You Can Outsource Payroll Tax

Payroll tax is complex. The calculations are nitpicky and penalties are steep. Even paying payroll taxes just a day late comes with a 2% penalty on the amount due, with that penalty rising as high as 15% for past due payroll taxes.

We highly recommend outsourcing your payroll to a company like Gusto. Theyâll take the headache out of everything from paying your employees the right amount at the right time, to handling pesky withholding calculations and payroll taxes.

When it comes time to record payroll costs on your books, Bench can take care of that for you. Learn more about how we are saving small business owners hours of admin every month.

Is A Pay Stub The Same As A Paycheck

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.

What Are They Used For

Some taxes are used to fund a broad array of programs. Federal, state, and local taxes fund government programs such as road construction, emergency disaster relief, enforcement of safety, and environmental regulations and health care. Other taxes are specifically designated to fund certain programs.

This applies to the Social Security and Medicare taxes, which fund Social Security benefits and Medicare health care programs for the elderly.

Also Check: Which State Has The Lowest Tax Rate

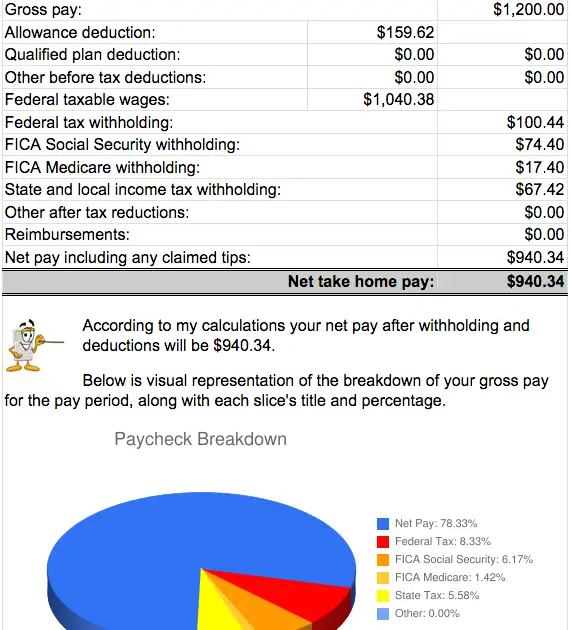

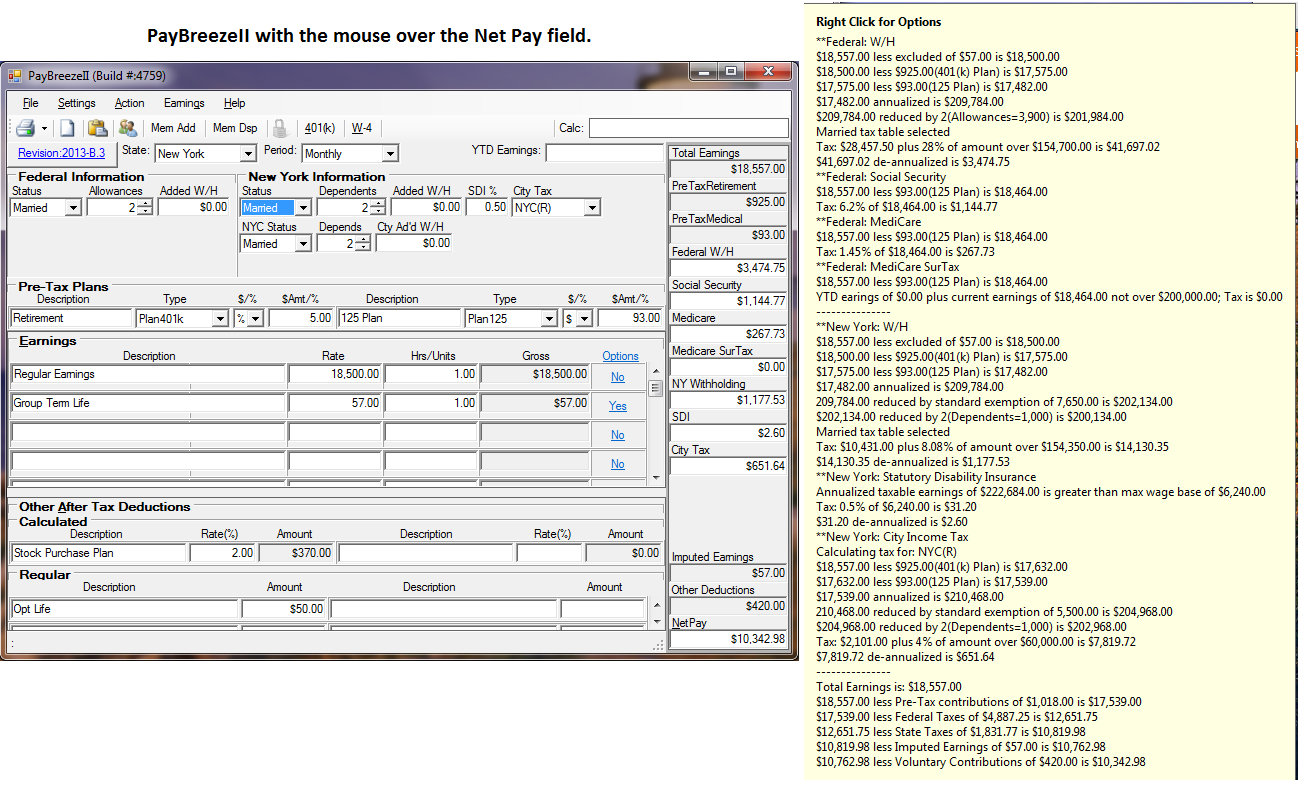

How To Calculate Paycheck Witholdings

Seeing all the withholding that comes out of your paycheck can put a damper on an otherwise exciting event. Besides federal and state income taxes, your employer also takes out Social Security and Medicare taxes. To figure your withholding, you need to know your filing status and the number of allowances you claimed on your Form W-4 you turned in to your employer. Knowing how much you’re going to lose to withholding helps you budget for what you’ll have left over. On the bright side, if you have more withheld than you owe, you’ll get it back when you file your taxes.

Direct Deposit Authorization Form

As an employer, you can pay your employees several different ways: paper check, direct deposit, prepaid debit card, or cash. Direct deposit is often the easiest and most secure way to deliver paychecks, which is why it is by far the most popular. In fact, more than 82% of US workers are now being paid by direct deposit.

An employee who chooses to be paid by direct deposit must fill out a direct deposit authorization form, complete with bank routing numbers and account numbers. The form acts as a permission slip for you to deposit the employees net pay electronically into their bank account.

As part of the verification process, many employers will ask for a voided blank check to confirm the accuracy of the bank account information provided by the employee.

Also Check: How To Pay Taxes For Free

How Your Washington Paycheck Works

Washington state does not impose a state income tax. However, federal income and FICA taxes are unavoidable no matter where you work.

How much you pay in federal income taxes depends on a few different factors, like your marital status, salary and if you want any additional withholdings. You have to enter information about your filing status and dependents on your Form W-4, which allows your employer to know how much to withhold from your paycheck. That’s why your employer will require you to fill out a W-4 whenever you start a new job. You should also fill out a new W-4 anytime you experience life changes, such as a marriage, divorce or the birth of a child.

Over the last few years, there have been slight changes to withholding calculations for the federal income tax, as well as Form W-4. The new W-4 removes the option to claim allowances, as it instead focuses on a five-step process that lets filers enter personal information, claim dependents or indicate any additional income or jobs. The new version of the form must be filled out by all employees hired on or after Jan. 1, 2020. But if you were hired before 2020, you aren’t required to complete it unless you’re adjusting your withholdings or changing jobs.

If Not Enough Is Being Withheld

The W-4 form has a place to indicate the amount of additional tax you’d like to have withheld each pay period.

If you’ve underpaid so far, subtract the amount you’re on track to pay by the end of the year, at your current level of withholding, from the amount you will owe in total. Then divide the result by the number of pay periods that remain in the year.

That will tell you how much extra you want to have withheld from each paycheck.

You could also decrease the number of withholding allowances you claim, but the results won’t be as accurate.

Don’t Miss: How To Calculate Quarterly Taxes

Account For The Employer’s Portion Of Fica Taxes

After you have completed the FICA tax calculations for all employees, you must set aside an amount equal to the total for your employer portion of the FICA taxes. This amount includes:

- 6.2% of the employee’s total FICA wages for Social Security, with no maximum, and

- 1.45% of the employee’s total FICA wages for Medicare .

Calculating Your Tax Rate

Your tax rate in retirement will depend on the total amount of your taxable income and your deductions. List each type of income and how much will be taxable to estimate your tax rate. Add that up, and then reduce that number by your expected deductions for the year.

For example, suppose that you’re married and filing a joint return with your spouse. You have $20,000 in Social Security income and $25,000 a year in pension income, and you expect to withdraw $15,000 from your IRA. You estimate that you’ll have $5,000 per year in long-term capital gains income from mutual fund distributions.

Your total income, not including capital gains and before Social Security benefits, is $40,000 . With capital gains, your total income is $45,000.

At $45,000, you’ll be taxed on up to 85% of your Social Security benefitsthat doesn’t mean 85% exactly, because it’s a formula, so it may be less. Based on all of this information, you’ll pay taxes on $15,350 of your Social Security benefits. That means your income will be $60,350 .

You can type all of this information into a tax calculator to better understand how much you’ll pay in taxes.

Your standard deduction for 2020the tax return you filed in 2021would be $24,800 as a married couple filing jointly. That would put your estimated taxable income at $35,500 , placing you in the 12% tax bracket for your top dollars. You’ll pay 10% on the first $19,750 of taxable income, and 12% on the income that falls between $19,750 and $80,250.

Recommended Reading: What To Do When Taxes Are Late

Overview Of Washington Taxes

Washington is one of a few states with no income tax, and there are no cities in the state that have local income taxes either. Washington earners will still have to pay federal income taxes, though.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Reporting And Depositing Payroll Taxes

Employers can either directly report and deposit payroll taxes with federal, state, and local governments, or they can contract with a payroll company to handle this task.

Generally, filings are handled electronically. The employer designates how much of each tax is to be withheld each pay period by each employee, and those funds are withheld from paychecks and electronically deposited on a periodic basis with the relevant federal, state, and local agencies.

Also Check: How Is Capital Gains Tax Calculated On Sale Of Property

Use A Tax Withholding Estimator

The tax withholding estimator on the Internal Revenue Service website is particularly useful for people with more complex tax situations.

It will ask about factors like your eligibility for child and dependent care tax credits, whether and how much you contribute to a tax-deferred retirement plan or health savings account, and how much federal tax you had withheld from your most recent paycheck.

Based on the answers to your questions, it will tell you your estimated tax obligation for the year, how much you will have paid through withholding by year’s end, and you’re expected overpayment or underpayment.

Calculate The Social Security Withholding

Multiply the current Social Security tax rate by the amount of gross wages subject to Social Security. In Sally’s example above , her FICA withholding for each paycheck would be $98.81.

Double-check that the employee’s year-to-date wages/salaries are not over the Social Security maximum wages for the year. Stop withholding Social Security for the year at the point where the employee’s total pay reaches the maximum for that year.

Recommended Reading: Can You File Taxes For Unemployment

Fica Maximum Income Threshold

Both FICA and SECA have maximum thresholds for mandatory deductions. However, this threshold only applies to your contributions to Social Security, according to AARP. The 2020 maximum income subject to Social Security tax is $137,700.

Once you have paid the correct amount into FICA for annual wages or income below this threshold, you wont be subject to Social Security deductions for that year. Your Medicare deduction continues regardless of income.

When To Make Adjustments

The IRS suggests that, as an employee, you should check your withholding when your life circumstances change.

On a yearly basis, you should check on your income tax withholding to make sure that you are on track to pay the proper amount of income taxes and when they want to pay it that is, either throughout the year or during the end of the income tax filing season.

If you have a more complex tax situation you may need to double check your withholding. The IRS suggests the following group of people may fall under this category:

- Two-income families.

- People working two or more jobs or who only work for part of the year.

- People with children who claim credits such as the Child Tax Credit.

- People with older dependents, including children age 17 or older.

- People who itemized deductions in 2019.

- People with high incomes and more complex tax returns.

- People with large tax refunds or large tax bills for 2019.

As a general rule:

You should not have to adjust it very often.

But there are some circumstances when you may want to adjust your tax withholding:

Overall, adjusting your tax withholding can be a cash management tool that can help you plan better for your financial goals.

You simply have to know what your preferences are in terms of getting more money per paycheck or having a larger refund when you file your income taxes.

Either way, consult with a professional who can give you proper guidance on how you should adjust your tax withholding for your particular financial needs.

Also Check: How Much Do I Owe In Property Taxes

How You Can Affect Your Washington Paycheck

While you dont have to worry about paying state or local income taxes in Washington, theres no escaping federal income tax. However, there are certain steps you may be able to take to reduce the taxes coming out of your paychecks.

The simplest way to change the size of your paycheck is to adjust your withholding. Your paychecks will be smaller but youll pay your taxes more accurately throughout the year. You can also specify a dollar amount for your employer to withhold. There is a line on the W-4 that allows you to specify how much you want withheld. Use the paycheck calculator to figure out how much to put.

Another thing you can do is put more of your salary in accounts like a 401, HSA or FSA. If you contribute more money to accounts like these, your take-home pay will be less but you may still save on taxes. These accounts take pre-tax money, which means the money comes out of your paycheck before income taxes are removed. This reduces your taxable income. Payments you make for most employer-sponsored health and life insurance plans also pre-tax.

With no state or local income taxes, you might have an easier time saving up for a down payment for a home in Washington. If youre looking to make the move, take a look at our guide to Washington mortgage rates and getting a mortgage in Washington.

How To Determine Gross Pay

For salaried employees, start with the person’s annual amount divided by the number of pay periods. For hourly employees, it’s the number of hours worked times the rate .

If you are not sure how to pay employees, read this article on the difference between salaried and hourly employees.

Here are examples of how gross pay for one payroll period is calculated for both salaried and hourly employees if no overtime is included for that pay period:

A salaried employee is paid an annual salary. Let’s say the annual salary is $30,000. That annual salary is divided by the number of pay periods in the year to get the gross pay for one pay period. If you pay salaried employees twice a month, there are 24 pay periods in the year, and the gross pay for one pay period is $1,250 .

An hourly employeeis paid at an hourly rate for the pay period. If an employee’s hourly rate is $12 and they worked 38 hours in the pay period, the employee’s gross pay for that paycheck is $456.00 .

Then include any overtime pay. Next, you will need to calculate overtime for hourly workers and some salaried workers. Overtime pay must be added to regular pay to get gross pay.

Don’t Miss: What Is The Federal Inheritance Tax

Washington Median Household Income

| 2010 | $55,631 |

Tax Day is a lot less painful for Washingtonians than for workers in many other parts of the country. Thats because the Evergreen State does not levy income taxes at the state level. Lawmakers have considered introducing a state income tax in recent years, but no attempt has been successful thus far. While local sales taxes in Seattle, Tacoma and some other metro areas are significantly higher than the national average, all areas in Washington are devoid of local income taxes.

A financial advisor in Washington can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

How Your Texas Paycheck Works

Your hourly wage or annual salary can’t give a perfect indication of how much you’ll see in your paychecks each year because your employer also withholds taxes from your pay. You and your employer will each contribute 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. These taxes together are called FICA taxes.

No matter which state you call home, you have to pay FICA taxes. Income you earn that’s in excess of $200,000 , $250,000 or $125,000 is also subject to a 0.9% Medicare surtax. Your employer will not match this surtax, though.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. The same is true if you contribute to retirement accounts, like a 401, or a medical expense account, such as a health savings account . These accounts take pre-tax money so they also reduce your taxable income.

Your marital status, pay frequency, wages and more all contribute to the size of your paycheck. If you think too much or too little money is being withheld from your paycheck, you can file a fresh W-4 with your employer at any time during the year. When you do this, be sure to indicate how much extra income you want withheld so as to avoid a tax bill come April each year.

Also Check: How To Subtract Taxes From Paycheck

Calculating Withholding More Accurately

One way to adjust your withholding is to prepare a projected tax return for the year. Use the same tax forms you used the previous year, but substitute the current tax rates and income brackets. Calculate your income and deductions based on what you expect for this year, and use the current tax rates to determine your projected tax.

Then, use the withholding calculator on the IRS website to see the suggested withholding for your personal situation. The number of dependents you support is an important component of your analysis, as is the number of streams of income.