Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors’ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

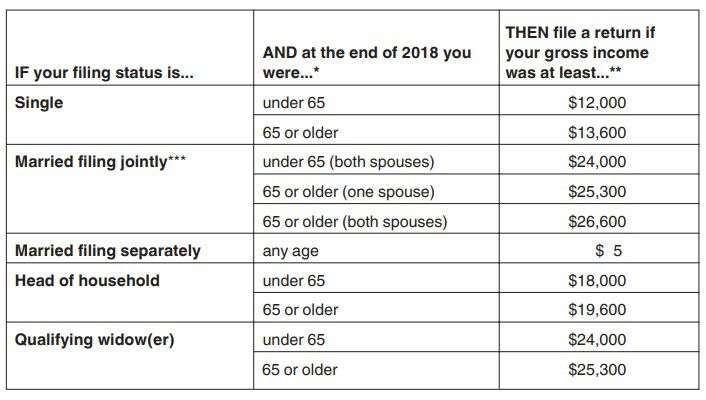

How Much Do You Have To Make To File Taxes

Income-based tax requirements will be dependent on how you plan on filing a tax return. Inevitably whether you’ll need to file a tax return who have to do with whether you’re income can even make it past the first tax bracket and how much more if so, but those tax brackets vary depending on how you file.

You May Like: How Can I Make Payments For My Taxes

Electronically File Your Arizona 2020 Income Tax Returns For Free

Free File Alliance is a nonprofit coalition of industry-leading tax software companies partnered with ADOR and the IRS to provide free electronic tax services. Free File is the fast, safe and free way to do your tax return online.

Individuals who meet certain criteria can get assistance with income tax filing. Taxpayers can file for free if they meet the following criteria:

Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions , for where to report the estimated tax penalty on your return.

The penalty may also be waived if:

- The failure to make estimated payments was caused by a casualty, disaster, or other unusual circumstance and it would be inequitable to impose the penalty, or

- You retired or became disabled during the tax year for which estimated payments were required to be made or in the preceding tax year, and the underpayment was due to reasonable cause and not willful neglect.

Read Also: How Do I Get My Pin For My Taxes

Extended Due Date Of First Estimated Tax Payment

Pursuant toNotice 2020-18, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to , the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

You May Like: How Does H& r Block Charge

Michelle The Career Streamer

Michelle is known for her deadpan humor while she plays retro games. She has been streaming for years and has managed to turn it into a sustainable career. In 2019, she earned $68,200.

She has done the math and has realized that she paid her editor $4,000 through the course of the year and had commissioned for $500, and replaced her Stream Deck for $250. She also split her expenses to account for her home business. Altogether, she has netted $19,750.

She subtracts the $19,750 from the $68,200 she received, equalling $48,450 . From that, she will need to pay the following in taxes:

For the first $9,875, she will need to pay 10% tax . For the $30,250 , she will need to pay 12% tax . For the remaining $8,325, she will need to pay 22% tax . This means she will pay a grand total of $6,449 in Federal taxes.

Income $72000 And Below:

- Free federal tax filing on an IRS partner site

- State tax filing

- Guided preparation simply answer questions

- Online service does all the math

- Free electronic forms you fill out and file yourself

- No state tax filing

- You should know how to prepare paper forms

- Basic calculations with limited guidance

Read Also: How Much Does H& r Block Charge To Do Taxes

Filing Requirements For Dependents

Taxpayers who are claimed as dependents are subject to different rules for filing taxes.

Dependents include children under the age of 19 , or who are permanently disabled along with qualifying relatives . When their earned income is more than their standard deduction, taxes have to be filed. A dependent’s income is unearned when it comes from sources such as dividends and interest.

Single, under the age of 65 and not older or blind, you must file your taxes if:

- Unearned income was more than $1,050

- Earned income was more than $12,000

- Gross income was more than the larger of $1,050 or on earned income up to $11,650 plus $350

If Single, aged 65 or older or blind, you must file a return if:

- Unearned income was more than $2,650 or $4,250 if youre both 65 or older and blind

- Earned income was more than $13,600 or $15,200 if youre both 65 or older and blind

If youre married, under the age of 65 and not older or blind, you must file a return if:

- Unearned income was more than $1,050

- Earned income was more than $12,000

- Your gross income was at least $5 and your spouse itemizes deductions

- Your gross income was more than the larger of $1,050 or your earned income was $11,650 plus $350

Dependents May Have To File

If you are a dependent of another taxpayer, then you follow a different set of rules.

The rules determining whether a dependent needs to file a tax return are somewhat complicated, but Ill try my best to keep it simple. Dependents who are under 65 and have unearned income over $1,100, or earned income over the standard deduction of $12,200, must file a tax return.

That parts pretty easy. Heres where it gets more complex: If you received both earned and unearned income in 2019, you must file a return if your combined income adds up to more than the larger of $1,100 or total earned income plus $350.

For example, 18-year-old Danielle is claimed as a dependent by her parents. In 2019, she received $200 in unearned income from taxable interest from an investment and also earned $4,050 from her part-time job at the library. Danielles unearned income and earned income each fall below the individual thresholds. Her total income of $4,250 is also less than her earned income plus $350 . Since all three of these factors apply, Danielle does not have to file a 2019 tax return.

Still confused? Understandable. Basically, if you are a dependent and have both earned and unearned income you have to file a tax return if your total income was more than $1,100 and your unearned income was more than $350.

Related:Where to Get Your Taxes Done

Read Also: Efstatus Taxact Com Login

What Are My Self

As a self-employed individual, generally you are required to file an annual return and pay estimated tax quarterly.

Self-employed individuals generally must pay self-employment tax as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording “self-employment tax” is used, it only refers to Social Security and Medicare taxes and not any other tax .

Before you can determine if you are subject to self-employment tax and income tax, you must figure your net profit or net loss from your business. You do this by subtracting your business expenses from your business income. If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1 of Form 1040 or 1040-SR. If your expenses are more than your income, the difference is a net loss. You usually can deduct your loss from gross income on page 1 of Form 1040 or 1040-SR. But in some situations your loss is limited. See Pub. 334, Tax Guide for Small Business for more information.

You have to file an income tax return if your net earnings from self-employment were $400 or more. If your net earnings from self-employment were less than $400, you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 and 1040-SR instructions.

When To Pay Estimated Taxes

For estimated tax purposes, the year is divided into four payment periods. You may send estimated tax payments with Form 1040-ES by mail, or you can pay online, by phone or from your mobile device using the IRS2Go app. Visit IRS.gov/payments to view all the options. For additional information, refer to Publication 505, Tax Withholding and Estimated Tax.

Using the Electronic Federal Tax Payment System is the easiest way for individuals as well as businesses to pay federal taxes. Make ALL of your federal tax payments including federal tax deposits , installment agreement and estimated tax payments using EFTPS. If its easier to pay your estimated taxes weekly, bi-weekly, monthly, etc. you can, as long as youve paid enough in by the end of the quarter. Using EFTPS, you can access a history of your payments, so you know how much and when you made your estimated tax payments.

Corporations must deposit the payment using the Electronic Federal Tax Payment System. For additional information, refer to Publication 542, Corporations.

Recommended Reading: Michigan.gov/collectionseservice

General Information About Individual Income Tax Electronic Filing

Filing electronically is a fast growing alternative to mailing paper returns. The Missouri Department of Revenue received more than 2.7 million electronically filed returns in 2019. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

Filing On Behalf Of Your Child

If your child is required to file a tax return for unearned income, you can claim the money on your return instead. The IRS places certain restrictions including a limit on the amount of money, and the tax you will owe may be greater than if your child filed an individual return. If you qualify, you can file Form 8814 with your 1040, and the IRS will not require your child to file.

You May Like: What Does Agi Mean In Taxes

Taylor The Hobby Streamer

Taylor is a college student who plays CS:GO on the weekends. His friends have complimented his skill often and suggested he stream. He agreed. While he only started streaming for fun, a few fans have donated to his stream or have given him bits. In 2019, he made $1,235.

Twitch sent him a 1099 for the $630 he made through bits and subscriptions. Streamlabs sent his a 1099 for the donations made through them. Taylor is required to claim the taxes as part of his income and will do so on Form 1040.

Teaching Teens About Taxes

When you are working on filing taxes for your teenager, it’s a great opportunity to them about taxes. If your teen has a job, explain that some employers withhold taxes from paychecks and suggest that your teen saves all paycheck stubs for tax time. Have your teen do the tax filing by gathering their paychecks and adding up the withholding. Show your teen where to enter the numbers on the tax forms and how to submit them.

Note that the above is a synopsis of the IRS rules that apply. There are numerous exceptions to these rules, and the IRS is constantly changing them. To be sure you are fulfilling your own and your child’s requirements, confer with a tax accountant familiar with your family. IRS Publication 929, “Tax Rules for Children and Dependents.”

You May Like: How To Buy Tax Liens In California

Tax Preparers: Going Pro

With a complex federal tax code more than 74,000 pages long, its no wonder over half of U.S. taxpayers hire a professional to help them. If you go this route, check to ensure your preparer has an IRS Preparer Tax Identification Number and find out their service fees up front.3 Also, keep in mind that if your tax preparer files 10 or more returns in a year, the IRS requires that your tax return be filed electronically.3

File Your Virginia Return For Free

Made $72,000 or less in 2020? Use Free File

If you made $72,000 or less in 2020, you qualify to file both your federal and state return through free, easy to use tax preparation software.

Don’t qualify for Free File? Try Free Fillable Forms

You may still be able to file your return for free using Free Fillable Forms if:

- you’re a Virginia resident , and

- you’re comfortable doing your taxes yourself

Are you a member of the military? Try MilTax

MilTax is an approved tax preparation software that provides free tax services for members of the military.

Also Check: Do Roth Ira Contributions Need To Be Reported On Taxes

Individuals Required To File A North Carolina Individual Income Tax Return

The following individuals are required to file a 2020 North Carolina individual income tax return:

- Every resident of North Carolina whose gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2020 for the individual’s filing status.

- Every part-year resident who received income while a resident of North Carolina or who received income while a nonresident that was attributable to the ownership of any interest in real or tangible personal property in North Carolina, or derived from a business, trade, profession, or occupation carried on in North Carolina, or derived from gambling activities in North Carolina and whose total gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2020.

- Every nonresident who received income for the taxable year from North Carolina sources that was attributable to the ownership of any interest in real or tangible personal property in North Carolina, or derived from a business, trade, profession, or occupation carried on in North Carolina, or derived from gambling activities in North Carolina and whose total gross income from all sources both inside and outside of North Carolina for the taxble year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2020. For nonresident business and employees engaged in disaster relief work at the request of a critical infrastructure company, refer to the Personal Tax Division Bulletins.

When You Might Want To File

Filing a federal tax return doesnt necessarily mean you have to pay tax. In some instances, filing a tax return could actually mean that you receive money back. When youre entitled to any of these three refunds or credits, consider filing even if you otherwise arent required to:

- Earned income tax credit

- Affordable Care Act premium tax credit

- Refund of overpaid taxes

Workers with low-to-moderate income might qualify for the EITC. The income threshold varies depending on your filing status and the number of qualifying children you can claim. Thresholds vary from $15,820 for a single filer with zero qualifying children to $56,844 for joint filers with three or more qualifying children.

The Affordable Care Act premium tax credit helps low- and moderate-income families pay for health insurance purchased through the health insurance marketplace created by federal law. You can generally qualify if your household income is between 100% and 400% of the federal poverty line.

In case you overpaid your taxes or forgot to file taxes in a prior year, you cant get your refund unless you file a tax return. You cant wait too long, either the IRS requires you to claim refunds from prior years within three years. After that, the IRS can no longer send a refund.

Recommended Reading: Reverse Ein Lookup Irs