How Do I Calculate Ad Valorem

Ad valorem taxes are applied to the value of property–real estate, investments or cars, for example–as opposed to taxes on income or sales transactions. If you own real estate, cities, counties, school districts and special tax districts can tax it. The county assessor’s office will calculate the value of any property you own there–this usually happens every year–and it will then be taxed according to the millage rate set by the various government bodies.

1

Learn the assessed value of your property. The tax assessor’s office in most counties makes the assessment at the start of each year, then mails the information to property owners, the Findlaw website states. The most common method for assessing value is using the price similar homes or empty lots have sold for in the period before the assessment. In California, once someone acquires property, state law prevents taxable value from rising more than 2 percent per year until the property is sold or given away, at which point it will be reassessed at current market values, according to the state Board of Equalization.

2

3

4

Find out the total millage charged by the various governing bodies that tax your property. A 0.1 percent property tax would equal a one-mill tax rate, which would equal a $1 tax per $1,000 of property, according to Investopedia.

5

References

Ad Valorem Tax Examples

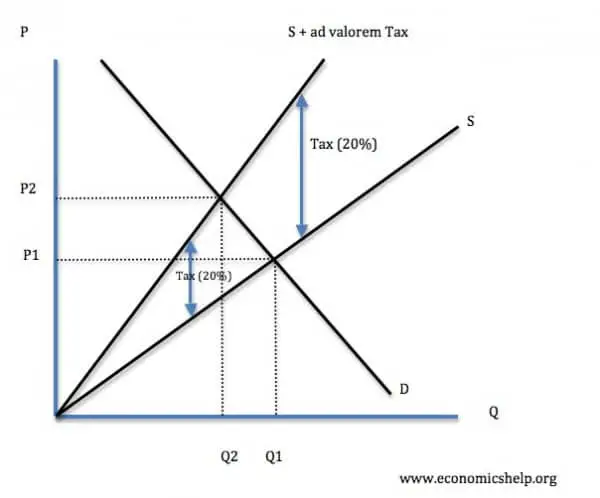

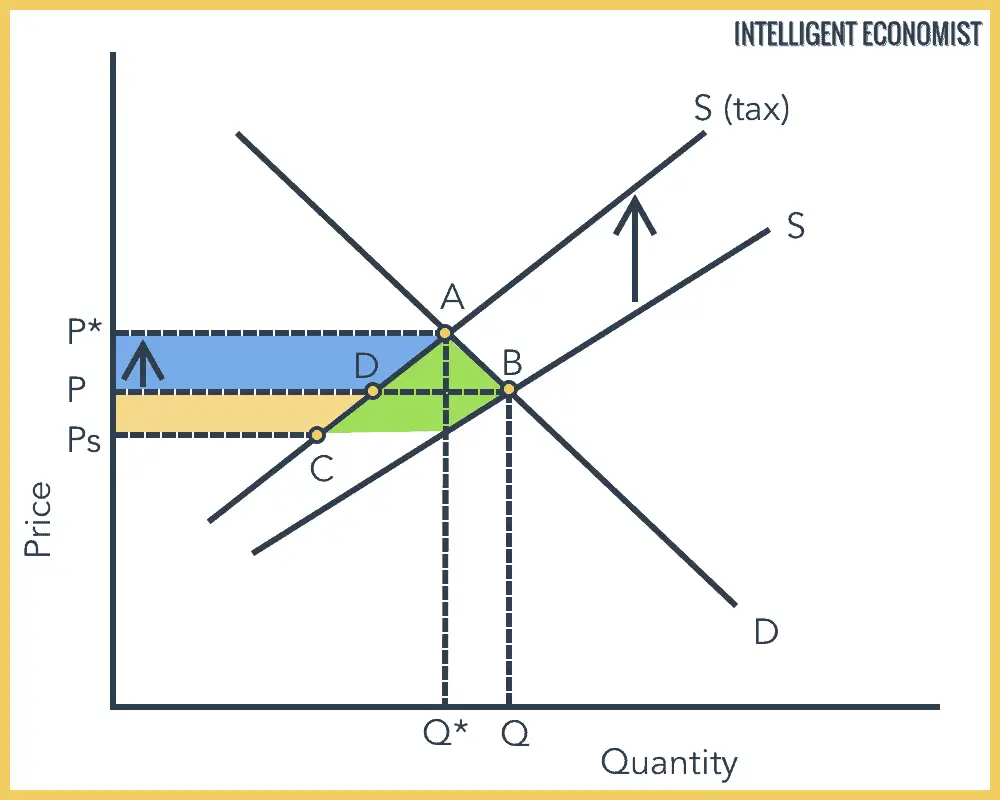

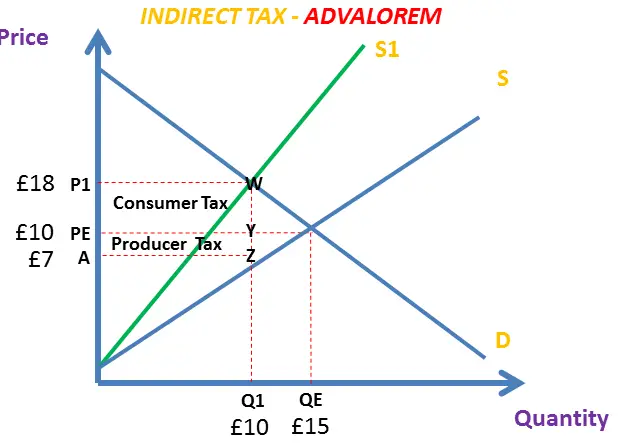

An ad valorem tax is expressed as a percentage. For example, VAT is charged at a rate of 20% in the UK. A 20% ad valorem tax increases production costs by 20% at each level of output, if you consider the supply curve to be the same as a cost curve in an ad valorem tax diagram.

Theres flexibility involved in the percentages, as well see in the ad valorem tax examples below.

How Much Are Ad Valorem Taxes

Ad valorem taxes can vary widely, from Tennessees combined state and local sales tax of 9.55% to an average of less than 1% property tax in Hawaii. The ad valorem tax varies between counties, hence the average.

In terms of dollars, however, a property owner in Hawaii might end up paying more in taxes than a property owner in another state with a higher rate because Hawaiis property values are often very high.

To calculate the impact of an ad valorem tax on your budget, youll need both the effective rate of the tax and the value to which it will be applied, such as your average spending each month for a sales tax or your homes assessed value.

Recommended Reading: Can You File Missouri State Taxes Online

Levy Of Tax And Classification

Once a value is determined, the tax is levied, and the property owner is notified. The actual tax rate may vary depending on the property’s classification. Property is often classified according to its use. Common classifications include commercial/industrial property, multiple dwelling property, residential homestead property, agricultural property, and business property.

Determining Ad Valorem Tax Values

Fair market value of the property

Tax assessments for determining ad valorem taxes are calculated as of January 1st. The tax is levied as a percentage of the assessed property value, which is also known as the fair market value. The concept of fair market value refers to the estimated price of the property that a willing buyer and a willing seller, who both possess a reasonable knowledge of all facts about the property, would accept without being under any compulsion to buy or sell. The price should be a reasonable one for both parties.

Valuation process

Paying levied tax

Once the fair value of the property has been determined and the ad valorem tax has been charged, the tax authority sends a notification to the property owner. The amount that a property owner pays is dependent on the classification of the property. Properties may be classified as residential, commercial, agricultural, industrial, etc. The amount of tax charged is also dependent on the state and municipal laws since each government unit enacts its own tax laws.

Recommended Reading: Where Is My State Refund Ga

Property Tax Issues Get Help From A Tax Law Attorney

Property taxes come in different shapes and sizes, but they all feel the same when they hit your pocket book. One of the issues that often arises is how a local tax authority assesses the value of your property as this determines the amount you will have to pay. Avoid surprises and speak with an attorney specializing in tax law today.

Thank you for subscribing!

Application Of A Value

The third largest source of government revenues is value-added tax , charged at the standard rate of 20% on supplies of goods and services. It is therefore a tax on consumer expenditure. Certain goods and services are exempt from VAT, and others are subject to VAT at a lower rate of 5% or 0% .

The Goods and Services Tax is a multi-level value-added tax introduced in Canada on January 1, 1991, by Prime MinisterBrian Mulroney and finance minister Michael Wilson. The GST replaced a hidden 13.5% Manufacturers’ Sales Tax because it hurt the manufacturing sector’s ability to export. The introduction of the GST was very controversial. As of January 1, 2012, the GST stood at 5%.

As of July 1, 2010, the federal GST and the regional Provincial Sales Tax were combined into a single value-added sales tax, called the Harmonized Sales Tax . The HST is in effect in five of the ten Canadian provinces: British Columbia, Ontario, New Brunswick, Newfoundland and Labrador, and . Effective April 1, 2013, the Government of British Columbia eliminated the HST and reinstated PST and GST on taxable services provided in British Columbia. VGGSA

The Goods and Services Tax is a value-added tax of 10% on most goods and services sold in Australia.

The Goods and Services Tax is a value-added tax of 15% on most goods and services sold in New Zealand.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

It’s Important To Know Your Tax Value

Because ad valorem taxation is on assessed value, property owners need to ensure that taxing authorities have that number right. If they assess the value of a property above the price it would likely sell for on the open market, then the current owner will pay more in taxes than they should. Because of that, property owners need to keep an eye on the assessed valuation and fight that number if it’s too high since that could reduce their tax bill.

What Are The Factors That Determine The Value Of Ad Valorem Tax

Taxing authorities base ad valorem taxes on the assessed value of a property. These government agencies will employ a property appraiser to determine a property’s assessment value. They’ll look at several things to establish this estimate, including:

- The recent sales price of similar properties in the area.

- The value of any recent improvements.

- Any income generated by the property .

- The replacement cost.

Because real property owners pay taxes based on the assessed value, they’ll want to make sure the assessor isn’t overvaluing their property. If a real estate owner believes the assessed valuation is too high, they can appeal their property taxes by requesting a reassessment, which is a second evaluation of a property’s value. Winning a reassessment can potentially save a property owner lots of money in annual real estate taxes.

You May Like: Can You File Missouri State Taxes Online

Understanding Of Ad Valorem Taxes

Because of Ad Valorem Tax their pervasiveness in the US tax system. Sales and property taxes are two typical types of ad valorem taxes. As previously stated. State, and municipal governments for a total of $1.4 trillion in 2018.

Because taxes differ by jurisdiction. Tax preparers must obtain correct. Local assessments to best assist their customers. In developing appropriate methods for managing their tax problems.

Ad Valorem Tax may also be leveraged across a supply chain, which tax professionals who engage with multinational transactions may confront. These experts will need to get a thorough grasp of how foreign taxes affect individuals and businesses.

Examples Of Ad Valorem Tax

Ad valorem taxes often form the main sources of revenues for state and municipal governments. The government unit may require any business or individual owning an asset or doing business within its jurisdiction to pay ad valorem tax. The most common ad valorem taxes are:

Property tax

Property tax is an ad valorem tax that the owner of real estate or other commercial and residential properties pays on the value of their property. The term property refers to land, personal property , and improvements to land . Tax authorities may hire evaluators to determine the value of the property on a regular basis before arriving at the final tax assessment value. The items taxed under property taxes vary by jurisdiction, and most government units exempt household goods, inventories, and intangible properties such as bondsTrading & InvestingCFI’s trading & investing guides are designed as self-study resources to learn to trade at your own pace. Browse hundreds of articles on trading, investing and important topics for financial analysts to know. Learn about assets classes, bond pricing, risk and return, stocks and stock markets, ETFs, momentum, technical.

How property tax is determined

Sales tax

Sales tax rates around the world

Value Added Tax

Also Check: How Much Does H& r Block Charge To Do Taxes

Developing A Practical Understanding Of Ad Valorem Taxes

As one of the most common types of taxes, ad valorem taxes are a frequent theme in the Online Masters in Taxation program from the DAmore-McKim School of Business at Northeastern University. In this program, students looking to take the next step in their careers can delve deeper into federal, state, and local tax issues. Whether students want to work in the public sector or a corporate environment, these courses can provide useful insights into common ad valorem taxes:

- Federal Tax Issues and Analysis: This course emphasizes property transactions, including the tax treatment of basis calculations. Lessons also focus on how the tax structure impacts individual taxpayers.

- Estate and Gift Taxation: Ad valorem taxes play a crucial role in the transfer of property and wealth from one generation to the next. This course explores the planning opportunities applicable to wealth transfer taxes.

- State and Local Taxation: This elective course covers the most common types of taxes imposed by state and local governments, many of which fall within the ad valorem category.

- Planning for Estate Tax Issues: Emphasizing several vehicles for estate planning, this advanced course covers the principles of estate taxation and related issues such as life insurance policies and associated annuities.

Do I Need To Pay Ad Valorem Tax

Some ad valorem taxes are assessed at the time of sale, like sales tax. These taxes are part of your bill, making it easy to know they are due.

Individuals who rent rather than becoming homeowners only pay indirectly when it comes to property tax. While landlords do have to charge rent that covers their expenses, you wont have to pay your own ad valorem property tax bill because that burden is on the landlord.

Beyond housing, other property including cars and boats, may also have some ad valorem taxes on them. However, as with other kinds of sales tax, they will be calculated and charged by the seller, in many cases.

Recommended Reading: Www.1040paytax

Creating An Ad Valorem Tax Definition

In Latin, ad valorem means according to the value. Essentially, an ad valorem tax is based on the value of a property or transaction, regardless of its size, weight, or quantity. Typically, this tax is a percentage of an assessed value of the property or transaction being taxed.

Generally, this percentage is calculated by the determined market value the dollar amount a buyer would be willing to pay and the amount a seller would be willing to accept. In the U.S., this figure is often an annual determination, especially in the case of property transactions. However, not all ad valorem taxes are levied annually.

So, what are the most common types of ad valorem taxes, and how are they levied?

You Pay These Taxes All The Time Without Even Thinking About It

No one likes paying tax, but it’s almost impossible to escape the numerous types of taxes that you face in everyday life. You might not be familiar with what an ad valorem tax is, but it’s one of the most common types of taxes, and most people pay one or more ad valorem taxes on a regular basis. Coming from the Latin for “to the value,” ad valorem taxes are tied to the value of a particular transaction or piece of property. Property taxes, sales taxes, value-added taxes, and many import duties are just a few of the most common ad valorem taxes you’ll encounter.

Also Check: How To Buy Tax Lien Properties In California

Understanding The Professional Implications Of Ad Valorem Taxes

Considering their ubiquity in the U.S. tax system, both professionals who work in the corporate world and those who work with individual taxpayers will likely encounter ad valorem taxes with great frequency. As noted above, sales and property taxes are two common forms of ad valorem taxes. In 2018, federal, state, and local governments collected over $1.4 trillion in ad valorem taxes.

Tax preparers and specialists may need to work with evaluators who can accurately determine the market value of assets. Taxes will vary by jurisdiction, so its important that preparers get accurate, local evaluations to best help their clients develop ideal strategies for managing their tax situations.

Additionally, tax professionals who work with international transactions may encounter VAT leveraged across a supply chain. These professionals will have to develop a deep understanding of how international taxes impact individuals and companies. This can seem very complicated on the surface, which is why an online masters in taxation program breaks down key topics to address specific challenges comprehensively.

Examples Of Ad Valorem In A Sentence

ad valorem sun-sentinel.comad valorem orlandosentinel.comad valorem orlandosentinel.comad valorem San Antonio Express-Newsad valorem alad valorem alad valorem courant.comad valorem Bloomberg.com

These example sentences are selected automatically from various online news sources to reflect current usage of the word ‘ad valorem.’ Views expressed in the examples do not represent the opinion of Merriam-Webster or its editors. Send us feedback.

Recommended Reading: How To Buy Tax Lien Properties In California

How Ad Valorem Taxes Are Levied

Property ad valorem taxes are usually levied by a municipality but may also be levied by other local government entities, such as counties, school districts, or special taxing districts, also known as special purpose districts. Property owners may be subject to ad valorem taxes levied by more than one entity for example, both a municipality and a county.

Ad valorem property taxes are typically a major, if not the major, revenue source for both state and municipal governments, and municipal property ad valorem taxes are commonly referred to as simply “property taxes.”

Ad Valorem Tax

Definition And Examples Of Ad Valorem Taxes

Ad valorem taxes comprise many of the state and local taxes in the U.S., as well as a variety of taxes charged abroad. These taxes are levied based on a percentage of an items value, such as a 6% sales tax added on to the price of a new hair dryer you purchase, for example.

When a country chooses a flat rate for an import tax or a value-added tax that is issued when someone brings the item into or out of the country, that is often an ad valorem tax. The most common type of ad valorem tax in the U.S. is property taxone of the main sources of revenue for local governments at the county or city level.

One of the complex elements of ad valorem taxes is that not everyone agrees on the assessed values assigned to their property. To decide your tax rate, an official assessor evaluates your propertysimilar to how an appraiser would evaluate it during a home sale processand reaches an assessed value. If the property is believed to be worth more now than in the past, your tax bill will rise.

While income taxes in the U.S. are progressive, meaning they levy higher percentages for higher income brackets, many ad valorem taxes are a set rate.

A community might charge a flat 1% property tax based on an assessed property value that is updated every few years, for instance. Many communities use these property taxes to pay for local government functions, as well as for public schools.

Recommended Reading: Do I Need W2 To File Taxes

How To Deal With Ad Valorem Taxes

Because ad valorem taxes deal with the value of goods you use or property you own, you typically have more control over them than you do over income taxes. Once you’ve spent as much as you need to spend in order to support basic needs, any additional spending is discretionary, and so any additional tax that you owe depends on what decision you make with your disposable income. Put another way, many ad valorem taxes reward saving, which stands in contrast to income taxes, which impose tax regardless of what you actually do with the money.

Even with property taxes, the amount you pay in tax depends on the value of the property you buy. This can serve as a valuable incentive to economize in most jurisdictions, although some tax exemption schemes can actually hinder moves to simplify, to the extent that their tax breaks only apply as long as one lives in one particular home.

Property Subject To Ad Valorem Taxes

Ad valorem taxes are generally levied on both real property and personal property. Real property includes land, buildings and other structures, and any improvements to the property. An example of an improvement is a garage added to a single-family home or a road built on a parcel of land. Personal property ad valorem taxes are most commonly levied only on major personal property holdings, such as a car or boat. Incidental personal property, such as household appliances or clothing, is not usually subject to personal property taxes.

Read Also: Tsc-ind Ct