We Also Have To File And Pay Self

This is the part of Doordash taxes that can really throw people off.

Self-Employment tax is not an extra tax for the self-employed. It’s just our version of employment taxes .

Schedule C profits are moved to form Schedule SE, where self-employment taxes are calculated at 15.3%Employees don’t often think about these because they don’t have to file anything. The money is just taken out of their paycheck and sent it.

However, being on our own for our taxes, we have to take care of our own Medicare and Social Security taxes.

FICA taxes are charged on every dollar of income. They’re not reduced by filing status or tax deductions. In the same way, self-employment tax is assessed on every dollar of profit. For this reason, this is the one tax item that can get a lot of drivers in trouble.

Here’s where independent contractor taxes feel at a disadvantage: Employees only get 7.65% taken out of their checks. How is this fair?

Uncle Sam doesn’t get more money. The difference is that employers pay half of the payroll taxes. When we’re self-employed, we’re responsible for both the employer AND the employee portion of these taxes.

How Does Doordash Handle Taxes

DoorDash has partnerships with local and state governments to collect sales tax on all takeout and delivery orders. As a DoorDash driver, you are responsible for collecting and remitting sales tax on all taxable goods and services.

While the specifics of how DoorDash collects and remits sales tax varies from state to state, in general, the company collects sales tax from the restaurant and then transfers that money to the state. This enables DoorDash to collect sales tax from customers and then transfer that money to the state. Because DoorDash transmits sales tax information to the state, you are responsible for collecting sales tax from customers and remitting it to the state on your own.

Requirements For A 1099

If you receive deposits from a partner platform like PayPal, you may receive a tax form 1099-K.

A Dasher would need to have conducted 200 transactions and have a gross volume of $20,000 to meet the 1099-K requirements.

Gross Volume, which in DoorDash’s case is the subtotal of payments and tax on processed orders.

However, there is one exception to this rule. If you made more than $600 in total earnings from deliveries in Vermont or Massachusetts, you will receive a 1099-K regardless.

Also Check: Is It Hard To Do My Own Taxes

Does Doordash Send You Tax Forms

The company will also send you an earnings report form, which you should receive from your tax preparer or accountant.

Stripe is a company that acts like a bank. It gives businesses a way to accept credit card payments. Businesses use Stripe to collect payments for services and products.

If people get an email from you, they will have to log in to their Stripe account.

You should have received a tax form if youre eligible, but if you did not, make sure you check your email junk and/or spam folders as sometimes you receive the form in there.

Please confirm your tax information with DoorDash.

You can also confirm your email address here:

And they give you a link to add an email address.

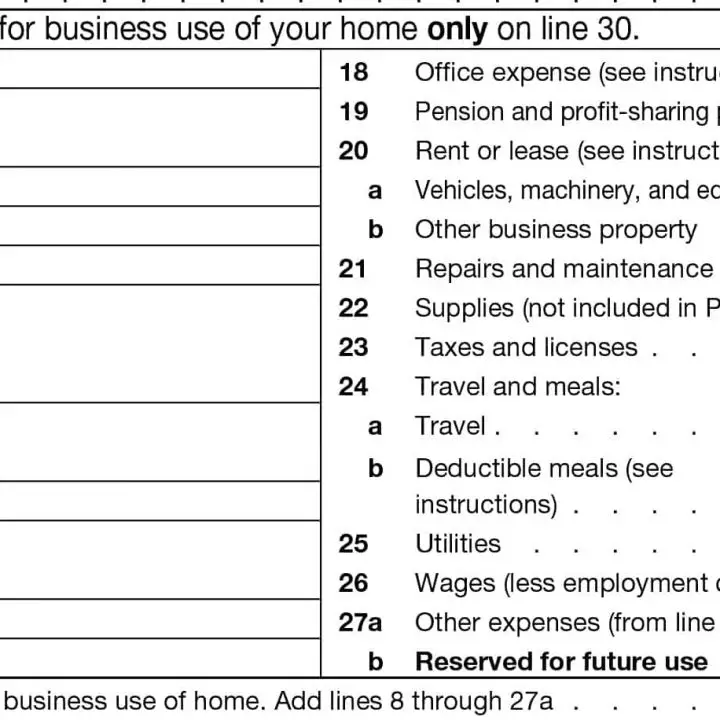

What Doordash Expenses Can You Write Off

The delivery fees you paid to order the food and ship it.The cost of the food you ordered and shipped.The gas, electricity, and water you consumed while shipping and picking up the food.

So that means, if you have business use, your deductions would be based on the percentage that you paid on the property.

You cannot deduct all Car Mileage from your taxes only the amount that occurred while delivering items to customers.

Don’t Miss: How Do I File Last Years Taxes

Mileage Or Car Expenses

One of the best tax deductions for Doordash driversâor any self-employed individualsâis deducting your non-commuting business mileage. This includes miles that you drive to your first delivery pickup, between deliveries, and back home at the end of the day. Alternatively, you can keep track of your vehicle expenses and deduct those from your taxes instead.

Keep in mind that you canât deduct both car expenses and mileage at the same time! The IRS standard deduction rate for mileage is estimated as the average cost to use your car for work purposes. You can either deduct the standard mileage rateâcurrently, $0.585 cents per mile for 2022âor you can itemize and deduct all of your car expenses.

What kinds of car expenses could you deduct? Things like:

- Insurance and registration fees

If you drive the same vehicle for both personal and work trips, you can only deduct the cost of the expenses for the percentage of time youâre driving the car for work. For example, if you drive your car 30% of the time for work and 70% of the time for personal use, you can only deduct 30% of your overall vehicle expenses on your taxes.

The IRS verifies the percentage of your work-related driving based on a mileage log to see the percentage of work-related mileage vs. total mileage on the vehicle.

Dasher Taxes Are Based On Profits

Gig workers pay taxes based on profits from their gig work. This is different than paying taxes based on income from a salaried job. As a gig worker, you take on more of the risks and have more costs. Dashers can deduct certain costs from their income to calculate their profits, so you dont have to pay extra taxes on your expenses.

Common deductions for DoorDashers include mileage and cell phone data charges. In 2022, the mileage rate is 58.5 cents for businesses, including self-employed gig workers. Alternatively, you can deduct actual expenses, such as insurance, gas, and depreciation of your vehicles value.

Read Also: Does Texas Have Property Tax

How Much Should I Set Aside For Taxes On Doordash

In order to pay your taxes, you must set aside income throughout the year to pay your 1099.

The Dasher app does not contain a Doordash tax calculator. You can determine your taxable income by subtracting any deductions from the money you earn and by determining your filing status with dependent children).

Generally, you should set aside 30-40% of your income to cover both federal and state taxes.

Whether you file your taxes quarterly or annually, you need to set aside a portion of your income for your taxes. For this, you must know the exact dollar amounts you need to save. Using a 1099 tax rate calculator is the quickest and easiest method.

A lack of a proper plan could lead you to spend some of the money you are supposed to pay in taxes. If you run this calculator monthly, you’ll have no surprises come tax time.

Get Help With Your Taxes

Hot Bags + Courier Backpacks + Stickers

Whether you use your car for the deliveries or you are a Doordash biker, Doordash requires you to use an insulated bag to keep the customers food nice, neat and fresh. Advertising and marketing costs such as DoorDash stickers are tax deductible.

Remember that Doordash customers can rate your performance. Do not take the risk to make your customer angry by delivering a coldpizza.

The insulated bag is ordinary and necessary for your job and qualifies as a tax-deductible expense. Take a lookat our guide to Doordash gear.

Don’t Miss: What Is The Sales Tax In Colorado

Does Doordash Provide A 1099

DoorDash uses Stripe to process their payments and tax returns. If you earn more than $600 in a calendar year, youll get a 1099-NEC from Stripe.

DoorDash no longer uses Payable for 1099-NEC forms, so if you never got your 1099 from Payable, thats why.

You can view DoorDashs tax information here.

DoorDash 1099 Form Information

| 812900 |

Everything You Need To Know About Doordash Taxes

How do taxes work with Doordash?…Read more

How much do you make working for Doordash?…Read more

Can you choose when Doordash pays you?…Read more

Does Doordash withhold taxes?…Read more

How much do Doordash drivers pay in taxes?…Read more

Does Doordash report to the IRS?…Read more

Doordash tax forms…Read more

How to get a Form 1099 from Doordash?…Read more

Deductions for delivery drivers…Read more

Don’t Miss: How To Apply For State Tax Extension

Where Can I Find My Doordash Pay Stubs

Simply put, they dont exist. Doordash doesnt disperse paystubs like a typical employer since theyre not a typical employer.

Essentially, Doordash is just a platform individuals use to start a food delivery business.

While you can log into your Dasher app account and view your earnings, you wont be able to find a paystub like you would with most other jobs.

The difference is that youre an independent contractor when you drive for Doordash not an employee. That means youll have to file your taxes as a business owner, which comes with a few extra steps, but nothing you cant handle.

Youll have to keep track of things like your mileage, fuel, vehicle maintenance and repairs, and any other Doordash-related expenses as they happen.

At first, this might seem like a burden, but its actually a blessing in disguise.

Why?

Because it will spare you the time of thumbing through your bank statements at tax season.

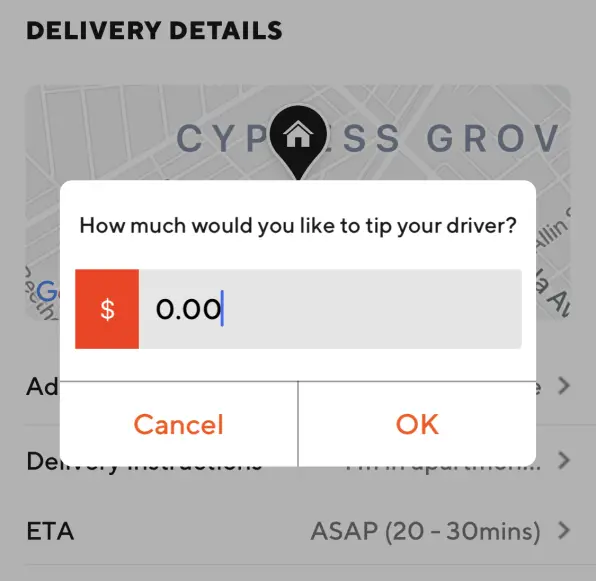

Are Tipping And Delivery Fees Taxable

When calculating sales tax on an order, you must take into account the delivery fee charged by DoorDash and the tip that customers leave on their orders. In most cases, tips are taxable the general rule of thumb is that any fees that are charged by the provider, distributor, or seller of goods or services and transferred to the government are considered taxable. This means that tips are taxable, and you must include them in the sales tax calculation.

Tipping is a common practice when ordering takeout or delivery, but customers may not realize that these fees are taxable. When calculating sales tax on an order, you must take into account the DoorDash delivery fee and the tip that customers leave on their orders.

Don’t Miss: How To Challenge Property Tax Assessment

Which Forms Do You Use To File Self

You will file Schedule C to report your business income and expenses to the IRS. On the Schedule C form, you record all your business income and business tax deductions . You pay taxes on your net income, which is your total income minus any business tax deductions.

You have several options for preparing and filing your taxes. One option is to visit GetYourRefund.org for free virtual tax preparation. Depending on your income and needs, GetYourRefund will direct you to full-service virtual tax filing, free tax preparation services, or free in-person services. They serve people making up to $73,000.

Tracking The Mileage Deduction

Most food delivery apps DO NOT track how many miles youre driving when youre online. If you dont track them yourself, you will pay more in taxes. You can only use mileage deductions for cars.

There are two ways to track your mileage deduction. If you drive a car, you can choose between either the standard mileage or actual expenses method.

Tracking actual car, truck, and bike expense tax deductions is a more complicated method than using standard mileage. In addition to tracking your business and personal mileage, youll need to track all your car expenses, such as gas, repairs/maintenance, insurance, license fees, parking fees for business, tires, car washing, lease payments, towing charges, and auto club dues. In addition, you can deduct a portion of your car as business use and deduct the depreciation of your cars value. See the page for actual car expenses to learn more.

Don’t Miss: When Do I Have To Pay Capital Gains Tax

Do I Need To Tell My Insurance If I Drive For Doordash

DoorDash drivers should check with their insurance carriers to see if they are insured while dashing, though, according to the New Jersey news website NJ.com.

Some companies will not cover accidents or damage that happens when dashing.

DoorDash offers commercial insurance coverage of up to $1 million for its drivers.

Still, it pays only after a DoorDash drivers personal auto insurance has been exhausted after an accident in which the driver was at fault, Forbes reports.

It only covers the damage caused by the DoorDash driver and not damage to the drivers car, making a personal car insurance policy a must.

The Types Of Doordash 1099 Forms You’ll Receive For Reporting Your Income

When you are a DoorDash independent contractor, you are part of the growing gig economy. There are a few different forms you’ll receive. The first form is the 1099-NEC and the second one is the 1099-K.

These will be used to identify your tax information on all of the other documents that are provided by DoorDash throughout the year in order to file taxes. The IRS requires companies to deliver or mail these forms by January 31. It could take 3-5 days, so you’ll receive a form 1099 within that time frame after February 1st.

There are different requirements for independent contractors to receive each one that we’ll break down in the next section.

Read Also: How Long Does It Take To File Your Taxes

Add Any Other Income To Your Business Profits

If you worked another job, you’ll add your income from that job . Did you have other taxable income? Did you have a profit from another business? That all gets added in as well: Investments and income, certain benefits that are taxable, etc, add it all up.

Are you filing a joint return? You’ll add in your partner’s income as well.

This is all for income tax purposes. Income tax and self employment tax gets calculated differently. As we noted, self-employment tax is only based on your business profit and it isn’t adjusted by personal deductions. Income tax on the other hand is based on the combination of all forms of income.

What Are The Doordash Tax Documents

In the United States, all Dashers that earn $600 or more within a calendar year will receive a 1099-NEC doordashtax form that reports to the IRS exactly how much a Doordash has paid you in the last tax year as a non-employee. You willreceive the 1099 income before January 31 Doordash. You can access your tax documents through the Payable portal. The 1009 form willbe delivered to you by the method of your choice. You can choose between:

Dashers in Canada will not receive a form to file their taxes. For more information on how to complete your requiredtax form, visit the CRA website.

Read Also: How To Pay Tax Uber Driver

Add Your Independent Contractor Profits To Other Income To Determine Your Income Tax Bill

Doordash earnings impact our income taxes differently than they do self-employment taxes. Self-employment taxes are more straightforward at 15.3% of your profit.

Income tax is a totally different story. Your profits are added to your other income, including W2 wages, interest, investment, retirement, and other income. Then you throw in whether or not you’re filing an individual joint return, whether you itemize, dependents, tax credits, and all that.

When it’s all said and done, total income minus adjustments and deductions equal taxable income. From there, calculate your Doordash taxes as a percentage of your taxable income.

Even then, it’s not that straightforward. As income increases, the tax percentage does as well. This is all based on tax brackets.

This is why it’s impossible to answer the question, âhow much will I have to pay in taxes because of Doordash?â Many other factors include additional income and qualified personal tax deductions.

Remember that your income tax bill isn’t the same as whether you pay in or get a refund. Income tax is the amount due to the government but is the part before credits and payments are applied.

We go into more detail here about how your Doordash income affects income taxes.

Correcting Information On Your 1099

Occasionally, you might get a 1099-NEC with some incorrect information on it.

Fortunately, Stripe Express makes these easy to correct. If you log into your account, you’ll be able to point out any errors and get a new 1099 form within 24 hours.

Keep in mind: The earnings you see on your 1099-NEC may not always reflect the full earnings history you can see on your Stripe Express account.

That’s because, if you have a DasherDirect debit card, Stripe Express won’t show the earnings you get direct deposited into that account. Your 1099 will include your DasherDirect earnings, though.

You May Like: How Do Tax Preparers Collect Fees

But There Are Lots Of Write Offs Against Your Doordash Taxes

If youre a Dasher, these Doordash write offs are important when it comes time to file your taxes. But even if youre not a Dasher, you should certainly pay attention to these tax write offsespecially if you are self-employed or participate in the gig economy.

Companies that provide an app facilitating peer-to-peer activities, like ridesharing and freelance work, all issue 1099 forms. If youre getting one, then you are operating as a sole proprietorship company, and you can write off the associated expenses that are needed to perform your work, which in turn can lower your annual tax payments.

If you have more questions about filing taxes as a gig worker/independent contractor, please join our free Tax Tuesday live stream. Its a great opportunity to get advice on sole proprietorship tax issues, straight from the Anderson Advisors experts themselves.

Bonus Video