If You Preparedyour Taxes Online

You’ll have to use your TurboTax login if you used the online version of the product. Make sure you sign in to the same account you used to prepare your return. From there, it’s a simple matter of clicking on the “Documents” tab, then on the tax year you want, then finally on “Download PDF.”

TurboTax suggests using the “Account Recovery” tool if you can’t find the return you’re looking for. It’s possible that you’re not signed in under the same account you used to prepare it.

Heres How To Get Prior

IRS Tax Tip 2018-43, March 21, 2018

As people are filing their taxes, the IRS reminds taxpayers to hang onto their tax records. Generally, the IRS recommends keeping copies of tax returns and supporting documents at least three years. Taxpayers should keep some documents such as those related to real estate sales for three years after filing the return on which they reported the transaction.

How To Access Amended Tax Slips

Amended tax slips are distributed electronically. Current employees should check online through Phoenix self-service, MyGCPay or under Additional Tax Slips using the Compensation Web Applications prior to the tax return filing deadlines set by CRA and Revenu Québec. The system does not generate notifications as such employees should consult Phoenix self-service, MyGCPay or Additional Tax Slips under CWA pay stubs and archived tax slips along with the tax slips amendments schedule for employees on a regular basis to see if an amended tax slip has been generated.

If you are a former employee or an employee on leave without pay, your amended tax slips are sent to your mailing address as it appears in Phoenix. If there is no mailing address, your home address will be used. To avoid any delays, ensure that your address is updated in Phoenix through your HR system self service functionality, or contact your HR department.

Don’t Miss: How Much Is Washington State Sales Tax

Heres How People Can Request A Copy Of Their Previous Tax Return

IRS Tax Tip 2021-33, March 11, 2021

Taxpayers who didn’t save a copy of their prior year’s tax return, but now need it, have a few options to get the information. Individuals should generally keep copies of their tax returns and any documents for at least three years after they file.

If a taxpayer doesn’t have this information here’s how they can get it:

If You Need To Change Your Return

You can make a change to your tax return after youve filed it, for example because you made a mistake. Youll need to make your changes by:

- 31 January 2022 for the 2019 to 2020 tax year

- 31 January 2023 for the 2020 to 2021 tax year

If you miss the deadline or if you need to make a change to your return for any other tax year youll need to write to HMRC.

Your bill will be updated based on what you report. You may have to pay more tax or be able to claim a refund.

Theres a different process if you need to report foreign income.

Read Also: When Is The Final Day For Taxes

Why You Might Need A Copy Of Your Tax Return

Your old tax returns have lots of important uses. For example, they can you prepare your taxes for the current year. You can repeat a lot of the information from last year when you prepare your new return. Previous tax returns also show how much money you paid the IRS in prior years.

Your old returns also show you how you’ve been doing financially. Want to know how much money you made in 2016? Look at your tax return for that year.

A copy of your tax return can also serve to verify your income. This can be necessary if you want to borrow money, get student financial aid, or even rent an apartment. For example, if you’re self-employed, prospective landlords often want to see your tax returns to make sure you earn enough income to afford the rent.

You might think that lenders also want to see your tax returns to verify your income. But this isn’t usually the case. They usually want something called a tax return transcript instead.

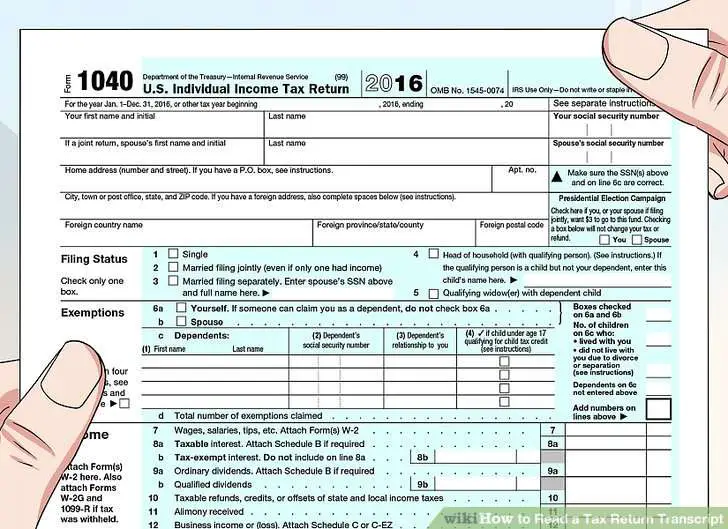

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

You May Like: Can Medical Expenses Be Deducted From Taxes

If You Used The Cd Or Downloadedversion

Your tax return is stored on your computer if you purchased the TurboTax CD or downloaded the program from the internet. It’s a tax data or .tax file, so you can only open it in the TurboTax software. Hopefully, that’s still installed on your computer, and you can print a copy of the return out from there.

Irs Transcripts Are Free

Your other option is to order a tax transcript from the IRS rather than an actual copy of your return. The IRS makes two types of transcripts available: a tax return transcript and a tax account transcript, and both are free. A transcript is more or less a summary of the information included in your return and your payment and refund histories.

Mail in Form 4506T-EZ if you want a tax return transcript, or Form 4506T if you want a tax account transcript. You can also request a transcript online from the “Get Transcript Online” page of the IRS website, or even call the agency, although the IRS isn’t taking phone calls in spring 2020 due to the coronavirus pandemic.

It will take from five to 30 days to get the transcript, depending on whether you make the request online or via USPS mail, and they’re only available for four years the current year and the previous three.

Read Also: How Much Federal Tax Should I Pay

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

How To Access Old Tax Returns

This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant and a Certified Financial Planner in Colorado. She has over 13 years of tax, accounting, and personal finance experience. She received her BA in Accounting from the University of Southern Indiana in 2006. This article has been viewed 37,465 times.

Accessing old tax returns may be necessary if you need to look up specific information about your income or your expenses. You can also use old tax returns as proof of your financial history for a mortgage or loan application. As a taxpayer, you are able to access a transcript or an official copy of old tax returns in just a few easy steps. A transcript is free to access, but each official copy of your old tax returns will cost you $50 USD as of March 2019.

Recommended Reading: How Much Money Is Taken Out Of Paycheck For Taxes

Create And File Prior Year Tax Returns

See Previous Year TaxAct Products for a list of available Online and Desktop programs for previous years.

Note. TaxAct does not provide archived copies of returns filed through the TaxAct Desktop or TaxAct Professional Editions. If you no longer have access to your saved return file, you can receive a copy of a successfully-filed return from the IRS by calling 800-829-1040. For more information, see Tax Topic 156 on the IRS website.

If you were a prior year TaxAct Online user and did not finish your prior year return, or if you need to start a new return for a previous tax year, you can still prepare and print your return using our TaxAct Online service.

To access an existing return, you need to know the tax year, username, and password that you set up for your account at the time of registration. Go to Access Prior Year Returns and select the year you wish to access to start a new return or sign-in to an existing return.

Prior year returns may be electronically filed by those using the TaxAct Professional program or by those using the TaxAct Business Consumer program.

While the IRS now allows year-round electronic filing with the new MeF system, they do shut down for a short period for maintenance each year from later in November to sometime around the end of January.

Was this helpful to you?

Masking Of Personal Information On Transcripts

The IRS is fighting a war against identity theft and tax fraud. Thieves attempt to gain access to IRS transcript data to file fraudulent tax returns or engage in other crimes. To help prevent this, transcripts only display partial personal information, such as the last four digits of your social security number. Full financial and tax information, such as wages and taxable income, is shown on the transcript. You can see a sample of a redacted transcript on the IRS website.

You may request an unmasked transcript for tax preparation. The IRS mails unmasked transcripts to your address in its records. Tax professionals can also obtain copies of their clients’ unmasked transcripts.

Read Also: How To Know If You Filed Taxes Last Year

Filing Amended Tax Slips

- if you receive amended tax slips and have not yet filed your tax return, use the amended tax slips to file your tax return

- if you are expecting amended tax slips but do not receive them in time to meet the deadline to file your tax return, use the tax slips that you have received

- if you receive amended tax slips and you have already filed your tax return, you do not have to refile using the amended tax slips if the year to which the amendment applies is within the past 3 years

- if you receive amended tax slips and you have already filed your tax return, you must refile using the amended tax slips if the year to which the amendment applies is beyond the past 3 years

Note

How To Access Past Tax Returns And Refund Information

One of the most painful things about filing your taxes is making sure that you have all of your documents in order. Sometimes these papers can get lost, and that only adds to the headache of filing taxes. Luckily for you, your friends at KD know where you can find all of your information, such as the status of your refund, a review of your prior years tax returns and carry forward information, as well as your T4 and T4A slips from last year. To access all of your prior tax information, you can log on to the Canada Revenue Agencys website, under My Account for Individuals. In order to view the full system, and to access all your information, you must register. Registering for this service requires a CRA user ID and password, which you can apply for online. In order to obtain a CRA user ID password, you will have to provide some personal information, create an ID and password, and also create security questions with answers. Once a security code has been mailed to you from the CRA, you can then gain full access into the site, where you can access up to ten years of past tax returns online. You can also contact the CRA by calling the CRA Helpline at 1-800-959-8281.

You May Like: When You File Taxes Is It For The Previous Year

Why Did Gethuman Write How Do I View My Past Tax Returns With H& r Block

After thousands of H& R Block customers came to GetHuman in search of an answer to this problem , we decided it was time to publish instructions. So we put together How Do I View My Past Tax Returns with H& r Block? to try to help. It takes time to get through these steps according to other users, including time spent working through each step and contacting H& R Block if necessary. Best of luck and please let us know if you successfully resolve your issue with guidance from this page.

How To Obtain Copies And Transcripts Of Past Tax Returns From The Irs

There are quite a few reasons why someone might need access to a previous years tax return. And unless youare highly organized, you might not be able to retrieve a copy from your personal filing cabinet. Neverfear, though, because in cases involving mortgages, student loans and citizenship, one is usually onlyrequired to provide the basic information that can be found on a tax return transcript.

You May Like: How To Buy Tax Lien Properties In California

How Long Should You Keep Old Tax Records

This is a common question: How long must taxpayers keep copies of their income tax returns and supporting documents?Generally, individuals should hold on to their income tax records for at least 3 years after the due date of the return to which those records apply. However, if the original return was filed later than the due date, including if the taxpayer received an extension, the actual filing date is substituted for the due date. A few other circumstances can require taxpayers to keep these records for longer than 3 years.The statute of limitations in many states is 1 year longer than in the federal statute. This is because the IRS provides state tax authorities with federal audit results. The extra year gives the states adequate time to assess taxes based on any federal tax adjustments.In addition to the potential confusion caused by the state statutes, the federal 3-year rule has a number of exceptions that cloud the recordkeeping issue:

- The assessment period is extended to 6 years if a taxpayer omits more than 25% of his or her gross income on a tax return.

- The IRS can assess additional taxes without regard to time limits if a taxpayer doesnt file a return, files a false or fraudulent return to evade taxation, or deliberately tries to evade tax in any other manner.

- The IRS has unlimited time to assess additional tax when a taxpayer files an unsigned return.

Tax return copies from prior years are also useful for the following:

Irs Routine Access Procedures

Copy of a tax return

Send a completed Form 4506 to the address provided in the forms instructions to receive copies of your tax returns as originally filed. IRS charges a fee of $50.00 for each copy provided. Call the IRS Forms hotline at if you need a Form 4506 mailed to you

- Use the Get Transcript tool.

- Send a completed Form 4506-T. In addition to the tax return and account transcripts available through the Get Transcript tool, you may also request wage and income transcripts and a verification of non-filing letter.

- Contact the Tax Exempt/Government Entities Hotline at .

- Send a completed Form 4506-A to the address printed on the form.

- Copies of approved applications for tax exempt status are also obtained via Form 4506-A.

Also Check: How To Report Self Employment Income On Taxes

If All Else Fails Contact The Irs

Of course, the IRS has copies of your tax returns as well, so you can reach out to the agency if your computer or tablet has since crashed or you can’t retrieve your return from TurboTax online for some reason. Unfortunately, you’ll have to pay for it, and you’ll have to wait a while to get your hands on it.

You can make your request by snail-mailing Form 4506 to the IRS along with your payment. You can download the form from the IRS website. You must include your spouse’s name and Social Security number on the form if you filed a joint married return, but your spouse doesn’t also have to sign the form.

The fee is $50 for each return as of 2020. The IRS indicates that you’ll have to wait about 75 days for processing. It keeps returns for seven years.

What If You Made Or See A Mistake On Your T1 General Form

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”>

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”> Mistakes happen to the best of us. If you notice a mistake on your T1 General Form and you have not yet submitted it, you simply need to fill out a new version of the form or input new information into your tax software to correct the mistake. If you have noticed a mistake after youve sent your taxes, you should notify the CRA immediately. If you do not notice a mistake until 90 days after you have received your assessment, you may not be able to change it. However, you can contact the CRA to advise you directly.

You may be advised to make an adjustment or amendment to that particular tax return, or even ReFile it using your tax software. The CRA will then process a reassessment to that particular tax year and depending on the situation, you may receive a refund cheque or have to pay back an amount.

For Quebec residents If you need to amend your provincial return, please click here for instructions directly from Revenu Quebec.

If you have made a mistake on your return, you should also be aware of the Voluntary Disclosures Program This program gives you a second chance to correct a tax return you previously filed or to file a return that you should have filed. If you file a VDP application and it is accepted by the Canada Revenue Agency you will have to pay the taxes owing, plus interest in part or in full. However, you would be eligible for relief from prosecution and, in some cases, from penalties that you would otherwise be required to pay.

Also Check: How Fast Can You Get Your Tax Refund