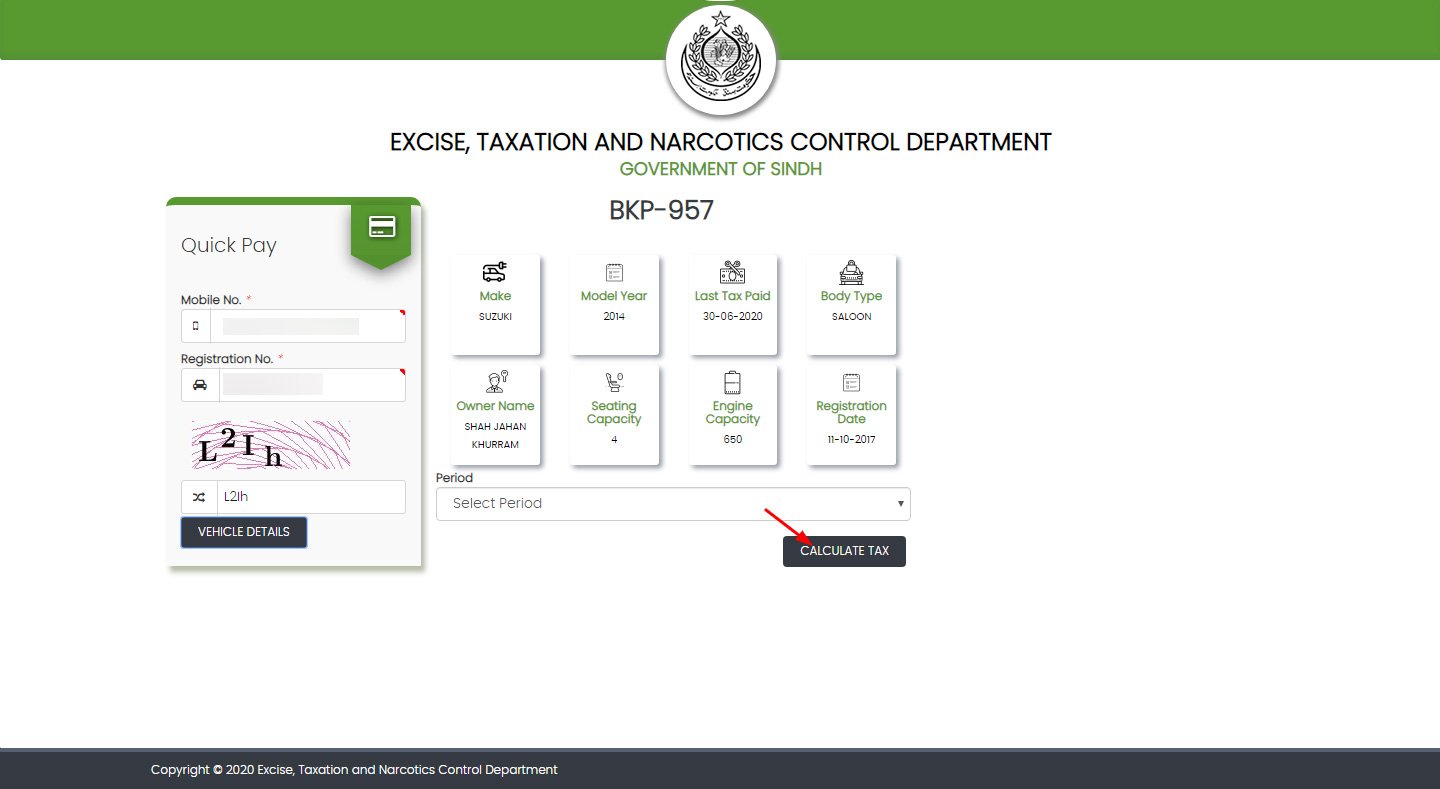

Pay Your Tax In 7 Easy Steps:

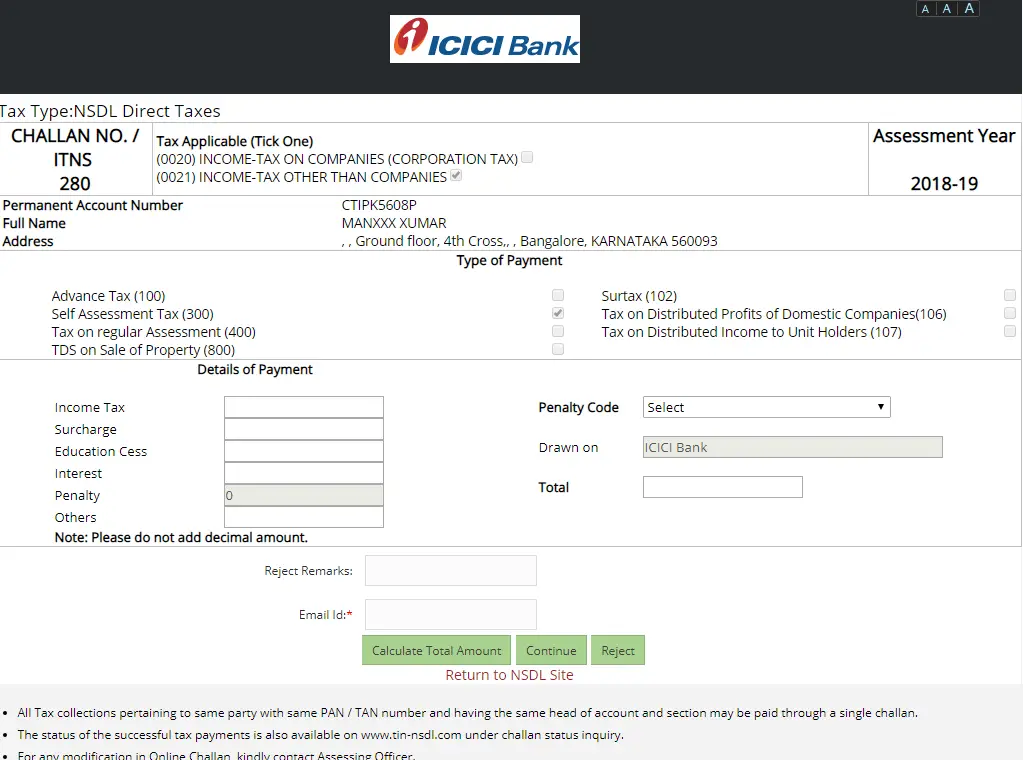

- Tax payers to select the relevant challan from NSDL site.

- Taxpayers to enter their PAN / TAN / Assessee code as applicable. There will be an online check on the validity of the PAN / TAN / Assessee code entered.

- If PAN/ TAN/ Assessee code is valid the taxpayer will be allowed to fill up other challan details like accounting head code / Major head code under which payment is made, name and address of PAN/TAN and also select ICICI Bank through which payment is to be made.

- On submission of data entered a confirmation screen will be displayed. If the taxpayer confirms the data entered in the challan, it will be directed to the net-banking site of ICICI Bank.

- The taxpayer will login to the ICICI Bank internet-banking site with the User id/ Password provided by the ICICI Bank .

- Taxpayer to enter payment details and authorize the payment.

- On successful payment a challan counterfoil will be displayed containing CIN, payment details and Bank name through which e-payment has been made. This counterfoil is proof of payment being made.

More About Pay Quebec Income Tax Online Food

METHODS OF PAYING INCOME TAX OWED TO REVENU QUEBEC

FromEstimated Reading Time

BALANCE DUE | REVENU QUéBEC

From

QUéBEC TAX BRACKETS 2022 | QC INCOME, CREDITS & AMP DEDUCTIONS

From

PAYMENT OF A FINE | GOUVERNEMENT DU QUéBEC – QUEBEC.CA

From

INSTALMENT PAYMENTS | REVENU QUéBEC

From

2022 INCOME TAX CALCULATOR QUéBEC – WEALTHSIMPLE

From

ONLINE SERVICES, FORMS AND PUBLICATIONS | REVENU QUéBEC

From

QUEBEC SALES TAX CALCULATOR 2022 | WOWA.CA

From

PAYMENT OPTIONS | REVENU QUéBEC

From

INCOME TAX RETURN | REVENU QUéBEC

From

THE GST AND THE QST IN THE FOOD SERVICES SECTOR | REVENU QUéBEC

From

PAY YOUR TAXES ONLINE – CANADA.CA

From

FILING YOUR INCOME TAX RETURN ONLINE | REVENU QUéBEC

From

PAY YOUR TAX ACCOUNT | VILLE DE MONTRéAL – MONTREAL.CA

From

INCOME TAX CALCULATOR 2022 – QUEBEC – SALARY AFTER TAX

From

From

MEAL AND ENTERTAINMENT EXPENSES | REVENU QUéBEC

From

MAKING PAYMENTS ONLINE THROUGH FINANCIAL INSTITUTIONS OR

From

QUEBEC INCOME TAX CALCULATOR – HELLOSAFE

From

PAY QUEBEC INCOME TAX ONLINE BEST RECIPES

From

Inquiry & Payment Counters And Drop Box Services

Property Tax, Utility and Parking Violation Inquiry & Payment Counters have reopened. Counters at Metro Hall remain closed.

Property tax accounts for newly constructed properties are created after the occupancy date. Property owners will receive a property assessment change notice from Municipal Property Assessment Corporation before receiving the first property tax bill. MPAC provides the City with the assessment information to create your new tax account.

New owners will not be able to make payment by digital, cheque or in-person options, before receiving their first property tax bill. Only after you have received your first tax bill, you can then set up your payment options through MyToronto Pay, or with your bank or financial institution.

Log on to the Lookups to view your account details, billing and payment information.

Toronto, ON M2N 5V7

In-person requests

Property Tax, Utility and Parking Violation Inquiry & Payment Counters have reopened. Counters at Metro Hall remain closed.

You May Like: How To Reduce Federal Taxes

Refund/credit Transfer Or Paid The Wrong Account

Requests for refund or transfer of a credit balance due to an overpayment or a payment applied to a wrong account will require proof of payment. Fees may apply. If you have an outstanding balance on your account any applicable credit will be applied to your balance. If you own more than one property, available credits will be applied to outstanding balance on any of your property tax accounts to bring account up-to-date. Refunds will only be issued if your account are paid in full.

Copies of the following are acceptable proof of payment:

- cancelled cheque

- bank statement

- cashiers paid stamp on a bill/statement paid at one of the Citys Inquiry and Payment counters

- receipt of debit payment made at one of the Citys Inquiry and Payment counters

Note: A printout of the payment history from the Property Tax Lookup and Utility Bill Lookup is not acceptable proof of payment.

Additional documents are required, if:

Your property has undergone a change in ownership:

- Provide a Statement of Adjustments.

- If a vendor is requesting a refund and a sale has transpired, both the vendor and purchaser Statement of Adjustments along with the vendors forwarding address is required.

You are the Power of Attorney or the Executor of the Estate:

- Provide documents assigning Power of Attorney or Executor of Estate.

- Provide a Statement of Adjustments .

You are the tenant paying the utility bill and are not listed on the account:

- Provide a letter of direction from the property owner.

How To Dispute Insufficient Interest Paid

If you think we underpaid interest owed to you on refunds or credits you’re eligible for, you can file an informal claim or complete and send Form 843PDF for us to consider allowing additional overpayment interest. Make sure to include your own computation and reason for making the request for additional interest on Line 7 .

Your request must be received within six years of the date of the scheduled overpayment.

Read Also: How Much Do You Have To Make To Pay Taxes

How Much House Can I Afford With A Va Loan

Veterans and active military may qualify for a VA loan, if certain criteria is met. While VA loans require a single upfront funding fee as part of the closing costs, the loan program offers attractive and flexibleloan benefits, such as noprivate mortgage insurance premiums and no down payment requirements. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage.

With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month , you can afford a house with monthly payments around $1,230 .

Use ourVA home loan calculatorto estimate how expensive of a house you can afford.

How To Stop Tax Payments

You cannot stop an immediate payment or a payment to be processed today. You can stop future transfers by deleting the payment from your future payments and transfers summary. If you wish to delete a future dated tax payment, the request must be lodged with ANZ Internet Banking prior to 11.59pm Melbourne time the day before the payment date.

You May Like: Can I File Extension If I Owe Taxes

Choose A Payment Method

You can pay your tax instalments online, in person, or by mail. There are several payment options with different processing times for each.

- Online:

- In person or by mail:

- Use your instalment remittance voucher to pay in person or by mail

You will need your instalment remittance voucher to ensure your payment is applied to the correct account.

Your remittance voucher is included in your instalment reminder package the CRA mails to you, unless you pay instalments by pre-authorized debit.

Choose your payment method:

- call our automated TIPS line at 1-800-267-6999

If your payment is not honoured, the CRA will charge a fee.

Stop And Start Dates For Underpayment Interest

In general, we charge interest on underpayments starting on the due date of the amount you owe and will continue to accrue until the balance is paid in full:

- Tax is due on the return filing date extensions to file do not extend the date for payment of the tax.

- Penalties and additions to the tax due dates vary by penalty type:

- Failure to File penalty, also called the delinquency penalty, is due on the return due date, or extended return due date if an extension of time is filed.

- Failure to Pay, Underpayment of Estimated Tax by Corporations, Underpayment of Estimated Tax by Individuals and Dishonored Check penalties are due on the date we send you a notice or assess the penalty.

- Accuracy-related penalties are due on the return due date, or extended return due date if an extension of time is filed.

If you received a notice, you will not be charged interest on the amount shown if you pay the amount owed in full on or before the “pay by” date.

You May Like: How Much Should You Set Aside For Taxes

Submit Your Request By Email Fax Or Mail:

5100 Yonge St., Lower Level,Toronto, ON M2N 5V7

If you submitted a payment and it is not reflected on your property tax or utility account, contact your financial institution directly to investigate and locate your payment, or, provide proof of payment directly to the City.

For payment investigation inquiries please contact a customer service representative.

How To Dispute Interest You Owe

We may reduce the amount of interest you owe only if the interest is applied because of an unreasonable error or delay by an IRS officer or employee.

To dispute interest due to an unreasonable error or IRS delay, submit Form 843, Claim for Refund and Request for AbatementPDF or send us a signed letter requesting that we reduce or adjust the overcharged interest. For more information, see Instructions for Form 843PDF.

Also Check: How To Get Child Tax Credit 2021

How Much House Can I Afford

While you may have heard of using the 28/36 rule to calculate affordability, the correctDTI ratiothat lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs should be no more than 36% of your gross monthly income, and your total monthly debt should be no more than 43% of your pre-tax income.

For example, if you make $3,000 a month , you can afford a mortgage with a monthly payment no higher than $1,080 . Your total household expense should not exceed $1,290 a month .

General Information About Individual Income Tax Electronic Filing And Paying

Filing and paying taxes electronically is a fast-growing alternative to mailing paper returns and payments. The Missouri Department of Revenue received more than 398,200 electronic payments in 2020. The Department also received more than 2.8 million electronically filed returns in 2020. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

You May Like: How To Get An Advance On Your Taxes

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Pay By Online Banking

You can pay your business taxes to the CRA through your financial institution’s online banking app or website. Most financial institutions also let you set up a payment to be made on a future date.

- Sign in to your financial institution’s online banking service for businesses.

- Under “Add a payee” look for an option such as:

- Federal Corporation Tax Payments TXINS

- Federal GST/HST Payment GST-P

- Federal Payroll Deductions Regular/Quarterly EMPTX

- Federal Payroll Deductions Threshold 1 EMPTX

- Federal Payroll Deductions Threshold 2 EMPTX

- Federal Canada emergency wage subsidy repayment

- Federal Canada emergency rent subsidy repayment

Make sure to visit the Making payments for businesses web page for more information about paying taxes online for all types of businesses. This includes sole proprietorships, partnerships and corporations. You can find information on:

- Making a payment to the CRA, collections and transferring payments within your accounts.

- Remitting source deductions.

- Remitting the GST/HST .

- Corporation payments.

When you make a payment, your financial institution’s online banking app or website will display the date your payment was made. It may take up to 5 business days for payments to be reflected in your CRA account. To avoid fees and interest, please make sure you pay on time.

Read Also: When Are We Getting Our Taxes

Benefits Of Electronic Filing

- Convenience â You can electronically file 24 hours a day, 7 days a week.

- Security â Your tax return information is encrypted and transmitted over secure lines to ensure confidentiality.

- Accuracy â Electronically filed returns have 13 percent fewer errors than paper returns.

- Direct Deposit â You can have your refund direct deposited into your bank account.

- Proof of Filing â An acknowledgment is issued when your return is received and accepted.

Estimated Tax Payment Options

Use the following options to make estimated tax payments. For more information about filing requirements and how to estimate your taxes, see Individual Estimated Tax Payments.

Online, directly from your bank account

- Log in to your online services account to schedule all 4 quarterly payments in advance.

- Dont have an account? Create one now.

Not ready to create an account? Use eForms – make sure to choose the correct voucher number for the payment you’re making.

- Individual estimated payment: 760ES eForm

ACH credit

Pay by ACH credit and initiate sending payments from your bank account to Virginia Tax’s bank account. See our Electronic Payment Guide for details on requirements and set-up with financial institutions, which may include fees.

Pay using a credit or debit card through Paymentus . A service fee is added to each payment you make with your card.

Check or money order

Mail the correct 760ES voucher for the tax period to:

Virginia Department of Taxation

Recommended Reading: Are Taxes Due By Midnight May 17

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

How Can I Pay A Tax Invoice

You can pay a Departmental Tax Invoice via Credit Card, BPAY or Direct Debit. The steps below outline these payment methods listed at the bottom of the Tax Invoice:

Online Services accepts Mastercard and Visa credit card payments. To make a credit card payment you must pay a surcharge which is calculated when you finalise your payment on Online Services. Refer to our Make a Payment help article.

BPAY payment:

Locate the BPAY logo on your tax invoice issued to you by the Department of the Environment and Energy.

Log in to your internet, mobile banking site or call your phone banking service.

Select the BPAY payment option and follow the instructions provided by your bank.

Enter a full or partial payment for your tax invoice.

Log in to your internet, mobile banking site or call your phone banking service.

Select the Direct Debit option .

Enter the below details:

Account: 115859

Reference : enter invoice number

Submit your details. You will receive a confirmation from your bank if the payment has been successful.

Also Check: Who Qualifies For California Earned Income Tax Credit

How Much House Can I Afford With An Fha Loan

With a FHA loan, yourdebt-to-income limitsare typically based on a 31/43 rule of affordability. This means your monthly payments should be no more than 31% of your pre-tax income, and your monthly debts should be less than 43% of your pre-tax income. However, these limits can be higher under certain circumstances.

If you make $3,000 a month , your DTI with an FHA loan should be no more than $1,290 â which means you can afford a house with a monthly payment that is no more than $900 .

FHA loans typically allow for a lower down payment and credit score ifcertain requirementsare met. The lowest down payment is 3.5% for credit scores that are 580 or higher. If your credit score is between 500-579, you may still qualify for an FHA loan with a 10% down payment. Keep in mind that generally, the lower your credit score, the higher your interest rate will be, which may impact how much house you can afford.

FHA loans are restricted to a maximum loan size depending on the location of the property. Additionally, FHA loans require an upfront mortgage insurance premium to be paid as part of closing costs as well as an annual mortgage insurance premium included in your monthly mortgage payment â both of which may impact your affordability.

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

Recommended Reading: How Much Tax Is Taken Off Paycheck

Individual Income Tax Return Payment Options

Use these options if you’re paying after you’ve filed your return. You can also pay at the time of filing through approved electronic filing options, and schedule your payment for any day up to the filing deadline.

Online, directly from your bank account

- Log in to your online services account.

- Dont have an account? Create one now.

Not ready to create an account?

You can pay using eForms.

- Individual return payment: 760PMT eForm

- Qualifying farmers, fishermen, and merchant seamen: 760PFF eForm

Make a return payment through Paymentus. A service fee is added to each payment you make with your card.

Check or money order

Mail the 760-PMT voucher with check or money order payable to Virginia Department of Taxation to:

Virginia Department of Taxation

Include your Social Security number and the tax period for the payment on the check.

Qualifying farmers, fishermen, and merchant seamen should use the 760-PFF voucher.

Note: If you filed a paper return with your local Commissioner, mail the voucher and check to the same place you sent your return and make the check payable to the local Treasurer.

Payment Fee – Returned Payments

If your financial institution does not honor your payment to us, we may impose a $35 fee . This fee is in addition to any other penalties and interest you may owe.