Putting The Ira Tax Deduction To Use

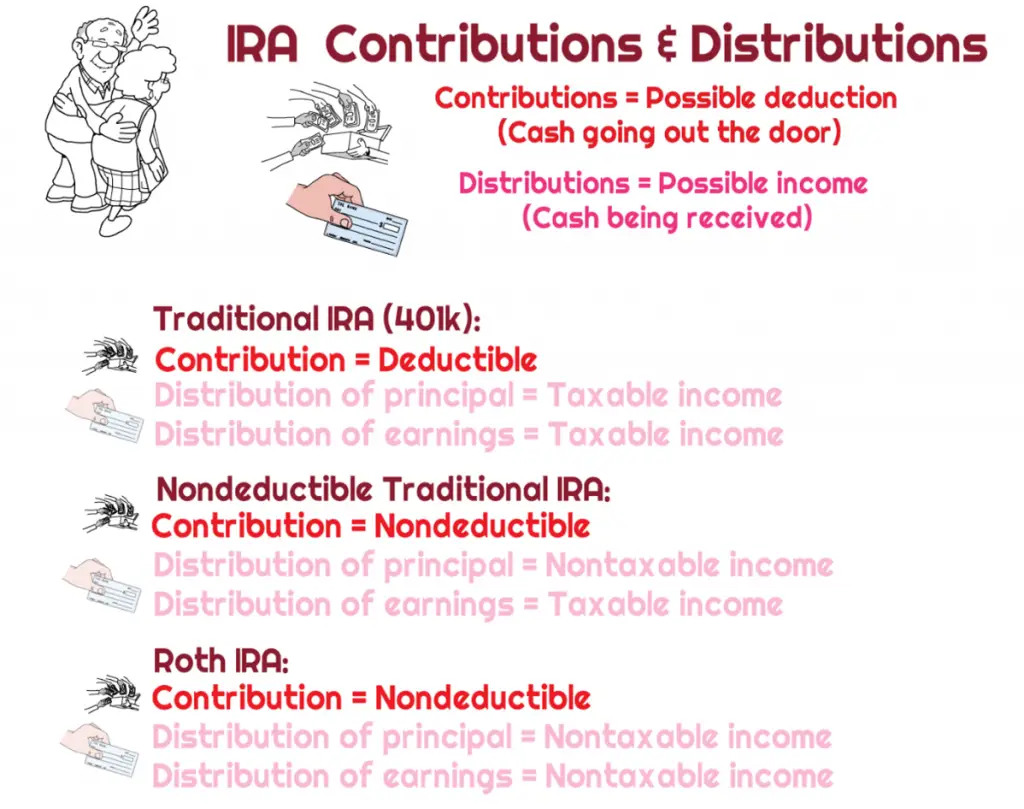

Traditional IRA tax deductions are quite simple. If a qualifying individual contributes the full $6,000 maximum allowed to a Traditional IRA in a year, they can deduct the contribution from their taxable income.

Its worth noting that 2022 deductions may be phased out if a tax filer is:

Single Married Covered by a work 401 plan Earning above specific income levels

Different restrictions apply to married couples where one person is not covered by a workplace plan but their spouse is covered through work. Contributions to Roth IRAs are not tax deductible.

401, 403, and other non-Roth workplace retirement plans work in a similar way. In 2022, the contribution maximum for a 401k is $20,500. A person who contributes the full amount could then deduct $20,500 from their taxable income, potentially reducing their highest marginal tax rate.

One common source of confusion: The tax deduction for an IRA will reduce the amount a person owes in federal and state income taxes, but will not circumvent payroll taxes, which fund Social Security and Medicare. Also known as Federal Insurance Contributions Act taxes, these are assessed on a persons gross income. Both the employer and the employee pay FICA taxes at a rate of 7.65% each.

Are Roth 401 Plans Matched By Employers

Roth 401 plans are typically matched by employers at the same rate as they match traditional 401 plans. Some employers do not offer Roth 401 plans.

A Roth 401 is an employer-sponsored investment account that is similar to a traditional 401 plan in almost every way, except that the contributions to the account are taxed up-front rather than at the time of withdrawal.

It can be well-suited for people who expect to be in a high tax bracket when they retire and who do not want to pay taxes on investment returns.

You May Not Be Able To Contribute In The Future If Your Income Grows

Most people know that the contributions to an IRA, 401, 457 or 403 plan are tax-deductible, but the subtleties of that process are sometimes misunderstood. You see, you may not be able to contribute to the plan in the future if your income grows. Well explore that in more detail below.

Well also look at some of the other alternatives to retirement accounts that may be more flexible and more attractive to a younger person. The takeaway is that because of a traditional IRA being so tied to ones income, you could have significant limitations to contribution ability.

You May Like: Highest Paying Plasma Donation Center Near Me

Invest In Real Estate

Real estate has always been a passion for Americans. Perhaps its because its something you can touch and feel rather than stocks or bonds, which allow you to own a piece of a firm. Perhaps its because its one of the quickest methods to make money. In any case, according to a Gallup study, 35% of Americans believe that real estate is the best long-term investment when compared to other long-term possibilities such as savings accounts and equities.

Real estate is a broad investment field as well. Unless you reside somewhere with a very low cost of living, $50,000 will not purchase you a full rental property, but it can be used as a down payment on your own rental property. This is one of the riskier and time-consuming methods of real estate investment.

REITs , which act similarly to index funds, are another way to invest in real estate indirectly. You still have the potential for high returns with REITs like RealtyMogul, but you dont have to worry about replacing a broken toilet in the middle of the night .

How Does The Irs Keep Track Of Roth Ira Contributions

Roth contributions, unlike standard IRA contributions, do not qualify for a tax deduction. The good news is that you are not required to report contributions to the IRS. The disadvantage is that, unlike a standard IRA, you do not receive a tax form that summarizes your Roth IRA contributions. Youll need to keep track of your contributions or request a statement from your account manager. If you convert another account to a Roth, the account manager will send you a Form 5498 detailing how much money you transferred to the Roth. Form 8606 is used to record conversions to the IRS.

Also Check: Tax Preparer License Requirements

General Comments About Roth Iras

1.1 A Roth Individual Retirement Arrangement is an individual retirement plan established pursuant to section 408A of the United States Internal Revenue Code of 1986 . For U.S. income tax purposes, contributions to a Roth IRA are not deductible from income, earnings and gains are exempt from tax, and distributions are generally not included in income. For an overview of Roth IRAs see Internal Revenue Service Publications 590-A, Contributions to Individual Retirement Arrangements and 590-B, Distributions from Individual Retirement Arrangements .

1.2 For Canadian income tax purposes, the income accrued in a Roth IRA is generally taxable on a current, annual basis. An individual resident in Canada who owns a Roth IRA must determine:

- the legal characterization of the Roth IRA and resulting taxation of income accrued in and distributions from the Roth IRA pursuant to the Act and

- whether the relief provided in the Canada-U.S. Treaty for Roth IRAs is available .

If You Do Have A Work Retirement Plan

If you do have a retirement plan at work, or if your spouse does, then your ability to deduct contributions depends on whether your income is above the traditional IRA income limits.

-

If your income is under the limits, youre eligible to claim a tax deduction for your contributions to a traditional IRA.

-

If youre in the income phase-out range, you can deduct a portion of your contributions.

-

If your income is higher than the maximum income limit, then you cant deduct your IRA contributions.

Recommended Reading: Irs Taxes Due

Are Ira Contributions Tax

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Are IRA contributions tax-deductible? Yes, IRA contributions are tax-deductible if you qualify.

To be clear, were talking here about contributions to a traditional IRA. Contributions to a Roth IRA are not tax-deductible.

Heres how to figure out if you qualify to deduct your traditional IRA contributions.

Traditional Ira Deduction Limits

If you are covered by a retirement plan at work, you can make a full or partially deductible contribution to a Traditional IRA, based on your modified adjusted gross income .

And starting in 2020, as long as you are still working, there is no age limit to be able to contribute to a Traditional IRA. The Secure Act, signed into law on December 20, 2019, removed the age limit in which an individual can contribute to an IRA. The top age prior to the law was 70½.

Find out which IRA may be right for you and how much you can contribute. Calculate your IRA contribution limit

Read Also: Taxes For Door Dash

Alternatives To Traditional Iras

If you cannot make a tax-deductible contribution to a traditional IRA, consider these alternatives.

Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier has you covered. Increase your tax knowledge and understanding all while doing your taxes.

Know The Rules To Take Full Advantage Of The Tax Perks

There are many advantages of saving your money in a Roth IRA. The most significant ones are the tax benefits. Roth IRAs offer tax-free growth on both the contributions and the earnings that accrue over the years. If you play by the rules, you won’t pay taxes when you take the money out. Here is some of the most important information you’ll need to know before you decide to contribute to a Roth IRA.

Read Also: Do You Pay Taxes On Plasma Donations

A Traditional Ira May Be A Better Choice

A traditional IRA doesnt offer tax-free withdrawals in retirement, but you do have the advantage of deducting your annual contributions. That can lower your tax liability since deductions reduce your taxable income for the year. The annual contribution limit for a traditional IRA is $6,000 for 2021 and 2022. A $1,000 catch-up contribution is allowed each year for those aged 50 and older.

You may be able to take the deduction if youre married filing separately. But it depends on your income, your living arrangement, and whether youre covered by a retirement plan at work.

Qualifying For A Tax Deduction

Only in very rare situations can you deduct losses in your Roth IRA account. To qualify for the deduction, you must close all of your Roth IRA accounts, including Roth IRA accounts that have profits.

Your traditional IRAs need not be closed, as they are treated separately, and the value of your Roth IRA from the previous year or at any point during the time the account was open does not matter. You must show a loss from your tax basis in the account.

Recommended Reading: Doordash Taxes 2021

Spousal Roth Ira Differences

The contribution limit for Roth accounts is the same as it is for traditional IRAs: your total contributions to traditional and Roth IRAs cannot exceed $6,000 in tax years 2021 and 2022 .

However, Roth accounts get different tax treatment. Unlike traditional IRAs, which are funded with pre-tax contributions and are therefore tax-deductible, Roth IRA contributions are not tax-deductible, because theyre funded with after-tax contributions.

Moreover, the withdrawals youll eventually make from Roth IRAs will not be taxed again, whereas traditional IRA withdrawals are taxable.

Your eligibility to contribute to a Roth IRA for yourself or your spouse is based on your MAGI.

Here are the contribution limits for tax year 2021:

| If your MAGI as a married couple filing jointly is… | You can contribute… |

|---|

| $214,000 or more | zero |

To determine the partial amount you may contribute if you are in that middle band of incomes, first subtract $198,000 for 2021 or $204,000 for 2022 from your MAGI. Divide the resulting number by $10,000 if you are filing jointly. Then, multiply that number by the maximum contribution limit . Finally, subtract that number from the maximum contribution limit.

What Is A Non

If you cant currently qualify for a Solo 401k, a traditional IRA, or a Roth IRA, you can still put away additional retirement dollars where they can grow tax-free. Its probably intuitive that a non-deductible IRA contribution is made with after-tax dollars. Therefore, you cannot deduct those contributions on your tax return. Still, many people turn to non-deductible IRA contributions when their income exceeds the allowable IRS tax-deductible contributions for a regular IRA.

In fact, non-deductible IRA contributions can be the gateway to a Mega Backdoor Roth Solo 401k. The Roth Solo 401k does have huge tax advantages. The earnings grow tax-free! Most importantly, the earnings remain tax-free when distribution withdrawals begin. The bottom line is that non-deductible IRA contributions can lead to tremendous tax savings in the long run.

Non-deductible contributions to a traditional IRA are subject to the same contribution limits as tax-deductible contributions. Your non-deductible contribution can be up to $6,000 in 2021, or $7,000 if youre age 50 or older. The difference is in the contribution tax treatment.

Taxes can be significant if you exceed the limits of a tax-deferred or non-deductible IRA. The IRS will levy a 6% excise tax on the excess amount each year until you remove those savings if you save more than your yearly limit. That is a reason that most people do not exceed the IRS limit with non-deductible contributions.

Recommended Reading: Tsc-ind Ct

You Are Not Covered By A Retirement Plan At Work

| Filing Status | Modified adjusted gross income | Deduction Limit |

| Single, head of household, or qualifying widow | any amount | A full deduction up to the amount of your contribution limit |

| or with a spouse who is not covered by a plan at work | any amount | A full deduction up to the amount of your contribution limit |

| with a spouse who is covered by a plan at work | $198,000 or less | A full deduction up to the amount of your contribution limit |

| > $198,000 but < $208,000 | ||

| with a spouse who is covered by a plan at work | ||

| < $10,000 |

Tax Brackets And Ira Deductions

Income tax brackets can work in a stair-step fashion. Each bracket reveals what a person owes at that level of income. Still, when a person is in a certain tax bracket, they do not pay that tax rate on their entire income.

For instance, single filers pay a 12% federal income tax rate for the income earned between $10,275 and $41,775. Then, the tax rate steps up, and they pay a 22% tax on the income earned that falls in the range of $41,775 and $89,075. Even if a person is a high-earner and in the 37% tax bracket, they still pay the lower rates on their lower levels of income.

Why is this worth noting? Because tax deductions reduce a persons taxable income at a persons highest marginal rate . Using 2022 tax rates, the above-mentioned person with $70,000 in taxable income would be taxed like this:

10% up to $10,275 12% up to $41,775 22% on the remaining $17,950

However, if that same person contributes the maximum to their tax-deferred retirement account, they would be taxed 22% on the top amount minus whats deductible. In other words, they wouldnt be taxed 22% on the full $17,950.

Also Check: Philadelphia Pa Sales Tax

Social Security Taxes And Medicare Premium Hikes

The formulas for Social Security taxes, Medicare Part B and Medicare Part D use so-called modified adjusted gross income, or MAGI.

If half of your Social Security payments plus MAGI is over $34,000 , up to 85% of those benefits may be taxable.

However, the bigger issue for retirees above certain income levels may be the surcharge for Medicare Part B, known as the Income Related Monthly Adjustment Amount, or IRMAA.

While the base amount for Medicare Part B premiums is $170.10 for 2022, payments go up once income exceeds $91,000 . The calculation uses MAGI from two years prior.

Roth withdrawals, however, won’t show up on tax returns, said Gessner, meaning retirees don’t have to worry about these distributions causing Medicare premium increases.

Utilize Flexible Spending Plans

A flexible spending plan may be offered by your employer as a way to lower taxable income. A flexible spending account is one that your company manages. Your employer utilizes a percentage of your pre-tax earnings that you set aside to pay for things like medical costs on your behalf.

Using a flexible spending plan lowers your taxable income and lowers your tax expenses for the year in which you make the contribution.

A flexible spending plan could be a use-it-or-lose-it model or include a carry-over feature. You must spend the money you provided this tax year or forfeit the unspent sums under the use-or-lose approach. You can carry over up to $500 of unused funds to the next tax year under a carry-over model.

Recommended Reading: Www.myillinoistax

Do I Need To Declare Roth Ira On Taxes

Have you made a Roth IRA contribution for 2020? You still have time if you havent done so. The tax-filing deadline, not including any extensions, is the deadline for making a prior-year contribution. The deadline for 2020 is April 15, 2021.

If you have made or plan to make a Roth IRA contribution in 2020, you may be wondering how these contributions will be treated on your federal income tax return. You might be surprised by the answer. Contributions to a Roth IRA are not reported on your tax return. You can spend hours reading through Form 1040 and its instructions, as well as all the various schedules and papers that come with it, and still not find a place on the tax return to disclose Roth contributions. There is a section for reporting deductible Traditional IRA contributions as well as a section for reporting nondeductible Traditional IRA contributions. Traditional IRA conversions to Roth IRA conversions must also be recorded on the tax return. There is, however, no place to report Roth IRA contributions.

While Roth IRA donations are not required to be reported on your tax return, it is crucial to note that the IRA custodian will report these contributions to the IRS on Form 5498. You will receive a copy of this form for your records, but it is not required to be filed with your federal tax return.

What Is An After

In general, there are 3 types of money that can be contributed to a 401 plan: Pre-Tax , Roth, and After-Tax. Pre-Tax gives a tax advantage by lowering taxable income in the year contributed, Roth provides a tax advantage by allowing the contribution basis to not be taxed again, and potentially tax-free earnings if some conditions are met.

At its face value, After-Tax contributions do not serve any tax advantages. If left sitting in an account, you will never be double-taxed on the contributions , but any investment earnings on that amount are taxable when distributed. As a result, it is not as commonly found as an option in 401 plans. Some plans will allow for participants to continue to contribute beyond the IRS 402 limit that determines how much Pre-Tax and Roth can be contributed in a calendar year. Others may allow for it to be assigned a percentage or dollar amount just like other contribution types, but some plans do not match this source. Another piece to consider with After-Tax contributions is that many plans allow for in-service distribution of these funds. Check with your 401 plan provider to see what options your plan provides.

Recommended Reading: Protest Property Taxes In Harris County