Previous Changes To The Child Tax Credit

The Tax Cuts and Jobs Act of 2017 brought some big changes to the U.S. tax code. These changes went into effect for the 2018 tax year and applied to 2020 taxes. This new tax plan included the following changes to the CTC:

- The credit amount increased from $1,000 to $2,000.

- The CTC is refundable up to $1,400. It previously was not refundable.

- Children must have a Social Security number to qualify.

- The earned income threshold to qualify for the CTC is $2,500.

- The CTC phases out at an income level of $200,000 for single filers and $400,000 for joint filers. In 2017 the phase-out level was $75,000 for single filers and $110,000 for joint filers.

- There is now a $500 credit available for each dependent older than 17.

Another big change was that the new tax plan largely combined the Additional Child Care Tax Credit with the CTC. This is part of the reason the CTC became refundable and its limits increased.

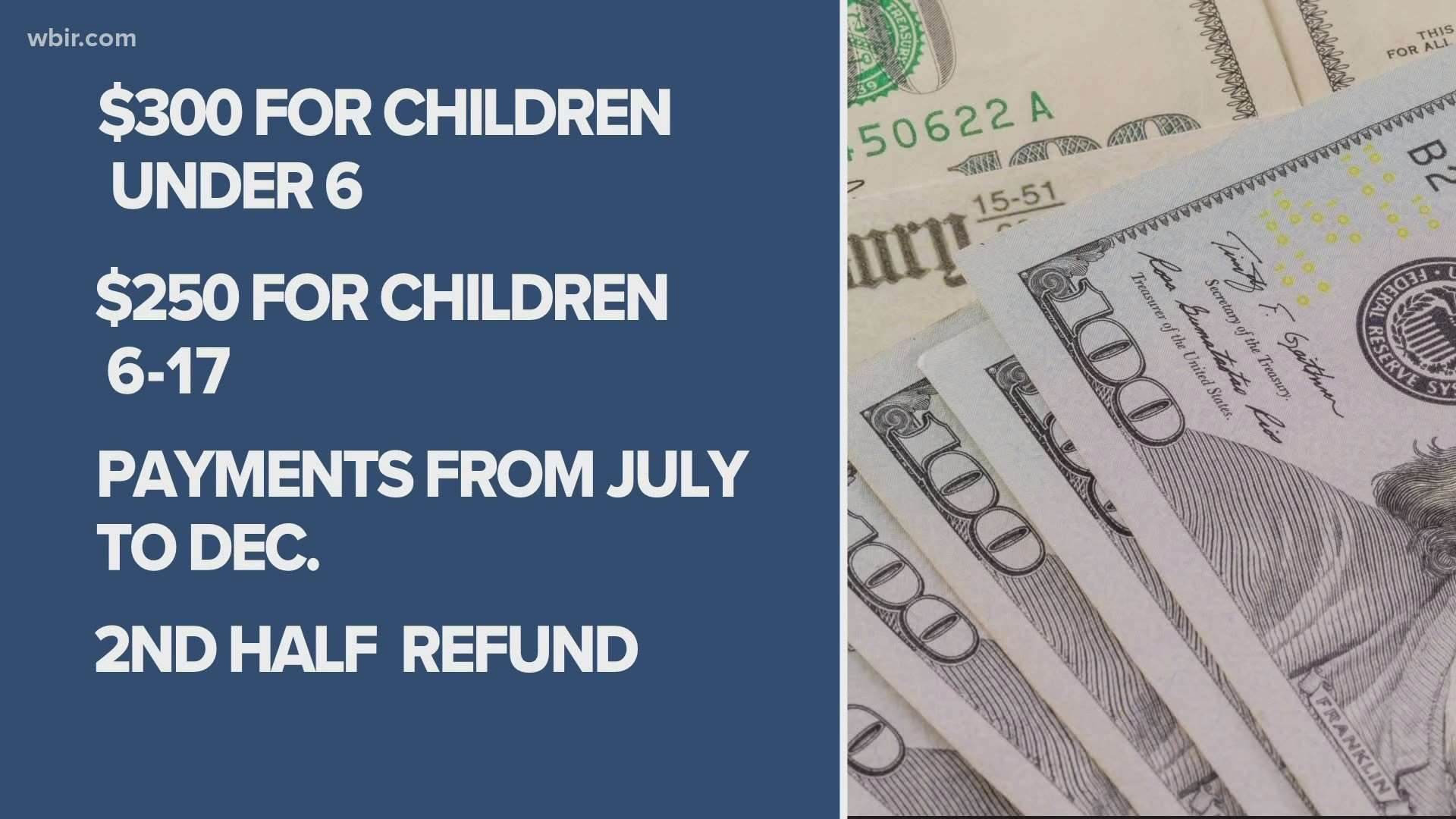

The American Rescue Plan, passed to help relieve the pressure from the COVID-19 economic crisis, expanded the CTC, making it worth $3,600 for children under 6 and $3,000 for children ages 6 to 17. It also removed the income floor and made the credit fully refundable and allowed for up to half of the credit to be available as a refund in advance, during the second half of 2021.

You May Like: Do I Need W2 To File Taxes

What To Do If You Are Missing Payments

If you were late applying or for some other reason did not get a July, August, September, October or November payment, you should be getting your first payment in December and it should be the full advance payment amount . This means that instead of up to 6 payments, you will receive one in December.

Alternatively, you can claim your full 2021 Child Tax Credit when you file your income taxes in 2022. You will be filing for half of your credit anyway and, if you didnt receive your full advance payment, you can claim that in April.

Is There A Deadline To Sign Up

The IRS will send checks starting in July to the families it knows about. If you file taxes or use the CTC non-filer portal later in the year to sign up for the CTC payments, you will get larger payments each month until December so you still receive half of the total amount of the CTC in 2021. The non-filer portal will be open until November 15, 2021.

If you dont get the advance payments of the CTC in 2021, you can still claim it by filing a tax return in early 2022. Everyone will need to file a return then to get the other half of their CTC credit.

Also Check: Doordash Pay Taxes

What Is The Irs Form 8812

The IRS isnt the most trusting organization, and they often ask taxpayers to justify the decisions they make during their tax preparation. In the case of the ACTC, the IRS asks taxpayers to file a Form 8812 along with their taxes.

This form will help you accurately calculate your ACTC and show the IRS your work. This helps everyone involved. Youll know you calculated the credit correctly and the IRS can catch and correct any innocent mistakes in your calculations quickly and easily in order to fix them without a lot of fuss and auditing.

How To Claim The Child Care Tax Credit

- Gather Care Provider Information

- Add Qualifying Care Expenses

- Complete Form 2441

Childcare is an expense that working parents often must pay out of pocket if they want to remain in the workforce. According to one poll conducted in 2019 by Child Care Aware of America, two-income households spent as much as 11 percent of their income on childcare. Compare this to other necessary and variable expenses, such as 8.6 percent of their income on food , and 2.4 percent on gas .

Childcare is expensive, and even more expensive in single-parent households, who spend, on average, around 36 percent of their income on childcare. To make matters worse, Americans of all income brackets have reported that only around 15 percent of the childcare facilities available to them are satisfactory. This puts a strain on parents when it comes to affordable child care that they feel comfortable with. The end solution for many parents is to just give up on pursuing upward career mobility.

For instance, as many as 61 percent of mothers with at least one child under the age of 6 years old said that their decision to remain out of the workforce was due to a lack of affordable and satisfactory childcare. Around 75 percent of postsecondary education dropouts said that they would have continued their educational path if not for a dearth of childcare options. Less than 28 percent of postsecondary students who are also parents complete a degree within a six year time frame.

Also Check: Does Doordash Take Taxes Out Of Your Check

What If I Dont Have A Bank Account

If you dont have a bank account, checks will be mailed to your address.

If you wish to open a bank account, visit the Federal Deposit Insurance Corporation for information on opening an account online.

Reloadable prepaid debit cards or mobile payment apps with routing and account numbers may also be an option.

What If My Information Or Situation Has Changed

If you have moved, had a child, changed your bank, or had other information about your living situation change since you last gave information to the IRS, you should update the IRS on your situation. This will help make sure they can get you the Advanced Child Tax Credit you are owed. To do this, you can use the Child Tax Credit Update Portal.

Read Also: Efstatus.taxact 2013

How Much Is The Child Tax Credit Worth

Before 2021, the child tax credit was worth $2,000 for children age 0 through 16. The expansion has increased the amount for children age 0 through 5 and children ages 6 through 17. The chart below shows the maximum tax credit you can claim based on the childs age:

| Child age |

|---|

| $3,000 |

As stated above, you can not claim the full child tax credit amount if your modified AGI exceeds certain thresholds. You can only receive the full $3,600 for newborn babies if your modified AGI does not exceed $150,000 as a married couple filing jointly.

For example: The Jones family had a baby in 2021, and their modified AGI is $205,000. Their income exceeds the $150,000 threshold for the $3,600 credit. However, because they are still below the $400,000 modified AGI threshold, the Jones family can claim a maximum child tax credit of $2,000.

Income Requirements And Limitations

The ACTC aims to help working families, so you must have at least $2,500 worth of earned income to qualify for the ACTC. Note the use of the word earned. Interest, dividends, unemployment and other passive income streams dont count. You must have $2,500 of earned income from work or other active endeavors to qualify.

Just as there is an income minimum to qualify for the credit, there is also a maximum. Married families filing jointly will see their credit start to phase-out if their adjusted gross income is more than $400,000. Those filing their tax return under other filing statuses are subject to the phase-out if their AGI exceeds $200,000.

The phase-out works like this: You lose $50 worth of your child tax credit and ACTC for every $1,000 or part of $1,000 that your income exceeds the limit. If youre married filing jointly but your AGI was $405,000, your child tax credit is reduced by $250.

Recommended Reading: Doordash 1099 Form

How Does The Child Tax Credit Impact Your Taxes

If youre one of the millions of Americans who received advance CTC payments in 2021, you may be wondering how those payments will affect your tax refund in 2022.

Those advance monthly credits are factored into your tax refund, so you may see a smaller refund or even a bill from the IRS once you file your tax return. This is because the eligibility for these advance credits was calculated based on taxpayers 2020 income, which for many Americans was negatively impacted by the COVID-19 pandemic.

If those who received an advance credit earned more in 2021 than they did in 2020, their eligibility to receive the CTC may be reduced or even eliminated. Tax experts anticipate that many Americans will be surprised by the smaller write-off on their tax return, and some may even have to repay their credits depending on how much their income changed in 2021.

How To Track And Trace Your Child Tax Credit

Eligible recipients who did not get a payment, or received the incorrect amount, should verify their information on the IRS Child Tax Credit Update Portal.

For cases where the portal shows that payment has already been disbursed but not received, a trace or inquiry to locate funds can be filed by mailing or faxing Form 3911 to the agency.

Payments could be delayed depending on the disbursement method. The IRS says that it can trace payments:

- 5 days after the deposit date and the bank says it hasnt received the payment

- 4 weeks after the payment was mailed by check to a standard address

- 6 weeks after the payment was mailed, and you have a forwarding address on file with the local post office

- 9 weeks after the payment was mailed, and you have a foreign address

The agency updates its frequently asked questions page with information about Child Tax Credit payments and posts notifications about delays.

Dont Miss: How To Buy Tax Lien Properties In California

You May Like: Doing Taxes For Doordash

How Much Money Will I Get From The 2021 Child Tax Credit When Will I Get The Payments

The 2021 CTC is worth up to $3,600 for children under six and up to $3,000 for children ages 6-17. Half the credit will be delivered through monthly payments in 2021. You can get the remaining half when you file a tax return in 2022.

Advance payments started in July 2021. If you havent received your payments, you can sign up for the payments through late fall. Once the IRS has processed the information you provided from either the IRS Non-filer Portal or your 2020 tax return, you will start receiving the CTC advance payments. These payments will be half of your CTC, even if you started receiving them after July.

Example: Catlin has a 12-year-old daughter and 3-year-old son and earned $12,000 in 2020. When he filed his 2020 tax return , he claimed the current CTC and received a total of $1,425 in 2021. Because of the new rule changes to the CTC, when he files his 2021 tax return , his CTC will be worth $6,600. Through the advance payments, he will start receiving half of his new credit in 2021 in monthly payments from the IRS between July and December 2021. He will claim the remaining amount when he files his tax return in 2022.

You can use Propels 2021 Child Tax Credit Calculator to calculate how much money you will receive from the CTC.

How To Claim And Track Your Child Tax Credit

Heres what you need to know about claiming your credit. Eligible filers can claim the CTC on Form 1040, line 12a, or on Form 1040NR, line 49. To help you determine exactly how much of the credit you qualify for, you can use the Child Tax Credit and Credit for Other Dependents Worksheet provided by the Internal Revenue Service. If you need to file a return for a year before 2018, you can only claim the credit on Forms 1040, 1040A or 1040NR.

Eligible recipients who did not receive the right amount or nothing at all should verify their information on the IRS Child Tax Credit Update Portal. For cases where the portal shows that payment has already been disbursed but not received, a trace or inquiry to locate funds can be filed by mailing or faxing Form 3911 to the agency.

There could be a payment delay depending on the disbursement method. The IRS says that it can trace payments:

- 5 days after the deposit date and the bank says it hasnt received the payment

- 4 weeks after the payment is in the mail by check to a standard address

- 6 weeks after the payment is in the mail, and you have a forwarding address on file with the local post office

- 9 weeks after the payment is in the mail, and you have a foreign address

The agency updates its frequently asked questions page with information about Child Tax Credit payments and posts notifications about delays.

Don’t Miss: Do You Pay Taxes On Doordash

Cutting Child Poverty In Half

-

These changes will lift nearly 10 million kids above or closer to the poverty line, cut childhood poverty in America nearly in half, and reduce racial disparities. The expansion would:

-

Cut poverty for Black children by 52%

- Lift 4.1 million Latino and Latina kids above or closer to the poverty line

- Cut poverty for Native American kids by 61%

- Lift 441,000 Asian American kids above or closer to the poverty line.

-

In Colorado, the expanded CTC will lift 57,000 kids out of poverty and benefit more than 1 million kids statewide, including nearly 350,000 kids who have been left out of the full existing credit.

-

The CTC expansion will benefit 96% of families with kidsincluding more than 96% of families with kids in Coloradoand pump an additional $1.5 billion each year into Colorados economy.

-

94% of kids living in rural areas will benefit, including 93% of kids in Colorados rural communities.

Determine For How Much You Are Eligible For

The amount you receive for your 2021 child tax credit is determined by your modified adjusted gross income and the amount, if any, by which it exceeds certain thresholds. The thresholds are:

- $150,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $112,500 if filing as head of household

- $75,000 if you are a single filer or are married and filing a separate return

Provided your MAGI does not exceed the relevant threshold above, your 2021 tax year child tax credit for each qualifying child is:

- $3,600 for children ages 5 and under at the end of 2021

- $3,000 for children ages 6 through 17 at the end of 2021

The amounts above will be reduced by $50 for each $1,000 that your MAGI exceeds the qualifying threshold above up to $400,000 if married and filing jointly or $200,000 for all other filing statuses.

The child tax credit wonât begin to be reduced below $2,000 per child until your MAGI in 2021 exceeds $400,000 if married and filing a joint return or $200,000 for all other filing statuses.

Above these levels, your child tax credit decreases by $50 for each $1,000 until it phases out entirely.

Also Check: How To Do Taxes Doordash

If You Have Not Filed A Tax Return You Can Sign Up To Get The Child Tax Credit

If you earned less than $12,550.00 , you can use GetCTC, a simplified tax filing portal to get the Child Tax Credit, receive a missing stimulus payment, and get cash now.

To get the Child Tax Credit you will need to provide the Social Security Numbers of your children. You can sign up for the Child Tax Credit even if you have little to no income or receive other federal benefits like SSI or SSDI.

Chat with our tax experts if you need help.

The Maximum Child Tax Credit That Parents Can Receive Based On Their Annual Income

You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than:

- $150,000 for a person who is married and filing a joint return

- $112,500 for a family with a single parent and

- $75,000 for a single filer or a person who is married and filing a separate return.

Parents and guardians with higher incomes may still receive a partial payment. Eligible parents and guardians receive a maximum of $3,000 for each qualifying child who was between the ages of 6 and 17 at the end of 2021. Eligible parents and guardians of qualifying children younger than age 6 at the end of 2021 receive a maximum credit of $3,600 per child. Children who attend college are qualifying children for the Child Tax Credit if they meet the age and other requirements described in the next section.

Dependent children age 18 and older can qualify their parents for the $500 Credit for Other Dependents. For more information about the Credit for Other Dependents, see the Instructions for Schedule 8812 .

If you do not qualify to receive the maximum amount, use the Get your Child Tax Credit tool to estimate how much you should receive.

Also Check: Http Efstatus.taxact.com

Alberta Child And Family Benefit

This benefit is a non-taxable amount paid to families that have children under 18 years of age. The quarterly amounts are issued in August 2021, November 2021, February 2022, and May 2022.

The benefit includes both a base component and a working component, with combined benefits to a maximum of $5,120.

The maximum base component ranges from $1,330 to $3,325 depending on the number of children. You may be entitled to:

- $1,330 for the first qualified dependant

- $665 for the second qualified dependant

- $665 for the third qualified dependant

- $665 for the fourth qualified dependant

The base component of the benefit is reduced if your adjusted family net income is more than $24,467.

Families may be eligible for the working component once their family employment income exceeds $2,760. The maximum working component will range from $681 to $1,795 depending on the number of children. You may be entitled to:

- $681 for the first qualified dependant

- $620 for the second qualified dependant

- $371 for the third qualified dependant

- $123 for the fourth qualified dependant

The working component of the benefit is reduced once your adjusted family net income is more than $41,000.

This program is fully funded by the Alberta provincial government.