How Capital Gains Taxes Work

If you buy $5,000 worth of stock in May and sell it in December of the same year for $5,500, youve made a short-term capital gain of $500. If youre in the 22 percent tax bracket, you have to pay the IRS $110 of your $500 capital gains. That leaves you with a net gain of $390.

Instead, if you hold on to the stock until the following December and then sell it, at which point it has earned $700, its a long-term capital gain. If your total income is $50,000, then youll fall in the 15 percent bracket for that long-term capital gain. Instead of paying $110, youll pay $105, and see $595 worth of net profit instead.

How To Avoid Capital Gains Taxes

Unfortunately, both short- and long-term capital gains taxes are simply the entry price of playing the stock market game. If you hope to benefit from the historic substantial growth of the U.S. stock market, youll be hard pressed to avoid them entirely. That said, you may be able to minimize them a few ways: with retirement accounts, tax-loss harvesting and tax-exempt investments, like municipal bonds.

Planning For The Alternative Minimum Tax

Another thing to consider when exercising your ISOs is the alternative minimum tax . This tax limits the size of tax benefits on ISOs past a certain exemption amount, which changes every year to account for inflation. For high-income individuals and married couples, AMT exemption begins to phase out at $523,600 for individuals and $1,047,200 for married couples filing jointly in 2021.

To calculate your AMT, you make adjustments to your taxable income based on instructions set by the IRS on form 6251. One of those adjustments is the spread between the FMV and exercise price of ISOs exercised and held through the end of the year. To the extent that your minimum tax is greater than your regular tax, the difference is tacked on as AMT on page 2 of your 1040. In other words, youre paying whatevers greater: your minimum tax or regular tax.

Because youre entitled to the AMT exemption every year, you may find it worthwhile to space out your ISO exercises over multiple years. Since this strategy may not be advantageous for everyone, you should consult a financial tax advisor before making your decision.

You May Like: Should I Efile My Taxes

What Is Subject To Tax

It’s important for all investors to know that any gains they make is considered taxable income.

“People think sometimes that they’re going to make a lot of money in this market and that they won’t be subject to the same taxes,” said Sheneya Wilson, CPA and founder of Fola Financial in New York. Instead, profits from sales of stocks as well as any dividends earned are subject to capital gains taxes.

Other assets are taxed, as well. For instance, investors pay capital gains taxes on cryptocurrencies, some bonds and some mutual funds.

“This is surprise unintended income that you might have to report,” said Gorman.

Capital Gains On Stocks

You generally must pay capital gains taxes on the stock sales if the value of the stock has gone up since you’ve owned it. Capital gains tax on stock you’ve had for more than a year is generally lower than ordinary income tax. If you’ve had the stock for less than a year, you simply pay your ordinary income rate.

The capital gain is the difference between the stock’s sale price, minus any fees you paid to sell it, and the purchase price, to which you add any fees you paid to buy the stock. That value, equal to the purchase price with any fees, is called the cost basis of the stock.

Long-term capital gains rates are either 0, 15 percent or 20 percent, depending on your income, and most taxpayers pay 15 percent.

Also Check: How To Receive Child Tax Credit

The Basics On How To Pay Taxes On Stocks

If you sell stock for less you bought it for, you wont owe any income tax on the losses. In fact, you may be able to use this loss to reduce your taxes. If you sell stock for more than you paid, however, youll have a profit and may need to pay taxes on that gain.

If youve owned the stock for less than a year before selling it at a profit, youll owe taxes on it at your regular income tax rate. If you owned the stocks for more than a year, the long-term capital gains tax rates apply. These rates are dependent on your overall income, but may be 0%, 15% or 20%.

You can use SmartAssets capital gains calculator to estimate the taxes youll owe. The calculator can also figure the estimated capital gains taxes on profits from sales of other assets, such as real estate, collectibles and cryptocurrency.

A basic strategy for reducing taxes on stock sale profits is to hold stocks that have appreciated since purchase for at least a year before selling them. This ensures profits on stock sales will be taxed at the usually lower capital gains rate. Another approach is to sell stocks that have declined in value in order to generate a loss that can be used to shelter gains.

What Forms Do I Need To Pay Taxes On My Stock Trades

As tax time approaches, your brokerage should send you one or more versions of Form 1099, which you report to the IRS when you file your taxes. Form 1099-B lists capital gains and losses, while Form 1099-DIV has dividends. There are also plenty of others.

You or your accountant typically must then attach the Form 1099-B to your 1040 by filling out Schedule D Qualified dividends listed on Form 1099-Div can usually be reported directly on your 1040.

You May Like: Where To Get Your Taxes Done

Managing Taxes On Your Stocks

Taxes are due when an investor sells stock and makes a profit known as a capital gain. Depending on their tax bracket and how long they owned the asset, they’ll have to pay the IRS a certain amount.

Although short-term capital gains are taxed as regular income by the IRS, long-term capital gains are taxed at 0%, 15% or 20% depending on the taxpayer’s tax bracket. The net investment income tax is an additional 3.8% tax on certain investment income for high-income earners.

Overall, consulting a tax expert will make a world of difference in your investment process. A professional provides information on tax filing, how to minimize taxed gains, and strategies of stock investment that will be helpful for you.

What Is Capital Gains Tax

A capital gains tax is a tax you pay on the profit made from selling an investment.

You dont have to pay capital gains tax until you sell your investment. The tax paid covers the amount of profit the capital gain you made between the purchase price and sale price of the stock, real estate or other asset. When you sell, your gain is referred to as realized. Conversely, unrealized gains and losses occur when you have yet to officially sell the investment.

How much you pay in taxes depends in part upon whether you made a short-term or long-term capital gain on your investment, and each is taxed in different ways.

Short-Term vs. Long-Term Capital Gains Taxes

- Short-Term Capital Gain

- Short-term capital gains tax rates apply to assets you sell in one year or less of owning them.

- Long-Term Capital Gain

Short-term capital gains are taxed as ordinary income, such as the income tax you pay on your salary, at your standard federal income tax rate. This tends to be a higher rate than for long-term capital gains taxes, which are based on defined tax brackets that are adjusted each year for inflation.

Recommended Reading: What Is 1040 Sr Tax Form

What Is A Capital Gains Tax

Just as the government wants a cut of your income, it also expects a cut when you realize a profitaka a “capital gain“on your investments. That cut is the capital gains tax.

For tax purposes, its helpful to understand the difference between unrealized gains and realized gains. An unrealized gain is a potential profit that exists on paperan increase in the value of an asset or investment you own but haven’t yet sold for cash. For example, say you buy some stock in a company, and a year later, its worth 15% more than you paid for it. Although your investment has increased in value by 15%, that gain is unrealized since you still own the stock.

On the other hand, a gain becomes realized when you sell the asset or investment at a profitthat is, for more than its basis. For instance, you realize a gain of $5,000 if you sell that stock for $25,000 after paying $20,000 for it. A tax on capital gains only happens when an asset is sold or “realized.”

Investors can also have unrealized and realized losses. An unrealized loss is a decrease in the value of an asset or investment you own but haven’t yet solda potential loss that exists on paper. A realized loss happens when you sell an asset or investment for less than you paid for it .

How Much Tax Do You Pay On Stocks

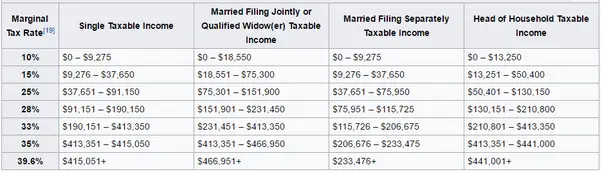

Your income from investments can be taxed at various rates, depending on how the income is classified and what your total income is from all sources. Short-term capital gains and ordinary dividends are taxed at your ordinary income tax rate based on your tax bracket. Long-term capital gains are taxed at lower rates.

Read Also: When Do I Have To File My Taxes By

Paying Taxes On Stocks’ Dividends

If you own a stock or mutual fund that pays dividends, which is a payment of cash or stock given to owners of the stock by the issuing company, you often must pay tax on those dividends. Dividends will often be reported to you using IRS Form 1099-DIV.

Most dividends are called ordinary dividends by the IRS and are taxed at your usual income tax rate. Some dividends, known as qualified dividends, get special tax treatment. You pay tax on those at your capital gains rate. Usually, that’s just 15 percent, though some taxpayers pay 0 percent or 20 percent, depending on overall income.

If you’re in a dividend reinvestment plan, you must pay tax on the dividend you receive even though you use it to buy more stock. If you get the stock at a discount, the discount itself is taxable dividend income.

Capital Gains Tax Rates For 2021

The capital gains tax on most net gains is no more than 15% for most people. If your taxable income is less than $80,000, some or all of your net gain may even be taxed at 0%.

As of 2021, the long-term capital gains tax is typically either 0%, 15% or 20%, depending upon your tax bracket. This percentage will generally be less than your income tax rate.

Source: Kiplinger

There are some exceptions to this 0-15-20% rule which allows certain capital gains to be taxed at higher rates.

Higher Capital Gains Tax Rate Exceptions

- Taxable portions of the sale of certain small business stocks are taxed at a 28% maximum rate.

- Net capital gains from selling collectibles such as coins or art are taxed at a 28% maximum rate.

- Certain portions of capital gains from specific real estate sales are taxed at a 25% maximum rate.

Source: Internal Revenue Service

Read Also: How Much Is To Do Taxes

Capital Gains Tax Rates For 2021 And 2022

Short-term capital gains are taxed at ordinary income tax rates up to 37% . On the other hand, long-term capital gains are taxed at different, generally lower rates. The capital gains rates are 0%, 15%, and 20%, depending on your taxable income. Here’s a breakdown for tax years 2021 and 2022:

| Long-Term Capital Gains Tax Rates for 2021 |

|---|

| Filing Status |

| $41,6751 to $258,600 | Over $258,600 |

Although marginal tax brackets have changed over the years, historically , the maximum tax on ordinary income has almost always been significantly higher than the maximum rate on capital gains.

Not all capital gains are taxed according to the standard 0%/15%/20% schedule. Here are some exceptions where capital gains may be taxed at higher rates than 20%:

- Gains on collectibles, such as artworks and stamp collections, are taxed at a maximum 28% rate.

- The taxable portion of gain on the sale of qualified small business stock is also taxed at a maximum 28% rate.

- The portion of any unrecaptured Section 1250 gain from selling Section 1250 real property is taxed at a maximum 25% rate.

What Is The Capital Gains Tax Rate In Canada

Go rooting in the Income Tax Act and you’ll struggle to find something called capital gains tax. That’s because there’s no special tax relating to gains you make from investments and real estate holdings. Instead, you pay the income tax on part of the gain that you make.

In Canada, 50% of the value of any capital gains are taxable. Should you sell the investments at a higher price than you paid you’ll need to add 50% of the capital gain to your income. This means the amount of additional tax you actually pay will vary depending on how much you’re making and what other sources of income you have.

If you have both capital gains and capital losses, you can offset the capital gains with capital losses until you reach zero. If you only have capital losses, the CRA allows you to use the capital loss to offset a capital gain you originally declared in the previous 3 years, or you are allowed to carry forward the capital loss into the future. How far into the future, right now it’s indefinitely, so don’t lose the paperwork! That said, rules can change and so it’s best to check with your tax professional before taking any action.

Read Also: How Do I Dispute My Property Taxes

Example Of How To Calculate Profits From A Stock Sale

Let’s say you bought 10 in Company X for $10 apiece and paid $5 in transaction fees for the purchase. If you later sold all the stock for $150 total, paying another $5 in transaction fees for the sale, here’s how you’d calculate your profits:

Cost basis = $100 + $10 = $110Profits = $150-$110 = $40

So, in this example, you’d pay taxes on the $40 in profits, not the entire $150 total sale price.

Now that you’ve determined your profits, you can calculate the tax you’ll have to pay. The taxes you owe depend on your total income for the year and the length of time you held the shares.

When Should You Sell A Stock

Ideally, you would sell a stock when it’s profitable to do so. Exactly when to do that depends on your risk tolerance, the stock’s performance, and your goals. If you’re investing for the long term, you might sell a stock if you feel that it was a mistake to buy it in the first place or if the price has risen significantly over a short period. You may also need to sell to meet other financial needs, like paying for college, funding your retirement, or making a down payment on a home.

You May Like: Can I File Taxes Separately From My Husband

Capital Gains Tax In Canada Explained

By Stefania Di Verdi and Justin Dallaire on February 18, 2022

Learn how capital gains are taxed and how to avoid paying more taxes than necessary when selling your assets.

Selling your high-performing stocks or your cottage with a view can reap significant profits, and those moments are worth celebrating. But while youre enjoying the spoils of your investments, keep in mind that youll eventually have to pay tax on them. In Canada, most gains on capital assets are taxed. Lets look at strategies to avoid paying more taxes than you need to come tax time.

Taxes On Stock Trades: Background

The taxes paid on investment profits is known as capital gains. There are two different types of capital gains taxes, determined by how long you held the investment for. The two types of capital gains taxes are long-term and short-term capital gains. The cost basis is the baseline used to determine gains or losses. The cost basis calculation includes using not only the cost of the security itself, but also any applicable commissions.

You also need to be aware of whether or not the security you hold pay dividends. Qualified dividends are taxed based on your federal tax bracket, though on a 0/15/20 percent scale. And ordinary dividends is based on your federal tax bracket. For more information on the taxes on stock trades paying qualified dividends, consider speaking to a tax professional.

Also Check: Are Home Closing Costs Tax Deductible

Whats Considered A Capital Gain

If you sell an asset for more than you paid for it, thats a capital gain. But much of what you own will experience depreciation over time, so the sale of most possessions will never be considered capital gains. However, youre still liable for capital gains taxes on anything you purchase and resell for a gain.

For example, if you sell artwork, a vintage car, a boat, or jewelry for more than you paid for it, thats considered a capital gain.

Property such as real estate and collectibles, including art and antiques, fall under special capital gains rules. These gains specify different and sometimes higher tax rates .

And dont forget that if youve sold cryptocurrency such as bitcoin for a gain, then youll also be liable for capital gains taxes.