Box 2a Capital Gain Distributions

Box 2a is the danger zone of the Form 1099-DIV. In a way, it is unavoidable to recognize dividends if one wants to invest in a broad based portfolio of equities in a taxable account. Eventually corporations pay out dividends. While younger companies tend not to pay dividends, as companies mature they tend to start paying dividends.

What are much more avoidable are capital gain distributions. Capital gain distributions come from mutual funds and ETFs .

Capital gain distributions occur when fund managers sell individual holdings at a gain. The fund is required to pay out those gains to the shareholders. The paid out gains are reported in Box 2a.

Three things tend to increase capital gain distributions: 1) active management; 2) a bull market; and 3) fund redemptions.

What Is The Eligible Income For Qbi Deduction

An eligible taxpayer can claim deductions based on their Qualified Business Income level.;

Qualified business income is essentially the net income you earn from business transactions, including profit from a sole proprietorship, rental income, income from qualified publicly traded partnerships, and any profit allocations listed on your K-1.;

Investment-related earnings like capital gains and net gains from foreign currency and commodities transactions are not qualified income. It is also essential to know that any compensation the business owner receives for a service rendered to their company does not pass for qualified business income.;

The IRS also excludes the following sources of income:

Business activities that involve guaranteed payments to partnerships do not pass as qualified business income.;

According to Section 707 , “payments to a partner for services or the use of capital shall be considered as made to one who is not a member of the partnership, but only for the purposes of section 61 and, subject to section 263, for purposes of section 162 .”

A guaranteed payment is a reasonable compensation that a partner is entitled to because of services rendered, including any capital contributions. Guaranteed payments differ from the income typically generated by the partnership.;

How To Calculate The Section 199a Deduction

QBI Deductions = 20% of Qualified Business Income + 20% of REIT Dividends and Qualified Publicly Traded Partnership Income

Keep in mind that the resulting deductions do not affect a single taxpayer’s adjusted gross income. This is because the IRS records your gross income before any qualified business deductions.;

Here is a 3-step guide to help you calculate qualified business deductions:;

You May Like: Is Heloc Interest Tax Deductible

Who Qualifies For The Qbi Deduction

The QBI deduction is only available to owners of pass-through businesses, but the limitations donât end there. If your business is a âspecified service trade or businessâ, your QBI deduction may be limited or disappear entirely once your total taxable income reaches a certain limit.

A specified service trade or business is a service-based business where the business depends on the reputation or skill of its employees or owners. Thatâs a broad definition, but it includes law firms, medical practices, consulting firms, professional athletes, accountants, financial advisors, performers, investment managers, and more.

When To Use Form 1099

Unless you received $10 or more in dividends from some type of financial institution, you will not receive a Form 1099-DIV. Companies do not have to report dividends received to you on a Form 1099-DIV unless they have paid you $600 or more.;Even if you dont receive this form from one of the entities that paid you dividends, you must report all dividend income you have received on your tax return. Sometimes your Form 1099-DIV is included in your year-end statement if you have a brokerage account.

In this case, you may not receive a Form 1099-DIV separate from your brokerage statement. You are still responsible for reporting the income on your taxes.

You use Schedule B to list the dividends you have received during the tax year if they are ordinary dividends and more than $1,500. Ordinary dividends;include those paid on stock, employee stock options and real estate investment trusts.

Also Check: How Much Money Is Taken Out Of Paycheck For Taxes

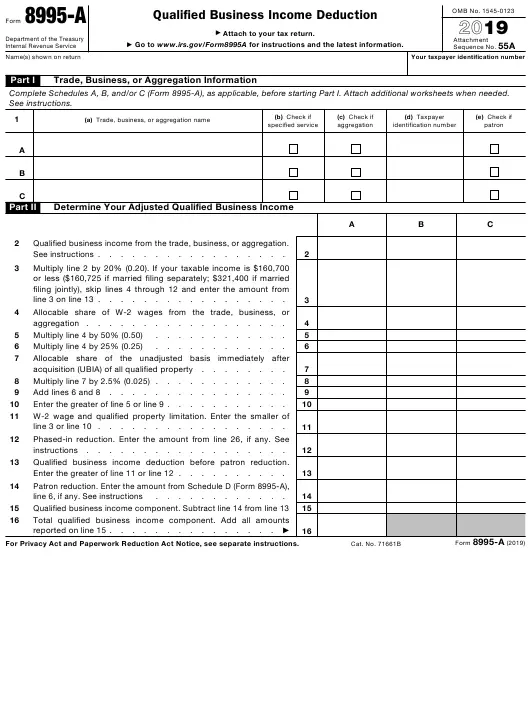

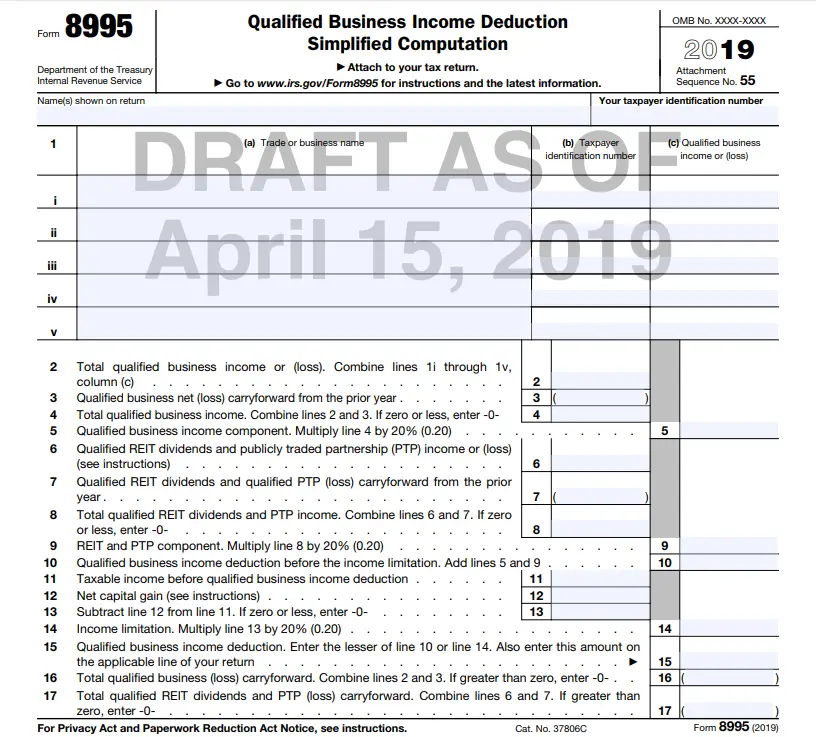

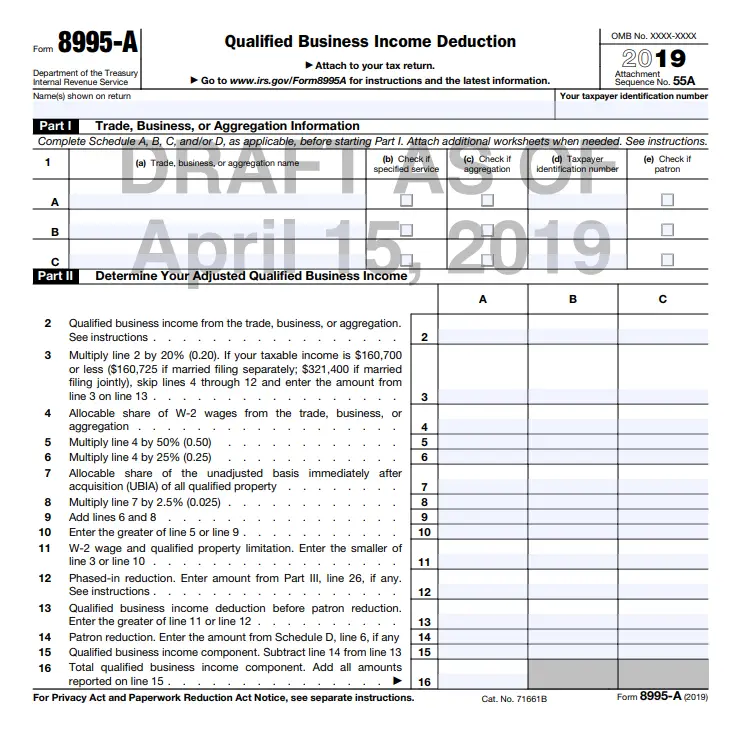

Use Form 8995 Or 8995

If you are claiming the QBI deduction for 2020, you will need to fill out either Form 8995, Qualified Business Income Deduction Simplified Computation, or Form 8995-A, Qualified Business Income Deduction.

Use Form 8995 if your taxable income is less than the income threshold in the table above. Fill out Form 8995-A if your taxable is more than the income threshold in the table above. Attach whichever form you use to your tax return, which means Form 1040 for most Americans.

Both of these forms take you through the process of adding up your qualified business income, qualified REIT dividends, and qualified PTP income. Then you determine the amount of your deduction. The calculations themselves are all relatively straightforward.

Note that this deduction does not affect other taxes or forms you need to attach to your return. For example, the QBI deduction doesnât reduce your self-employment tax. If you have income from rental real estate, even if it qualifies for the QBI deduction, you likely still need to report it on Schedule E. If you are a sole proprietor with business income or loss, you still need to file Schedule C.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: How To Know If You Filed Taxes Last Year

Box 5 Section 199a Dividends

Section 199A dividends are dividends from domestic real estate investment trusts and mutual funds that own domestic REITs. These dividends are reported on Form 8995 or Form 8995-A and qualify for the Section 199A QBI deduction. The good news is that the taxpayer gets a federal income tax deduction equal to 20 percent of the amount in Box 5. This deduction does not reduce adjusted gross income but does reduce taxable income.

Section 199A dividends are another slice of the pie of Box 1a ordinary dividends.

Previously, I wrote an example of a REIT dividend and the QBI deduction here.

Reit Dividends & Ptp Income

For this deduction, qualified REIT dividends include most of the REIT dividends that people earn. You can find the amount of your qualified REIT dividends in box 5 of a 1099-DIV.

For a REIT dividend to qualify, you must have held it for more than 45 days, the payment must be for you, and it cannot be a capital gain dividend or regular qualified dividend. An example of a REIT dividend that may not qualify is one where the REIT sold its underlying real estate and generated a capital gain.

Qualified income from a PTP includes your share of income, gains, deductions, and losses from a PTP.

Recommended Reading: How To File Federal Taxes For Free

Iv: Determine Your Qualified Business Income Deduction

This section is where you calculate your deduction, starting with your total qualified business income from Part II. If you have any qualified dividends from a real estate investment trust or income from a publicly traded partnership , you’ll add those amounts to your qualified business income before calculating the deduction.

Who Can Claim The Section 199a Deduction

Deductions on qualified business income are only available for pass-through entities. Pass-through entities are companies subjected to individual tax rates as opposed to federal business income taxes. Here, the taxpayer reports the business income on their personal tax returns.;

A common denominator for these entities is how much taxable income they earn. Typically, these are businesses with a taxable income of less than $157,000 for individuals and $315,000 for joint returns .;

Specifically, you qualify for the Section 199A deduction if you are;;

Don’t Miss: How Much Taxes To Pay On Stocks

A Deduction And New Form 8995/8995

The Section 199A deduction was enacted as part of the Tax Cuts and Jobs Act of 2017. Section 199A allows taxpayers, other than corporations, a deduction equal to 20% of qualified business income earned in a qualified trade or business, subject to certain adjustments and limitations.

The QBI deduction is allowed at the partner, S Corporation shareholder, estate and trust, or sole proprietor level for tax years beginning after December 31, 2017. . For the 2018 tax year, taxpayers must calculate the deduction amount on a worksheet, filed separately from the taxpayers return.

On April 15, 2019, the IRS released a draft of new Form 8995, Qualified Business Income Deduction Simplified Computation, and Form 8995-A, Qualified Business Income Deduction. Form 8995-A is the long form for those taxpayers not eligible for short Form 8995. For the 2019 tax year, Form 8995 or 8995-A will be required to be attached to the taxpayers return and submitted to the IRS.

Form 8995 is required for taxpayers who have qualified business income, qualified REIT dividends, or qualified PTP income; have taxable income that does not exceed the threshold amount, and are not patrons of specified agricultural cooperatives. All other taxpayers with QBI must use form 8995-A.

Form 8995-Ais six pages with four parts and four schedules:

Defining Employees And Independent Contractors

Section 199A prevents employees from claiming tax deductions based on their wages. However, it allows independent contractors to claim deductions if their taxable income is higher than the first threshold.;

The ripple effect of this advantage is that more employees may resign from their full-time engagements to qualify for tax deductions. Owners of companies can also terminate their appointments and set up S corporations that allow them to earn higher qualified income and benefit from W-2 wage limitations. This makes it difficult for the IRS to define workers for payroll and income taxes.;

Read Also: How To Track Your Taxes

How Do I Calculate A Pass

To calculate your pass-through deduction, you first need to calculate your actual Qualified Business Income . The IRS defines QBI as:;

The net amount of qualified items of income, gain, deduction and loss from any qualified trade or business, including income from partnerships, S corporations, sole proprietorships, and certain trusts. Generally this includes, but is not limited to, the deductible part of self-employment tax, self-employed health insurance, and deductions for contributions to qualified retirement plans .

Next, business owners that fall beneath the income threshold can simply multiply their QBI by 20% to calculate their pass-through deduction. The IRS has also outlined numerous items that do not qualify as QBI to ensure pass-through businesses do not abuse this deduction. While this is not an all-inclusive list, you should not include the following items in your QBI calculation:;

- Items that are not properly includable in taxable income

- Investment items such as capital gains or losses or dividends

- Interest income not properly allocable to a trade or business

- Wage income

- Income that is not effectively connected with the conduct of business within the United States

- Commodities transactions or foreign currency gains or losses

- Certain dividends and payments in lieu of dividends

- Income, loss, or deductions from notional principal contracts

- Annuities, unless received in connection with the trade or business

- Amounts received as guaranteed payments from a partnership

What Is A Dividend

Publicly traded companies can decide what to do with profits. They can reinvest them to grow the company and raise share prices or they can pay some of their profits to shareholders as;dividends.

Dividend payments to shareholders are a portion of a firms net income, or profit, that they do not need for growth. Instead, the firm distributes the extra profit to its shareholders. Often, businesses compensate their shareholders for a lower growth rate in share price by paying out dividends. The remainder of a firms net income is retained by the firm for the growth of the business.

Recommended Reading: How Much Do I Get Back In Taxes

If You Have A Specified Service Trade Or Business

You can determine whether you get the full 20 percent deduction, a limited deduction, or no deduction at all based on your total taxable income.

Total taxable income refers to all the taxpayerâs income before the QBI deduction is applied. This may include wages from other jobs, wages earned by your spouse , interest and dividends, capital gains, rental income, and more. For most taxpayers, this will be the adjusted gross income shown on Form 1040.

| Filing status |

|---|

| No deduction for SSTBs |

Unadjusted Basis Immediately After Acquisition Of Qualified Property

A qualified property refers to any depreciable business assets that have helped you generate qualified income within the tax year. For example, if you purchased a new laptop for your business, it is a form of qualified property. Land or physical structures are not subject to depreciation, so they do not fall into this category.;

The IRS described qualified property as a tangible depreciable property that;

- is held by, and available for use in, the qualified trade or business at the end of the tax year;

- is used to produce QBI at some point during the tax year;;

- and has a depreciable period that does not end before the close of the tax year.;

The cost of tangible property upon purchase is its Unadjusted Basis Immediately After Acquisition . Lets refer to the laptop mentioned earlier. If it cost you $4,000 and you made the purchase in 2021, it means you have a UBIA of $4,000 for 2021. The depreciable period for a qualified property is ten years from its purchase date.;

So how do all these come to play when it’s time to calculate your QBI deduction? Lets look at this example;

A business owner files a taxable income of $600,000 which is more than the first threshold. She also has $100,000 qualified property and has paid another $100,000 in wages. To determine her deductions, she needs to calculate both wage limitations and choose the higher amount.;

Limitation 1: 50% of the companys W-2 wages;

50% of $100,000 = $50,000;

25% of $100,000 + = $27,500

You May Like: Do I Have To Pay Taxes On My Unemployment

How To Claim Section 199a Deductions

Small business owners can claim their qualified business deductions by submitting Form 8995 or Form 8895-A attached to Form 1040 when filing a tax return.;

Form 8995 is also known as Qualified Business Income Deduction Simplified Computation. Form 8995 is a simple document that allows qualified business owners with taxable earnings less than the first threshold to claim the 20% deductions on qualified income. The IRS guidelines spell out specific instructions for completing this form.;

If your taxable income is above the first threshold, you should file for claims using File 8995-A or Qualified Business Income Deduction. Form 8995-A has four parts;

It also has the following additional schedules;

The IRS guidelines also spell out instructions for completing Form 8995-A for your tax return.;

Form 8995 Qualified Bus Income Deduction Didn’t Include The Self

To figure the total amount of QBI,; you must consider all items that are attributable to the trade or business.; This includes, but isn’t limited to unreimbursed partnership expenses, business interest expense, deductible part of self-employed health insurance deduction, and contribution to qualified retirement plans.; The aforementioned is taken directly from the instructions of Form 8995.

You May Like: How Much Can You Get Back In Taxes

New Updates This Year For The 20% Qbi Business Deduction

Last tax season was a learning experience for everyone who had partnership, S corporation or sole proprietor income as they tried to understand the new qualified business income deduction. The rules and regulations challenged taxpayers, tax practitioners, tax software providers, even the IRS.

Now that weve made it through Year 1 of interpreting, calculating and implementing the QBI deduction, there are several updates to be aware of for the 2019 tax year.

Understanding Your Form 1099

If youre reading this in the Winter of 2021, you may have already received a bill from your financial institution. Its called a Form 1099-DIV. Oddly, the financial institution isnt demanding a penny of payment. Rather, your 1099-DIV prompts the IRS and your state tax agency to expect the payment of income tax with respect to your financial assets.

A Form 1099-DIV is a great window into your taxable investments. By learning how to read the major boxes of your 1099-DIV, you can gain valuable insights about your investments and their tax efficiency.

Also Check: Are Property Taxes Paid In Advance

How To Calculate The Qbi Deduction

As youâve probably noticed by now, the QBI deduction gets complex fast. The best way to figure out whether it applies to your business is to take it step-by-step.

Step 1: Determine whether your business is a specified service business. The IRS Qualified Business Income FAQs go into greater detail about the kinds of businesses that qualify as an SSTB.

Step 2: Calculate your total taxable income for the year. If itâs less than $157,500 then you donât need to worry about the type of business. You can take the full 20 percent QBI deduction.

Step 3: If your business is an SSTB and your total taxable income is $207,500 or more , stop here. Your income is too high to claim the deduction.

If your business is not an SSTB, and your total taxable income is between $157,500 and $207,500 , you can claim the full 20 percent deduction.

If your business is an SSTB and your total taxable income is between $157,500 and $207,500 , then continue to the next step to calculate your limited deduction.

Step 4: If your business is an SSTB with income in the phase-out range, youâll calculate your deduction by taking 20 percent of your qualified business income and applying the limitation of:

-

50 percent of your share of W-2 wages paid by the business, or

-

25 percent of those wages, plus 2.5 percent of your share of qualified property

Compare these calculations to 20 percent of your QBI and deduct the smaller amount.