. Washington State, which does not have an income tax, is the highest-tax state in the country for poor people. In fact, when all state and local taxes are tallied, Washingtons poor families pay 17.8 percent of their income in state and local taxes. Compare that to neighboring Idaho and Oregon, where the poor pay 9.2 percent and 10.1 percent, respectively, of their incomes in state and local taxes far less than in Washington.

Recommended Reading: How Much Federal Tax Should Be Withheld From My Paycheck

Tax Cuts And Tax Fairness

Democratic party leaders have taken rhetorical shots against tax reform bill since it was introduced back in 2017. During the debate, Speaker of the House Nancy Pelosi went so far as to the TCJA the worst bill in the history of the United States Congress. Senate Minority Leader Chuck Schumer also disparaged the bill as a product that no one can be proud of and everyone should be ashamed of.

Progressives continue to assail the TCJA in the years since its passage. A few days before the election, the Center for American Progress, a self-described progressive policy institute, the tax system unfair and said the results of the TCJA were a hugely regressive tax cut.

This ignores that most taxpayers paid less thanks to the TCJA. In fact, the Tax Policy Center estimated that nearly two-thirds of households paid less income taxes in 2018 than they would have under the pre-TCJA code, while 6 percent paid more .

Low-income households having very little tax burden to cut in the first place, in dollar terms, is also why tax cut proposals targeted at lower-income households rely heavily on refundable credits. Like other tax credits, these reduce a filers income tax liability. But unlike nonrefundable credits, any remaining credits are paid to the filer. The refundable portion manifests as direct spending through the tax code.

What To Watch For

In order to pay for his $1.8 trillion American Families Plan, an ambitious spending proposal designed to dramatically increase investment in education, childcare and universal family and sick leave, President Biden has proposed a series of tax hikes on the wealthiest Americans and wants to funnel more money to the IRS so it can step up enforcement and audits of the wealthy. Bidens proposed hikes include increasing the top ordinary income tax rate from 37% to 39.6% and taxing capital gains and dividends at the higher ordinary income rate for households making more than $1 million per year. Biden also wants to eliminate the step-up in basis for previously untaxed capital gains passed down to heirs above $1 million for individuals or $2 million per couple-currently, step-up means that all the unrealized capital gains that accrued to a wealthy person who has just died are never taxed.

Recommended Reading: What Are Itemized Tax Deductions

Ato Reveals How Much Tax The Rich Pay

New data from the Australian Taxation Office has revealed exactly how much money those in the highest tax bracket have forked out in taxes.

Despite assumptions that the rich pay little tax, the data actually tells us a different story.

According to the ATOs

Interestingly, those in the top tax bracket only make up around 3.6 per cent of all taxpayers.

So, 3.6 per cent of Aussies account for more than 31 per cent of tax revenue.

The majority of tax revenue comes from those earning $90,001-$180,000 – which makes up 36.8 per cent of tax paid.

However, only 16.5 per cent of the number of taxpayers fall into this category.

The majority of Aussies fall into the $37,001-$90,000 tax bracket and account for 29.8 per cent of the taxes paid.

The ATO also revealed which professions paid the most.

Surgeons took out the top spot yet again – a position they have held since at least 2010.

Surgeons are raking in around $406,068 per year on average – up from $394,000 in the previous financial year.

Here are the top 10 highest-paid professions in the country.

And there is a good chance many of these professionals live in New South Wales, which dominated the list for the wealthiest suburbs.

NSW takes out seven of the top 10 wealthiest postcodes, but it was a Western Australian suburb that took out this year’s number one spot.

Here are the top 10 wealthiest postcodes in the country.

Income Tax Provisions That Benefit Low

A key tool that states have available to enhance income tax fairness and lift individuals up and out of poverty are low-income tax credits. These credits are most effective when they are refundable that is, they allow a taxpayer to have a negative income tax liability which offsets the regressive nature of sales and property taxes and are adjusted for inflation so they do not erode over time.

Twenty-nine states and the District of Columbia have enacted state Earned Income Tax Credits . Most states allow taxpayers to calculate their EITC as a percentage of the federal credit. Doing so makes the credit easy for state taxpayers to claim and straightforward for state tax administrators.

Refundability is a vital component of state EITCs to ensure that workers and their families get the full benefit of the credit. Refundable credits do not depend on the amount of income taxes paid rather, if the credit exceeds income tax liability, the taxpayer receives the excess as a refund. Thus, refundable credits usefully offset regressive sales and property taxes and can provide a much-needed income boost to help families pay for basic necessities. In all but five states , the EITC is fully refundable. The use of low-income tax credits such as the EITC is an important indicator of tax progressivity: only two of the ten most regressive state income taxes have a permanent EITC, while all of the ten relatively progressive state income taxes provide a permanent EITC.

Read Also: How To Get My Tax Return Faster

Impose A Tax On Wealth

Incomeis different from wealth. Income is what you earn from your labor each year as wellas interest, dividends, capital gains, and rents . Wealth is the value of the things you own, such as stocks, bonds, houses,etc. The federal government taxes income, but generally doesnt tax wealth exceptwhen someone makes a profit on the sale of assets, such as a share of stock or apiece of property. The Federal Reserve estimatesthat the top 1% holds slightly more wealth than entire the bottom 90% ofthe population , and their share has rising been over time.

Senator Elizabeth Warrens proposal would impose a 2% annual tax onhouseholds with a net worth of more than $50 million, and a 3% tax on every dollarof net worth over $1 billion. A family worth $60 million, for instance, would owe$200,000 in wealth tax on top of their income taxes. The developers of this tax,Emmanuel Saez and Gabriel Zucman of the University of California at Berkeley, estimatethat 75,000 householdsor about one out of 1,700would pay the tax.