Tax The Rich Liberals Renew Push For State Wealth Taxes

Posted: Jan 20, 2023 / 05:49 PM CST

Posted: Jan 20, 2023 / 05:49 PM CST

Supporters of taxes on the very rich contend that people are emerging from the COVID-19 pandemic with a bigger appetite for what theyre calling tax justice.

Bills announced Thursday in California, New York, Illinois, Hawaii, Maryland, Minnesota, Washington and Connecticut vary in their approaches to hiking taxes, but all revolve around the idea that the richest Americans need to pay more.

All of the proposals face questionable prospects. Similar legislation has died in state legislatures and Congress. But the new push shows that the political left isnt ready to give up on the populist argument that government can and should be used as a tool for redistributing wealth.

Under the pandemic, while people struggled to put food on the table, we saw billionaires double their wealth, said California Assembly Member Alex Lee, a Democrat.

The Tax Foundation, a conservative-leaning policy organization, called wealth taxes which levy taxes not just on new income, but on a persons total assets economically destructive.

It also said in a statement that such taxes create perverse incentives for the rich to avoid taxes, including simply moving to states with a lower tax burden.

In Connecticut, progressive lawmakers are proposing more traditional hikes: a higher tax rate on capital gains earnings for wealthy taxpayers and higher personal income tax rates for millionaires,

Federal Income Tax Withholding From Payments That Are Not Wages

There are some types of pay that must be reported as taxable wages, but are not subject to withholding. The most common example for state employees is the imputed value of life insurance in amounts above $50,000.

An employee can have up to $50,000 of life insurance as a tax-free benefit. However, if the value of the life insurance exceeds that threshold, the amount above the threshold is taxed based on the employees age, the amount contributed toward the purchase of the life insurance by the employee, and the IRS table for the cost per $1,000 of coverage. The IRS does not require an agency to withhold above $50,000 of life insurance but does require the agency to report the amount as taxable wages.

An agency can allow withholding on payments considered taxable wages but not subject to withholding based on an agreement by the agency and a decision by its employees. The agency can present a statement to its employees offering to withhold on payments that are not considered wages. If the agency and all its employees agree to this arrangement, then the agency will withhold FIT. If any employee does not wish to have the payment withheld, then the withholding will not be applied at the agency. However, the agency must report the wages as taxable on W-2 reports and the Employers Quarterly Federal Tax Return 941.

Texas Inheritance Tax And Gift Tax

There is also no inheritance tax in Texas. However other states inheritance taxes may apply to you if a loved one who lives in those states gives you money, so make sure to check that states laws. For example, in Pennsylvania, there is a tax that applies to out-of-state inheritors. If you have a loved one who dies in Pennsylvania and leaves you money, you may owe taxes to that state.

Texas also has no gift tax, meaning the only gift tax you have to worry about is the federal gift tax. The gift tax exemption for 2022 is $16,000 per year per recipient, increasing to $17,000 in 2023. Gifting more than that to any individual person in a single year means that the amount over the limit counts against your lifetime exemption of $12.92 million.

Read Also: Does Illinois Have State Income Tax

Which State Has The Highest Income Tax

That depends on how much is earned. Some states impose a flat tax while others offer varying rates of taxation depending on the amount of income generated. In the 2021 tax year, the highest marginal income tax rate is 13.30% in California. However, that rate is only paid on income in excess of $1 million.

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

Also Check: How To File Income Tax

Final Franchise Tax Reports

Before getting a Certificate of Account Status to terminate, convert, merge or withdraw registration with the Texas Secretary of State:

- A Texas entity, terminating, converting or merging, must file its final tax report and pay any amount due in the year it plans to terminate, convert or merge.

- An out-of-state entity, ending its nexus in Texas, must file its final report and pay any amount due within 60 days of ceasing to have nexus.

Reason Number Three These Taxes Are Set At A Local Government Level

The State of Texas doesnt determine what your property tax bill will be, as this is set by your local authorities. While this is a good thing in some ways, as it keeps the power to change taxes local to your own community, it does mean that the state government cant act to regulate or influence this taxation. The most they can do is pass a bill that tightens regulations on tax hikes, pass a law that allows residents of Texas to vote on tax increases in their local community, or increase state funding for public education . For these changes to occur, they would have to be passed by the state legislature, which hasnt happened at this point. In fact, state funding for public education has dropped in recent years from 45% to 38%.

Recommended Reading: Can I Check My Property Taxes Online

State Income Taxes On Businesses

Some states impose an income tax on corporations, partnerships, and certain trusts and estates. These states frequently offer lower corporate rates and special exemptions to attract businesses to locate there. States cannot impose an income tax on a U.S. or foreign corporation unless it has a substantial connection, called a nexus.

Requirements for a nexus are different among states, but they generally include earning income in the state, owning or renting property there, employing people there, or having capital assets or property there. Even then, the income taxes imposed are apportioned and nondiscriminatory and require that other constitutional standards are met.oo

Understanding State Income Tax

Tax laws, rates, procedures, and forms vary widely from state to state. Filing deadlines also vary, but for individuals, state tax day usually falls on the same day as federal tax day, which is typically April 15.

Taxpayers must file tax returns in each state and each year that they earn an income greater than the states filing threshold. Many states conform to federal rules for income and deduction recognition. Some may even require a copy of the taxpayers federal income tax return to be filed with the state income tax return.

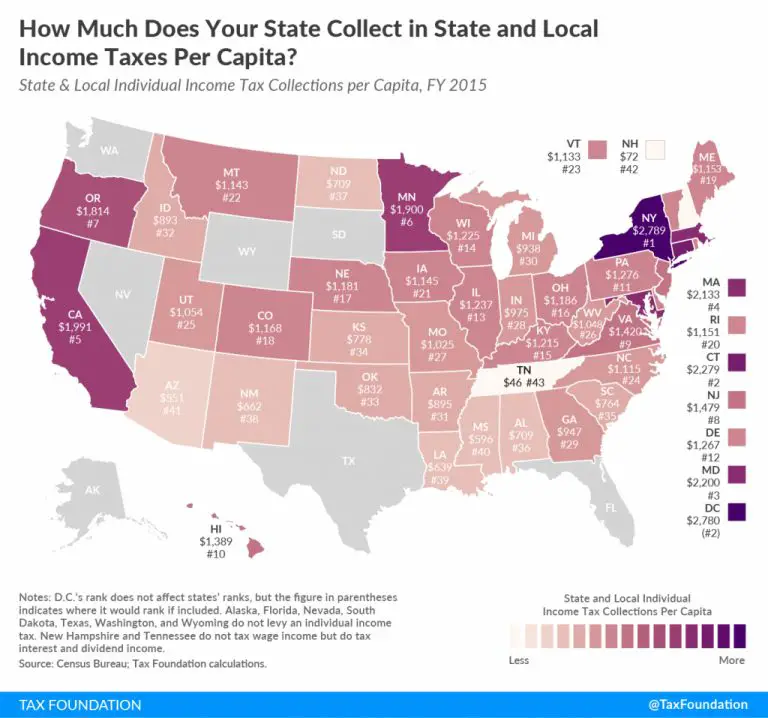

As of 2022, eight states have no income tax: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. New Hampshire, which doesn’t tax earned wages, will join that list in 2027 when it finishes phasing out taxation on unearned income, such as interest and dividends.

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not levy state income taxes, while New Hampshire doesn’t tax earned wages.

All the other states and Washington, D.C., have a state income tax. If you live in a state that levies an income tax, avoidance of it by working in a no-income-tax state is not possible. Your home state will continue to tax the income even though your earnings were made in a no-income-tax state.

Read Also: How Do You Paper File Your Taxes

Total Tax Burden: 614%

With an estimated six people per square mile, Wyoming is the second least densely populated state, bested only by Alaska, which has roughly one human being for every square mile. Citizens pay no personal or corporate state income taxes, no retirement income taxes, and enjoy low sales tax rates. The total tax burdenincluding property, income, sales, and excise taxes as a percentage of personal incomeis 6.14%, ranking the state third lowest.

Like Alaska, Wyoming taxes natural resources, primarily oil, to make up for the lack of a personal income tax, according to reporting in the Cowboy State Daily. The state ranks an average 33rd in affordability and 35th on the U.S. News & World Report list of Best States to Live In.

In 2019, at $16,304 per pupil, Wyoming was one of the highest spenders on education in the western U.S., second only to Alaska. It also earned a grade of A for its school funding distribution in 2015, the best on this list.

Wyomings healthcare spending in 2014 was more moderate by comparison, at $8,320 per capita. Although Wyoming hasnt received an official letter grade for its infrastructure yet, the ASCE found that 6.9% of its bridges are structurally deficient and 99 of its dams have a high hazard potential.

Reason Number One Texas Is Highly Dependent On Revenue From Property Taxes

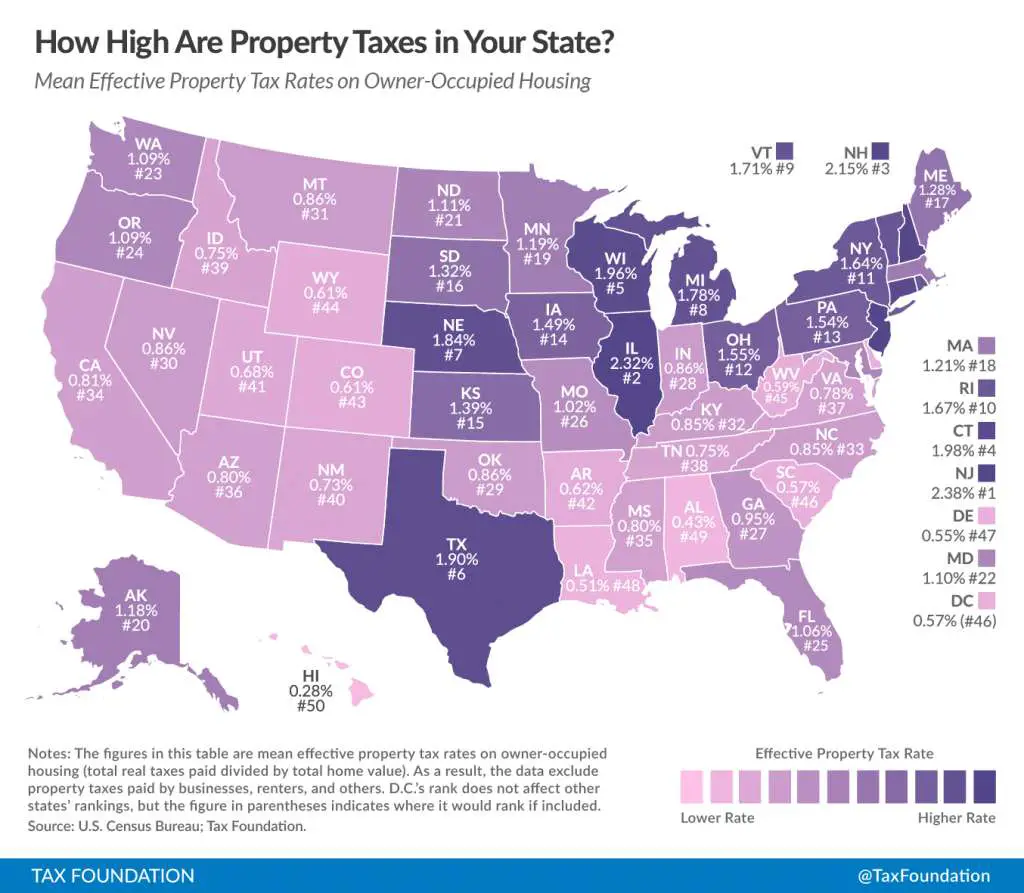

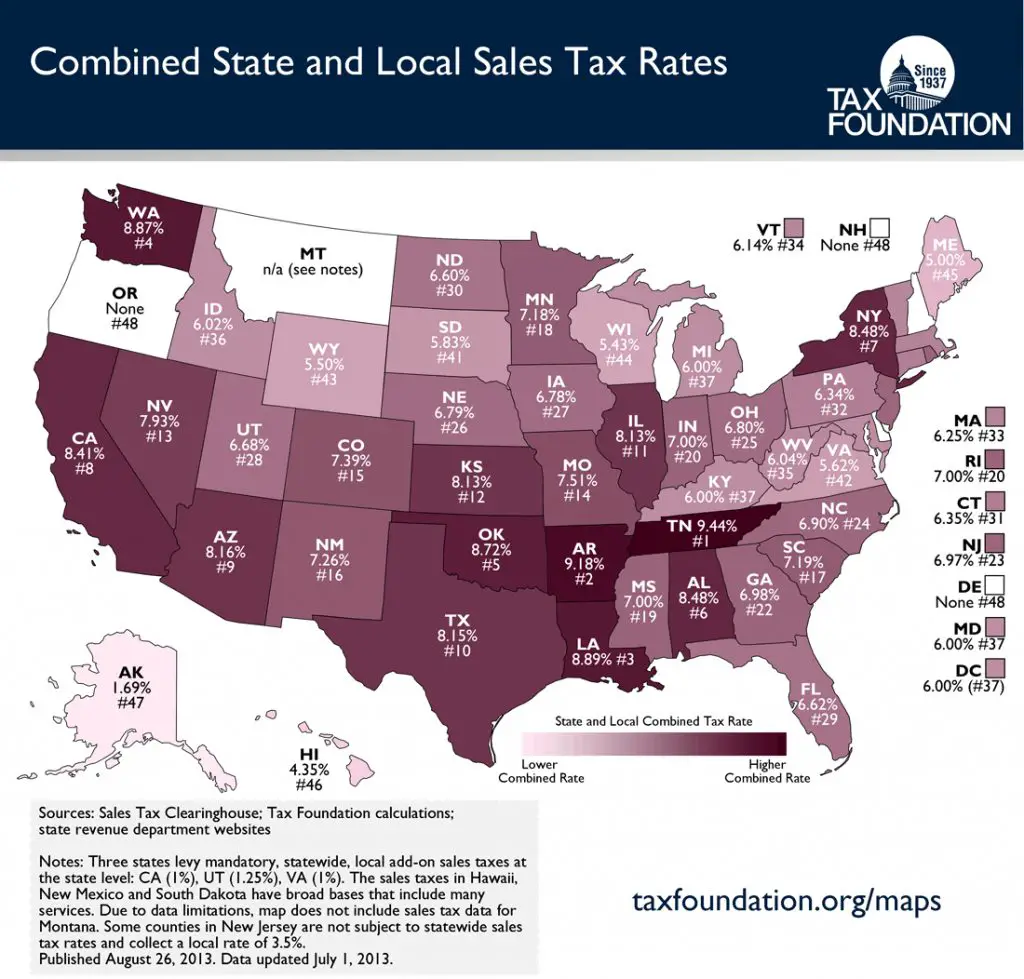

Despite having the 6th highest property taxes in the nation, the state of Texas has an average tax burden for its citizens. Sales taxes for the state are comparatively low at 6.25% , and Texas is one of nine states that does not have personal income taxes.

However, as taxation is a vital source of revenue for local government, the burden falls squarely on property taxation to compensate for the lack of other revenue. This money is utilized to fund essential resources and public services for Texas citizens, including public schools, libraries, emergency services, road maintenance, and community safety measures.

If property tax reform occurred, this would likely result in redistributing the tax burden by implementing state income tax or introducing higher sales tax rates to make up this shortfall. This is unlikely to occur even though it would mean tax relief on our annual property tax, as many of us enjoy the fact that theres no income tax.

Also Check: When Do I Have To File My Taxes By

The Nations Top Corporate Tax Environment

Top ranked by Area Development, Texas tax climate is a constant benefit for companies.

With no corporate or personal income tax, Texas has one of the lowest tax burdens in the nation. The state offers a number of other advantages for businesses, including a sales tax exemption for manufacturing machinery and equipment and R& D-related materials, software, and equipment, as well as a franchise tax exemption to manufacturers, sellers or installers of solar energy devices. Property tax abatements, permit fee waivers, local cash grants and local funding are also available to assist companies looking to relocate or expand in the state.

Gov. Greg Abbott and the Texas Legislature continue their efforts to make the state even more competitive from a cost perspective. For example, in 2015, during his first session in office, Gov. Abbott successfully passed an across-the-board 25% reduction in the franchise tax. Texas lawmakers also passed a meaningful property tax cut to increase the homestead exemption by $10,000.

How Much Are Taxes In Texas

Property taxes in Texas are calculated based on the county you live in. The average property tax rate in Texas is 1.80%. This is currently the seventh-highest rate in the United States. Breaking this out in dollars, if your home is valued at $200,000, your personal property taxes at the average rate of 1.80% would be $3,600 for the year.

Don’t Miss: How Do Tax Write Offs Work

Who Pays Texas Income Tax

Most states impose a tax on your earnings if you live or work within the state that is similar to that imposed by the federal government. States that have income taxes often base them on a percentage of your income that can either vary based on your income level or be imposed at a flat rate. Texas is one of a select group of states that dont impose an income tax on individuals, but it does levy taxes on business income.

Unemployment Obligation Assessment Rate

The third component of your tax rate is the unemployment Obligation Assessment . The purpose of the OA is to collect amounts needed to pay bond obligations and also collect interest due on federal loans to Texas used to pay unemployment benefits.

The OA is the sum of two parts, the Bond Obligation Assessment Rate and the Interest Tax Rate.

You May Like: What Is The Property Tax Rate In California

States With The Lowest Personal Income Tax Rates

Only eight states have no personal income tax:

In addition, New Hampshire limits its tax to interest and dividend income, not income from wages.

Among the states that tax income, Pennsylvania’s 3.07% flat tax ranks the Keystone State as the 10th lowest in the nation for 2021.

Low personal income tax rates can be misleading a lack of available tax deductions, for example, can raise the effective rate you pay. The Retirement Living Information Center states that figuring your total tax burden, including sales and property taxes, can give you a more accurate reading on affordability, especially if you’re on a fixed income. However, these states with the lowest taxes on income can be a good place to start looking for a more affordable location.

TurboTax Tip: Personal income tax rates do not tell the whole state tax story. The states vary in their personal income tax floors, deductions, exemptions, credits, and definitions of taxable income. Sales and property taxes also affect the states affordability.

State And Local Income Tax Withholding

State employees who live or work outside of Texas may be subject to state or local income taxes in addition to federal income taxes. Most states have state personal income taxes. Many localities also have income taxes that require withholding. For example, a Comptrollers office employee working in the Oklahoma area is subject to Oklahoma state income tax, as well as local taxes where required.

State agencies must comply with applicable tax laws and ordinances for each state or municipality where their employees work. To do this, a state agency must establish itself as an employer with the state or local tax authority and calculate and remit taxes appropriately.

For more information on state and local taxes, contact the appropriate state or local taxing authority. Contact information for taxing authorities in a particular state is often listed on the states website.

You May Like: How Much Do I Owe In Taxes 2020

Overview Of Texas Taxes

Texas is often considered tax-friendly because the state does not collect any income taxes. But there are other taxes that Texans have to pay, such as significant property and sales taxes.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

What Is The Penalty And Interest Rate For Filing A Late Quarterly Fuel Tax Report In Texas

Texas charges a late penalty of $50 or 10% of the net tax due, whichever is greater. Interest is computed on overdue taxes in each jurisdiction at a rate of .4167% per month. Even if you are due a net refund, interest still applies to each jurisdiction for any underpayment of fuels use tax to that jurisdiction. This interest is calculated from the day after the IFTA quarterly due date for each month, or fraction of a month, until paid.

You May Like: Which State Has The Lowest Income Tax

Property Taxes In Texas

Property taxes are based on the assessed current market value of real estate and income-producing tangible personal property. “Income” is the keyword when it comes to personal property. Your vehicle might be considered tangible personal property, but it’s not subject to a tax as long as you never use it to earn a living. Driving it back and forth to your place of employment doesn’t count.

Appraisals of real estate are performed by county districts. The appraiser will compare your home to other similar homes that have recently sold in the area.

The appraised value of your real estate is then multiplied by the local tax rate to determine your tax bill. These rates are set by counties and school districts. They’re based on yearly budgets and how much revenue the districts need to cover their costs.

States With The Highest Personal Income Tax Rates

A comparison of 2020 tax rates compiled by the Tax Foundation ranks California as the top taxer with a 12.3% rate, unless you make more than $1 million. Then, you have to pay 13.3% as the top rate. The additional tax on income earned above $1 million is the state’s 1% mental health services tax.

The top 10 highest income tax states for 2021 are:

Each of these states has a personal income tax floor, deductions, exemptions, credits, and varying definitions of taxable income that determine what a citizen actually pays.

Don’t Miss: How Much Does H& r Block Cost To File Taxes

Other Notable Taxes In Texas

Texas has an oyster sales fee. Shellfish dealers in Texas are required to pay a tax of $1 per 300 pounds of oysters taken from Texas waters.

- Cameron County, Texas is located at 26.15° North, and contains the most southern point along the US-Mexico border.

- Three of the ten most populous cities in the country are in Texas.

- In 2014, Texas produced more oil than any country in the world except Saudi Arabia.