Sales Tax Rate Changes

Access the latest sales and use tax rate changes for cities and counties. Local sales taxes are effective on the first day of the second calendar quarter after the Department of Revenue receives notification of the rate change . Local taxes can also have an expiration date, lowering the sales or use tax rate for that particular city or county. Expirations also take place on the first day of a calendar quarter .

Motor Vehicle Washing And Waxing

Can I buy my soap, wax, and other supplies for resale?

No. You are the consumer of all materials and supplies used in providing your washing and waxing services, and must pay sales or use tax on all purchases of such materials and supplies used to provide your service.

Do gross receipts from providing coin-operated motor vehicle washing and waxing services include coin-operated vacuuming?

No, provided the vacuuming receipts are accounted for separately.

Our nonprofit organization is conducting a car wash to raise funds for a camping trip. Is this a taxable service?

The gross receipts from motor vehicle washing services are taxable. If your nonprofit organization chooses not to set a fee or charge for its car wash and will accept a free-will donation, the free-will donation is not taxable. The organization must post a sign that states “free-will donations accepted.” If the organization charges a specific amount for washing, it must have a sales tax permit and collect sales tax on the amount charged for washing the vehicles.

Our church is conducting a car wash to raise funds for the organization. Is this a taxable service?

In addition to the above answer on free-will donations, a religious organization may have one sale a year that is not taxed. The sale may last up to 3 consecutive days. . A car wash with a set charge could be conducted during the once a year sale without collecting tax.

Can a motor vehicle dealer purchase detailing services for resale?

Building Cleaning And Maintenance

Is construction site clean-up subject to tax?

Yes. Charges for the clean-up of a building under construction are subject to tax. Contractors cannot purchase such services tax-free from a third party. This service is not considered contractor labor for sales tax purposes. Nor can such services be purchased tax-free under a Purchasing Agent Appointment, Form 17, issued by the governmental unit or exempt entity.

Are charges to clean a furnace, air conditioner, heat pump, duct work, or drains taxable?

Yes. Building cleaning services includes any work done to clean a fixture that has been annexed to real estate. This includes cleaning a furnace, air conditioner, heat pump, duct work, sewer, and drains located in or attached to a building. Such work in not considered contractor labor.

What happens when a contractor responds to a service call to repair a furnace blower and also takes a few minutes to change out the furnace filter?

An Option 1 contractor must collect sales tax on the total amount charged for the furnace filter and parts and will not collect any tax on his or her labor charge provided it is separately stated. Option 2 and 3 contractors will pay or remit tax on the furnace filter and repair parts according to their option and will not collect any tax on the amount charged to repair the furnace.

Is the charge to clean a building after a fire or flood subject to tax?

Is the charge to winterize an underground sprinkler system subject to tax?

You May Like: Where To File Tax Return

Sales Tax In Canada 202: A Guide To Gst Hst Pst And Qst Sales Taxes

Canadians pay a sales tax when they purchase most goods and services. Also known as a Value Added Tax in some countries, sales taxes in Canada come in various formats.

There is the federal sales tax referred to as the Goods and Services Tax .

Individual provinces may levy a provincial sales tax or retail sales tax, and some provinces combine their PST with the federal GST for a Harmonized Sales Tax .

In Quebec, the provincial sales tax is called the Quebec Sales Tax .

The sales tax is added to the cost of goods and services and is generally due at the point of sale. Businesses collect this tax on behalf of the government and remit it to the Canada Revenue Agency.

Some goods and services are exempt from federal and/or provincial sales taxes. These exempt or zero-rated goods and services vary across jurisdictions.

Read on to learn about sales taxes in Canada, how to calculate GST, HST, and PST, and what is exempt.

There are some others and you can find a complete list here.

Some goods and services are exempt or zero-rated for GST, but not for PST.

Low-income Canadians receive a tax-free GST/HST creditor refund every quarter to offset all or part of the sales tax they have paid.

Related: Federal Income Tax Rate.

Every State Taxes Services In Its Own Way

This guide is designed to provide an overview of the complexity of sales tax on services by state.

Five U.S. states do not impose any general, statewide sales tax, whether on goods or services. Of the 45 states remaining, four tax services by default, with exceptions only for services specifically exempted in the law.

This leaves 41 states and the District of Columbia where services are not taxed by default, but services enumerated by the state may be taxed. Every one of these states taxes a different set of services, making it difficult for service businesses to understand which states laws require them to file a return, aswell as which specific elements of their services are taxable.

Also Check: How Do Tax Debt Relief Companies Work

Make Sure Youre Monitoring Sales Tax Rates In All States

Following the South Dakota v. Wayfair decision, most states changed their tax law. For example, Californias changes to its e-commerce sales tax regulations took effect on April 1, 2019. This was major news, as any business selling over $100,000 worth of goods online to California customers was subject to the California use tax. Having 200 or more separate transactions into California also subjected online sellers to the tax.

California updated its e-commerce sales tax requirements in February 2020, less than a year after the first adjustments were made, and now requires businesses that make three or more sales in a 12-month period to hold a sellers permit. This change underscores just how important it is for businesses that sell their goods online to continually monitor state sales tax regulations.

Many states have followed the monetary guidelines set forth in the Supreme Court case. Other states wont always enact the exact standards as South Dakota, but you can use those numbers as a guide to prepare in the event that your state has not set laws yet. If you exceed that hypothetical threshold, you should closely monitor the sales tax laws in that state to remain compliant.

Key takeaway: Preparing for shifting e-commerce laws involves investing into resources, such as software, that can help you monitor law changes in all 50 states and make adjustments to your sales-tax-collection processes accordingly.

How Do I Pay Sales Tax

Submit sales tax you collected to each state government in which you had qualifying sales. You will need to report and file sales taxes on either a monthly, quarterly or annual basis, depending on the state. Most states require you to file a tax form even if you collected no tax during the reporting period. States will generally forward any local tax to the taxing authority that gets it, so you dont have to worry about paying a bunch of separate municipalities.

Sales tax calculations and payments can be confusing at best. The assistance of an experienced tax accountant can help to smooth the road and make sure you dont encounter any surprises, like back taxes and penalties.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. 1-800Accountant assumes no liability for actions taken in reliance upon the information contained herein.

Don’t Miss: How Do You Get Your Tax Return

When And What Sales Taxes You Should Charge In Canada

Join millions of Canadians who have already trusted Loans Canada

If youve purchased anything in your lifetime a television set, a pair of shoes, or a coffee machine youve had to pay sales tax. Remember when you bought that t-shirt from your favourite store? The price tag listed the item as $24.99, but the final price came to a higher amount. This is because the t-shirt was subject to sales tax.

If you own a small business, sales tax is an essential part of your operations. But there are different kinds of sales tax and many rules and regulations outlined by the Canada Revenue Agency that vary depending on the province the customer is buying, or how much revenue a business brings in annually. Its important for business owners and consumers to understand how sales tax works so that they understand their purchases more, and avoid any problems with the CRA when tax time comes in March. Lets take a look at the basics.

Find Out If Your State Collects Sales Taxes

Sales taxes are state-driven. Each state has its own rules on transactions involving products and services sold by businesses.

If you are doing business in a state, you have what’s called a tax nexus in that state. A business can have a tax nexus if the business has a physical presence in the state, by having property or employees.

A home-based business is a tax nexus because it’s located within the state. Each state also has tax nexus definitions for internet sellers.

Most states collect sales taxes. Five states – Alaska, Delaware, Montana, New Hampshire, and Oregon – do not collect statewide sales taxes. Of these, Alaska and Montana allow localities to charge sales taxes.

Also Check: How Much Can I Make Without Filing Taxes

Key Actions For Filing & Paying Sales/use Tax

The following categories of sales or types of transactions are generally exempted from the sales/use tax:

Food & clothing

Sales of food for human consumption and clothing costing $175 or less. For items that cost more than $175, sales tax is only due on the amount over $175 per item.

Periodicals

Sales of periodicals such as newspapers and magazines. Newsletters, however, are generally not treated as newspapers and may be taxable.

Admission tickets

Sales of tickets to activities such as sporting and amusement events.

Utilities and heating fuel

Sales of utilities and heating fuel to:

- Residential users – Residential use includes use in any dwelling where people customarily reside on a long-term basis, whether or not they purchase the fuel, including: Residential users don’t have to present exemption certificates.

- Apartment buildings

- Nursing homes

- Single family or multifamily homes

Telephone services to residential users

- Car repairs

Resales

The Taxjar Api Ensures You Collect The Right Amount Of Sales Tax From Every Customer Every Time

With TaxJars vast library of product tax codes , all you need to do is attach the right code to your service, and we handle the rest. Sell CPA services in New Mexico and New York? We ensure you collect sales tax from your New Mexico customers , and never collect sales tax from your New York customers You never have to worry about over- or under-collecting sales tax, or paying sales tax out of your bottom line.

You May Like: How Is Capital Gains Tax Calculated On Sale Of Property

Collecting And Remitting Sales Tax

When Must You Collect Sales Tax?

Most small businesses operating in Canada must collect sales tax. However, there are a few exemptions. You do not need to charge or collect sales tax if any of the following criteria are met:

- You are a small supplier, meaning your annual sales of taxable goods and services fall under $30,000 per year

- You sell zero-rated items , or other goods and services exempt from sales tax

If your sales of taxable goods and services exceed $30,000 per year, you must collect sales tax and remit it, or pay it, to the CRA.

Find out whats the difference between a tax credit and a tax deduction in Canada.

Registering for a Sales Tax Account

To charge and file sales tax with the government, you first need to register for a sales tax account. There are many ways to register, including by phone, mail, fax, or online. The type of sales tax account that you will register for generally depends on the province in which you are selling your goods and services:

Remit Sales Tax through CRA

You are responsible for keeping the sales tax you have collected and charged until its time to remit it or pay it to the CRA. Filing taxes can be complicated if you arent organized. Thats why its important to have strong recordkeeping practices in place to ensure you are on top of your tax obligations.

GST/HST: If you have collected GST/HST, you are responsible for holding onto it until paying it back to the CRA. To remit this sales tax, you must:

Do Liquefied Natural Gas Producers Qualify As Manufacturers Eligible To Obtain Production Machinery And Equipment Exempt From Pst

No, the PM& E exemption for manufacturing does not apply to LNG production.

However, while liquefied natural gas processing does not qualify as manufacturing, there is a PM& E exemption for qualifying oil and gas producers. LNG producers may be eligible for the PST exemption for PM& E obtained for use in the extraction or processing of natural gas. For more information, see Oil and Gas Industry Producers and Processors .

You May Like: How To Evade Taxes Legally

What Constitutes A Service For Sales Tax Purposes

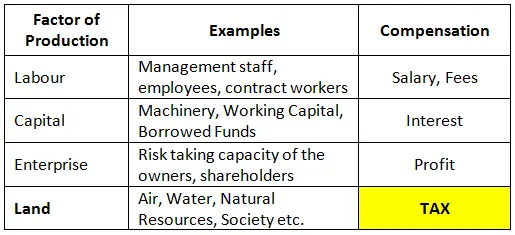

Lets take a step back and make sure we know how a service is defined. The term services encompasses a wide variety of businesses. Services are roughly organized into these four categories:

- Business services These include services for businesses such as advertising, computer services, human resources services, lobby and consulting and payroll services.

- Personal services These include services such as dry cleaning, hair care, and tanning salons.

- Professional services These include services provided by accountants, architects, attorneys, and doctors.

- Maintenance and repair services These include services that are provided to tangible personal property or improvements to buildings and land

Rules To Follow When Evaluating Sales Tax On Services

1. Avoid making assumptions

Many companies assume services delivered in conjunction with goods sold arent taxable, but that’s often not the case. Delaware, Hawaii, New Mexico, and South Dakota tax most services. Still others, like Texas and Minnesota, are actively expanding service taxability.

Businesses that sell services across multiple states need to know where those services are subject to sales tax. The fact that sales tax laws often change makes it challenging to remain in compliance.

2. Remember that sales tax rates can change

States regularly change product and service taxability rules, and the onus of staying on top of changes is on businesses. For example, Washington state lawmakers decided to tax martial arts and mixed martial arts classes in the fall of 2015. Two years later, many of those services were once more exempt. Failure to correctly apply sales tax rates and rules to products and services can lead to costly errors.

Knowing which rate to charge and which sales tax rules apply is especially challenging for companies that sell goods or services in multiple states. No two states have the same sales tax laws.

3. Understand your nexus exposure

Determining nexus is the first step toward sales tax compliance.

4. Services sold with taxable goods can complicate sales tax

5. The true object test can help determine service taxability

Recommended Reading: What Tax Year Is The Third Stimulus Based On

Recreational Vehicle Park Services

Do RV park services include charges for the rental or lease of a site for a mobile home that is annexed to real property?

No. A mobile home annexed to real property is not considered a recreational vehicle.

If I operate an RV park that has a separate RV storage area, is the charge for storage taxable?

No, as long as the RV is parked in the separate storage area. However, if the RV is actually parked at a pad site instead of in the storage area, the charge would be subject to tax.

Sales Taxes On Digital Products

Here’s another example of the product vs. service dilemma. The discussion about taxing digital products is getting more complicated. Digital products include:

- Digital audiovisual works, like movies, music videos, news shows, entertainment programs, and live events.

- Digital audioworks, like songs, music, audiobooks, speeches, ringtones, and other sound recordings.

- Digital books (fiction and non-fiction.

Software is considered tangible personal property.

Each state may include or exclude certain products from sales taxes based on their own rules, so the taxability of digital products varies greatly by state. Currently, if a state wants to tax digital products, they label as tangible personal property.

Recommended Reading: Can I File Taxes Now And Pay Later

Sales Taxes On Products For Resale

The U.S. doesn’t have an indirect tax on which taxes are imposed at all stages of the production process. If your business produces products, component parts for resale, or if you buy materials that you make into products for resale, you may not have to pay sales tax on these purchases.

You may be able to get a sales tax certificate or a seller’s certificate which exempts your business from sales tax for purchases that will be turned into products for resale. The sales tax certificate doesn’t apply to products that you buy for use within your company, like copy paper and office equipment. It also has nothing to do with sales taxes you collect from customers.

You may be able to get a sales and use tax exemption certificate if your state belongs to the Streamlined Sales Tax Registration System, or go to your state’s revenue department for more information.

If a business in your state gives you a sales tax exemption certificate when buying products for resale, you must honor it. Keep a copy of the certificate and check your state’s laws on how to deal with these certificates.