Your Federal Tax Refund

Many people probably file their federal income tax returns hoping for a tax refund. Typically, you pay your federal income tax throughout the year, either through the payroll withholdings your employer takes out of your paycheck or through estimated tax payments if youre self-employed. Pay too little, and you could owe Uncle Sam on Tax Day. Pay too much, and you could get an IRS refund of the amount you overpaid.

Tax calculators can help you estimate your tax refund, but when will your federal refund arrive? The IRS says most people can expect their refunds in less than 21 days, and e-filing and choosing to have your refund directly deposited into your financial account can be the fastest way to get your refund. Direct deposit is not only faster than waiting for a paper check to arrive in the mail, its more secure direct deposit means you wont have your refund check get lost in the mail.

If you want to track your refund, you can use the IRSWheres My Refund? tool.

What Happens If You Don’t Pay Taxes

You may be subject to penalties and interest on the overdue balance if you fail to file or pay taxes on time. These accumulate the longer you go without making payment. The IRS can take further collection actions if you accrue a large enough balance, such as putting a lien against your bank accounts or home. Teach out to the IRS promptly to make arrangements and avoid these penalties if you think you will have trouble paying your taxes.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

You May Like: How Much Do I Owe In Property Taxes

I Am Applying As An Individual:

- Name exactly as it appears on your most recently filed tax return

- Valid e-mail address;

- Address from most recently filed tax return

- Date of birth

- Your Social Security Number or Individual Tax ID Number

- Based on the type of agreement requested, you may also need the balance due amount

- To confirm your identity, you will need:

- financial account number or

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.;

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS; you should also submit a Change of Address to the USPS.

Recommended Reading: Do I Have To Pay Taxes On My Unemployment

Federal Quarterly Estimated Tax Payments

Generally, the Internal Revenue Service requires you to make quarterly estimated tax payments for calendar year 2021 if both of the following apply:

- you expect to owe at least $1,000 in federal tax for 2021, after subtracting federal tax withholding and refundable credits, and

- you expect federal withholding and refundable credits to be less than the smaller of:

- 90% of the tax to be shown on your 2021 federal tax return, or

- 100% of the tax shown on your 2020 federal tax return .

To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the calendar year 2021.; Form 1040-ES includes an Estimated Tax Worksheet to help you calculate your federal estimated tax payments.

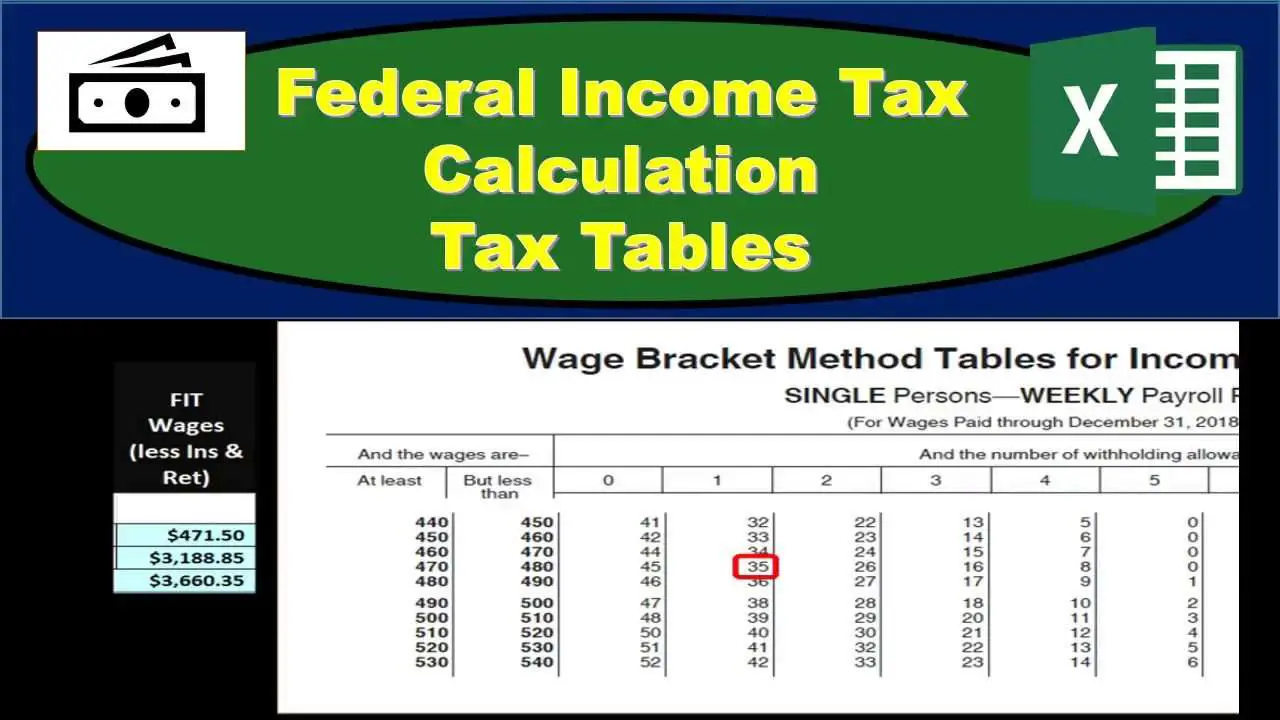

Calculating Income Tax Rate

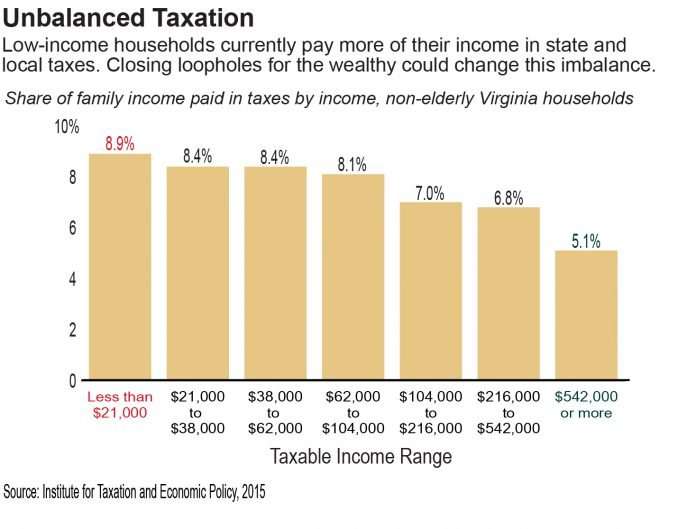

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are called brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2020 tax year, which are the taxes due in early 2021.

Also Check: What Is The Pink Tax

Why Pay Taxes With A Credit Card

Before deciding whether or not to pay taxes with a credit card, think about reasons that it makes sense to do so. Having a reason or incentive to pay taxes with a credit card is a mustwithout one, the extra fee only adds to the tax bill. If this is the case, write a check instead.

Here are the most common reasons to pay taxes with a credit card, despite the added cost:

General Information About Individual Income Tax Electronic Filing And Paying

Filing and paying taxes electronically is a fast growing alternative to mailing paper returns and payments. The Missouri Department of Revenue received more than 238,000 electronic payments in 2020. The Department also received more than 2.6 million electronically filed returns in 2020. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

Recommended Reading: How Much Is California State Tax

How Do You Minimize Taxes In Retirement

The best way to minimize taxes in retirement is by planning ahead. Ideally, you would meet with a financial advisor specializing in retirement planning well before your retirement date. A retirement planner can help you strategize about the vehicles you’ll use to fund your retirement and minimize taxes. Even if you’re close to retirement, or already retired, it doesn’t hurt to consult a professional for advice.

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The credit can be up to $6,660 per year for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $3,000 or $6,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

Don’t Miss: What Is Tax In Nevada

What Happens If You Can’t Pay Your Taxes

What happens if you complete your tax return and find that you can’t pay the amount you owe?

This isn’t supposed to happen. You’re supposed to pay income taxes gradually throughout the year so that in April you won’t owe much or will even be entitled to a refund of overpaid taxes. Employees have income tax withheld from their paychecks. Self-employed taxpayers pay quarterly estimated taxes directly to the Internal Revenue Service .

But sometimes your life situation changes or an unusual one-time event occurs during the year. When you prepare your annual return, you may get an ugly surpriseyou owe hundreds or thousands of dollars that you didn’t expect and simply don’t have.

While this isn’t a good situation to be in, it’s not the end of the world. There are a number of ways to resolve it.

What Are The Browser Requirements Of The Online Payment Agreement Tool

OPA is supported on current versions of the following browsers:

- Google Chrome

- Internet Explorer or Microsoft Edge

- Mozilla Firefox

- Safari

In order to use this application, your browser must be configured to accept session cookies. Please ensure that support for session cookies is enabled in your browser, then hit the back button to access the application.

The session cookies used by this application should not be confused with persistent cookies. Session cookies exist only temporarily in the memory of the web browser and are destroyed as soon as the web browser is closed. The applications running depend on this type of cookie to function properly.

The session cookies used on this site are not used to associate users of the IRS site with an actual person. If you have concerns about your privacy on the IRS web site, please view the IRS Privacy Policy.

You May Like: Can You File Missouri State Taxes Online

Use A Rewards Credit Card To Rack Up Points Or Miles

One common reason consumers pay taxes with a credit card is the reward earning potential offered by certain credit cards. While it adds an additional fee to pay your tax bill with a credit card, its not difficult to find cards that offer rewards worth more than the fee.

For example, the three processing companies that accept credit cards for federal tax payments all charge less than 2%, with PayUSAtax charging the least at 1.96%. With that in mind, its important to choose a card that offers more than 1.96% cash back, or the equivalent in rewards .

Even without having to consider the value of various rewards points, you can simply pick up a card that earns a solid flat rate on purchases like the Citi® Double Cash Card or Alliant Cash Back Visa Signature Card.

While paying 1.96% on a tax bill to earn 2% to 2.5% back may not seem like it would be worth the effort, for enormous tax bills even a small percentage of profit can add up fast.

Imagine for a moment someone owes $50,000 in federal taxes this year and pays a fee of 1.96% to use a rewards credit card that earns 2% back. In this hypothetical, $20 worth of rewards could be earned. This may not be compelling to someone paying $50,000 per year in taxes, but it could be more convenient than writing a check.

What Is A Federal Allowance

A federal withholding allowance refers to information that is on the W-4 form for tax years before 2020. You generally fill out a W-4 when you start a new job or experience a life change, like having a child. Your W-4 helps your employer understand how much tax to withhold from your paycheck. Before 2020, the number of personal allowances you took helped determine the amount your employer withheld the more allowances you claimed, the less tax your employer would withhold. But the IRS changed the W-4 starting with the 2020 tax year. The new form eliminates personal allowances.Learn more about the new W-4.

Read Also: Where Do I Mail My Taxes In California

Just Started Collecting Social Security Heres How To Know Whether Youll Owe Taxes On It

Roughly 1 in every 2 older adults will pay federal income taxes on a portion of their Social Security benefits for the 2020 tax year.

To be sure, this usually happens only if you have other substantial income in addition to your Social Security benefits, such as wages, self-employment, interest, dividends and other taxable income that must be reported on your tax return, according to Uncle Sam.

Deadline To File And Pay Taxes Was May 17

Find out what to do if you cant pay what you owe.;An extension to file is not an extension to pay the taxes you owe.

The estimated tax payment deadline was April 15. Get details on the;2021;tax deadlines.;

Pay with your bank account for free or choose an approved payment processor to pay by credit or debit card for a fee.

Read Also: What Taxes Do You Pay In Texas

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Anticipate Late Fees And Penalties

Unfortunately, the IRS is going to charge you interest and penalties on any amount you pay late. Like running a balance due on a credit card, these charges are going to make it harder to pay what you owe.

The more you’re able to pay on time, the less interest and penalties you’ll be assessed.

The IRS will eventually send you a bill, but you don’t have to wait to get the bill to make additional payments.

Pay what you can when you file your return, then send in whatever additional payment you can afford each payday using Form 1040-V.

Don’t Miss: How To Find Tax Amount

Payroll Tax Deposit Due Dates

Monthly deposits must be made by the 15th day of the month following the month when you paid employees. For example, if you paid employees in July, you must make a deposit no later than August 15.

Semi-weekly deposits are made on the following schedule:

- Deposit taxes from payrolls paid on Saturday, Sunday, Monday, or Tuesday by the following Friday.

- Deposit taxes from payrolls paid on Wednesday, Thursday, or Friday by the following Wednesday.

Next-day deposits. If your payroll tax obligation is $100,000 or more, you must deposit the next day and you must continue to make next-day deposits for the rest of that year and the following year.

There is no penalty for deposit errors if they don’t exceed $100 or 2% of the amount of employment taxes required to be deposited. You must make up the balance by a pre-defined make-up day to avoid further penalties.

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.;

Also Check: How Do You File An Amendment To Your Tax Return

How To Minimize Federal Taxes In Retirement With A Pension

You can minimize federal taxes in retirement on your FERS pension by contributing as much money to Roth accounts as possible. Unfortunately, you cannot do much more than that.

So- should you contribute to your Roth TSP? I compared the Roth and Traditional TSP in an earlier post. I believe that for most people it is a toss-up.

However, I want you to know that Brian and I disagree about the importance of Roth contributions. So I thought I should lay out both of our arguments so you can make your own decision.

Ways To Pay Less In Taxes And Save Money

-

Date

Would you like to reduce your federal income tax bill? I cant imagine anyone who wouldnt prefer to pay less of their income to the federal government. And there are several ways to cut your tax bill or increase your tax refund without running afoul of IRS rules.

While tax credits and tax deductions are easy ways to reduce your tax bill, they tend to come and go as Congress makes changes to the tax code. Here are a few ways to trim your tax bill that remain relevant year after year, barring legislative action.

You May Like: How Much Time To File Taxes

Canada Pension Plan And Employment Insurance

These programs are run by the federal government and participation is mandatory. You may benefit in the future by receiving payments from these programs. For example, EI protects workers who become unemployed by paying out benefits to those who apply and qualify. If you retire after age 60, the CPP pays benefits to seniors who qualify.

In addition to the amounts that are deducted and withheld from your pay, your employer also makes contributions to EI and CPP on your behalf. The amount depends on how much you contribute.