Where Can I Get Tax Forms

- Obtaining tax forms is one of the first steps in completing returns for many people. Find out where you can get tax forms and where you probably can’t.

Older adults may remember when tax forms were readily available in locations such as public libraries and post offices. The IRS also used to automatically mail forms to tax payers. But it’s not as easy to get your hands on a physical copy of these forms today. Find out where you can get tax forms below.

Deadlines For Making Tax Forms Available To You

The IRS has established deadlines by which employers and financial institutions must mail you these forms or make them available electronically. Here are the deadlines for when youre supposed to receive some of the most common forms people need to file their 2021 tax returns.

- 1099-S, Proceeds from Real Estate Transactions Feb. 1

- Schedule K-1, Partner’s Share of Income, Deductions, Credits, etc. March 15

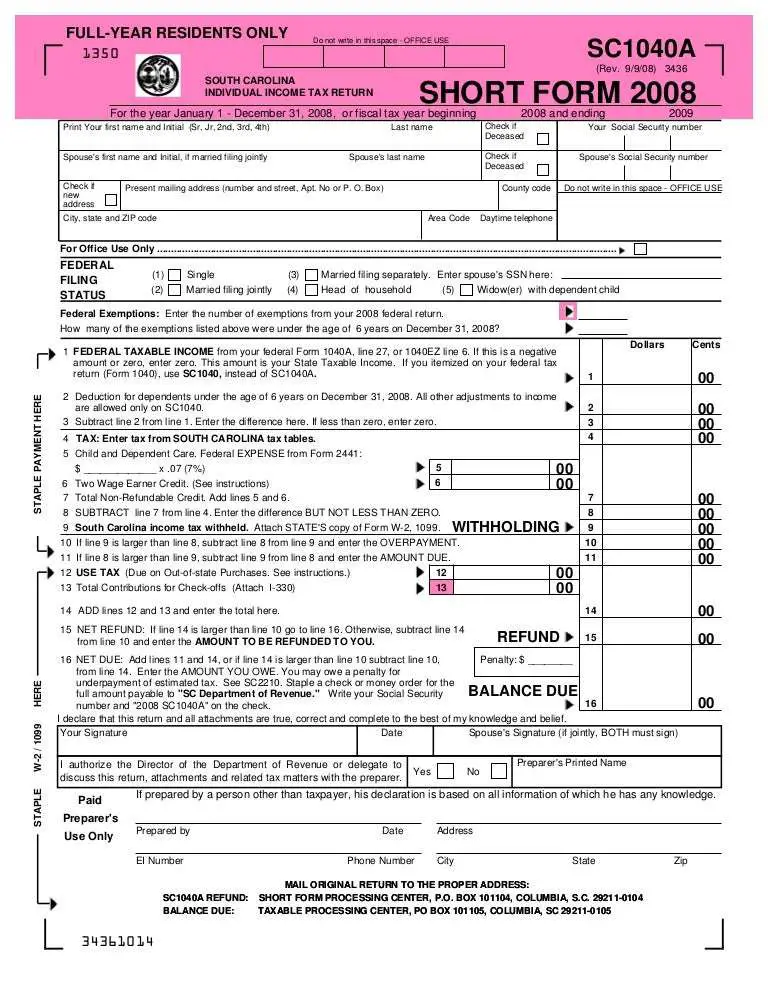

Choose The Right Income Tax Form

Your residency status largely determines which form you will need to file for your personal income tax return.

If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000.

If you lived in Maryland only part of the year, you must file Form 502.

If you are a nonresident, you must file Form 505 and Form 505NR.

If you are a nonresident and need to amend your return, you must file Form 505X.

If you are a nonresident employed in Maryland but living in a jurisdiction that levies a local income or earnings tax on Maryland residents, you must file Form 515.

Special situations

If you are self-employed or do not have Maryland income taxes withheld by an employer, you can make quarterly estimated tax payments as part of a pay-as-you-go plan, using Form PV. Please refer to Payment Voucher Worksheet for estimated tax and extension payments instructions.

If you owe additional Maryland tax and are seeking an automatic six-month filing extension, you must file Form PV along with your payment by April 15, 2020. You should file Form PV only if you are making a payment with your extension request.

If you need to make certain changes to your original Maryland return that has already been filed and processed, you must file Form 502X for 2019 to amend your original tax return.

Recommended Reading: Who Does Not Have To File Taxes

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

Where Can I Get Irs Tax Forms

The easiest way for most people to get tax forms is online. The IRS provides a web page specifically for this purpose. You can find the most common tax forms here, including all the versions of Form 1040, which is the individual tax return.

The IRS also links to the instructions for completing these forms. You can also search for forms by name or number.

Don’t Miss: How To Pay Quarterly Taxes

Which 2021 Tax Forms Do I File

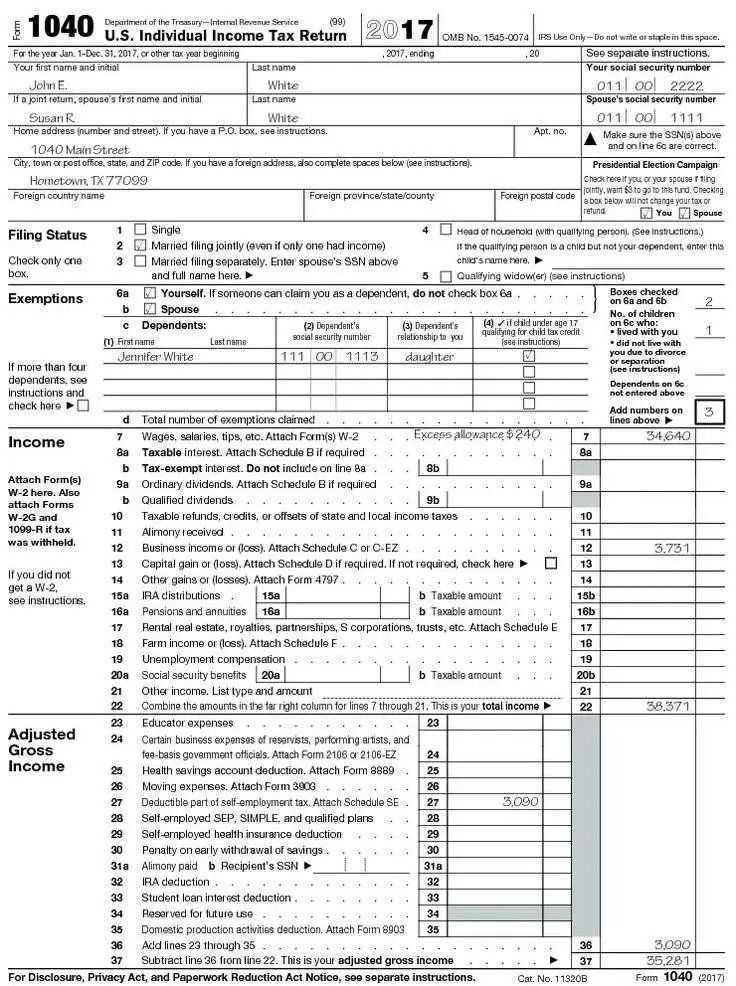

If you don’t know which federal tax forms to file, start by downloading the 2021 Form 1040 and the 2021 1040 Instructions. The instructions will tell you if you need to file, and, when you need to download additional forms. In general, you will skip the line items that do not apply to you.

Most US resident taxpayers will file Form 1040 for tax year 2021. Seniors age 65 and older have the option to file Form 1040-SR this year, which is basically the same as Form 1040. Nonresident taxpayers will file Form 1040-NR. Commonwealth residents will file either Form 1040-SS or Form 1040-PR.

If you need to amend a federal income tax return, file Form 1040X.

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income you’ve made

- ensure you’ve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

Don’t Miss: How Long Does It Take To Get Your Taxes

How Can I Get My T4

- If you need a T4 slip for the current tax year, your employer should be able to provide it to you. Employers are required to provide T4s by the end of February.

- For previous tax years, you can request a copy from the Canada Revenue Agency or by calling 1-800-959-8281.

- Get Your T4 and Other Tax Forms Online From CRAs Auto-fill my return

With the Canada Revenue Agencys secure online My Account system and Auto-fill my return, you can access many of your tax forms, including:

- RRSP contribution receipts

- Unused amounts for tuition/education/textbook credits and past losses.

Auto-fill my return has revolutionized the way Canadians do their taxes. It helps you get a jump start on your taxes by enabling you to securely download your most up to date and accurate tax slips from the CRA then it automatically uploads the information right the proper spot in your return using a trusted software like TurboTax. You save time and frustration by not searching for your slips and entering box numbers.

TurboTax has been serving Canadians since 1993. It is the #1 selling tax preparation software across the country. We have a variety of product options to serve every individuals needs. Recently added a LIVE service to enable our customers to have access to tax experts at the tip of your fingers. Go ahead and give it a try! Easy to use with a choice of support options to assist you with all your taxation needs.

References & Resources

What You Need To Know

Before filing, you can learn more about the advantages of filing online. Electronic filing is the fastest way to get your refund. If you file online, you can expect to receive your refund within 2 weeks. If filing on paper, you should receive your refund within 6 weeks.

These forms are subject to change only by federal or state legislative action.

All printable Massachusetts personal income tax forms are in PDF format. To read them, you’ll need the free Adobe Acrobat Reader.

If you have any suggestions or comments on how to improve these forms, contact the Forms Manager at .

If you need information about the most common differences between the federal and Massachusetts state tax treatment of personal income, please visit our overview page.

Also Check: Which Hybrid Cars Are Eligible For Tax Credits

When Getting Ready To Fill Out Your Tax Forms

Even before you start doing your 1040 tax forms, you need to have the following material ready:

- Valid identification

- Submitting status and Residency status

- Social Security Numbers for yourself

- Birth dates for yourself

- A duplicate of your previous income tax return

- Documents of salary received

- Statements of interest/dividends from finance institutions, brokerages, etc.

- Evidence of any tax credits, tax deductions, or tax exemption

- Your checking account number and routing number

Keep in mind that IRS Tax Form 1040, with the payment amount, is owed by April 15. A 6-month tax continuance may be allowed for overdue submitting. However, payments still have to be made by April 15. You can file Form 1040 by paper mail, via IRS e-file, or by way of a certified tax preparer.

How To Get Forms

With the continued growth in electronic filing and to help reduce cost, the North Carolina Department of Revenue will no longer mail paper tax forms and instruction booklets with preprinted labels to individuals. If you still wish to use a paper form, the Department has several options available to help you obtain paper copies of individual income tax forms and instructions:

- To download forms from this website, go to NC Individual Income Tax Forms.

- To order forms, call 1-877-252-3052. Touch tone callers may order forms 24 hours a day, seven days a week.

- You may also obtain forms from a service center or from our Order Forms page.

If you use computer software to prepare your income tax return, go to List of Approved Tax Forms of Software Developers to determine if the software being used has been approved by the Revenue Department. Computer-generated forms that cannot be processed in the same manner as the Department’s forms will be returned to you with instructions to refile on an acceptable form.

Also Check: Is Aaa Membership Tax Deductible

Consider Filing Online To Avoid Delays

If you choose to file by paper, file before the deadline to avoid any interruptions to any benefit and credit payments. Our service standard is to issue your notice within two weeks of receiving your digital return. Due to COVID-19, the CRA may take 10 to 12 weeks to process paper returns. The CRA will process them in the order they are received. Taxpayers who file electronically and who are signed up for direct deposit may get their refund in as little as eight business days.

We encourage you to file your taxes online and sign up for direct deposit and My Account early. Filing online is the fastest and easiest way to do your taxes. If youre registered for My Account, you can also use Auto-fill my return to quickly fill in parts of your return with information the CRA has on file. Filing online also helps you get your refund faster and avoid any delays. If youre registered for direct deposit, youll receive your payments without delay.

You can file as early as February 21, 2022 with NETFILE. If you chose to file online using NETFILE, youll need an eight-character alphanumeric access code before filing. This unique code can be found to the right, beneath the Notice details box on the first page of your notice of assessment. Your access code will let you use information from your 2020 tax return when confirming your identity with the CRA. Your access code isnt mandatory, but without it youll have to rely on other information for authentication purposes.

Get Your Refund Faster By Filing Online

Filing income taxes online is usually safer, quicker, and more straightforward. Also, you can get your tax refund a lot faster should you opt for the Direct Deposit method. While there are a few income tax forms to pick from when preparing your federal income taxes, a reliable option is to use IRS Form 1040 when you are unsure if you will be eligible for the 1040A or 1040EZ.

- The standard guideline is: If uncertain, submit Tax Form 1040.

- You have to submit Form 1040 once any of the following apply:

- You have taxable earnings of $100,000 or higher

- You have self-employment earnings of $400 and up

- You had income tax being taken from paychecks

- You made anticipated income tax payments or have overpayment that applies to the current tax year

- You have listed deductions

- You generate revenue from a company, S-corporation, partnership, trust, rental, or farm

- You have sold real estate, stocks, bonds, or mutual funds

- You are claiming revenue alterations

- You got an advance payment for Earned Income Tax Credit from a company

- You have a W-2 that indicates uncollected tax or a W-2 that demonstrates a code Z

- You owe excise tax on insider stock payment

- You are a person in debt in a Chapter 11 personal bankruptcy case

- You make foreign income, paid foreign income taxes, or are claiming tax treaty benefits

- You are obligated to repay any further special taxes

Read Also: What Can Be Itemized On Taxes

Filing Your Income Tax And Benefit Return On Paper

If you filed on paper last year, the Canada Revenue Agency will automatically mail you the 2021 income tax package by February 21, 2022.

The package you will receive includes:

- a letter from the Minister of National Revenue and the Commissioner of Revenue

- the Federal Income Tax and Benefit Guide

- an information guide for your province or territory

- two copies of the income tax and benefit return

- Form 428 for your provincial or territorial tax

- File my Return invitation letter and information sheet, if youre eligible for the service

- personalized inserts or forms, depending on your eligibility

- a return envelope

If you havent received your package by February 21, you can:

- view, download, and print the package from canada.ca/taxes-general-package

- order the package online at canada.ca/get-cra-forms

- order a package by calling the CRA at 1-855-330-3305

It can take up to 10 business days for publications and forms to arrive by mail.

When Can I File My 2021 Tax Return

You can file a 2021 tax return after January 1, 2022. However, the IRS will not start processing tax returns until late January 2022. Also keep in mind that Form 1040 instructions are often not finalized until the middle of January.

Many of the IRS forms and instructions are published late in December of each year. When published, the current year 2021 PDF file will download. The prior tax year 2020 PDF file will download if the IRS has not yet published the form.

Read Also: How To Find Delinquent Property Tax List

Personal Income Tax Rates

The rates are based on the following income tax brackets:

| Tax Rate |

|---|

| $314,928.01 and up |

The dividend tax credit rate for dividends paid out of income taxed at the general corporate income tax rate will be adjusted on January 1, 2021, corresponding with the acceleration of the general corporate income tax rate reduction announced June 29, 2020 in Albertas Recovery Plan.

How To Find And File Your Federal Tax Forms

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Michelle P. Scott is a New York attorney with extensive experience in tax, corporate, financial, and nonprofit law, and public policy. As General Counsel, private practitioner, and Congressional counsel, she has advised financial institutions, businesses, charities, individuals, and public officials, and written and lectured extensively.

If bureaucracies are good at anything, its creating paperwork, and the Internal Revenue Service is the king of all bureaucracies, especially when it comes to tax forms. Most paperwork needed for filing your federal tax return can be completed and submitted electronically, but youll need to acquire some forms, on paper or via the web, to get the job done. Well explain how to find and obtain the forms you need, how often the IRS updates its forms, and the options for filing your tax forms online.

For the 2021 tax year, the U.S. tax season began on Monday, January 24, 2022, which is when the IRS begins accepting and processing 2021 returns.

Also Check: Can I File Back Taxes Online

Need Help Or Have Questions On Filing Your Income Tax And Benefit Return

If you have a modest income and a simple tax situation, volunteers at a free tax clinic may be able to complete your tax return. Free tax clinics are available in-person or virtually. Find out about the Community Volunteer Income Tax Program by going to canada.ca/taxes-help.

If you have a lower or fixed income, you may be eligible to use File my Return. This service will let you file your return by answering a series of short questions through a secure, dedicated, and automated telephone service. If you filed a paper return last year and are eligible to use File my Return, youll receive an invitation letter with the 2021 income tax package sent by the CRA. Starting February 21, 2022, you can use File my Return to quickly file your return by phone.

Prior Year Forms & Instructions

Make your estimated tax payment online through MassTaxConnect. Its fast, easy and secure.

- Form 1-ES, 2022 Estimated Income Tax Payment Vouchers, Instructions and Worksheets

- Form 2-ES, 2022 Estimated Tax Payment Vouchers, Instructions and Worksheets for Filers of Forms 2 or 2G

- Form UBI-ES, 2022 Non-Profit Entities Corporation Estimated Tax Payment Vouchers and Instructions

Income and Fiduciary Vouchers these estimated tax payment vouchers provide a means for paying any taxes due on income which is not subject to withholding. This is to ensure that taxpayers are able to meet the statutory requirement that taxes due are paid periodically as income is received during the year. Generally, you must make estimated tax payments if you expect to owe more than $400 in taxes on income not subject to withholding. Learn more.

Read Also: Do Your Own Taxes Online

Individual Tax Forms And Instructions

We offer several ways for you to obtain Maryland tax forms, booklets and instructions:

You can also file your Maryland return online using our free iFile service.

Do Not Send

- Federal forms or schedules unless requested.

- Any forms or statements not requested.

- Returns by fax.

- Returns completed in pencil or red ink.

- Returns with bar codes stapled or destroyed.

Fill-out forms allow you to enter information into a form while it is displayed on your computer screen and then print out the completed form. You must have the Adobe Acrobat Reader 4.1 , which is available for free online. You can also print out the form and write the information by hand. Fill-out forms are better than hand written forms because they offer a cleaner and crisper printout for your records and are easier for us to process.

IMPORTANT: The Acrobat Reader does not allow you to save your fill-out form to disk. To do so, you must have the full Adobe Acrobat 4.1 product suite, which can be purchased from Adobe. Maryland fill-out forms use the features provided with Acrobat 3.0 products. There is no computation, validation or verification of the information you enter, and you are fully responsible for the accuracy of all required information.