The Canada Revenue Agency

We permit only approved participants to electronically file income tax returns.

Personal and financial information must be transmitted to us in an encrypted format. Encryption is a way of encoding information before it is transmitted over the Internet. This ensures that no unauthorized party can alter or view the data.

We also ensure that all personal and financial information is stored securely in our computers. We use state-of-the-art encryption technology and sophisticated security techniques to protect this site at all times.

We have made every possible effort to ensure the safety and integrity of transactions on our Web site. However, the Internet is a public network and, as a result, is outside our control.

Watch For Your Income Documents To Arrive

You should receive forms about how much income youve earned from your employers and other income sources in January or February. If you are a full-time employee, you will receive a Form W-2 detailing your earnings, as well as which taxes were withheld. If you work freelance or on a contract, you may receive a Form 1099-NEC detailing what you earned. You may also receive documents showing dividends or interest earned on investments , or student loan interest youve paid . If youre a college student , youll receive a Form 1098-T that shows how much you paid in tuition, as well as any amounts you received from grants or fellowships, to help you figure out deductions and credits related to education expenses.

How To File Tax Returns For Previous Years

Filing a tax return for a previous year isn’t as hard as you may think, but it does require a few steps.

1. Gather information

The first step is gathering any information from the year you want to file a tax return for. Pull together your W-2s, 1099s, and information for any deductions or credits you may qualify for. Look on the tax forms you gather for the year of the tax return you’re filing to make sure you use the right ones.

2. Request tax documents from the IRS

Finding documents from previous years may be challenging for some. Thankfully, the IRS has a form you can fill out to request any tax information they have on file for you for a given year. Form 4506-T allows you to request a transcript of your tax return information, even if you haven’t filed a tax return. You can request information from the last 10 tax years.

The IRS will send the information it has on record, including information found on forms such as W-2s, 1099s, and 1098s. It won’t have information about deductions and credits you may qualify for, though, so you’ll still need to do some work on your own.

3. Complete and file your tax return

Once you have all the forms you need, be sure to use the tax forms from the year you’re filing. For instance, you must use 2018 tax return forms to file a 2018 tax return. You can find these documents on the IRS website. Patience is important when filling out a tax return by hand. And thankfully, you can also file tax returns from previous years using TurboTax.

Also Check: Why Do I Owe Taxes This Year 2021

When Your Child Should File A Tax Return

Even if your child isn’t required to file an income tax return, it can still be a good idea to file if:

- Income taxes were withheld from earnings

- They qualify for the earned income credit

- They owe recapture taxes

- They want to open an IRA

- You want your child to gain the educational experience of filing taxes

In the first two cases, the main reason for filing would be to obtain a refund if one is due. The others are income-dependent or based on taking advantage of an opportunity to begin saving for retirement or to begin learning about personal finance.

Learn Which Credits And Deductions You Can Take

Getting a sense of which can help you pull together the proper documentation. Here are a few to consider:

- Savers credit. If you are not a full-time student and are not being claimed as a dependent, you may be eligible for a tax credit if you contribute to a retirement plan. The amount of the credit depends on your filing status and adjusted gross income. For the 2022 tax year, if your filing status is single, you may be eligible if your adjusted gross income is $34,000 or less. If you are married and are filing jointly, you may be eligible if your adjusted gross income is $68,000 or less. However, these numbers are subject to change in future tax years.

- Student loan interest. You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

- Charitable deductions. Donating to your alma mater or a favorite charity? Generally, you can deduct qualified charitable donations if you itemize your taxes.

- Freelance expenses. If you are self-employed, you may be able to claim deductions for work-related expenses such as industry subscriptions and office supplies.

If you think you may qualify for additional credits or deductions, check the IRS website.

Read Also: How To File Federal Taxes Electronically

At What Age Should You Start Filing A Tax Return

The CRA tax law code requires filing a tax return based on income levels. If you earn more than the amount of the personal exemption allowed by the Canada Revenue Agency within one tax year, you will need to report that income on an annual tax return. Special rules apply to income received by children who are claimed as dependents by other taxpayers.

Children can be six months, six years, or 16 they still have to file a tax return in Canada depending upon their income level. It depends on whether their earned, unearned, or combination income exceeds certain limits. The applicable standard deduction is also a factor. Earned income is what they make from a job. Unearned income sometimes referred to as passive income, would be interest or dividends from investments.

File Your Virginia Return For Free

Made $73,000 or less in 2021? Use Free File

If you made $73,000 or less in 2021, you qualify to file both your federal and state return through free, easy to use tax preparation software.

Are you a member of the military? Try MilTax

MilTax is an approved tax preparation software that provides free tax services for members of the military.

Free Fillable Forms: The software provider that previously supported our free fillable forms no longer offers them for individual income tax filing. Please consider one of our other filing options for your 2021 Virginia income tax return.

You May Like: How To Calculate Paycheck After Taxes

Help Your Child Learn The Process And Build Good Habits

As your child moves toward adulthood, you face several milestone decisions that involve, in part, a desire to help your child become more independent and responsible. But one milestone for your child that you may not anticipateeven though it will be part of their growing-up experienceis filing that first income tax return.

Taxpayers Have To Furnish Certain Documents In Order To File Income Tax Returns The Due Date Of Which Ends On Sunday Check The List Here

- Follow us:

ITR Filing AY 2022-23: There are only two days left to file your income tax returns for the assessment year 2022-23, and the income tax department has been urging taxpayers to file ITR within the due date. The due date to file ITR is July 31, which is Sunday. Taxpayers only have Saturday and Sunday in hand to complete this important work, as the government and the I-T Department seem to be in no mood to extend the ITR filing due date. As of July 29, 4.52 crore people have filed their ITRs, as per the income tax e-filing website.

Over 4.09 crore ITRs filed till 28th July, 2022 & more than 36 lakh ITRs filed on 28th July, 2022 itself.The due date to file ITR for AY 2022-23 is 31st July, 2022.Please file your ITR now, if not filed as yet. Avoid late fee.

Income Tax India

Taxpayers can file their both online and offline . However, in both cases, the individual needs to furnish a certain set of documents, depending on the ITR form.

ITR Filing: 10 Documents You Need to File Income Tax Return

i. Form 16: Form 16 is a tax deducted at source certificate issued to an employee by his or her employer that provides details of the salary paid, taxes deducted and deposited during the span of the relevant financial year.

iii. Annual Information Statement: Annual Information Statement is th comprehensive view of information for a taxpayer displayed in Form 26AS. It shows both reported value and modified value under each section .

Read all the Latest News and Breaking News here

You May Like: How Much Of Charitable Donations Are Tax Deductible

Payment Date For 2021 Taxes

Knowing these dates will help you prepare enough in advance, so you dont miss any deadline for filing, payment or both. You can begin preparing for these deadlines as early as the January before your taxes are due. Much of the supporting documentation youll need should arrive by the end of February so you can file your taxes in time.

Gather Tax Filing Information

Youll need to do this whether youre hiring a tax preparer or doing the tax filing yourself. The goal is to gather proof of income, expenses that might be tax-deductible or win you a tax credit, and evidence of taxes you already paid throughout the year. Our tax prep checklist has more guidance, but heres a short version of what to round up:

-

Social Security numbers for yourself, as well as for your spouse and dependents, if any.

-

W-2 form, which tells how much you earned in the past year and how much you already paid in taxes.

-

1099 forms, which are a record that some entity or person not your employer gave or paid you money.

-

Retirement account contributions.

-

State and local taxes you paid.

-

Educational expenses.

You May Like: Do You File Personal And Business Taxes Together

Filing To Open An Individual Retirement Account

It might seem a little premature for your child to consider opening an individual retirement account , but it is perfectly legal if they have earned income. By the way, earned income can come from a job as an employee or through self-employment.

If you can afford to, consider matching your child’s contributions to that IRA. The total contribution must be no more than the child’s total earnings for the year. That lets your child start saving for retirement but keep more of their own earnings. It also teaches them about the idea of matching funds, which they may encounter later if they have a 401 at work. It will probably make sense for the child to open a Roth IRA if they qualify and begin to benefit from decades of compound interest before retirement and tax-free withdrawals when they do retire.

Do Working Children Pay Taxes

As with any Canadian citizen, your child isnt generally required to file a tax return if they have no tax owing. Usually, the amount earned by a minor child doesnt hit the basic personal credit amount meaning they wont owe tax on their earnings. There are some exceptions.

Regarding tax returns for a child, how much the child earned from what activities will determine if your child needs to file taxes. Dont worry well help you figure out what you and your child need to do.

Also Check: What Is The Penalty For Late Taxes

Welcome To Maine Fastfile

Maine Revenue Services solution to fast and secure tax filing. The Maine Fastfile service provides three options:

Modernized e-File e-File using tax preparation softwareThis service is offered through the IRS and provides one stop processing of federal and state returns. This is the do it yourself option through the purchase of tax preparation software either over-the-counter or online, prepare your own return and press send to e-file. Your return is sent through safe and secure channels, not via e-mail. Prices do vary so shop around .

OR e-File through a paid tax professional

Find a tax professional you trust to prepare and e-file your return. Nearly all tax preparers use e-file now and many are now required by law to e-file. But it’s still a good idea to tell your tax preparer you want the advantages of e-file your refund in half the time, or if you owe, more payment options.

Maine i-File i-File free for Maine taxpayersThis service is available for filing your individual income tax return including the Maine property tax fairness credit. The advantages of Maine i-File are:

Certain restrictions apply. See the directions page of the i-File application for more information.

Paying With Your Bank Account

This is your best option because this way youll avoid any fees. Plus, the IRS will have your account information on file for refunds and awesome things like stimulus checks. People who pay directly from their bank account can count on the quickest processand the fastest refund if youre owed one.

When you file with direct deposit, you can see your refund in as soon as one week, compared to filing with a check in the mail, which can take up to eight weeks, a Chase representative told me. E-filing with direct deposit is easy, you just need to find your account and routing numbers.

Not sure where to find your account info? Its easy. Most major banks will have it in your online account. As Ive mentioned, I bank with Chase and was able to find my account and routing numbers in the banks app in a couple of taps while at my appointment with H& R Block.

Also Check: How Much Medicare Tax Is Withheld

File With Approved Tax Preparation Software

If you don’t qualify for free online filing options, you can still file your return electronically with the help of commercial tax preparation software. View approved software options.

To file on paper, see Forms and Paper Filing below. If you do choose to file on paper, please note that, due to COVID-19 workplace protocols and mail delays, it will take longer for us to process your return.

When You Cannot File Online

You cannot file a Self Assessment tax return online:

- for a partnership

- to report multiple chargeable gains, for example from life insurance

- if you get income from a trust, youre a Lloyds underwriter or a religious minister

If youre sending a tax return for the 2017 to 2018 tax year or earlier, get forms from the National Archives.

Read Also: How Much Federal Tax Should I Pay

Should I File Taxes Even If I Dont Have To

People with income under a certain amount arent required to file a tax return because they wont owe any tax. Its very common to feel like you shouldnt need to file a return if you dont owe any tax. However, owing to tax and having filing requirements are two separate situations in the CRAs eyes.

Even if the amount of income from your childs job doesnt require a tax return, if a refund is coming, a return should be filed. A child should file a tax return for many reasons:

If your child had any income tax deducted at the source, chances are theyll receive those deductions back as a refund.

Filing a return sets up your childs information with CRA for future years. Many first returns still need to be mailed in, as opposed to NetFiling. Once the first return is processed, your childs info will be filed, enabling them to file electronically in the future. Trust me, sending in a paper return for a high schooler is generally much easier than waiting until they have tuition credits or medical expenses to claim.

RRSP contribution room begins as soon as earned income is reported. Even if your child doesnt purchase RRSPs , their contribution room will begin to accumulate as soon as they report their earned income on their tax return.

Filing To Earn Social Security Work Credits

Children can begin earning work credits toward future Social Security and Medicare benefits when they earn a sufficient amount of money, file the appropriate tax returns, and pay Federal Insurance Contributions Act or self-employment taxes. For the tax year 2021, your child must earn $1,470 to obtain a single credit . They can earn a maximum of four credits per year.

If the earnings come from a covered job, your child’s employer will automatically take the FICA tax out of their paycheck. If the earnings come from self-employment, your child pays self-employment taxes quarterly or when filing.

Read Also: How To Claim Child Tax Credit

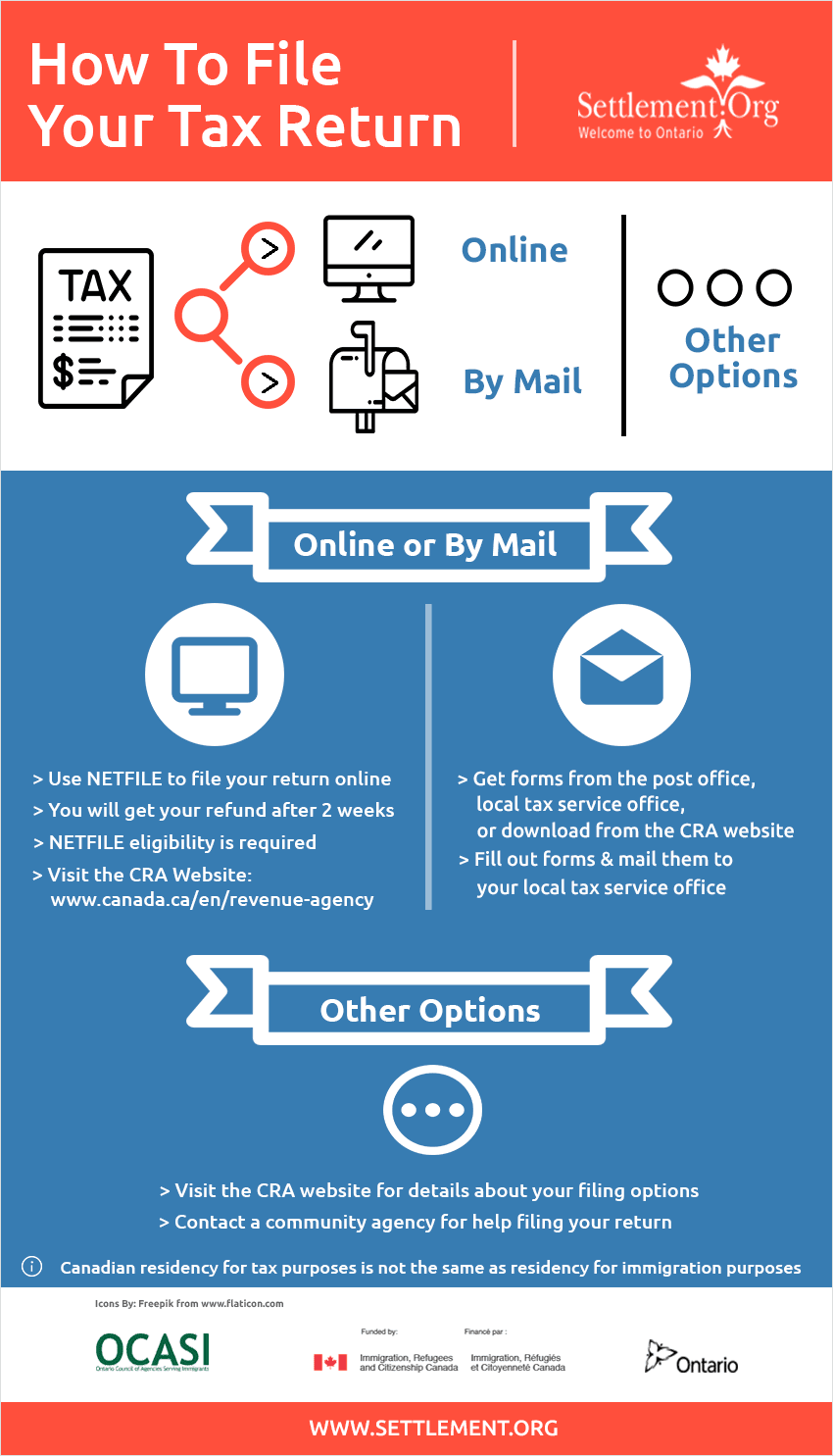

Determine How You Will File Your Taxes

Now that you are ready to file your taxes online, you must determine how to complete the online filing process. There are a few different ways to file your provincial and federal taxes with the CRA.

To file your taxes online, youll have to make sure that you are filing using a Canada Revenue Agency certified tax software platform. In many cases, you can even file your taxes returns for free with one or more of these applications.

Any CRA-certified app will allow you to connect to and submit your tax filing through NETFILE. NETFILE is an electronic tax-filing service that lets you file taxes online and send your income tax and benefit return directly to the Canada Revenue Agency .

As long as youve filed taxes at least once since 2017, your information should be stored in the CRAs database and retrievable by any CRA-certified tax software. Also, if your employer has been completing filings and making remittances on your behalf throughout the current tax year, your information should already be stored in the CRA database. In this case, your information should pre-populate using Auto-fill my return.

Its important to know that not all tax software is certified for all years. So whether you are filing for the current tax year or before, check this page for a list of CRA-certified tax software developers along with the years they are approved for.