When Your Child Should File

Your child should file a;federal income tax;return even though it isn’t required for the reasons above, if:

- Incomes taxes were withheld from earnings

- They qualify for the earned income credit

- They owe recapture taxes

- They want to open an IRA

- You want your child to gain the educational experience of filing taxes.

In the first two cases, the main reason for filing would be to obtain a refund if one is due. The others are income dependent or based on taking advantage of an opportunity to begin saving for retirement or to begin learning about personal finance.

I Need Proof That My Taxes Were Filed And Accepted Where Do I Get That

;When you e-file your federal return you will receive two emails from TurboTax.;The first one will say that your return was submitted.;The second email will tell you if your federal return was accepted or rejected.;If you e-filed a state return, there will be a third email to tell you if the state accepted or rejected your state return.

If the IRS accepted it, what does it say here?;

;;;;;Or does your account say Ready to Mail?

Used This Form If You Dont Plan To Claim Any Tax Credits Or Deductions

IRS Form 1040-EZ was the shortest of the 1040 forms and the easiest to fill out. You could take the standard deduction, but you wouldn’t be able to itemize deductions, claim adjustments to income or claim any tax credits except for the Earned Income Tax Credit , which is available to certain low-income taxpayers. Also, you could not use 1040-EZ if you had any income from self-employment, alimony, dividends or capital gains.

You could use Form 1040-EZ if all of the following apply:;

- You are filing as single or married filing jointly

- Your taxable income is less than $100,000

- You dont claim any dependents

- You dont itemize deductions

- You were under age 65 on January 1 of the year in which you file, and not legally blind at the end of the tax year for which you are filing

- Your income comes only from wages, salaries, tips, taxable scholarship and fellowship grants, unemployment compensation or Alaska Permanent Fund dividends

- Your taxable interest is $1,500 or less

- Your earned tips are included in boxes 5 and 7 of your W-2

- You dont owe household employment taxes on wages you paid to a household employee

- Youre not a debtor in a Chapter 11 bankruptcy case filed after Oct. 16, 2005

Also Check: Is Past Year Tax Legit

What Information Do You Require To File Form 1099 Div Online

Given below information is mandatory to file the 1099 DIV Tax Form online:

Payer Details

The person who paid the dividends must provide their name, address, Taxpayer Identification Number, or Social Security Number to file an information return.

Recipient Details

Include the recipient details like name, address, and a TIN of the payee correctly. Because filing information with incorrect details may lead to starting backup withholding taxes from the payee.

Federal Details

Provide the dividend and distribution of income information in the correct boxes of the Form 1099 DIV.

State Filing Details

Check whether there are any federal/state income taxes withheld previously. Include them when filing the tax returns. Otherwise, the IRS may impose penalties.

Entering Multiple 1099 Forms

if you received 1099-MISC forms from several payers, you will need to enter each one separately in your tax software. If you have just one business, all 1099-MISC forms are collected and added to your business tax schedule for that business. If you have several businesses, be sure each 1099 form is connected to the right business.

Recommended Reading: How To File Past Years Taxes

How To Find Out Which Years Taxes Were Not Filed

You’re supposed to pay your taxes by April 15 every year. There can be substantial penalties if you fail to do so. Fortunately, the Internal Revenue Service still will take your money if you pay late and even send out refunds up to three years after the original deadline. You’ll need to start by figuring out which years you did not file your income taxes. You can check online, call the IRS and speak to an agent or visit an IRS office in person to find out this information.

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return.; Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers.; Free File is available in English and Spanish.; To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

Also Check: How To File Taxes At H&r Block

Withholding Taxes From Your Payments

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary; withholding taxes is not required. If you ask us to withhold taxes, we will withhold;10 percent of the gross amount of each payment before sending it to you.

To start or stop federal tax withholding for unemployment benefit payments:

- Choose your withholding option when you apply for benefits online through Unemployment Benefits Services.

- Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My Home page.

- Review and change your withholding status by calling Tele-Serv and selecting Option 2, then Option 5.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

You May Like: How To Claim Inheritance Money On Taxes

What Is A 4506 Form

Use Form 4506 to request the copies of previously filed tax returns from the IRS. You can also use the form to designate a third party to receive the tax return. The form will ask for personal information, the year and types of forms you would like to recieve, and a $43 fee for each return requested.

Best for:People who need a copy of their tax return and cant get one free of charge from a tax preparer if they used one.

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors’ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

Also Check: How Much Income To File Taxes

What’s Causing The Massive Irs Backlog And Delays

Because of the pandemic, the IRS ran at restricted capacity in 2020, which put a strain on its ability to process tax returns and created a backlog. The combination of the shutdown, three rounds of stimulus payments, challenges with paper-filed returns and the tasks related to implementing new tax laws and credits created a “perfect storm,” according to a;National Taxpayer Advocate review;of the 2021 filing season to Congress.;

The IRS is open again and currently processing mail, tax returns, payments, refunds and correspondence, but limited resources continue to cause delays. The IRS said it’s also taking more time for 2020 tax returns that need review, such as determining;recovery rebate credit;amounts for the first and second stimulus checks — or figuring out earned income tax credit and additional child tax credit amounts.

Here’s a list of reasons your income tax refund might be delayed:;

- Your tax return has errors.

- It’s incomplete.

- Your refund is suspected of identity theft or fraud.

- You filed for the earned income tax credit or additional child tax credit.

- Your return needs further review.

- Your return includes;Form 8379;, injured spouse allocation — this could take up to 14 weeks to process.

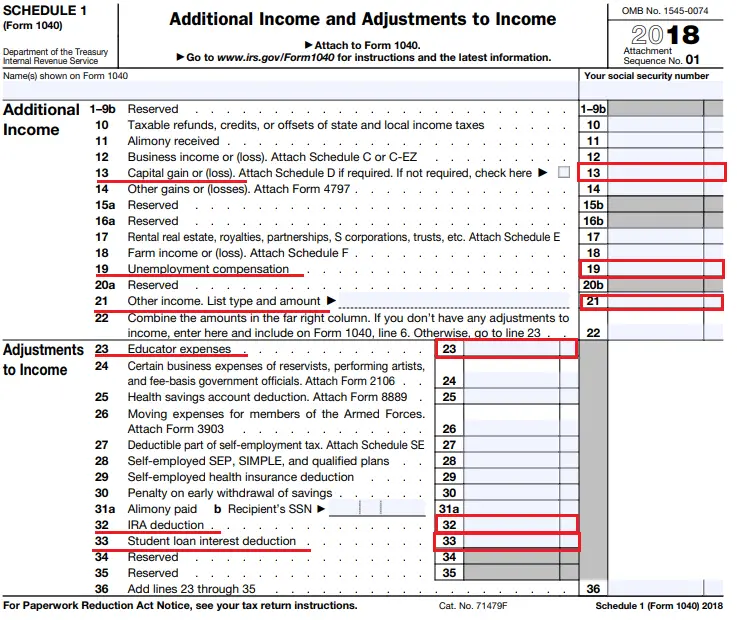

Tax Forms: Everything You Need To Know For Filing

As you get ready to file your tax return for income you earned in 2016, youll have to pick from among three forms: the;1040, the 1040EZ or the 1040A.

Anyone can decide to fill out Form;1040; the others have more-specific requirements.

Heres a quick breakdown:

;;Form 1040EZ:;With this one, you cant claim any , with the exception of the Earned Income Tax Credit. Its by far the briefest version of the 1040, and you can easily file your return;for free with many;online tax preparation services.

;Form 1040A: If you dont plan to itemize your deductions, like for mortgage interest, then take a look at the 1040A. You might not be able to claim deductions, but you can claim tax credits, like for educational expenses.

;Form 1040: You can claim all the deductions and credits in the world, and anyone can use it, regardless of filing status. Its just much longer than the other forms.

The longer the form, the more opportunities for tax breaks, both deductions and credits. Both are good, ultimately reducing how much the federal government takes from you.;The table;below;shows you which deductions and credits are available with each 1040 tax form.

More help on filing your taxes:

You May Like: Where Can I File An Amended Tax Return For Free

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Refund Delays Due To Fraud

Another thing that could affect your IRS tax refund status is fraudulent activity on your Social Security number. You likely wont even be aware of this until you file. Identity theft has become a persistent problem with the IRS, even though the agency has put protections in place to keep taxpayers safe.

Fraudulent tax activity happens when someone uses your Social Security number to file a return and get access to your refund. If this happens, the IRS may notice it in advance and send a letter alerting you to it, but often the agency will find out when you try to file your own return, and they already have one filed on your behalf.

To prevent tax filing fraud, do your best to safeguard your Social Security number. Try to avoid using it as an identifier or including it on forms you submit non-securely.

If you work as an independent contractor, consider obtaining an Employer ID Number that you can use when filling out Form W-9 to perform work for someone. You can get an EIN in a matter of minutes on the IRS website and any taxes paid will be connected to your Social Security number without having to give that information to random third parties.

Read More:What Happens If You Don’t File Taxes?

You May Like: What Is Tax Liabilities On W2

How Irs Form 1040

Here are some quick facts about the 1040-SR:

-

It’s for people who are 65 or older.

-

You can itemize or take the standard deduction.

-

The basic differences between the 1040-SR and the regular 1040 tax form are cosmetic: the 1040-SR has a different color scheme, a larger font and an embedded standard deduction table

Here’s what IRS form 1040-SR does:

» MORE:Make sure you’re not overlooking these 5 tax breaks for retirees

Understanding The Irs Timeline

Before electronic filing became so popular, the IRS processed the majority of returns manually. This meant employing representatives whose sole responsibility was typing the information from paper-based forms into the computer.

As paper-based returns come in, though, theyve long been sorted by machines that have the ability to detect envelopes that contain checks. Those go to a separate area for processing, while basic returns are sent to employees who get the information into the system. The switch to e-filing has allowed the IRS to reallocate its resources to checking electronic returns for errors and approving them to go to the area for refund processing.

Today, representatives manually review each return for errors, correct any that can be easily fixed and approve returns for refunds. Once a return has been approved, it can then go to the refund processing center, where payment is remitted based on the method the taxpayer specified. If the taxpayer wants a paper-based check, it will need to be printed and mailed via the postal system. However, if the taxpayer is OK with a direct deposit, the funds can be transferred electronically, which is a much quicker process.

Read More:How Long Does It Take to Get Tax Refunds From Electronic Filing?

You May Like: Do You Have To Claim Social Security On Taxes

Speeding Up Your Refund

If youre checking your IRS refund status and dissatisfied with the length of time its taking to go through, there are a few things you can do next year to get things moving along faster.

The first step is to avoid paper-based filing altogether. If you e-file, not only will you receive your return faster, but youll have the confidence of knowing your return is with the IRS almost as soon as youve submitted it, rather than having to worry whether its been lost in the mail.

One exception to this is if you owe, since you may want to hold on to your money and mail it on the date of the tax deadline. However, you can still file electronically and mail your payment separately later. You should also file as early as possible in the tax season, although you may find that youre held up waiting for your employers and financial institutions to send the forms you need.

Another way to speed up your refund is to opt to receive it electronically. If you choose to have a check mailed to you, youll be waiting much longer. You can have your refund deposited in up to three separate bank accounts.

You should also begin checking the IRS Refund Status page as soon as possible and check it regularly throughout the time youre waiting for your refund. This will allow you to see a request to call the IRS early in the season, possibly letting you clear things up quickly so that your return can be moved to the refund processing stage.

How To Fill Out Form 1040

To get started filling out Form 1040, youâll first need to gather all of your tax documents, including W-2s, 1099s, and other records of your income and deductions.

Once you have your tax documentation in hand, you have three main options for filling out and filing Form 1040:

- Do it yourself using IRS Free File

- Do it yourself using commercial tax software

- Hire a paid tax preparer to do it for you

Also Check: Where Can I Find My Property Tax Bill

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Is It Safe To File My Taxes Online

Maybe youre nervous about filing your taxes online. Rest assured that at TurboTax, security is built into everything we do. We use multi-factor authentication, data encryption, and data safeguards to make filing your taxes online safe. Learn more about security at TurboTax.

As well as ensuring that weve taken every security precaution in our products, TurboTax Free connects securely with the government through CRAs Auto-fill my return to import your data into your return and submits your electronic return if you file online through the CRAs NETFILE service. For an additional layer of security when you file online, learn about using the CRAs new NETFILE Access Code to authenticate your identity when you submit your taxes this year.

Also Check: What Is Tax Resolution Services