Countries With Active Discussion

Ireland

In 2010 the government of Ireland announced that it would introduce an LVT, beginning in 2013. Following a 2011 change in government, a property tax was introduced instead.

New Zealand

After decades of a modest LVT, New Zealand abolished it in 1990. Discussions continue as to whether or not to bring it back. Earlier Georgist politicians included Patrick O’Regan and Tom Paul .

United Kingdom

In September 1908, Chancellor of the Exchequer David Lloyd George instructed McKenna, the First Lord of the Admiralty, to build more Dreadnoughts. The ships were to be financed by an LVT. Lloyd George believed that relating national defence to land tax would both provoke the opposition of the House of Lords and rally the people round a simple emotive issue. The Lords, composed of wealthy land owners, rejected the Budget in November 1909, leading to a constitutional crisis.

LVT was on the UK statute books briefly in 1931, introduced by Philip Snowden‘s 1931 budget, strongly supported by prominent LVT campaigner Andrew MacLaren MP. MacLaren lost his seat at the next election and the act was repealed, MacLaren tried again with a private member’s bill in 1937 it was rejected 141 to 118.

The Green Party “favour moving to a system of Land Value Tax, where the level of taxation depends on the rental value of the land concerned.”

Scotland

Your Tax Assessment Vs Property Tax: What’s The Difference

The concepts of an assessment and property tax have proven to be a point of confusion for some business ownersare they one and the same, or two different things? In fact, assessment is an integral function of the tax cycle, but taxation and assessment are two distinct things. The rationale behind the separation: It protects property owners from possible unfair treatment. As a taxpayer, thats good for you, but theres more you need to know to ensure youre being taxed fairly.

This article explains tax assessment vs. property tax in some detail, and briefly touches on how to appeal a property tax assessment if you feel youve been assessed unfairly.

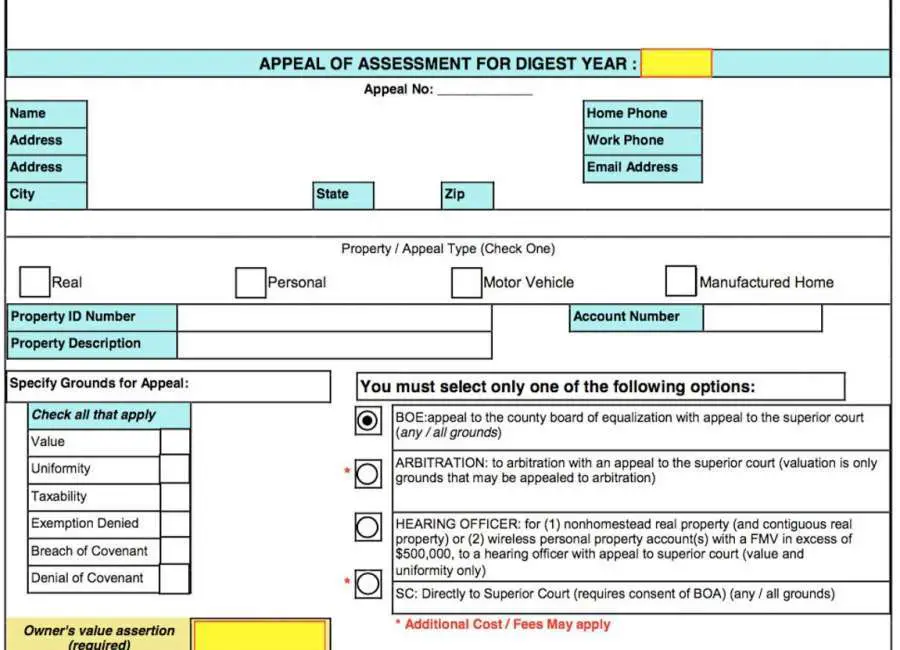

Should You Appeal Your Property Tax Assessment

If you disagree with your propertys assessed value, appealing is an option. Its important to note that an appeal isnt always about value it may be about some other aspect of the tax, such as a denial of an exemption, a clerical error, a dispute over the taxing jurisdiction, or something else. Also, assessors generally do mass appraisals of buildings in their jurisdiction, so they may not know the specific details regarding your property that could affect its value.

If you do choose to appeal, you may make either an informal or formal appeal.

- An informal appeal may be settled in an informal manner, possibly over the phone with the assessor or by visiting the assessors office to discuss it in person. Often, the issue is settled during this informal process.

- If the taxpayer and the assessor are unable to come to a resolution, a formal appeal is usually the next option. If a formal appeal is necessary, a specific appeal form may be required or a letter of appeal may be accepted. Be sure to check the particular assessors requirements.

If you are successfully able to reduce your propertys value, it is the appraised value that is being reduced. As a result, the assessed value is then indirectly reduced because the appraised value is the starting point for assessed value, before any assessment ratios and exemptions are applied.

Recommended Reading: H& r Block Early Access W2

Charges From Province Of British Columbia

On your Property Tax Bill there are charges from the Province of British Columbia for school taxes and for other regional bodies including:

- BC Assessment Authority

- TransLink

These taxing authorities determine the amounts payable and the City collects on their behalf.

Approximately 40% of a typical residential property tax bill is collected on behalf of other agencies that are outside the Citys budget control.

How Do Assessments Work

Local governments cities, municipalities, towns, etc. take in significant revenues by levying property taxes upon local homeowners. These sums are used to pay for assorted expenses such as public works, public safety, schools, parks, and other shared resident benefits.

Local jurisdictions set tax rates and home assessment methodologies and employ assessors to review property data and visit local homes to determine their assessed value. These home assessors may take into account various factors such as home inspection findings, prior years worth of property data, and comparative market analysis to arrive at a propertys assessed value, which is considered the most widely accepted dollar value indicator.

Note that the tax assessments these assessors provide are primarily for purposes of taxation. These findings will not necessarily represent or reflect the total amount that you could obtain through an actual sale of the property on the open market.

Read Also: How To Get Doordash Tax Form

Appeal Assessment Of Property Value

If you disagree with MPACs classification or assessment of your property, please contact MPAC directly at 1-866-296-MPAC with a Request for Reconsideration .

Businesses can appeal to the Assessment Review Board an independent tribunal of the Province of Ontario without making a Request for Reconsideration.

The deadline to appeal can be found on the Property Assessment Notice you received from MPAC.

Check Your Assessment Annually

You should check your assessment on the tentative assessment roll each year.

If your assessment or the estimated market value for your property is higher than the price for which you can sell your home, you should discuss it with your assessor. See How to estimate the market value of your home.

If the assessor does not reduce your assessment, you can contest your assessment.

Also Check: Is 1040paytax Com Real

How To Take Control Of Your Assessments

If you receive a lot of assessments, chances are your team will be overwhelmed and want to simply process them before moving on to the next one. But that means you miss out on opportunities to appeal. Be more proactive with CrowdReason, property tax software that helps you prepare for, track, and stay on top of tax assessments so you can save time and take advantage of appeal opportunities and lower your tax burden.

For Properties Classified As Residential Farm Managed Forest Or Conservation Land

- File a RfR with MPAC by deadline printed on your Property Assessment Notice.

- MPAC will review your request and come to a determination, if you agree with the review, sign the Minutes of Settlement. A copy of the Minutes of Settlement will be sent to the City for processing.

- If you disagree with the RfR recommendation, you may file an appeal with the ARB before the deadline, which is 90 days from the mailing date on your RfR recommendation. The RfR recommendation must be received BEFORE filing with the ARB.

You May Like: Do You Have To Pay Tax On Doordash

Property Assessments And Property Taxes

In January, property assessment notices are mailed annually to property owners throughout the province from BC Assessment, an independent agency created by the Provincial Government for the purpose of valuing all properties in BC for taxation purposes. Your assessment notice estimates the market value of your property as of July 1 of the previous year.

An increase in your property assessment does not mean your taxes will automatically go up by the same amount .

Assessment is simply a distribution mechanism. Your assessment indicates the estimated value of your property. The property tax rate, which is based on budget requirements, is what determines how much your taxes will be. The tax rate is set by City Council each year.

How much have 2022 property assessments increased in the City of Duncan?

The average value of a home in the City of Duncan has increased from $399,322 to $533,833, an increase of almost 34%. The average commercial property has increased from $657,225 to $761,477, an increase of almost 16%.

If my property assessment increased, will my tax bill go up too?

Properties that change in value by the same percentage up or down as the average property will experience a tax increase at the same rate as the overall tax increase set by City Council. Properties that increase or decrease in value by more or less than the average will experience changes in their taxes that are more or less than the average increase.

What are the next steps?

Liberal And Labour Parties In The United Kingdom

In the United Kingdom, LVT was an important part of the platform of the Liberal Party during the early part of the twentieth century. David Lloyd George and H. H. Asquith proposed “to free the land that from this very hour is shackled with the chains of feudalism.” It was also advocated by Winston Churchill early in his career. The modern Liberal Party ” rel=”nofollow”> Liberal Democrats, who are the heir to the earlier Liberal Party and who offer some support for the idea) remains committed to a local form of LVT, as do the Green Party of England and Wales and the Scottish Greens.

The 1931 Labour budget included an LVT, but before it came into force it was repealed by the Conservative-dominated national government that followed.

An attempt at introducing LVT in the administrative County of London was made by the local authority under the leadership of Herbert Morrison in the 1938â1939 Parliament, called the London Rating Bill. Although it failed, it detailed legislation for the implementation of a system of LVT using annual value assessment.

After 1945, the Labour Party adopted the policy, against substantial opposition, of collecting “development value”: the increase in land price arising from planning consent. This was one of the provisions of the Town and Country Planning Act 1947, but it was repealed when the Labour government lost power in 1951.

Recommended Reading: How To Keep Track Of Taxes For Doordash

When You Receive Your Notice

Review the details on your assessment notice.

Browse our interactive notice

This interactive assessment notice will walk you through the information categories in your notice. Click on each section to read the description.

Drag to view image

The date the City of Edmonton mailed this assessment notice.

What Is The Difference Between The Tax Assessment And Property Taxes

Property taxes provide significant revenue for local governments. To determine your property tax bill, your local government will conduct a tax assessment.

Heres a quick breakdown of the difference between tax assessments and property taxes:

- Tax assessment: An evaluation of your property, often conducted by a county or city assessor, to determine the propertys assessed value.

- Property taxes: What you pay based on the assessed value of your property and the property tax rate.

A portion of your monthly mortgage payment goes into an escrow account to cover property taxes and insurance premiums. Once your property tax bill is due for the year, your lender will use the funds in your escrow account to pay the bill.

Tip:

On the other hand, if either the assessed value or property tax rate decreases while the other increases, theres a chance you could end up paying less in taxes.

Some states also have property tax limits that protect residents from drastic increases in property values. Look into how property taxes are implemented in your area, and stay up to date on the latest changes.

Find out: How to Conduct a Property History Search Before You Buy

Read Also: Irs Taxes Due

Conseil Des Coles Publiques De Lest De Lontario

Parents or ratepayers who wish to direct their school support to the French Public School Board, can specifically request a change in their direction of school support/electoral status by downloading and completing the Application for Direction of school support form from the Conseil des écoles publiques de lEst de lOntario . Completed forms must be returned to:

Tax Assessment Vs Property Tax: Definitions

Assessment: A tax assessment is a value attached to your real property and business personal property by the local government, specifically for the purpose of levying and collecting tax money that is used to support your community.

Under this broad definition, there are three types of specific values related to the assessment:

- The appraised value of your property is based on the fair market value, which is the price a willing seller would sell to a willing buyer through an arms length transaction .

- The assessed value is an adjusted value: Appraised value/market value multiplied by the assessment ratio. The assessed value does not affect the propertys appraised value or fair market value it only affects the tax bill.

- The taxable value is the assessed value minus any exemptions. The taxable value is multiplied by the jurisdictions tax rates to arrive at the tax liability. That number may then be adjusted further if necessary by applying any exemptions or penalties. Tax rates are not set by assessors, they are set by taxing jurisdictions . Public hearings are often held to discuss proposed tax rates.

Property tax: Property tax is a tax levied by a government on the buildings, land, and certain types of personal property bought or owned within their jurisdictions. Property tax liability is based on the tax assessment.

Don’t Miss: Is Giving Plasma Taxable Income

How Supplementary And Omitted Assessments Affect Your Property Taxes

When the City issues a building permit, there will most likely be a value change in the property, which creates a supplementary/omitted assessment. Your property assessment will need to be updated to reflect the completed work as a result of the building permit. The Municipal Property Assessment Corporation will mail you a supplementary or omitted assessment notice that outlines such assessment values and the effective date they take effect.

Supplementary/omitted property tax bill

For taxation purposes, you will receive a tax bill at a later date called a “supplementary” tax bill. The bill will reflect the additional change in your assessment and taxes owing will be adjusted accordingly. Supplementary taxes are determined by multiplying the supplementary assessment by the applicable tax rate and prorating this amount based on the number of days the building has been completed or occupied for the year.

The bill must be paid by the due date indicated on your supplementary tax bill. Municipalities must provide 21 days notice from the date issued to the due date under provincial legislation. Additional assessment occurring from building a new home or addition can result in a supplementary tax bill that can amount to thousands of dollars. It is a good idea to plan for this billing as soon as you start work on your property by putting money aside monthly to pay the bill when it comes due.

Examples of supplementary/omitted assessments

| Billing Type |

|---|

Reduce The Time You Spend Handling Assessments

Better tracking isnt the only benefit TPT offers. It also helps you save time. For example, on the notice summary screen, you can use the displayed values and comparisons in conjunction with deadlines to quickly assess whether individual assessments should be accepted or flagged for appeal. Its a welcome time-saver as your staff members proceed through their workflows, addressing assessments and other elements of the property tax cycle.

This screen also provides easy access to any notice-related documents your team may have connected to a given assessment. Instead of hunting down reference documentation, you can find it attached to the associated assessment.

Another time-saving aspect of TPT is the ability to generate a pre-populated appeal letter. You can send this letter to an assessor to start the appeal process. Some states require special appeal forms in lieu of letters TPT makes available a few of these state-specific forms, namely for Texas and Oklahoma.

Lastly, TPT can be used in conjunction with its sister product, MetaTaskerPT to save additional time. MetaTaskerPT is data extraction software that automatically scans and extracts key data points from tax documents, eliminating any need for manual data entry. For assessment notices, MetaTaskerPT can extract notice values and appeal deadlines and import them into TPT or your existing tax database. MetaTasker has a 99% accuracy rate and can turn around documents in less than 24 hours.

Don’t Miss: Doordash Mileage Calculator

Understanding Appraisal Vs Assessment

Whats the difference between an appraisal and an assessment and how are these terms defined in real estate jargon? While its not uncommon to mistakenly hear these phrases used interchangeably, as it turns out, theyre not actually the same in practice.

Although both can refer to ways of measuring a propertys value, each takes widely different approaches to the calculation of this figure. Noting this, understanding the difference between an appraisal and an assessment can help you become more aware of what your home is ultimately worth and how it may be taxed, and to stay more informed.

Property Tax Calculator 2022

As a homeowner, youre responsible for paying taxes on your property to the municipality in which you live. Property taxes are used to generate money for public purposes in your area. Without this major source of funding, the services available where you live would be greatly reduced. Nestos property tax calculator will help you estimate the amount of property taxes youll have to pay to the municipality so you can add that to your annual homeownership budget.

Don’t Miss: Buying Tax Liens California