You May Know About Ways To File Your Federal Income Tax Return For Free But What About Filing State Taxes For Free

In 43 states and the District of Columbia, Americans have to pay some sort of state-level income tax as well as federal income tax. If you live in a state with a state-level income tax, you may dread the idea of paying someone to complete yet another tax return for you.

If so, youll be happy to know that its possible to file state taxes without paying for it. Heres what you should know about filing your state taxes for free.

How To Collect Sales Tax In Missouri

If the seller has an in-state location in the state of Missouri, they are legally required to collect sales tax at the tax rate of the area where the seller’s business is located, as Missouri is an origin based sales tax state.If the seller’s location is out of state, then the collection of sales tax gets a bit more difficult. In this case, the seller who has sales tax nexus within the state, is required to collect sales tax at the sales tax rate of the buyer’s location.

Filing Information For Individual Income Tax

Whether you file electronically using our free iFile service, hire a professional preparer, have us prepare it for free, or complete a paper return, filing a Maryland tax return is easy.

For those in a hurry, some quick links to everything you need to know about…

Follow the links to sort out all the details quickly and make filing your tax return painless!

Read Also: How To File School District Taxes In Ohio

Missouri Income Tax Rates

Missouri has a progressive income tax system with income tax rates that range from 1.5% to 5.4%. In 2019, the highest tax rate applied to annual income of more than $8,424. With a median household income of about $36,000 , most Missouri taxpayers would currently have most of their income taxed at the highest marginal tax rate.

Payment Methods And Fees

Electronic Bank Draft

You will need your routing number and checking or savings account number. There will be a .50 cent handling fee to use this service. Please allow 3-4 business days for E-Check transactions to apply to your tax account. Please note that your payment will be postmarked the date you submitted the payment, unless your payment is scheduled for a future date.

Note: Make sure that your bank authorized ACH withdrawals from your account before using this service. A rejected ACH withdrawal could result in additional fees.

Debit & Credit Card

The Department accepts MasterCard, Discover, Visa, and American Express. Debit cards are accepted and processed as credit cards. Please allow 5-6 business days for debit and credit card transactions to apply to your tax account. Please note that your payment will be postmarked the date you submit payment. The following convenience fees will be charged to your account for processing:

| Transaction Amount |

|---|

Also Check: How Do I Know What Form I Filed For Taxes

Can You Make Payments On Missouri State Taxes

Yes, you can do this through a Missouri Department of Revenue payment plan if youre having tax problems. The Missouri Department of Revenue accepts online payments in the form of a credit card or E-Check . However, you can only begin making payments once you have been accepted into the Missouri state income tax payment plan via your own installment agreement .

Recommended Reading: How To Pay My Federal Taxes Online

Is My Business Address In One Of The Citys Special Sales Tax Districts

Use the Citys mapping tool to determine if your business is in a special sales tax district. Click on the Layers dropdown , select the Community Improvement District, Neighborhood Improvement District and Transportation Development District checkboxes and enter the business address.

For a complete listing of these districts and the corresponding sales tax rate go to the Missouri Department of Revenue website.

Also Check: How To Appeal Property Taxes Cook County

You May Like: How Much Do Llc Pay In Taxes

Other Free State Income Tax Filing Websites

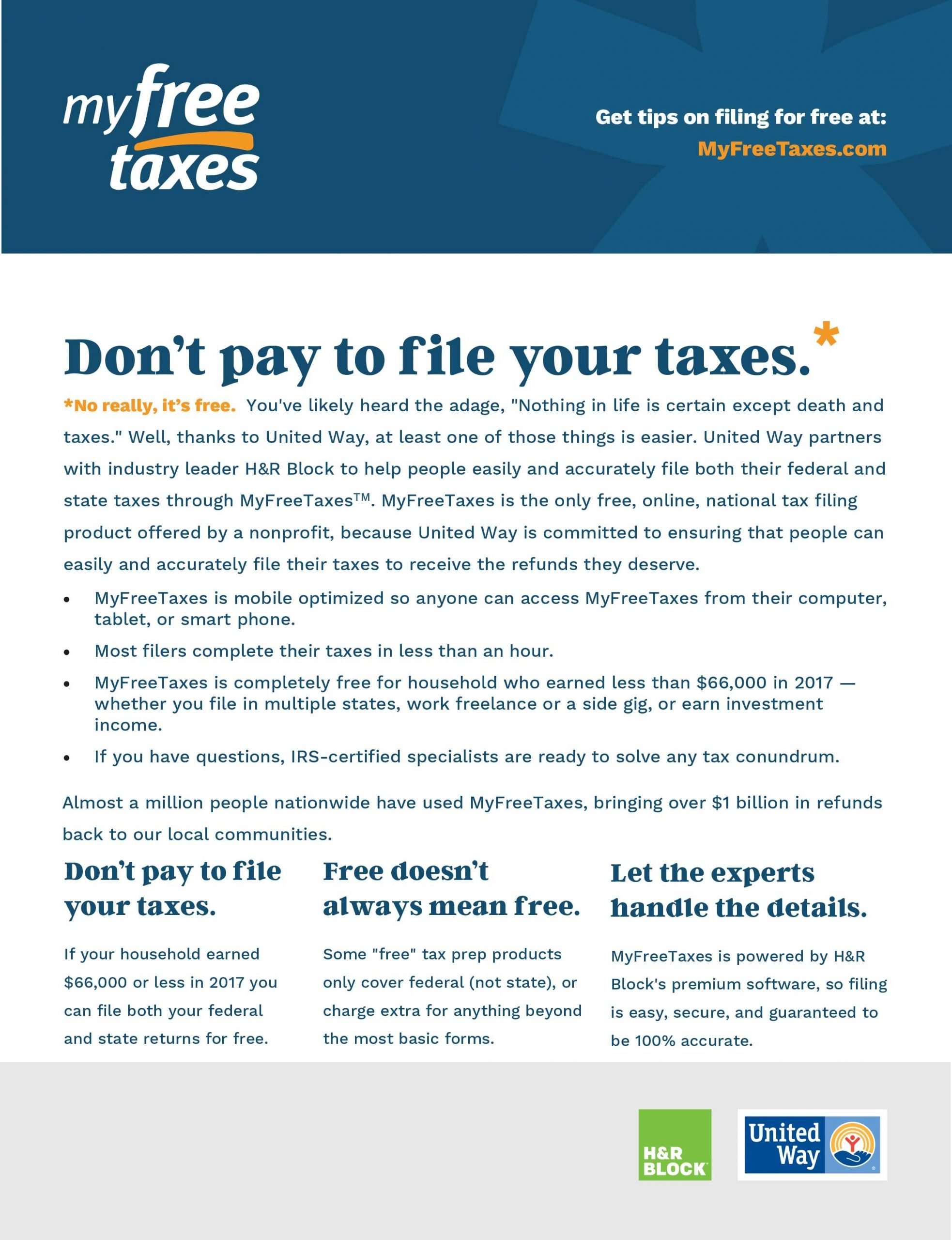

3. MyFreeTaxes.com This is a not-for-profit with funding from the Walmart Foundation, The United Way and H& R block and they offer free state and federal tax returns if you meet the criteria.

4. On-Line Taxes This one is pretty simple. You have to have an adjusted gross income within a certain range. If you dont qualify both returns cost $7.95. They are a little bit different than many of the other places in that they offer free customer service with a toll-free number, e-mail, and live tax help. They also allow you to view the forms before paying.

What Is Missouri State Tax

State tax is a tax levied by the state on your income earned within the state or as a resident of Missouri. State income taxes, which vary by state, are a percentage you pay to the state government based on income received within a tax year.

Similar to federal taxes, state income taxes are self-assessed. Yet, the structure of the taxes is different from state to state. In fact, some states have a flat tax rate, marginal tax rate, or no tax at all.

Recommended Reading: How To File State Taxes By Mail

You May Have To Deal With Different Taxes Deductions And Credits

Your employer will typically withhold only state and local income taxes from your paycheck, but you may also owe local taxes and other taxes, depending on where you live. For example, Ohio, has a school district tax in many of its school districts that requires a separate return to be filed in addition to your state income tax return. Ohio has city tax returns for their taxing municipalities, so you could be filing up to three tax returns if youre filing in Ohio.

You would usually see certain withholdings at the federal level that are not at the state level, says Desnoyers. For example, Social Security and Medicare taxes are withheld for federal tax purposes, but you would typically only see state income taxes withheld at the state level.

You may also qualify for certain deductions and credits that dont show up on your federal tax return. For example, some states offer a deduction or credit for contributions you make to a 529 College Savings Plan, while others offer great deductions for age and/or retirement income. To learn more about your states taxes, deductions and credits, visit your states Department of Revenue or Department of Taxation website.

Who Pays Missouri Income Tax

Just like the federal level, Missouri imposes income taxes on your earnings if you have a sufficient connection to the state if you work or earn an income within state borders.

You may not have to file a Missouri return if:

- You are a resident and have less than $1,200 of Missouri adjusted gross income

- You are a nonresident with less than $600 of Missouri income

- Your Missouri adjusted gross income is less than the amount of your standard deduction plus your exemption amount.

As a traditional W-2 employee, your income taxes will likely be taken out on each payroll period automatically. You will see this on your paycheck stub, near or next to the federal taxes.

Don’t Miss: How Much Taxes Do They Take Off Your Paycheck

What Are The Conditions Of A Missouri Tax Payment Plan

The Missouri Department of Revenue generally takes an inviting approach to its payment program. However, the program does have criteria. A Missouri income tax business payment plan can only be created for delinquent balances totaling $50 or more. Youll need to make a full payment online via credit card or E-Check to clear your balance if you owe less than $50 in taxes.

There are three big stipulations to know about if youll be applying to the program as either an individual or business. First, you must be current with all tax filings to be eligible to enter the Missouri state tax payment plan. Taking care of this can often be as simple as filing your unfiled taxes. You must also have less than two previous defaulted agreements in order to qualify. Lastly, defaulting on taxes by missing payments or incurring new tax debts while your payment plan is ongoing will result in your account being canceled.

Unlike The Federal Income Tax Missouris State Income Tax Does Not You May Also Electronically File Your Missouri Tax Return Through A Tax Preparer Or Using Online Tax Software And Pay Your Taxes

Missouri secretary of state corporations unit james c. Free tax filing is a misnomer. File for free with taxact free file! Unlike the federal income tax, missouriâs state income tax does not you may also electronically file your missouri tax return through a tax preparer or using online tax software, and pay your taxes. The stateâs tax revenue per individual is close to $1,000 annually. Plus, you can make online missouri tax estimate payments for next tax year. How do you pay missouri state income tax? Print out the completed forms and take them to a cpa to review those forms and help. Traditional irs free file provides free online tax preparation and filing options on irs partner sites. Our income tax calculator calculates your federal, state and local taxes based on several key inputs: Where can i get more information about the state of missouri annual report filing? Premier investment & rental property taxes. Missouri income taxes and mo state tax forms.

If you would like to file an extension, you will need to register for a mytax missouri account for the corresponding business. Please note, only taxpayers whose adjusted gross income is $72,000 or. Premier investment & rental property taxes. File your state & federal taxes for free. Traditional irs free file provides free online tax preparation and filing options on irs partner sites.

Don’t Miss: Did The Tax Deadline Get Extended

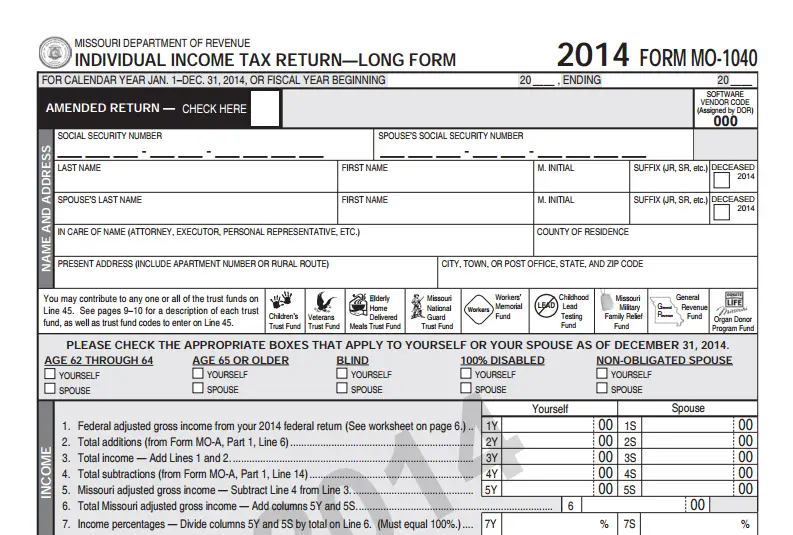

Where Can I Get Missouri Tax Forms

Printable Missouri tax forms for 2020 are available for download below on this page. These are the official PDF files published by the Missouri Department of Revenue, we do not alter them in any way. The PDF file format allows you to safely print, fill in, and mail in your 2020 Missouri tax forms.

To get started, download the forms and instructions files you need to prepare your 2020 Missouri income tax return. Then, open Adobe Acrobat Reader on your desktop or laptop computer. Do not attempt to fill in or print these files from your browser.

From Adobe Acrobat Reader use the Ctrl + O shortcut or select File / Open and navigate to your 2020 Missouri tax forms. Open the files to read the instructions, and, remember to save any fillable forms periodically while filling them in. Print all Missouri state tax forms at 100%, actual size, without any scaling.

States Where There Is No Unemployment Tax Break

So far, 11 states have said they aren’t adopting the federal unemployment tax cut, according to H& R Block data: Colorado, Georgia, Hawaii, Idaho, Kentucky, Minnesota, Mississippi, North Carolina, New York, Rhode Island, and South Carolina.

If you live in one of those 11 states and you filed your taxes after the American Rescue Plan was passed, you should not have excluded your unemployment benefits from your taxable income. If you did, you’ll need to file an amended return to remedy the issue, says Henry Grzes, lead manager for tax practice and ethics at the American Institute of Certified Public Accountants.

Other states don’t tax unemployment benefits, including Alabama, New Hampshire, and New Jersey. So there’s no need to take further action with your return.

Read Also: Where Do I Pay My Federal Taxes

I Live In Kansas But Work In Missouri

Multi-state and nonresident returns have rules that can scare the average taxpayer. Most think that living and working in different states, and consequently having to file in several states, creates a difficult situation. However, that cannot be further from the truth. Sometimes, multi-state returns are commonplace. For example, employees working in firms located in Kansas City, MO frequently live in the State of Kansas and commute daily for work. This sitation is so frequent that the two states have agreements between their departments of revenue. The same can be found in the Chicagoland area in the Midwest . Many are confused by this, but the basic mechanics are very simple. I will give an example to illustrate:

You get your W2 from your employer in MO and you are sitting at your primary residence in Overland Park, KS. You notice that state taxes have been withheld for the state of MO on your W2. But as a resident of KS, you expect to also pay KS tax. Does this mean you are getting taxed twice?

Not necessarily. Your KS state K-40 income tax return will have a line for credit paid to other states. This is where you insert the amount of taxes you owe on your MO return. So, to summarize:

Complete your MO-1040

Take the dollar amount of state taxes that you are liable for from line 41 of yoru MO-1040 return and use that amount to credit your taxes in line 13 of your KS State K-40.

Here are some pictures:

You May Have To File More Than One State Tax Return

If youve moved during the year or have worked in two or more different states, you may need to file an income tax return in each state where youve lived and worked.

If both states collect income taxes, then the employers will withhold state income taxes for their respective states, says Lydia Desnoyers, owner of Desnoyers CPA LLC. Come time to file your state income tax returns, you would be taxed on a prorated basis.

Note, however, that this may not apply if you live in one state and work remotely for a company in another state.

If you live in one state and commute to another where you work, things can get trickier. If the two states have a reciprocal tax agreement, filing state income taxes may be required only in the state where you live.

Whats more, some states even have special tax forms just for their full-year residents who work in a reciprocal state. Indiana, for example, has a form called IT40-RNR to address situations like this. Check your state requirements for an additional tax forms you may need to file if you earned income other than wages, salaries, tips or commissions in your resident state.

You May Like: Are Tax Returns Delayed This Year

Faqs About State Tax Software

If you live in a state that doesn’t have state income tax, you might not have to file a state return. Congrats! Here are the states without any income tax. Note: New Hampshire and Tennessee do tax certain interest and dividend income and other activities.

- Alaska

- Wyoming

Yes. Use this state tax software to e-file right from your computer. An additional fee for e-filing applies, and you can’t e-file in a state that doesn’t have income tax. Note: New Hampshire doesnt allow e-filing for state returns.

Yes. For most states, you can file nonresident and part-year resident state returns using H& R Blocks State tax software. We support e-filing part-year and/or nonresident returns for:

- Arizona

- Wisconson

Absolutely! You can e-file up to three state returns for the same filer. Any additional state returns must be printed and mailed.

Yes, you can file a state return by itself after you’ve completed your federal return. Just make sure you already have the federal software downloaded and installed. To buy your state’s program, choose your state from the drop-down menu above, then install it to access it from the federal software.

Some States Will Require An Amended Return To Get The Tax Break

In several states, some additional legwork may be required to get the unemployment tax break at the state level. “Now states are saying you’re going to need to formally amend your individual state return if you want to take advantage of the exclusion that we retroactively adopted,” Grzes says.

West Virginia, New Mexico, and Louisiana are among the states that have agreed to follow the federal unemployment tax break, but they are requiring eligible residents to file amended returns to get it. Other states, like Massachusetts, are allowing residents to take the unemployment tax break without having to file an amended return.

“Every state is different,” Grzes says. “That’s one of the challenges.” To find out how your state plans to tax unemployment benefits, visit its tax agency’s website for details.

Don’t Miss: Do You Have To Claim Social Security On Taxes

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Irs Electronic Free File For Federal Returns

You may qualify to electronically file your federal return for free by using IRS Free File Some of the companies participating in the IRS Free File service will file your Maryland return electronically for free as well. No matter what company you select, you can always return to file your Maryland tax return for free online, using our iFile or bFile services. Keep in mind that your Maryland return begins with your federal adjusted gross income, so you must prepare your federal return first before you can prepare your Maryland return.

Generally, you are required to file a Maryland income tax return if:

- You are or were a Maryland resident

- You are required to file a federal income tax return and

- Your Maryland gross income equals or exceeds the level listed below for your filing status. The filing levels also apply to nonresident taxpayers who are required to file a Maryland return.

Even if you are not required to file a federal return, you may be required to file a Maryland return if your Maryland addition modifications added to your gross income exceed the filing requirement for your filing status. Dependent taxpayers must take into account both their additions to and subtractions from income to determine their gross income.

For more information, see the instructions in the and nonresident tax booklet.

Filing Requirements for 2020 Tax Year

|

Filing Status |

|

| One spouse 65 or older | $ 24,800 |

| $ 24,800 |

Your income tax return is due July 15, 2021.

Also Check: When Is Sales Tax Due