Other States That Made Changes To Deadlines

- Alabamamade a sort of hybrid tax extension: The state will automatically waive late-payment penalties for payments remitted by May 17. However, interest on taxes owed will still accrue from April 15.

- Idaho introduced a bill;to push its state income tax filing deadline back to May 17, but the legislature did not come to an agreement before adjourning March 19. The legislature reconvenes on April 6.

Do I Have To File An Alabama Tax Return

You must file an Alabama tax return if your gross income exceeds the minimum specified for your filing status. For tax year 2020, Single full year residents must file if their gross income is $4,000 or more. Married full year residents must file if their gross income is $10,500 or more. Part year and nonresident filers may need to adjust and prorate these amounts.

Gross income means all income before deducting expenses that is reportable to the state of Alabama. Even if your gross income is below the amount specified for your filing status, you may still want to file an Alabama tax return. You may receive a refund for the state tax amount shown on your Alabama W-2, for example. You may also be eligible for any Alabama earned income credit or other low-income related credits.

Read the Filing Requirements

section of the Alabama 40 instructions book to help determine if you should file a state income tax return for tax year 2020.

Filing And Payment Deadline

For 2019 state taxes, the state has extended the filing and payment deadline. Alabama residents now have until July 15, 2020 to file their state returns and pay any state tax they owe for the year. As with the federal deadline extension, Alabama wont charge interest on unpaid balances between April 15 and July 15, 2020.

While this year is a bit different, generally the income tax filing deadline in Alabama is the same as the federal tax return due date April 15. If the federal deadline falls on a holiday or weekend, the IRS will extend it to the next business day.

If you cant file your Alabama state tax on time, you get an automatic six-month extension to complete your return. But if you owe tax, you must pay it on or before the original due date. The extension doesnt extend your time to pay your taxes, and you could face penalties and interest if you dont pay your tax on time.

Don’t Miss: When Was Income Tax Started

Alabama State Tax Tables

The Alabama State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019 Alabama State Tax Calculator. We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

The Alabama Department of Revenue is responsible for publishing the latest Alabama State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in Alabama. Tax rates and thresholds are typically reviewed and published annually in the year proceeding the new tax year. This page contains references to specific Alabama tax tables, allowances and thresholds with links to supporting Alabama tax calculators and Alabama Salary calculator tools.

The Alabama State Tax Tables below are a snapshot of the tax rates and thresholds in Alabama, they are not an exhaustive list of all tax laws, rates and legislation, for the full list of tax rates, laws and allowances please see the Alabama Department of Revenue website. The Alabama tax tables here contain the various elements that are used in the Alabama Tax Calculators, Alabama Salary Calculators and Alabama Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers. If you would like additional elements added to our tools, please contact us.

Who Pays Alabama State Tax

Just like the federal government, Alabama imposes an income tax on your earnings if you live or work in the state. So, as a traditional W-2 employee, Alabama income taxes will be withheld and deposited on each paycheck automatically. You will see this on your paycheck, near or next to the federal taxes.

If you work remotely, you should pay taxes to the state in which the work is performed. Employers will generally also pay taxes on wages paid to these workers to the same state, even if the employer has no physical presence in that state. However, some states may require that workers are taxed based on their employers location.

Don’t Miss: How Do I Get My Pin For My Taxes

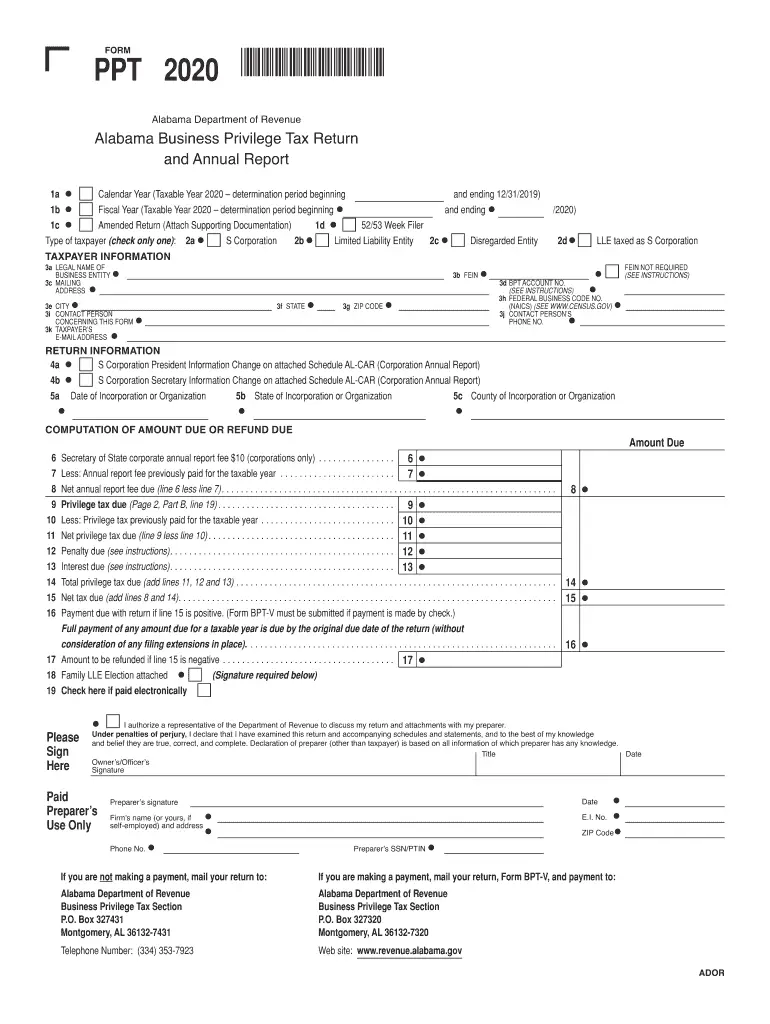

Where Can I Get Alabama Tax Forms

Printable Alabama tax forms for 2020 are available for download below on this page. These are the official PDF files published by the Alabama Department of Revenue, we do not alter them in any way. The PDF file format allows you to safely print, fill in, and mail in your 2020 Alabama tax forms.

To get started, download the forms and instructions files you need to prepare your 2020 Alabama income tax return. Then, open Adobe Acrobat Reader on your desktop or laptop computer. Do not attempt to fill in or print these files from your browser.

From Adobe Acrobat Reader use the Ctrl + O shortcut or select File / Open and navigate to your 2020 Alabama tax forms. Open the files to read the instructions, and, remember to save any fillable forms periodically while filling them in. Print all Alabama state tax forms at 100%, actual size, without any scaling.

General Tax Return Information

Due Date – Individual Returns -;April 15, or same as IRS

Extensions – Alabama individual and business income taxpayers are no longer required to file an Alabama extension form if they find they cannot meet their annual return filing deadline. Taxpayers will be given an automatic single six-month extension to file.;NO EXTENSION FORM IS REQUIRED TO BE FILED. The automatic extension only applies to filing a return; no extensions are granted for payment of taxes due. ALL TAX PAYMENTS ARE DUE BY THE ORIGINAL DUE DATE OF THE RETURN.

To make a payment, use Form 40V, Individual Income Tax Payment Voucher. Mail: Alabama Department of Revenue, PO Box 327467, Montgomery, AL 36132-7467

Drivers License/Government Issued Photo Identification:;Alabama requires Driver’s License or Government Issued Photo ID information to be included in the tax return in order to electronically file. Returns without photo ID must be paper filed and are not eligible for e-file.

New for 2020: Exemption of firefighters insurance benefits & Certified firefighter insurance premiums.

Do not report: Insurance benefits received by a certified fire-fighter as a result of a cancer diagnosis to any extent the amounts are included in the federal AGI of the taxpayer and are not exempt under any other law

Also Check: How Much Do I Need To Make To File Taxes

Where To Send Your Alabama Tax Return

| Tax Return With Payment |

You can save time and money by electronically filing your Alabama income tax directly with the . Benefits of e-Filing your Alabama tax return include instant submission, error checking, and faster refund response times. Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

Alabama encourages taxpayers to submit their Alabama income tax returns through the e-File system, and usually processes tax refunds for e-Filed returns in two weeks or less.

Almost all Alabama Department of Revenue tax forms can be electronically submitted through Alabama’s e-File system. The following forms are accepted:Form 40 , Alabama Schedule A , Alabama Schedule B , Federal Schedule C , Federal Schedule C EZ , Alabama Schedule D , Alabama Schedule E ), Alabama Schedule NOL-85 , Alabama Schedule NOL-85A , Federal Schedule F , Alabama Schedule CR , Alabama Form 4952A , Federal Form 2106 , Federal Form 2106 EZ ), Federal Form 3903 , Federal Form 4562 , Federal Form 4684 , Federal From 6252 , Federal Form 8283 , and Federal Form 8829 (Expenses for Business Use of Home.

How High Are Property Taxes In Alabama

Alabamas property taxes are very low, as the states average effective property tax rate is just 0.40%. A typical homeowner in Alabama pays only $609 annually in property taxes, about one-fourth the national average. Furthermore, seniors in Alabama may qualify for exemptions to lower their property taxes even further.

Don’t Miss: Do You Have To Claim Social Security On Taxes

Overview Of Alabama Taxes

Alabama is a state with relatively low income tax and effective property tax rates. The state sales tax of 4% is also low, but local rates can more than double what you pay in sales tax in some cities.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2020 – 2021 filing season.

Deducting Alabama Income Taxes

If you pay Alabama income tax, the IRS allows you to claim a deduction on your federal tax return for them. You can claim a state income tax deduction if you itemize deductions on your federal return.

If, you are single you can claim a standard deduction of $12,200 on your federal return. So, if you pay more than that in Alabama income tax and other itemized deductions, then consider itemizing your taxes.

Note: Due to the Tax Cuts and Jobs Act, state and local tax deductions, including state income taxes, are limited to $10,000 per year.

Don’t Miss: When Do We Start Filing Taxes 2021

More Help With Al State Tax

Understanding your tax obligation can be confusing. Whats even more confusing is how to deduct AL state tax from your federal taxes as an itemized deduction.

So, get help with H&R Block Virtual! With this service, well match you with a tax pro with Alabama tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your AL taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find Alabama state tax expertise with all of our ways to file taxes.

Related Topics

You can claim the standard deduction vs. itemize deductions to lower your taxable income. The standard deduction lowers your income by one fixed amount. Itemized deductions are made up of a list of eligible expenses.

Alabama Update On Extension Of Filing Deadline

The Alabama Department of Revenue has issued a notice to taxpayers in response to the IRS issuance, on March 17, 2021, of IR-2021- 59, which provides for an automatic extension of the filing and payment due date for federal individual income tax returns for the 2020 tax year from April 15, 2021, to May 17, 2021. The Department notes that Alabama provides for an automatic extension of up to six months to file Alabama income tax returns whenever there is a corresponding federal extension. Consequently, Alabama taxpayers will not need to request an extension to file Alabama individual income tax returns without a late-filing penalty through the extended Federal due date . Regarding the payments of Alabama income tax for the 2020 tax year, which are due on April 15, 2021, the Department will automatically waive, without request, late-payment penalties for payments remitted by May 17, 2021. However, the Department is not authorized to waive interest, and any interest accruing from April 15, 2021, through the actual payment date will be due. The Department also reminds taxpayers that the IRS relief does not apply to estimated tax payments that are due on and still must be paid by April 15, 2021.

Don’t Miss: How Much Federal Tax Should I Pay

Alabama Grants Use Tax Refund Request On Materials Stored In

The taxpayer at issue furnished and installed protective custom curtain walls on the exterior of buildings. Materials used in such projects were shipped and stored at the taxpayers facility in Alabama before ultimately being routed to out-of-state job site locations. The City of Bessemer imposes use tax on tangible personal property purchased at retail for storage, use, or other consumption within the City. However, an exemption exists for property temporarily stored in the city/state for use outside the state. The Taxpayers use tax refund requests were granted because the companys intent to use those materials outside of Alabama was supported by purchase orders, invoices, and the fact that the materials in question were segregated for the out-of-state jobs.

Alabama Extends State Tax Filing Deadline

MONTGOMERY, Ala. – The state of Alabama has extended its state income tax filing deadline to match the federal date of May 17, 2021, this year.

The Internal Revenue Service announced the extension Wednesday for federal income tax filings but the relief does not apply to estimated tax payments that are due on.

Alabama is also waiving late-payment penalties for state taxes owed if payments are made by May 17, but cannot waive any interest that accrues on late payments.

Most Read

Don’t Miss: How To Apply For Irs Tax Forgiveness

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Alabama Extends Tax Filing Deadline To May 17

Interest will still accrue on payments made after April 15.

Alabama taxpayers have until May 17 to pay individual income tax returns, the Alabama Department of Revenue announced on Thursday.

The extension matches a federal individual income tax extension announced on Wednesday.;

Interest will still accrue on payments made after April 15, however. ALDOR issued a statement that it is not authorized to waive interest.

The department encouraged people to file as soon as possible because refunds can be approved earlier by avoiding the crush of last-minute filings. Gov. Kay Ivey also issued a statement encouraging residents to file early.

While many Alabamians are getting their ducks in a row this tax season, they can rest a little easier knowing there will be an extension for filing both federal and state individual income tax. Folks will not accrue any penalty for payments received by May 17, 2021. However, we should still not delay, and I would encourage all Alabamians to go ahead and get your taxes filed and behind you, she said.

Don’t Miss: How Do Property Taxes Work In Texas

State Income Tax Filing Extended

Governor Kay Ivey and the Alabama Department of Revenue announced today that the state income tax filing due date is extended from April 15, 2020, to July 15, 2020. Taxpayers can also defer state income tax payments due on April 15, 2020, to July 15, 2020, without penalties and interest, regardless of the amount owed. This deferment applies to all taxpayers, including individuals, trusts and estates, corporations and other non-corporate tax filers. Other taxes included in the deadline extension are corporate income tax, the Financial Institution Excise Tax , and the Business Privilege Tax . Taxpayers do not need to file any additional forms or call the Alabama Department of Revenue to qualify for this automatic state tax filing and payment relief. Individual taxpayers who need additional time to file beyond the July 15 deadline can request a filing extension through the usual methods.

Getting Your Alabama Tax Refund

If your state tax witholdings are greater then the amount of income tax you owe the state of Alabama, you will receive an income tax refund check from the government to make up the difference.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. E-filing your return and filing early can help ensure your refund check gets sent as quickly as possible.

Once you’ve filed your tax return, all you have to do is wait for your refund to arrive. If you want to check the status of your Alabama tax refund, you can visit the Alabama Income Tax Refund page.

Don’t Miss: How To File Taxes Doordash

When Are Alabama State Taxes Due

According to the Alabama Department of Revenue:

“Regarding the;payments of Alabama income tax;for the 2020 tax year, which are due on April 15, 2021, the Alabama Department of Revenue will automatically waive, without request, late-payment penalties for payments remitted by May 17, 2021.;

However, ALDOR is not authorized to waive interest, and any interest accruing from April 15, 2021, through the actual payment date will be due. Therefore, ALDOR encourages taxpayers to make their payments for the 2020 tax year as soon as possible to avoid the accrual of interest beyond April 15.”

The department also encourages taxpayers to file as early as possible to avoid “logjams” when it comes to refunds.

For more info visit:;

IRS says more stimulus checks on the way: But when will seniors, others on Social Security get COVID payments?