Fill Out The Correct Form For Your Business

| Business type | |

|---|---|

|

|

|

|

| Limited Liability Company : |

|

When Electronically Filing Amended Returns If A Field On Form 1040 Amended Return Is Blank Should The Corresponding Field On The Form 1040

For electronically filed Amended Returns: If an amount in a field on the Form 1040 or 1040-SR is blank, then the corresponding field on the Form 1040-X must also be left blank. If there is a zero in a field on the Form 1040 or 1040-SR, then the corresponding field on the Form 1040-X must also contain a zero.

Why Would Your Refund Come By Snail Mail

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If that’s not the reason, you may be getting multiple refund checks, and the IRS can only direct-deposit up to three refunds to one account. Additional refunds must be mailed. Also, your bank may reject the deposit and this would be the IRS’ next best way to refund your money quickly.

It’s also important to note that for refunds, direct deposit isn’t always automatic. Some are noticing that like the stimulus checks, the first two payments for the child tax credit were mailed. Just in case, parents should sign in to the IRS portal to check that the agency has their correct banking information. If not, parents can add it for the next payment in September.

For more information about your money, here’s the latest on federal unemployment benefits and how the child tax credit could impact your taxes in 2022.

Read Also: What States Are Tax Free

Amending A Partnership Or Multiple

To amend a partnership or multiple-member LLC return, make a copy of the partnership return Form 1065, and check box G on page 1. Attach a statement that identifies the line number of each amended item, the corrected amount or treatment of the item, and an explanation for each change.

Most partnerships or LLCs can amend their partnership returns using Form 1065, but some partnerships or LLCs may need to use Form 1065X to amend their partnership return in certain specific cases. Check with your tax professional if you think you need to use this form.

If the Schedule K-1 on the partnership or LLC return is incorrect, or if the change to the Form 1065 causes a change in the information on the K-1, prepare an amended K-1. Check the “Amended K-1” box on the top of the Schedule K-1 to indicate that it has been amended. Then give the amended Schedule K-1 to the partner or LLC member to file.

No Amended Return Needed

A simple math or clerical error doesn’t require an amended return. The IRS will fix the mistake, though the agency might contact you first if it needs more information.

As a general rule, you also won’t need to file a Form 1040-X if you forgot to attach a form or schedule to your return. According to Howard, this scenario could happen to retirees who fail to take a required minimum distribution and are hit with the 50% penalty. The IRS can waive the penalty if there’s a reason for the error and you’re taking reasonable steps to remedy the RMD shortfall. “In that case, the taxpayer would only need to file Form 5329 for the prior year,” she says. If no other changes are needed, “filing a Form 1040-X is not necessary.”

Recommended Reading: Is Past Year Tax Legit

Can You File A Form 1040x Online

Form 1040-X can now be e-filed, and is available through some companies. 1040.com does not currently offer 1040-X e-file however, while you cant send the amended return online through 1040.com, you can use 1040.com again to fix the tax return and fill out the Form 1040X

Before you start filling out Form 1040X, make sure you print your original return so that youll have it to refer to. Then, print Form 1040X and the corrected version of your tax return and mail the whole package to the IRS address provided below.

How To Change A Return

COVID-19: Expect the normal timeframe for processing adjustment requests submitted by paper to be 10-12 weeks in most cases.

You can request a change to your tax return by amending specific line of your return. Do not file another return for that year, unless the return you want to amend was a 152 factual assessment.

Wait until you receive your notice of assessment before asking for changes.

Generally you can only request a change to a return for a tax year ending in any of the 10 previous calendar years. For example, a request made in 2021 must relate to the 2011 or a later tax year to be considered.

Read Also: Where Do I Get Paperwork To File Taxes

Why File An Amended Tax Return

The broad answer to this question is: You should file anamended return if the information on youroriginal US expat tax return is incorrect. Its possible that you will discover that you misfiled your taxessomehow on your own, and its also possible that the IRS will notify you of your mistake and insist that youfile an amended return. This, of course, is generally only in a situation in which the IRS wouldreceive more money they probably wont require you to file an amended return if you missed some of thedeductions that are available to you.

So what are the reasons why you would need to file an amended return?

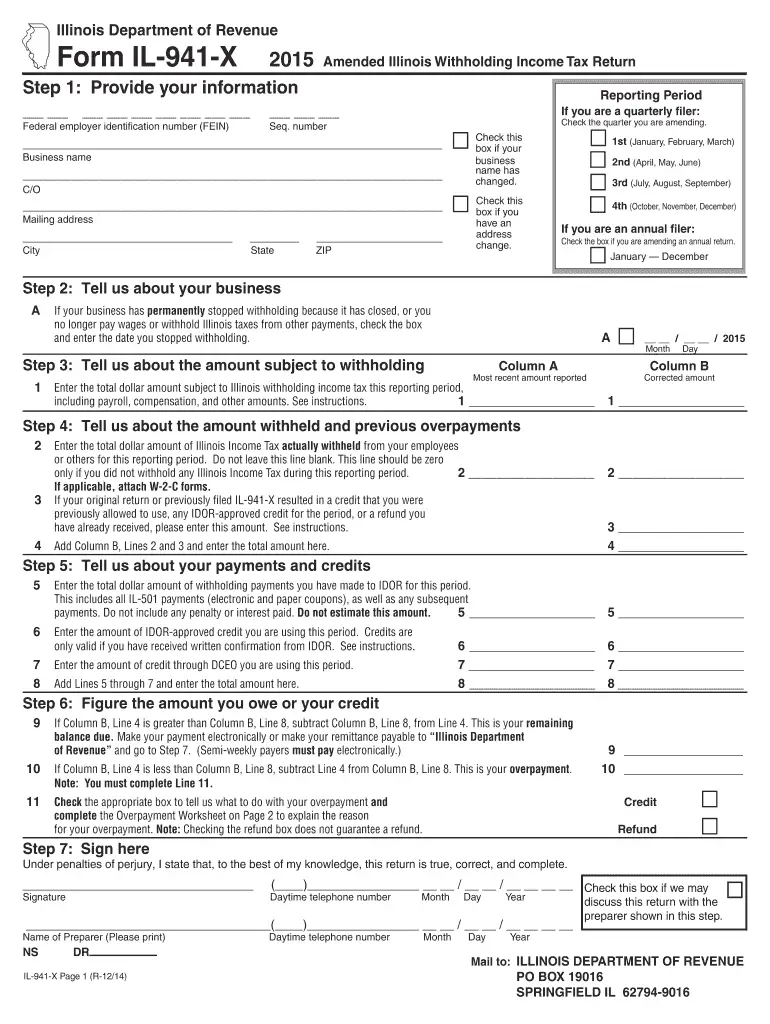

Submit The Amended Forms

The amended forms must be submitted via post at an IRS Service Center. Three weeks after youve mailed the return, you can begin tracking the amended return. The returns are processed manually, so the entire process can take up to 16 weeks or more, especially if the return is incomplete, has errors, or has been subjected to identity fraud.

- No electronic filing: Amended returns cannot be filed electronically. You can, however, prepare them online and print them out. When asked how to amend the 2020 tax return electronically, the IRS communicated that it would start accepting electronic returns sometime in the future.

NOTE:Those born before 1955 can file for an amendment with Form 1040-SR. Thankfully, with so many tax forms available, you can quickly learn how to do your own taxes.

Read Also: How Much Does H& r Block Cost To File Taxes

You Can File An Amended Tax Return On Your Own

People with simple tax situations and small changes might be able file an amended tax return on their own. Many major tax software packages include modules that will file an amended tax return. Many tax preparers are happy to file amended returns as well.

And note: Amending your federal tax return could mean having to amend your state tax return too.

How To Amend A Tax Return In 2021

Mistakes happeneven on tax returns. If youve made a mistake on your return, theres no reason to panic. You can rectify your miscalculation by filing an amended tax return. If you find yourself in this situation and you need to fix an error, you should first learn what an amended return is and how to amend a tax return.

You May Like: How Much To File Taxes

When To File An Amended Return

File Form 1040-X only after you have filed your original tax return. If you want a credit or refund you must file:

- Within three years after the date you filed the original return, or

- Within two years after the date when you paid the tax, whichever is later.

If you file early, your return is considered filed on the due date .

If your business was affected by a federally declared disaster, you may have extra time to file your return for that year.

If you are filing Form 1120-X for a corporation based on a tax carryback for years before 2018, you must file within three years after the due date of the return for those tax years.

You can now submit Form 1040-X electronically with tax-filing software or business tax software, for the 2019 tax year and beyond. You can check the status of your amended tax return by using the IRS “Where’s My Amended Return?” page for the current tax filing year and up to three prior years.

Filing An Amended Return

For 1040-X, the address depends on special situations and where you live. See the Instructions for Form 1040-X for the list of addresses.

For Form 1120 for corporations, file the amended return at the same address where the corporation filed its original tax return.

Corporations and S corporations can use the IRS E-file system to file their tax returns online.

You can file an amended partnership return by mailing it to a specific IRS office, depending on certain circumstances. See IRS Form 1065 for the list of locations.

Don’t Miss: How Much Can You Get Back In Taxes

Where To Send Amended Tax Returns

After youve completed the 1040X, check amended return details carefully for accuracy. The next step is to find out where to send amended tax returns. Up until summer 2020, amended returns could only be physically mailed to the IRS Service Center. You can still opt to send it this way. Alternatively, you can submit your return online.

How To File Your Amended Return

Use Vermont Form IN-111, Vermont Income Tax Return to file your amended return. Verify you are using the form for the correct year and that you are including all schedules submitted with your original filing even if the information on these schedules has not changed.

You May Like: What Am I Getting Back In Taxes

Time Limit For Filing An Amended Us Expat Tax Return

Whether you discovered your filing mistake on your own or you were notified by the IRS that you arerequired to file an amended return, its best to get it done and over with as soon as possible. Themore rapidly you correct the situation, the more additional fees and interest you can avoid. If youreexpecting to receive a refund after you file your amended return, it must be within 3 years of having filedyour original return. If you are amending a return older than 3 years, you will not receive a refundfrom the IRS.

Filing An Amended Tax Return

Federal Income Tax Return

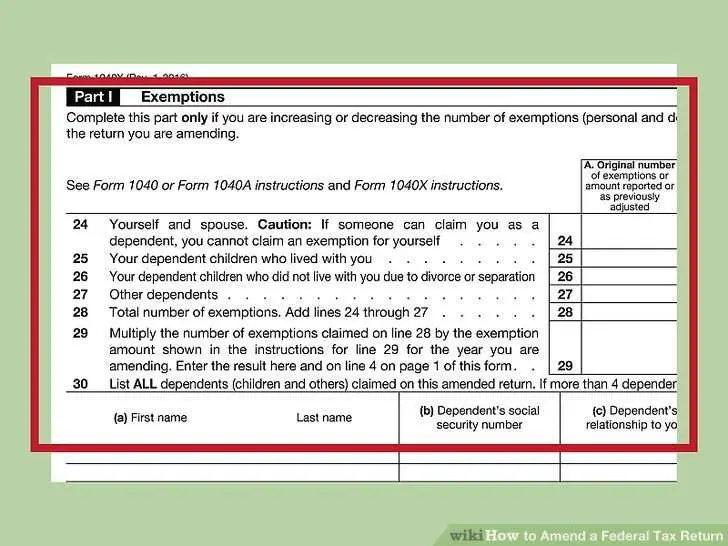

If you made a mistake on your tax return or forgot to claim a credit or deduction, you can fix the return by filing an amended return. You should amend your return if you need to correct filing status, the number of dependents you claimed, or your total income. The IRS generally corrects math errors when processing your return and will send you a letter if you forgot to include a schedule or other item.If you have to file an amended tax return because you realized that a previous return was not filed correctly or you received corrected forms W-2, 1042S, etc., you usually have to use Form 1040X . For a short introduction on what is needed see this IRS Article.

Also Check: Are Nonprofit Organizations Tax Exempt

How Can I Amend My Tax Return

Fortunately, if youve made an error on your tax return and need to amend it, dont worry, there are a few ways to do so that youll find quite simple.

First and foremost, if you need to amend your tax return, do not file another return for that year.

You must wait to receive your Notice of Assessment before making any changes to your tax return. Amendments can be made for 10 previous years, so if you are filing this years , you can only amend back to 2010.

There are three ways to make amendments to your tax return: through CRA My Account, ReFile using your tax solution, or . There are rules and limitations for each one, and well take you through them so you have a better understanding of which one to choose.

For Quebec residents If you need to amend your provincial return, please click here for instructions directly from Revenu Quebec.

Requesting an Amendment Online through CRA My Account

Requesting an amendment to your tax return online simply requires you to log in to your CRA My Account and click Change my return. You select the line that needs to be corrected and input the corrected value.

Do keep in mind that you cannot request an amendment to change any of the following:

Requesting an Amendment using ReFILE and your tax software

- Making or amending an election

- Applying for certain benefits

- Applying for the disability tax credit

- Have a current reassessment in progress

- Have not yet received the original return assessment

- If you have to change personal information

What Is An Amended Tax Return

An amended tax return is necessary when youve made a mistake on your original return. For example, if you need to change the amount of income you initially reported, the number of dependents, or change your tax filing status, you should amend your return. Additionally, you can also file an amendment if you forgot to claim a certain tax deduction or tax credit. If you file for an amended return, you can maximize your tax returns.

Not all mistakes, however, require you to amend your return. For example, if there is a small mistake in your returnsuch as a typo in your Social Security number or addressthe IRS will reject the tax return, and youll only need to refile taxes with the correct information.

Amended returns are usually filed when the filer needs to receive an overlooked tax refund. But a simple mathematical error on the original tax return is not a reason for filing for an amendment. If there are such errors, the IRS will automatically correct them, and you wont need to do any corrections yourself. But if there is a more significant error in your calculations, or youre missing a specific form, youll be notified by letter.

Auditing is sometimes a big concern if youre filing an amended return. Still, the amending tax return audit risk is equal to the risk youre undertaking when you file the initial return.

Don’t Miss: What Happens If You Cannot Pay Your Property Taxes

How Can Expats File An Amended Tax Return

Up until now, it hasnt been possible to e-file an amended tax return, only to post a paper version. This has caused issues for many expats, as postal systems in other countries often arent reliable. In June 2020 though, the IRS announced that it would shortly begin to accept e-filing Form 1040-X for 2019 and subsequent tax years.

Some States Require Amended Tax Returns For $10200 Unemployment Tax Break Refunds

- President Joe Biden signed the American Rescue Plan, a $1.9 trillion Covid relief bill, a month into tax season. It gives a federal tax break on up to $10,200 of unemployment benefits from 2020.

- The IRS is issuing refunds automatically to taxpayers who filed a return before the unemployment exclusion was available.

- But many states aren’t automatically recalculating taxes. An amended tax return may be necessary.

Some states are requiring workers who received a federal tax break on unemployment benefits to file an amended tax return to get their refund.

This largely applies to taxpayers who’d filed a federal and state tax return before the American Rescue Plan became law.

That $1.9 trillion Covid relief measure waived federal tax on up to $10,200 of unemployment benefits collected last year, per person.

More from Personal Finance:

President Joe Biden signed the bill on March 11 about a month into tax season.

Many people filed their returns without claiming the tax break, meaning they likely overpaid their taxes and may be owed a refund.

The IRS is issuing federal tax refunds automatically starting in May. It’s unclear how many people are affected.

Taxpayers won’t have to file an amended federal tax return unless the unemployment tax break makes them newly eligible for tax benefits like the earned income tax credit.

State taxes

Taxpayers may not be so lucky at the state level.

The situation will vary by state.

You May Like: What If I File Taxes Late

Why You Must File An Amended Return

Some changes don’t require you to file an amended return, while others do.

You don’t need to file an amended return if:

- Your errors were just math errorsthe IRS will make the changes.

- You forgot to attach tax formsthe IRS will ask for these.

You must file an amended business tax return if:

- You made a substantial error on your return that will affect your tax liability .

- You received new information that needs to be included.

You must file an amended return If any of this information changes:

- Your income, including business income

- Your deductions, including business deductions

- Your tax credits, including business tax credits

- Your refund amount

- Your dependent information .