Calculating Your Payroll Is Just The Beginning

After completing payroll, its helpful to devise a method for keeping records. Some people prefer electronic records, while others are more comfortable knowing they can access physical records. Whats more important is developing a system that works for your needs.

Additionally, there are regular payroll tax deadlines to keep up on to make sure your hard work is in compliance with IRS and other regulatory agencies.

Looking for a good payroll software solution? Our comprehensive payroll service reviews can help you choose the right app for your business. For more information on running payroll, from payroll taxes to employee onboarding, check out the Merchant Maverick blog.

What Are Income Tax Brackets

Income tax brackets explain how much of your income can legally be taxed yearly by the Federal level. In some cases, it simply depends on how much income you earn during the tax year. The more money you make, the more taxes you pay. It applies to your income after deductions and exemptions have been made.

The percentages of income tax brackets for 2021 are as follows: 10%, 12%, 22%, 24%, 32% 35%, and 37%.

When An Employee Leaves

When an employee stops working for you, we suggest you calculate the employees earnings for the year to date and give the employee a T4 slip. Include the information from that T4 slip in your T4 return when you file it on or before the last day of February of the following year.

You must also issue a Record of Employment to each former employee. Generally, if you are issuing an ROE electronically, you have five calendar days after the end of the pay period in which an employees interruption of earnings occurs to issue it. If you are issuing a paper ROE, you have to issue it within five calendar days of the employees interruption of earnings or the date you become aware of the interruption of earnings. However, special rules may apply.

For more information, or to get the publication called How to Complete the Record of Employment Form, go to Service Canada at The Record of Employment on the Web . You can also call their Employer Contact Centre at 1-800-367-5693 .

If you do not have any employees for a period of time

Inform us by using the Provide a nil remittance service through My Business Account, or through Represent a Client, by calling our TeleReply service, or by sending us your completed remittance form and indicating when you expect to make deductions next. To find out how to use our TeleReply service, see How to use TeleReply.

Recommended Reading: What Does Agi Mean For Taxes

Form Td3f Fishers Election To Have Tax Deducted At Source

When a fisher sells a catch, the fisher can choose to have the buyer, also known as the designated employer, deduct income tax at a rate of 20% from the proceeds of the sale. To do this, the fisher must fill out Form TD3F and give it to the designated employer. The designated employer is then responsible to deduct, remit and report the amounts withheld.

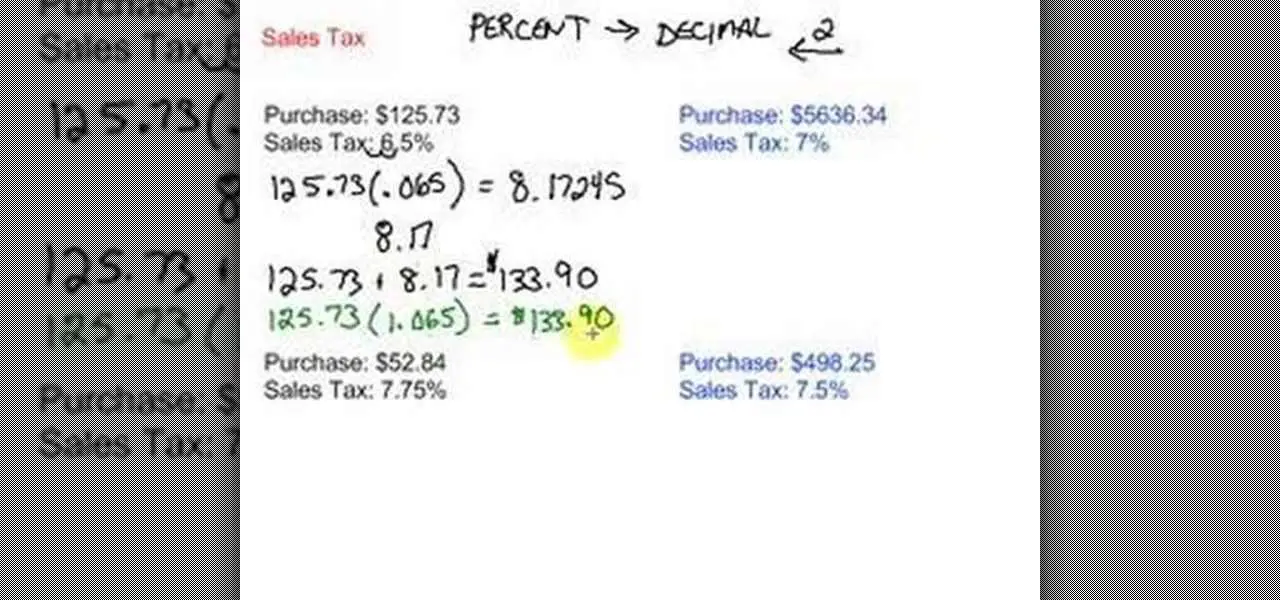

Step : Additional Fit Withholding

The last step in manually calculating FIT is to add any additional withholding to the FIT per pay amount.

- If an employee is using the new W-4, they would indicate this in Step 4c.

- If the employee is using the old W-4, they would indicate this in Line 6.

This amount is already in terms of each pay period, so theres no need to divide by the number of pay periods.

The extra withholding amount is simply added to the FIT per pay amount.

So for example, if Marthas FIT per pay is $236.44 and she wants an additional $20 per pay withheld, her FIT per pay would be $256.44.

You May Like: How Much Taxes Do You Pay On Slot Machine Winnings

Who Pays State Unemployment Taxes

State unemployment taxes are usually paid solely by the employer and are calculated based on an employees wages.

Employees in Alaska, New Jersey, and Pennsylvania are subject to state unemployment tax withholding as well. If you employ workers in any of these three states, you will be required to withhold the tax from their wages and remit these funds directly to the state.

Special Or Extra Duty Pay For Police Officers

Police forces regularly allow their police officers to provide security and other special or extra duty services to third parties for events.

We consider a third party that pays special or extra duty pay to police officers to be their employer. The third party has to do all of the following:

- withhold CPP contributions, EI premiums, and income tax from SEDPwhen the payment is made to a police officer

- remit these deductions to us

- report the SEDP and deductions on a T4 slip

However, we administratively allow the individual police forces, who are the regular employers of the police officers in question, the option to assume these responsibilities instead.

Note

If the police force does not assume the responsibility for withholding remitting, and reporting, it is the third partys responsibility to do this. In such a situation, the third party may have to put the police officer on payroll as a part-time employee.

Under the administrative option, the police force can take into account the CPP contributions and EI premiums previously deducted from the police officers regular salary and SEDP when determining the maximum CPP pensionable and EI insurable earnings for the year.

To determine how much income tax to deduct, the police force should use the method described under Bonuses, retroactive pay increases, or irregular amounts.

For more information, go to Police forces and extra duty.

Also Check: How To Buy Tax Lien Certificates In California

Overview Of Texas Taxes

Texas has no state income tax, which means your salary is only subject to federal income taxes if you live and work in Texas. There are no cities in Texas that impose a local income tax.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

How Your Texas Paycheck Works

Your hourly wage or annual salary can’t give a perfect indication of how much you’ll see in your paychecks each year because your employer also withholds taxes from your pay. You and your employer will each contribute 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. These taxes together are called FICA taxes.

No matter which state you call home, you have to pay FICA taxes. Income you earn that’s in excess of $200,000 , $250,000 or $125,000 is also subject to a 0.9% Medicare surtax. Your employer will not match this surtax, though.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. The same is true if you contribute to retirement accounts, like a 401, or a medical expense account, such as a health savings account . These accounts take pre-tax money so they also reduce your taxable income.

Your marital status, pay frequency, wages and more all contribute to the size of your paycheck. If you think too much or too little money is being withheld from your paycheck, you can file a fresh W-4 with your employer at any time during the year. When you do this, be sure to indicate how much extra income you want withheld so as to avoid a tax bill come April each year.

Recommended Reading: Do You Have To Report Roth Ira On Taxes

How To Calculate Payroll Taxes For Your Small Business

If you have employees, youre responsible for accurately calculating and paying payroll taxes. Check out our guide to get started.

We may receive compensation from partners and advertisers whose products appear here. Compensation may impact where products are placed on our site, but editorial opinions, scores, and reviews are independent from, and never influenced by, any advertiser or partner.

Of all the taxes business owners must pay, payroll taxes can be the most vexing. If you think paying your employees is confusing, just wait until you have to calculate payroll taxes.

While you can find plenty of payroll services eager to take this task off your hands, even if you do turn payroll over to payroll software or a service provider, you should still know how to calculate payroll taxes.

Total Work Time For Hourly Employees

Calculating total work time for hourly employees is a little more involved than it is for salaried workers but not too complicated. Essentially, youll add all of the hours and minutes an employee worked for the pay period.

For example, lets assume that an hourly employee has worked various hours throughout the week from Monday through Saturday and none Sunday. Lets calculate those hours and minutes to get the total hours worked for the period.

This employees total work time for the week:8.67 + 8.17 +8.75 + 8.75 + 7.08 + 2= 43.42 hours

Some employers are stricter about the time their employees clock in and out , so calculations are easier. Nevertheless, if you find yourself needing to convert minutes for payroll, there are plenty of online resources to help.

Tip: If youd rather skip the manual calculations and minutes to decimals calculations, check out our time card calculator. You can enter hours worked and breaks taken each day and it will calculate the total hours worked for you automatically.

Don’t Miss: Where’s My State Refund Ga

Eight : Take Other Deductions

You’re not quite done yet with deductions. Here are some other possible deductions from employee pay you might need to calculate:

- Deductions for employee contributions to health plan coverage

- Deductions for 401 or other retirement plan contributions

- Deductions for contributions to internal company funds or charitable donations.

Remember, all deductions start with and are based on gross pay.

Total Work Time For Salaried Employees

You should pay your salaried employees the same amount per pay period .

Upon hiring a new employee, youll determine a set annual salary and a guaranteed number of hours for which they will be paid. When an exempt employee is hired at an annual salaried rate, they are expected to work a minimum of 40 hours each week. They can work more, but should know that they will not be compensated extra for it. Since their work time is typically fixed, most employers dont require their exempt employees to track their time.

Tip: If youre looking to use payroll software, check if there is an autopilot feature that automatically calculates payroll each period . Paychecks for salaried employees are the easiest to automate because their hours worked and pay rate stay the same.

Nonexempt Salaried Employees

The exemption to that rule, however, is nonexempt salaried employees. Although not as common, some employers will pay their nonexempt employees a salary, meaning a guaranteed amount each week, along with any overtime they work.

The nonexempt part of the position means these employees fall under federal labor law protection. The employer expects employees to work the set minimum number of hours each week, but if they exceed those hours, they must be paid at an overtime rate for them. This requires time tracking to manage successfully.

You May Like: Can You Change Your Taxes After Filing

State And Local Taxes

Depending on the state you live in, you may have to pay state and/or local income taxes. There are currently seven states that do not impose a state income tax, including Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

Generally, state and local taxes are lower than federal income taxes and go toward the state government. Each state and local government has its own tax rates, which means the amount you pay can vary. Fortunately, the IRS allows taxpayers to claim a deduction on their federal tax return for the amount they paid in state income tax.

If you recall, Hectors bakery is located in the sunny state of California. California has one of the highest state income tax rates in the country. There are nine tax rates in California, starting at 1% and going up to 12.3%. Similar to calculating federal income taxes, taxpayers have to make adjustments to their gross income to get to their adjusted gross income. Adjustments are made by taking certain tax deductions and credits into consideration. You will then use your states tax rates to determine how much state income tax you owe.

Step : Figure The Tax Withholding Amount

To recap from the previous page, the adjusted annual wages are $69,400.

Lets look at the tax table found on page 6 of IRS Pub 15-T.

Note there are actually six different tables on this page. The one you use depends on the employees filing status, the version of the W-4 they are using, and whether they have checked the multiple jobs box in Step 2 of their new W-4 . Since our example is using the new W-4 and has the Step 2 box unchecked, were going to use the middle table in the left column.

- Looking in the Single or Married Filing Separately table, the employees taxable wages of $69,400 fall between the range of $44,475 to $90,325 . See the highlighted row above.

- We can see in Column C, at least $4,664 in FIT needs withheld for the year. The $4,664 is a total of the following:

- 10% on wages between $3,950 and $13,900

- 12% on wages between $13,900 and $44,475

Here is what the worksheet would look like:

Recommended Reading: Do You Have To Report Roth Ira On Taxes

What Is The Payroll Tax

There actually isn’t a payroll taxinstead, “payroll tax” is an umbrella term for the various types of taxes employers deduct from their employees’ paychecks. Typically, payroll taxes include federal and state income taxes, Social Security tax, and Medicare tax. Payroll taxes can also refer to the matched contributions employers make on some employee payroll tax contributions.

Bringing It All Together

Calculating payroll taxes can be very complicated, and it is important to send out payments on time to avoid penalties and late fees. Federal tax payments may be made either online through the Electronic Federal Tax Payment System , or through banks authorized to accept federal payments. If you use the latter method, each payment should be accompanied by Form 8109, which can be obtained by calling the IRS at 1-800-829-4933 or from the IRS website.

FUTA taxes are usually paid quarterly and income and FICA taxes are deposited semi-monthly or monthly. The IRS usually sends business owners a notice at the end of each year detailing which method to use for the upcoming year.

In general, the timeliness of a deposit is determined by the date it is received. However, a mailed deposit received after the due date will be considered timely if you can establish that it was mailed at least two days before the due date. To learn more about small-business employers’ payroll duties, go to or call the IRS live help line for businesses at 1-800-829-4933.

Read Also: Do You Have To Report Roth Ira On Taxes

Making Payments To The Irs

Just because youve calculated payroll and paid your employees doesnt mean your job is done. You also need to send the taxes you withheld to the respective taxing authority. For FIT and FICA, that is the IRS. For state and local income taxes, that is your states withholding tax agency.

Be sure to send both the taxes you withheld from your employees paycheck as well as the taxes that you as the employer are responsible for.

The timing of when you send the federal taxes depends on how much you pay employees, how frequently you pay them, and your lookback period . The IRS Form 941, Employers Quarterly Federal Tax Return, provides details on how, when, and where to pay FIT and FICA.

The deadline to file Form 941 is the last day of the month following the end of a calendar quarter. For example, for the quarter ending on March 31st, Form 941 is due on April 30th. There are significant penalties for not filing this form, so dont forget!

For state tax filings, you should contact your states withholding tax agency for filing requirements for state and local income tax rates. Each state is different.