Help Filing Your Past Due Return

For filing help, call 1-800-829-1040 or 1-800-829-4059 for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 1-800-Tax-Form or 1-800-829-4059 for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

When Are The Returns And The Taxes Owed Due

Each type of the deceased return has a due date:

The Final Return:

- If the death occurred between January 1st and October 31st, you have until April 30th of the following year.

- If it was between November 1st and December 31st, it is due six months after the date of death.

The Optional Returns:

- The Return for Rights or Things is due by the later of one year from the date of death or 90 days after the mailing date of the Notice Of Assessment for the final return.

- The other optional Returns such as Return for a Partner or Proprietor and the Return of Income from a Graduated Rate Estate are due on the same date as the final return.

The T3 Trust Return:

The T3 Trust return is due 90 days from the end of the trusts tax year. The T3 tax year starts the day after the death date and the end date can be any date up to one year from the date of death. This means that the due date of the T3 return could be before the final return.

International Tax Assistance Available From Us Tax Help

Navigating the many tax challenges that U.S. taxpayers in Canada face can be quite difficult. Not only do expats have to contend with the same issues that many domestic taxpayers face, but they have a number of additional considerations to keep in mind as well. If you or someone you know lives in Canada but is still an American citizen, turn to the experts at U.S. Tax Help for the assistance you need. Learn more about all our services by visiting us online or calling 362-9127 today.

Let Us Tackle Your U.S. Tax Issues

Recommended Reading: Can You Change Your Taxes After Filing

What If You Need Help

If you need more information after reading this guide, go to Taxes, or contact the CRA.

If you work in the film or video production industry and you need more information, go to Film and Media Tax Credits. You can find the telephone numbers, fax numbers, and addresses for the film services units on our website.

Does Your Teenager Need To File An Income Tax Return

Luckily, most teenagers dont earn enough income to be required to file a tax return. Generally, any Canadian who earns less than the basic personal credit doesnt have to file a return. Some exceptions do apply of course. Check out the full details on the Canada Revenue Agencys Do you have to file a return? webpage.

Should your teenager file an income tax return? Definitely!

- They could get a tax refund. If your teen has deductions for income tax, EI, or CPP and didnt make a lot of money, they may be entitled to a refund.

- They can build some RRSP room. RRSP contribution room starts building as soon as income is reported, regardless of age.

- They can register for benefits. Filing a tax return registers your teen in CRAs system. Once they turn 19, theyll be automatically considered for the GST/HST credit if theyve filed a return the previous year.

Make it a teachable moment. Involve your teen in the process of filing their return.

If your teen is a university student, be sure to prepare their return before yours if you plan to transfer tuition credits. Youll need to enter certain numbers from their return into your return to complete the process. If they plan on carrying forward those tuition credits to a future year when they need to use them, theyll need to file a return and report the amounts from their T2202 or official tax receipts.

Which TurboTax is Best for You?

Also Check: How Do I Get My Pin For My Taxes

What Date Is Your 2020 Tax Return Due

Generally, your return for 2020 has to be filed on or before April 30, 2021.

Self-employed persons

If you or your spouse or common-law partner carried on a business in Canada in 2020 , your return for 2020 has to be filed on or before June 15, 2021. However, if you have a balance owing for 2020, you have to pay it on or before April 30, 2021.

If you are filing a Canadian tax return for someone who died in 2020, the due date may be different. For more information, see Guide T4011, Preparing Returns for Deceased Persons.

Note

If you are filing an elective return under section 216 or section 217 of the Income Tax Act, see Guide T4144, Income Tax Guide for Electing Under Section 216, or Pamphlet T4145, Electing Under Section 217 of the Income Tax Act, for the due dates of these types of returns.

Exception to the due date of your return

When a due date falls on a Saturday, Sunday, or public holiday recognized by the CRA, your return is considered on time if the CRA receives it or if it is postmarked on the next business day. For more information, go to Important dates for individuals.

Send your completed return to your designated tax centre. If you are an actor in the film and video industry and are electing to file a Canadian tax return under section 216.1 , send your return to the Film Services Unit. For more information, go to Film and Media Tax Credits.

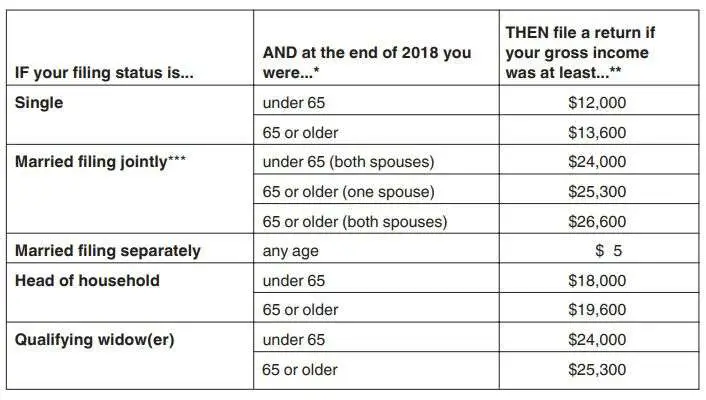

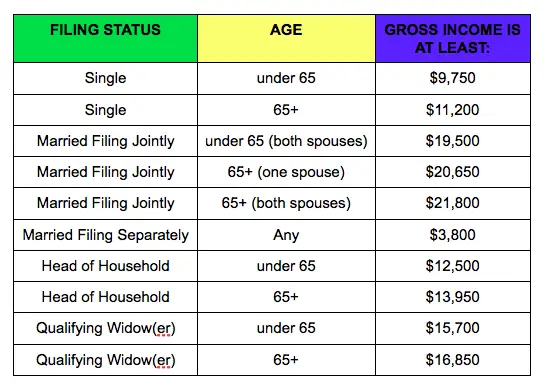

Minimum Gross Income Thresholds For Taxes

The IRS defines “gross income” as anything you receive in the form of payment that’s not tax-exempt. Gross income can include money, services, property, or goods. The thresholds cited here apply to income earned in 2020, which you must report when you file your 2020 tax return in 2021.

In a practical sense, the limits are equal to the years standard deduction, because you can deduct this amount from your gross income and only pay income tax on the difference. You would owe no tax and would not be required to file a return if youre single and earned $12,400 in 2020, because the $12,400 deduction would reduce your taxable income to $0. But you would have to file a tax return if you earned $12,401, because youd have to pay income tax on that additional dollar of income unless you had applicable tax credits you could use.

As of the 2020 tax year, these figures are:

| Single under age 65 | |

| Qualifying widow age 65 or older | $26,100 |

You May Like: Www.1040paytax

Filing An Amended Return

If you file your income tax return and later become aware of any changes you must make to income, deductions, or credits, you must file an amended Louisiana return. To file a paper amended return:

- Mail an amended return that includes a payment to the following address:Louisiana Department of Revenue

Income Requirements For Filing A Tax Return

Your first consideration is how much do I have to make to file taxes?. If your gross income for 2020 is above the thresholds for your age and filing status, you must file a federal tax return next year. See the table below.

Tax-filing earnings thresholds for 2020 taxes| Filing status | |

|---|---|

| $5 | $5 |

In addition to federal taxes, you may also have to pay state taxes. Currently, seven states dont tax income at all, while two other states only tax investment income. You can find out if you owe state income taxes by going to your states revenue, finance or taxation offices website. The IRS also has a link to every states tax office.

Read Also: How Much Does H & R Block Charge To Do Taxes

Tax On Taxable Income

Certain types of income you earn in Canada must be reported on a Canadian tax return. The most common types of income include:

- income from employment in Canada

- income from a business carried on in Canada

- the taxable part of Canadian scholarships, fellowships, bursaries, and research grants

- taxable capital gains from disposing of taxable Canadian property

You may be entitled to claim certain deductions from income to arrive at the taxable amount. You can also claim a credit for any tax withheld at source or paid on this income.

If there is a tax treaty between Canada and your country or region of residence, the terms of the treaty may reduce or eliminate the tax on certain types of income. To find out if Canada has a tax treaty with your country or region of residence, see Tax Treaties. If it does, contact the CRA to find out if the provisions of the treaty apply.

Tax Credit For Seniors

Even if you must file a tax return, there are ways you can reduce the amount of tax you have to pay on your taxable income. As long as you are at least 65 years old and your income from sources other than Social Security is not high, then the tax credit for the elderly or disabled can reduce your tax bill on a dollar-for-dollar basis.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Don’t Miss: Michigan Gov Collectionseservice

Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

Penalties For Not Paying Your Taxes

Even if you file an extension to submit your tax return, you must pay any estimated tax you owe by April 15, 2021. If you do not pay your taxes, you will be charged a penalty and owe interest on any unpaid balance.

The penalty for failing to pay your taxes by the due date is 0.5 percent of your unpaid tax for each month or part of a month that your return is late. This penalty is capped at 25 percent of late unpaid taxes. If you file your return on time and request to pay by an installment agreement, the penalty drops to 0.25 percent for each month or part of a month of the installment agreement.

Youre also charged interest on the unpaid balance, which compounds daily. The rate is set each quarter and is based on the federal short-term rate, plus an additional 3 percent.

If you owe taxes and dont file your return on time, youll be charged a penalty for failing to file. This is usually five percent of the tax owed for each month or part of a month your return is late. This penalty is also capped at 25 percent

Recommended Reading: Where’s My Tax Refund Ga

Which Tax Package Should You Use

- If you are reporting only income from employment in Canada, from a business or partnership with a permanent establishment in Canada, including a non-resident actor electing to file a return under section 216.1, use the tax package for the province or territory where you earned the income. The tax package includes the return you will need

- If you are also reporting other types of Canadian-source income , you will need Form T2203, Provincial and Territorial Taxes for Multiple Jurisdictions, to calculate your tax payable

- If you are reporting only Canadian-source income from taxable scholarships, fellowships, bursaries, research grants, capital gains from disposing of taxable Canadian property, a business with no permanent establishment in Canada , or if you are filing an elective return under section 217 of the Income Tax Act, use the Income Tax and Benefit Guide for Non-Residents and Deemed Residents of Canada. It includes the return and schedules you will need. For more information, see Electing under section 217

- If you received rental income from real or immovable property in Canada or timber royalties on a timber resource property or a timber limit in Canada and you are electing to file a return under section 216 of the Income Tax Act, use Guide T4144, Income Tax Guide for Electing Under Section 216. For more information, see Electing under section 216. Form T1159, Income Tax Return for Electing Under Section 216 is the return you will need

What Are The Tax Returns Filed In Canada For A Deceased Individual

There are three types of deceased returns that might be filed after death. The legal representative has to file at least one return called the Final Return. However, it is possible to file multiple returns after death that includes Optional Returns and the Trust returns.

You may use the optional returns to declare certain types of income that cannot be claimed on the final return. Also, by claiming certain amounts more than once, splitting them between returns, or claiming them against certain kinds of income, you may be able to reduce or eliminate the deceaseds tax payable. For any further questions, please refer to the CRAs T4011 guide, Preparing Returns for Deceased Persons, located here

Read Also: Efstatus Taxact Com Return

When A Dependent May Need To File A Tax Return

Taxpayers who are claimed as a dependent on someone’s tax return are subject to different IRS filing requirements, regardless of whether they are children or adults. A tax return is necessary when their earned income is more than their standard deduction.

The standard deduction for single dependents who are under age 65 and not blind is the greater of:

- $1,100 in 2020

- Or the sum of $350 + the person’s earned income, up to the standard deduction for an unclaimed single taxpayer which is $12,400 in 2020.

A dependent’s income can be “unearned” when it comes from sources such as dividends and interest. When a dependent’s unearned income is greater than $1,100 in 2020, the dependent must file a tax return.

You May Be Eligible For More Credits This Year

In addition, Americans may be eligible for different credits this year due to the coronavirus pandemic.

Most important, low- to medium-income Americans are generally able to take advantage of the earned income tax credit, a tax break which can be used to lower the amount families owe and potentially lead to a bigger refund. In 2020, the maximum credit for someone with no qualifying children is $538, and the most a family with three or more children could receive is $6,660, according to the IRS.

Some Americans who didn’t previously claim the earned income tax credit may be able to this year, depending on how much money they made. And, non-filers who submit a return for the first time for 2020 can look back over the last three years to see if they were eligible and retroactively file to claim the credit, said Maag.

Other changes will also ensure that families get the maximum credit they need, even if they lost income because of Covid. If you claimed the earned income credit in 2019 but had lower income in 2020, you can use your 2019 income again to claim the credit.

There are other credits that families may be eligible for or can use their 2019 income to claim in 2020, such as the child tax credit.

Also Check: Mcl 206.707

Why You May Not Need To File A Tax Return

Single filers dont need to file a tax return if your gross income doesnt exceed the standard deduction of $12,400, or $24,800 if youre married and filing jointly. This threshold is increased if you and/or your spouse is over the age of 65if you are, it begins at $26,100 for those married and filing jointly.

The IRS says that gross income includes all forms of money, goods, property and servicesincluding the sale of your home.

Some people arent required to file a tax return because of the way taxable income is calculated, says Nell Curtis, an accounting instructor at Milwaukee Area Technical College in Wisconsin.

Sometimes this is because their income is below certain thresholds or because of the types of income they have, Curtis says. For instance, Social Security is subject to tax limitations, so if that is someones primary income source, he or she might not need to file a tax return.

There are exceptions to this rule. Taxpayers who earn less than those amounts might be required to file if specific situations apply to them, such as the need to pay special taxes or if the taxpayer has received net self-employment earnings of $400 or more, Curtis says. Another exception is if you received the advanced premium tax credit when enrolling in health insurance coverage through the marketplace that was created by the Affordable Care Act, youll need to file a tax return with a completed Form 8962 attached.